The evolution of credit repair automation has revolutionized how credit repair businesses operate in today’s digital age. For businesses looking to scale and succeed, learning to automate your credit repair business has become essential rather than optional.

The best automation tools for credit repair services have transformed traditional manual processes into streamlined, efficient operations that can handle higher client volumes while maintaining quality service. Let’s explore the seven key ways that credit repair dispute software with automations can revolutionize your business operations.

- Automate Client Onboarding – Use digital portals and automated document collection to simplify intake and reduce setup time by up to 75%.

- Streamline Disputes with Credit Repair Dispute Software – Automatically generate, send, and track dispute letters for faster, more compliant credit repair.

- Improve Client Communication – Automate updates, reminders, and progress tracking to boost retention and client satisfaction.

- Gain Real-time Insights – Leverage analytics to monitor performance, optimize processes, and make data-driven business decisions.

- Automate Billing and Payments – Save time and avoid missed invoices with recurring billing and financial reporting built into your system.

- Stay Legally Compliant – Built-in compliance tools help meet CROA, FTC, and documentation requirements—without the stress.

- Scale Your Credit Repair Business – Handle more clients with fewer resources using automated workflows and scalable infrastructure.

Start Today and Explore the Features Firsthand!

#1: Transform Credit Repair Client Onboarding Through Automation

The foundation of successful credit repair lies in efficient client onboarding processes. The best automation tools for credit repair businesses have revolutionized how businesses handle new client intake and documentation management. Modern credit repair automation systems can reduce onboarding time by up to 75% while significantly improving accuracy and compliance.

Streamlined Document Collection

Client document collection has traditionally been a time-consuming process requiring constant follow-up and organization. Modern best automation tools for credit repair services now feature automated document request systems that send reminders and track submissions automatically.

These systems can verify document completeness and alert staff when additional information is needed. The automation tools can categorize and store documents in secure, organized digital folders for easy access.

Implementing credit repair dispute software with automations ensures that all necessary documentation is properly collected and stored according to compliance requirements.

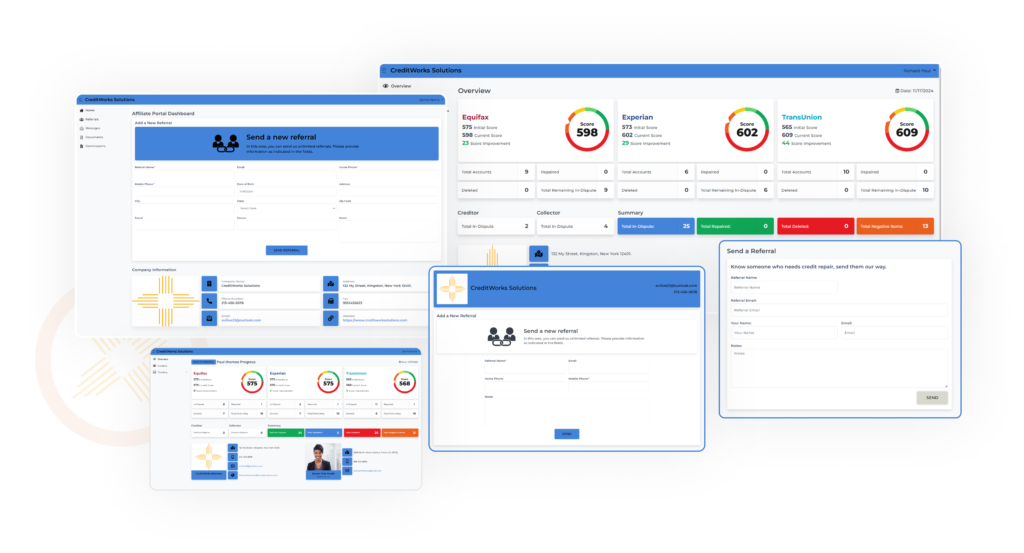

Digital Client Portal Implementation

When you automate your credit repair business, a digital client portal becomes an essential tool for client engagement and document management.

The portal serves as a centralized hub where clients can securely upload documents, view their repair progress, and communicate with your team.

Modern portals include features like electronic signature capabilities, progress tracking dashboards, and automated notification systems.

These systems significantly reduce the administrative burden on your staff while improving the client experience.

#2: Streamline Dispute Processing with Best Automation Tools for Credit Repair Businesses

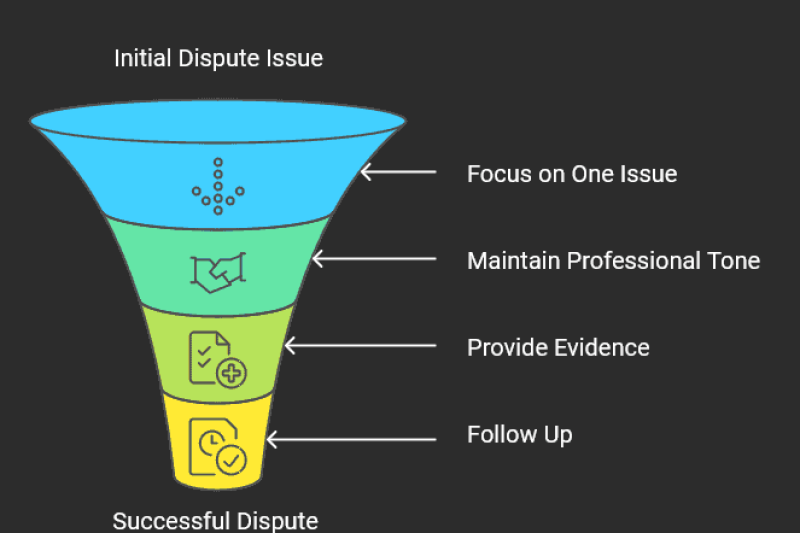

The dispute process forms the core of any credit repair operation, and automation transforms how businesses handle this crucial function. Modern credit repair automation systems dramatically reduce the time spent on dispute letter generation and tracking. The best automation tools for credit repair businesses can analyze credit reports and generate appropriate dispute strategies automatically, ensuring consistency and compliance.

Credit Repair Dispute Software with Automations: Letter Generation

Advanced credit repair dispute software with automations has revolutionized how businesses create and manage dispute letters. These systems can intelligently analyze credit reports to identify disputable items and generate appropriate letters automatically. The software maintains a comprehensive template library that adapts to different dispute scenarios and bureau requirements.

Smart automation features track bureau responses and adjust follow-up strategies accordingly. These tools ensure consistent formatting and compliance while significantly reducing manual effort.

Start Today and Explore the Features Firsthand!

Best Automation Tools for Credit Repair Services: Response Tracking

When you automate your credit repair business, tracking dispute responses becomes seamless and efficient. The best automation tools for credit repair services provide comprehensive tracking capabilities that monitor bureau responses and deadlines automatically.

These systems can analyze response patterns and suggest optimal follow-up strategies based on historical success rates. Advanced tracking features ensure no dispute falls through the cracks, maintaining consistent progress for every client.

#3: Enhance Client Communication Through Credit Repair Automation

Effective client communication is crucial for success in the credit repair industry. Modern credit repair automation systems transform how businesses interact with clients, ensuring consistent, timely, and relevant communications. The right automation tools can significantly improve client satisfaction and retention rates while reducing the workload on your team.

Automating Your Credit Repair Business Communications

Implementing automation in your client communication strategy revolutionizes how you stay connected with clients. The system automatically generates progress updates, milestone notifications, and important reminders based on client account activity. Smart scheduling features ensure communications are sent at optimal times for maximum engagement.

Regular automated check-ins help maintain client engagement throughout the repair process. These automated touches complement personal communications from your team, creating a comprehensive communication strategy.

Start Today and Explore the Features Firsthand!

Credit Repair Dispute Software with Automations: Client Updates

The latest credit repair dispute software with automations includes sophisticated client update features that keep customers informed and engaged. These systems can automatically generate and send detailed progress reports showing dispute statuses and credit score changes.

Automated alerts notify clients about important developments or required actions in real-time. The software can customize communication frequency and content based on client preferences and account status. These automated updates help maintain transparency and build trust with clients.

#4: Implement Advanced Analytics with Credit Repair Automation

Modern credit repair automation has transformed how businesses track and analyze their performance. The best automation tools for credit repair businesses provide comprehensive analytics capabilities that help identify trends, measure success rates, and optimize operations. These insights enable data-driven decisions that can significantly improve your business outcomes.

Best Automation Tools for Credit Repair Services: Performance Tracking

Advanced analytics in the best automation tools for credit repair services provide deep insights into your business operations. These systems track key metrics like dispute success rates, average resolution times, and client satisfaction scores automatically.

Comprehensive dashboards present data in easily digestible formats that help identify trends and opportunities. Performance tracking features help identify both successful strategies and areas needing improvement. Real-time monitoring allows for quick adjustments to maintain optimal results.

Start Today and Explore the Features Firsthand!

How to Automate Your Credit Repair Business Reporting?

When you automate your credit repair business, reporting becomes more comprehensive and insightful. The system generates detailed reports on client progress, dispute statistics, and business performance metrics automatically. Custom reporting features allow you to focus on the metrics most relevant to your business goals.

Advanced filtering and sorting capabilities help identify patterns and trends across different client segments. These automated reports save time while providing deeper insights into your business operations.

#5: Streamline Financial Operations with Credit Repair Dispute Software

Managing financial operations efficiently is crucial for business success. Credit repair dispute software with automations includes sophisticated financial management features that automate billing, payments, and financial reporting. These tools ensure accurate financial tracking while reducing administrative overhead.

Credit Repair Automation for Payment Processing

Modern credit repair automation systems transform payment processing and financial management. The software automatically handles recurring billing cycles and payment reminders according to service agreements. Automated payment processing features integrate with popular payment gateways for secure transactions.

The system tracks payment status and automatically flags any issues requiring attention. These automation features ensure consistent cash flow while reducing payment-related administrative tasks.

Best Automation Tools for Credit Repair Businesses: Financial Management

The best automation tools for credit repair businesses provide comprehensive financial management capabilities. These systems automatically generate financial reports including revenue, expenses, and profitability metrics.

Automated reconciliation features help maintain accurate financial records with minimal manual intervention. The tools can track commission structures and calculate payments automatically. Integration with accounting software ensures seamless financial operations.

Client Dispute Manager in Credit Repair Dispute Software with Automations

Modern credit repair dispute software with automations includes sophisticated dispute management systems that streamline the entire dispute process from initiation to resolution. These advanced tools integrate seamlessly with the best automation tools for credit repair services to provide a comprehensive dispute tracking and management solution.

When you automate your credit repair business, the dispute manager becomes your central hub for monitoring and managing all client disputes across multiple credit bureaus. The system automatically tracks dispute statuses, deadlines, and bureau responses while maintaining detailed records of all communications.

Professional dispute management features help maintain organization and ensure no disputes fall through the cracks.

Key Features of Client Dispute Manager Software

- Dispute Automation: The software automatically generates dispute letters, allowing you to address multiple client issues quickly. This is essential for businesses handling large client volumes.

- Client Management: With built-in CRM features, Client Dispute Manager Software helps businesses keep track of client interactions, credit report changes, and dispute statuses. This makes managing multiple clients easier and more organized.

- Progress Tracking: The platform offers real-time tracking and reporting, so both you and your clients can monitor the progress of disputes as they move through the process. Clients can also receive updates on credit score changes.

- Customization and Scalability: Whether you’re a small business or looking to scale, Client Dispute Manager Software can grow with you. It offers customizable templates and tools that fit businesses of various sizes.

Start Today and Explore the Features Firsthand!

#6: Ensure Compliance with Automated Systems

Maintaining compliance in the credit repair industry requires constant attention to regulatory requirements. Credit repair dispute software with automations includes built-in compliance features that help ensure adherence to all relevant regulations. These automated systems significantly reduce compliance-related risks while maintaining proper documentation.

Automate Your Credit Repair Business Compliance

When you automate your credit repair business, compliance becomes more manageable and reliable. The system automatically tracks and enforces compliance requirements across all operations. Built-in checks ensure all communications and disputes follow regulatory guidelines.

Automated record-keeping maintains comprehensive audit trails for all activities. These features provide peace of mind while reducing the burden of compliance management.

Best Automation Tools for Credit Repair Services: Documentation

The best automation tools for credit repair services excel at maintaining proper documentation. These systems automatically generate and store required compliance documents for each client relationship.

Automated backup systems ensure all documentation is securely preserved and easily accessible. Regular compliance updates keep your documentation current with changing regulations. The software maintains detailed logs of all client interactions and dispute activities.

#7: Scale Operations Through Automation Technology

Modern credit repair automation provides the foundation for scalable business growth. The best automation tools for credit repair businesses enable efficient expansion without proportional increases in overhead. These tools create systems that can handle growing client volumes while maintaining service quality.

Credit Repair Dispute Software with Automations: Scalability

Advanced credit repair dispute software with automations supports business growth through scalable architecture. These systems can efficiently handle increasing client volumes without performance degradation. Automated workflows maintain consistency as your business expands to new markets.

The software adapts to growing team sizes with role-based access controls. Scalable features ensure your technology grows with your business.

Start Today and Explore the Features Firsthand!

Building Growth with Automated Systems

Implementing comprehensive automation creates a foundation for sustainable growth. The system streamlines operations allowing your team to handle larger client volumes efficiently. Automated task distribution ensures balanced workloads as your team expands. Integration capabilities support adding new tools and services as needed. These features enable strategic growth while maintaining operational efficiency.

Remember that successful implementation of credit repair automation requires careful planning and ongoing optimization. Start with the features that will have the most immediate impact on your operations, then gradually expand your automation capabilities as your team becomes more comfortable with the technology. Regular training and updates ensure you continue to maximize the benefits of your automation investment.

Conclusion: Transforming Your Credit Repair Business Through Automation

The implementation of credit repair automation has become more than just a competitive advantage—it’s now a necessity for sustainable business growth in the credit repair industry. As we’ve explored throughout this guide, the best automation tools for credit repair services can transform every aspect of your operations, from client onboarding to dispute management and compliance.

When you decide to automate your credit repair business, you’re investing in your company’s future. The right automation tools not only streamline current operations but also create a foundation for scalable growth. The best automation tools for credit repair businesses provide the infrastructure needed to handle increasing client volumes while maintaining service quality and compliance standards.

Mark Clayborne

Mark Clayborne specializes in credit repair, starting and running credit repair businesses. He's passionate about helping businesses gain freedom from their 9-5 and live the life they really want. You can follow him on YouTube.

Start Today and Explore the Features Firsthand!

Below Is More Content For Your Review: