After you send out your initial dispute letters to credit bureaus, creditors, or collectors, all you need to do is wait for the results of your dispute so they can check or investigate the dispute you raise. You should have these respond letters in the credit repair business plan to use them when needed.

Once the investigation is conducted, you will receive the results. If the negative items in question are proven accurate, the credit bureaus, creditors, and collectors will inform you, along with supporting evidence.

If the negative items have been removed, you will receive an update on the credit reports of your customer.

We have these respond letters in the credit repair business plan that you can use to create letters for credit bureaus, creditors, and collectors response letters to use in different scenarios.

That way, you can respond to disputes effectively and increase your chances of winning the dispute that you raise.

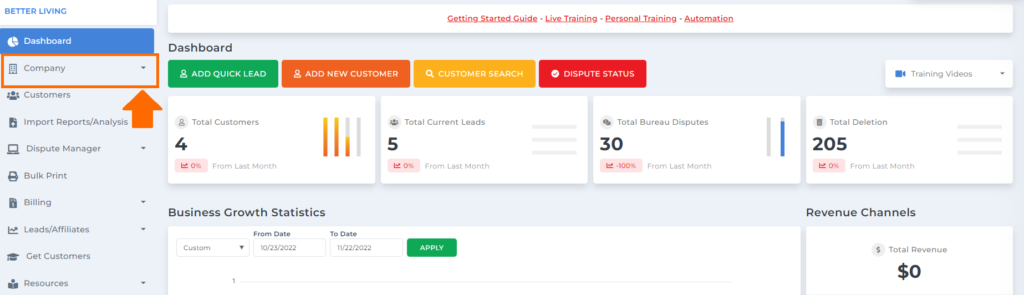

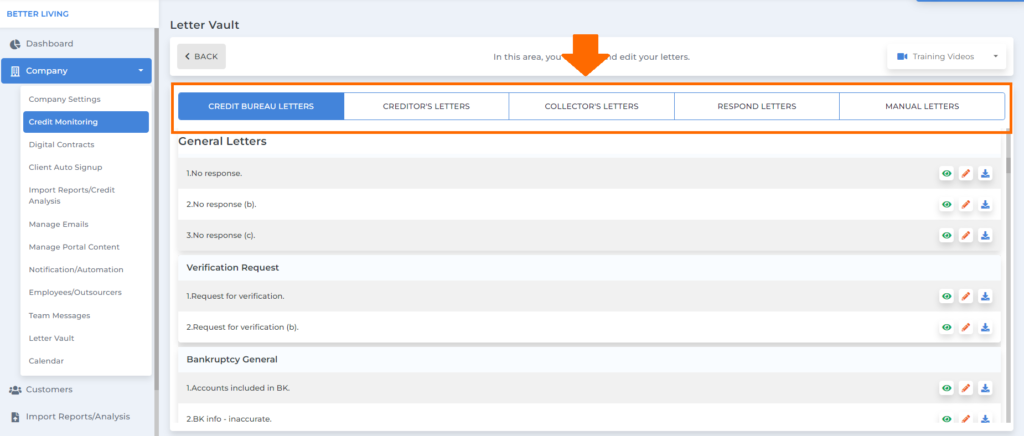

To check the respond letters in the credit repair business plan, go to the company tab.

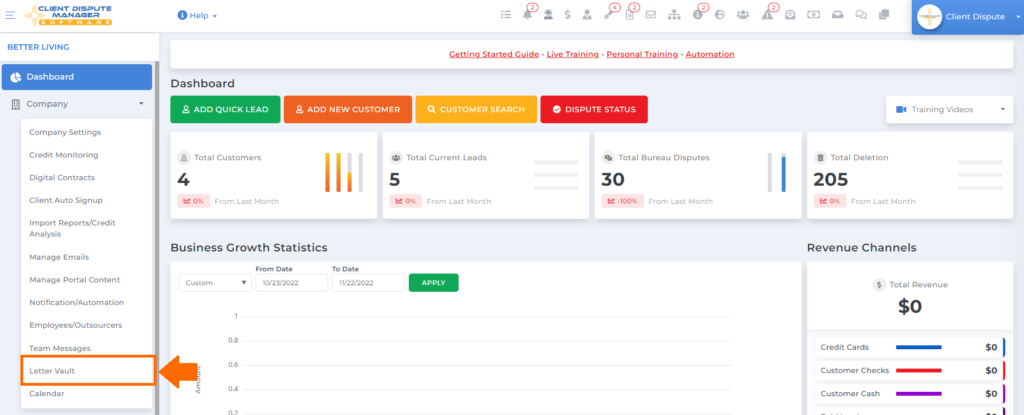

Then under the company menu options, click letter vault.

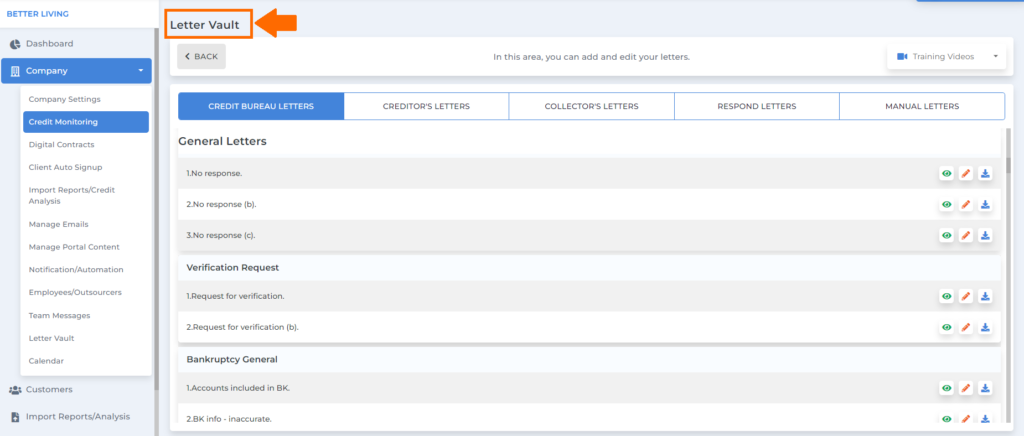

Then you will be routed to the letter vault screen, where you can see all the letters available to use. In this area, you can also add and edit your letters.

In the letter vault, we have letters for credit bureaus, creditors, collectors, respond, and manual letters.

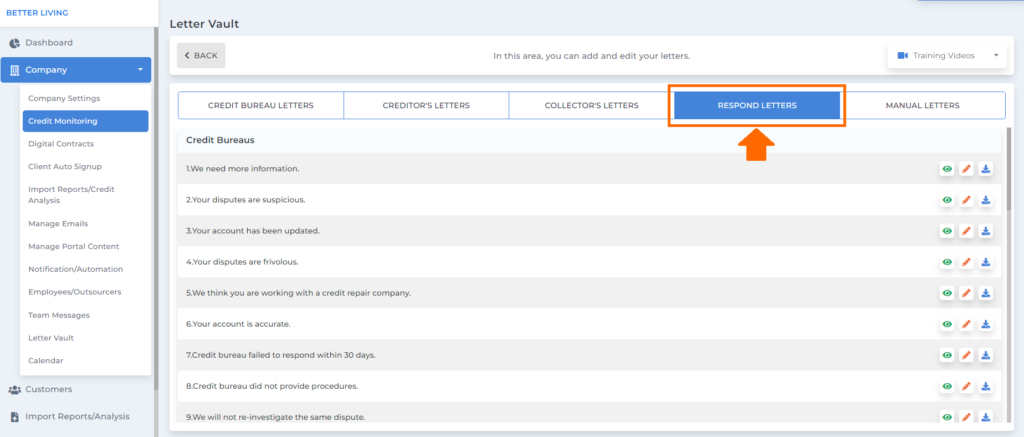

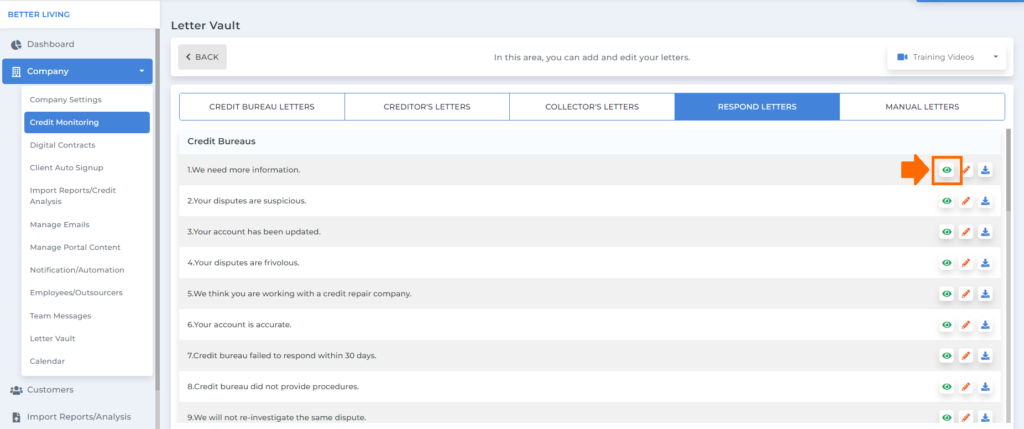

Then over here are the respond letters.

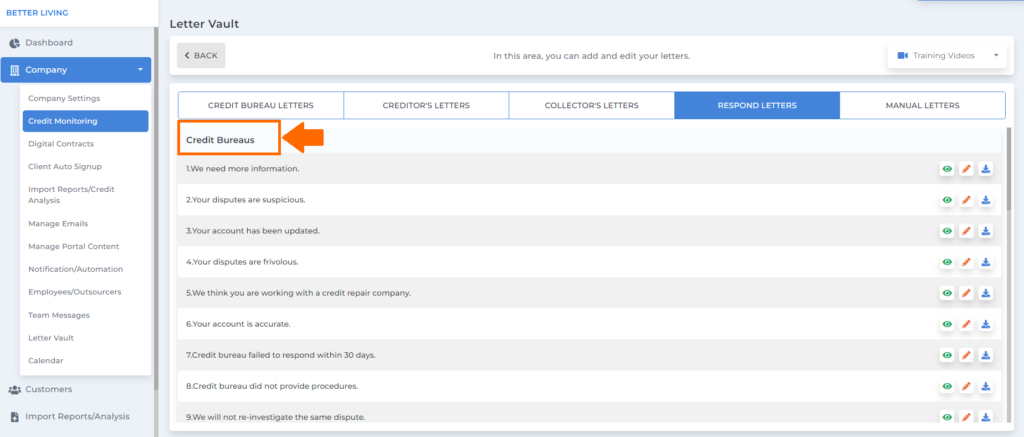

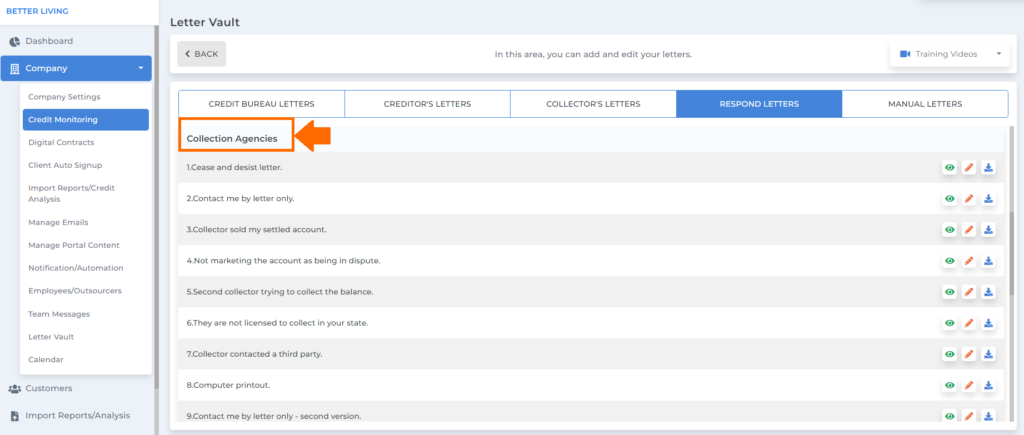

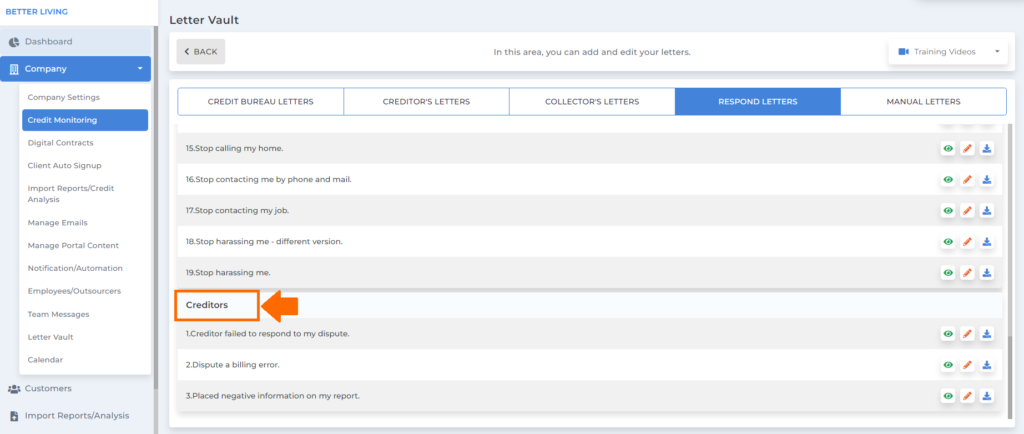

Under respond letters, we have credit bureaus, collection agencies, and creditors.

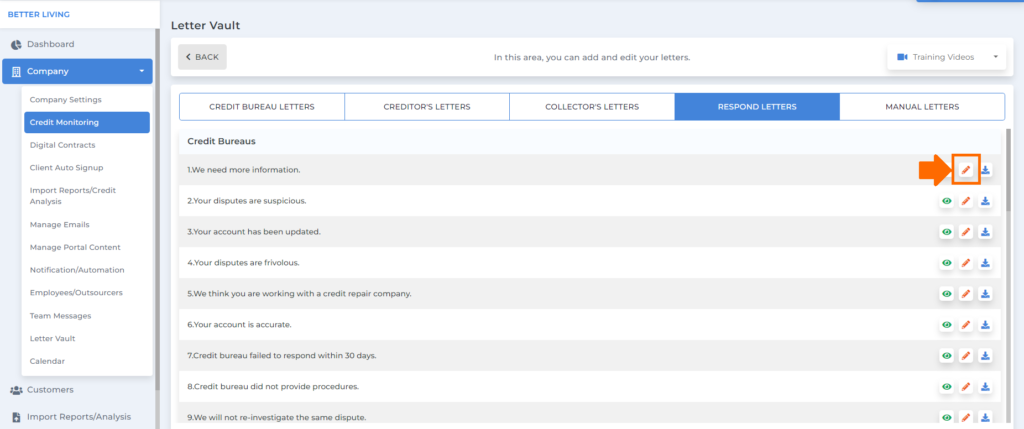

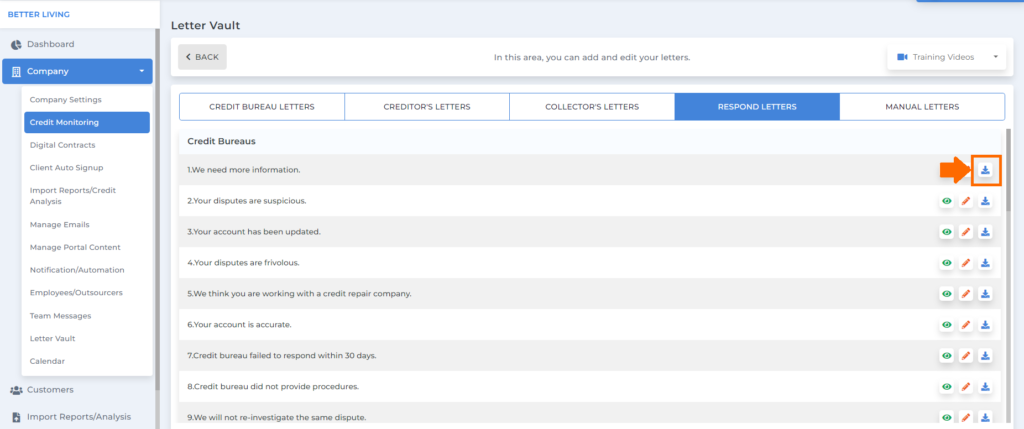

Credit bureaus respond letters

-These are the letters you can use if you receive results from credit bureaus and want to respond to them.

Collection agencies respond letters

-These are the letters you can use as a response from the collection agencies.

Creditors respond letters

-These are the letters you can use if you receive results from the creditors and want to respond to them.

Then you can click this icon if you want to preview the letter before you use it.

You can also edit the default letters by clicking this icon.

You can also download the letter by clicking this icon.

Before writing a response letter, you should analyze the situation. The main purpose of a response letter is to provide the information requested in another letter.

It’s a good idea to contact the customer and discuss the issue before you accept or challenge it. It is also advisable that your response be prompt and include supporting documents. You can do it easily using Client Dispute Manager Software.

Bonus: Now that you have read this article, why not take your new skill and start your own credit business helping others? We have free training that can help you do just that.

Click here to learn more.