Get Started for as Low a $107 for the First Month: Click Here

Google

- 4.9 Excellent

- 100 + Reviews

Get Started for as Low a $107 for the First Month: Click Here

This comprehensive 20-step guide will help you start on the right path in having your very own starting your credit repair business. Not only that, but I have also created additional steps to help you grow it.

End the long hours where you have no control of your own time. Say goodbye to living from paycheck to paycheck, where you can’t even spend enough time with your family and friends.

Being a credit repair business owner before I started my very own credit repair software company and the author of the book “Hidden Credit Repair Secrets,” which was the #1 book on Amazon for SEVEN years in a row, I am sharing with you the knowledge to start your own business in the credit restoration industry.

It’s your time to take the step in claiming the life you want.

I know we all want to say goodbye to our 9-5 and become our own boss. It may seem like a dream, but the truth is, this is something you can attain. How do you make it happen? You either hit the jackpot in a lottery or start your own business.

Now, the latter is more realistic but starting your own business is not easy unless you pick an easy one; this is why the credit repair business should be on the top of your list.

The credit repair business is a good business, but if you want to succeed, you must have people skills and dedication among other traits that you need. People are at the core of this business because of the constant interaction.

Dedication is needed because of the multiple hats that you will be wearing when you first start your journey of running a credit repair business. In addition to being a people’s person and having dedication, you need to be aware of the following:

Knowing your industry is vital to providing the services you offer as well as understanding your clients’ needs. If you have already experienced fixing your own credit, then you can already capitalize on your skills. All you need is additional training to become more efficient in improving other people’s credit scores.

One of the best courses out there for you will be our very own Credit Repair Mastery Class. This is a ten-hour on demand course where you learn the A-Z of credit repair and get a Mastery Certificate at the end when you pass the test.

Let’s discuss how much you will need to start your own credit repair business and the different fees you need to pay.

A fair estimate to getting started is at least $500; this is a reasonable fee compared to starting other businesses.

This will depend on what state you are in. Normally, it can run anywhere from 1% to 2% of whatever the state requires you to have for coverage for the surety bond. Visit the website of your Secretary of State or get in touch with them for information about surety bonds.

This is the amount of money you need to pay to engage in a specific kind of business, including credit restoration services. Certain states will require you to pay this to register your business, and it can run anywhere from $25 to $100.

Other expenses you need to consider include website, hosting, and domain; this is especially true if you want to reach out to potential clients online and, at the same time, build your brand and credibility.

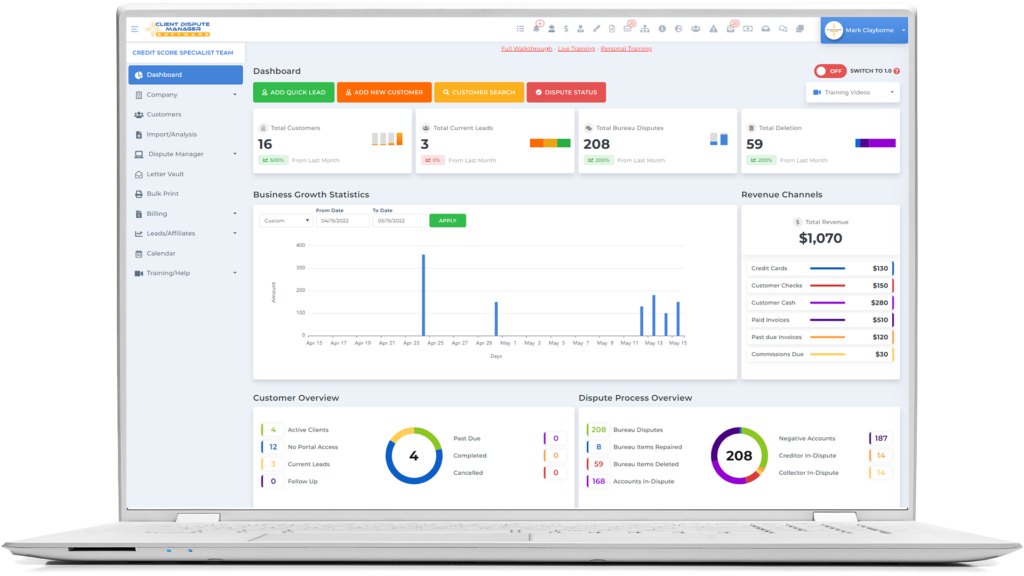

Having your own computer or laptop is important when you have a credit restoration business. Not only will you use it to manage your clients but also to store your files. Also, you need a printer that can print color as you will use this to print documents and letters. Lastly, having credit repair software like the Client Dispute Manager Software will greatly help you manage your business and your clients.

Learn more about the Client Dispute Manager Software and how it can help automate your business. Click here for the Free 30-day Trial.

In this kind of business, compliance plays a big role for you to thrive. Being compliant means following all the rules and regulations in your State Law. Each state has its own rules and regulations for everyone offering credit score improvement services.

You can go to your Secretary of State or Office of the Attorney General for more information.

Aside from state laws, you must also comply with federal laws. These laws are put in place to protect consumers and regulate credit repair businesses.

One of these laws is the CROA (Credit Repair Organization Act). CROA will help you to understand what you can and can’t do.

A good business plan will guide you through the different stages of your business. Since you are starting up, your plan can help you become more organized, focused, and efficient.

Your business name represents you and what your business is all about. Picking any name you choose is not enough.

Once you decide on the business name, the next thing is to ensure you set up a business email address. Check online if the domain for your business name is available. If it is, purchase it as soon as you can.

Your email address should be a simple and recognizable name. Remember, a professional business email should be easy for customers to identify that it is from you.

Learn more about the Client Dispute Manager Software and how it can help automate your business. Click here for the Free 30-day Trial.

A virtual office is a service that allows companies to work remotely while still maintaining a presence in a specific area without having to pay physical rent.

Virtual offices can provide a wide range of features, such as a mailing address, a receptionist, phone and voicemail services, printing and fax services, and even meeting rooms

You can also check https://www.ipmcinc.com/ or other similar platforms if you are interested in getting your own Virtual Office

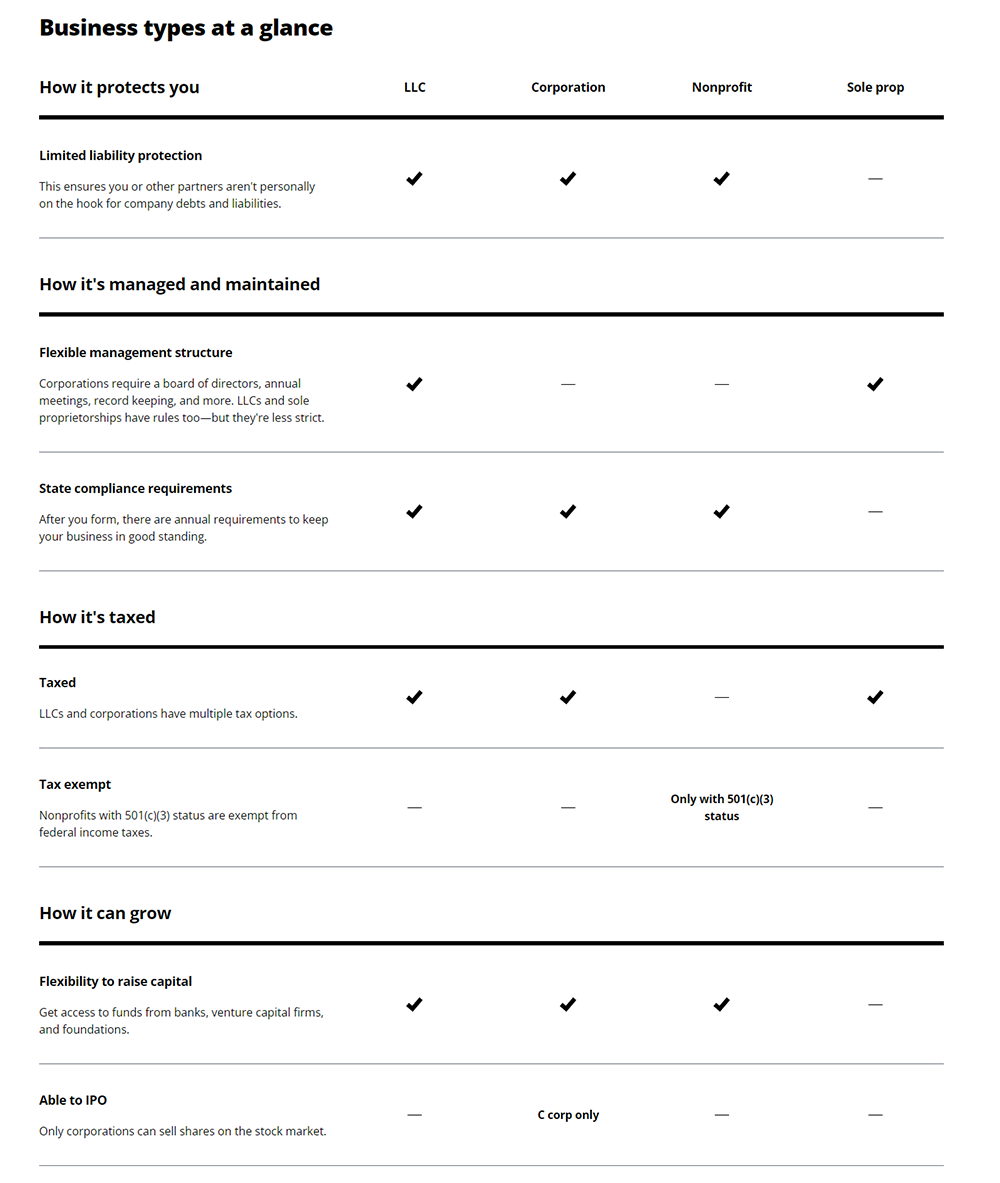

There are different types of business structures to choose from. It is crucial that you decide which one you need as it will impact your operations, taxes, and your personal liability protection. This is a decision that you must make before you register your business.

You can check the comparison in a chart from https://www.sba.gov/business-guide/launch-your-business/choose-business-structure

Learn more about the Client Dispute Manager Software and how it can help automate your business. Click here for the Free 30-day Trial.

Whether your business is big or small, forming your brand is one of the most vital aspects you need to focus on. Creating your brand and using it effectively can give you an edge over your competitors.

Your business should reach your target audience and there’s nowhere better than online to do it nowadays.

Setting up a website may take a lot of work and some basic technical skills. If you want to save time, you can choose a pre-made site with custom layout for the credit repair business industry. For more information https://clientdisputemanagersoftware.com/credit-repair-websites/

Running your own credit restoration business may take a lot of time. However, gone are the days where you have to do most of the tasks manually such as interviewing your clients, writing down their information and storing their files. Having a credit repair software will do wonders for you and your business.

Learn more about the Client Dispute Manager Software and how it can help automate your business. Click here for the Free 30-day Trial.

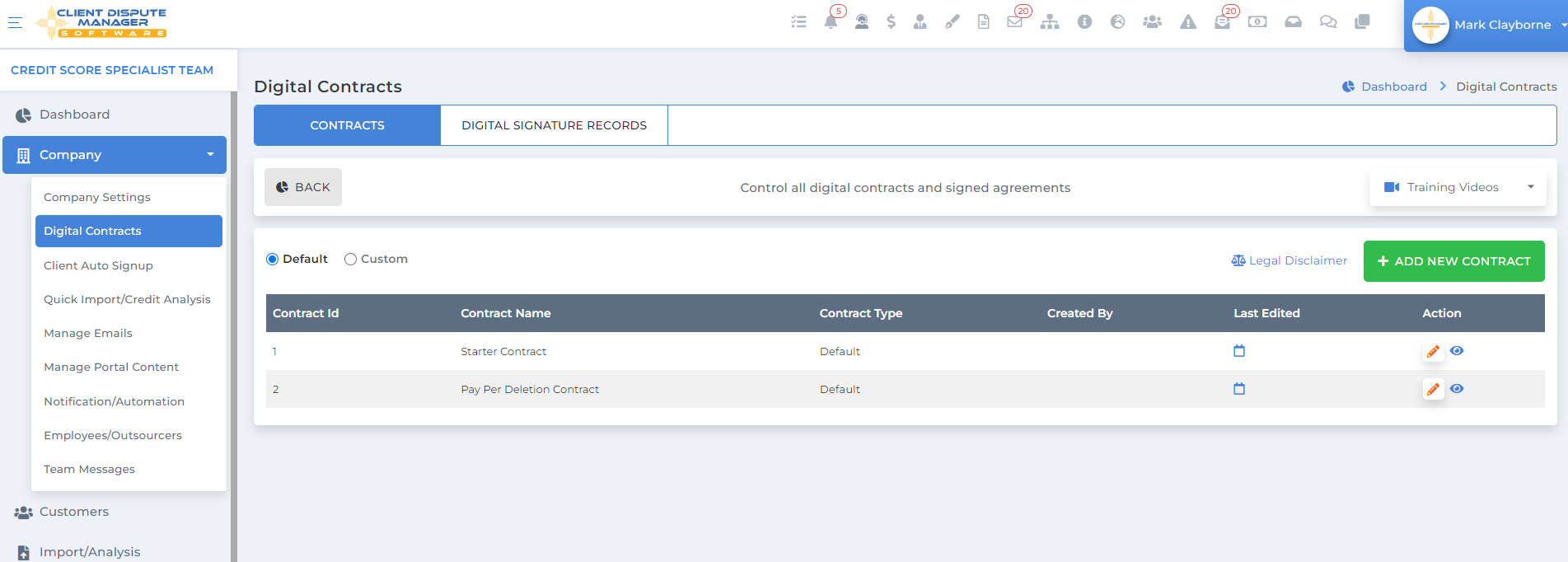

Before you start offering your services, one of the things you must have is a contract. This is because some of the State laws, and Credit repair Organization Act require you, as a credit restoration company, to provide your customer with a contract/or agreement.

It’s very important that you understand the basics of a contract. You must know the terms and clauses that you need to place inside of the contract, before you render service for a customer.

There are contract templates that you can use as a reference. You can find them online and also in the Client Dispute Manager Software.

Email is one of the most powerful platforms that can turn an interested individual into a potential client. Setting up your own email nurturing campaign will help educate your leads about your services. This will in turn keep them in a path where you can guide them to finally turn their “maybe” to a “yes” in acquiring your services.

If you think you need an email marketing guide that will teach you how to properly run your email campaigns and provide you with content that you can use, then you might want to check out my lead generation email nurturing campaign which is free in the Client Dispute Manager Software.

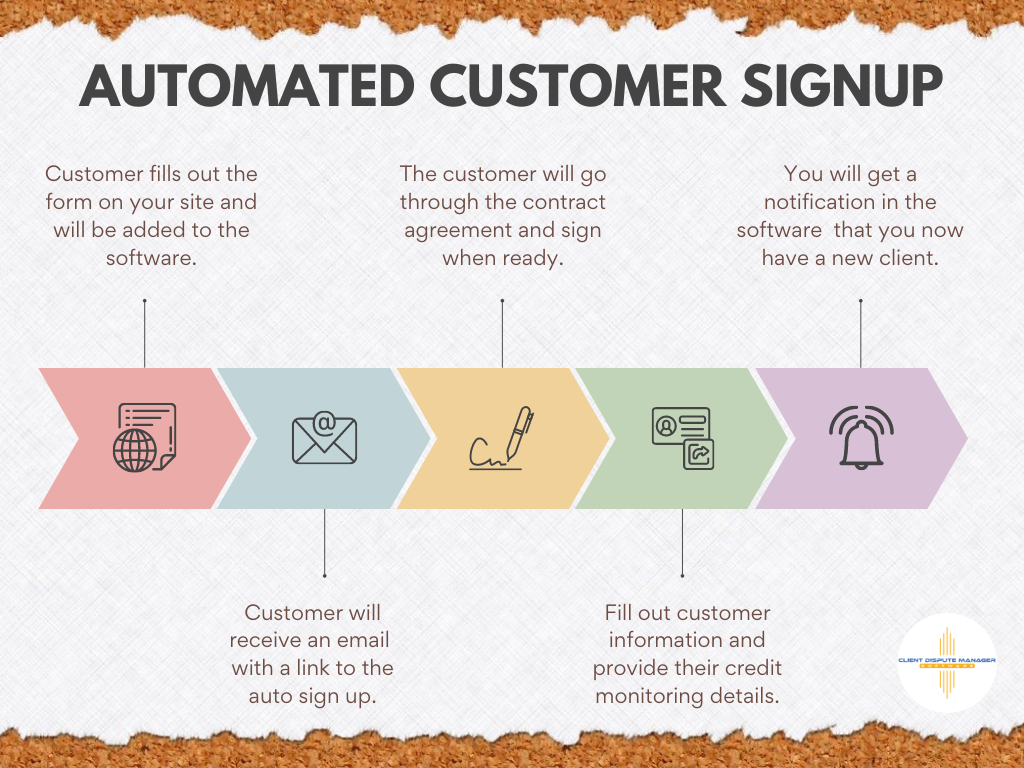

One of the challenges for someone who is offering credit restoration services is finding the time to go after clients and get the necessary details. This is why having an automated system is such a big help, as it will make you more efficient and is convenient on both sides.

The Client Dispute Manager Software can automate customer signup without any phone interaction at all.

Your customer can complete the whole process online, on their own time, even while you sleep. Imagine waking up with a new client waiting and ready to use your services!

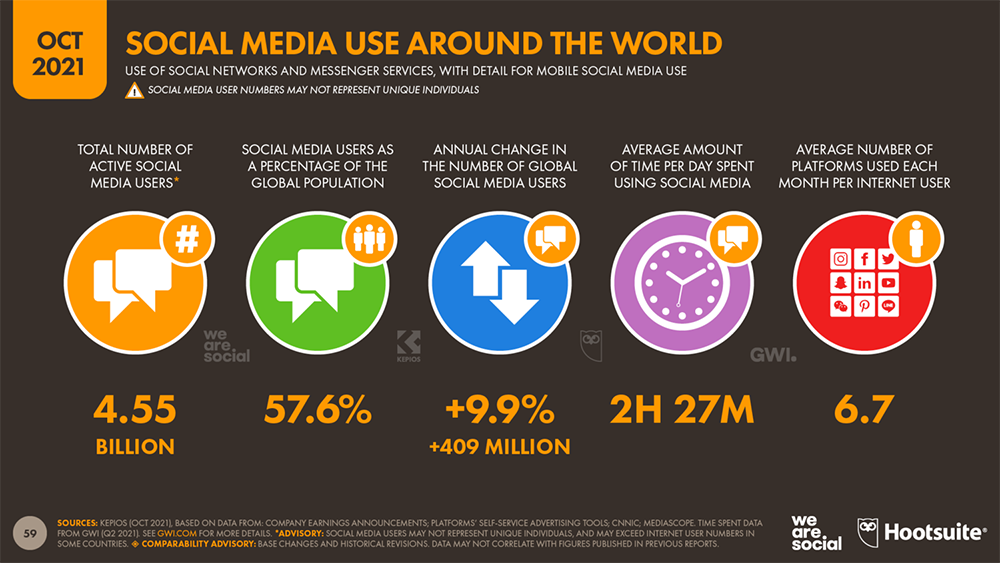

One way to market your services and stand out from your competitors is to build a strong online presence. You don’t necessarily have to spend a lot to do this, as your social presence is really more about being active. What you need is knowledge of the platforms you should use and the right social media strategy.

Learn more about the Client Dispute Manager Software and how it can help automate your business. Click here for the Free 30-day Trial.

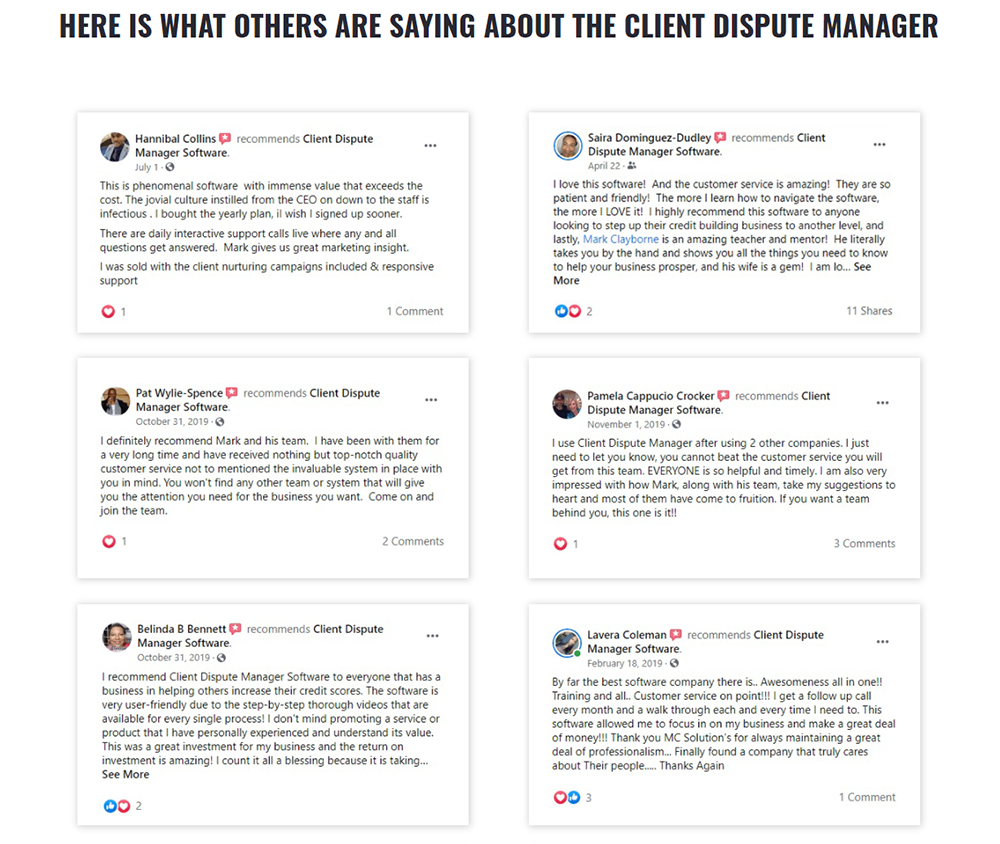

A very powerful way to get the attention of the people you want is to have them see you as an authority when it comes to credit score improvement. This is not something that can happen overnight. However, even if you are new to the industry, you can still achieve this by using your social media to become a subject matter expert that your target audience will know, like and trust.

To know more about products that can rebuild credit, visit this link: https://clientdisputemanager.com/register

There are more ways than one to grow your credit repair business, and one of those is to offer free credit repair services in exchange for testimonials.

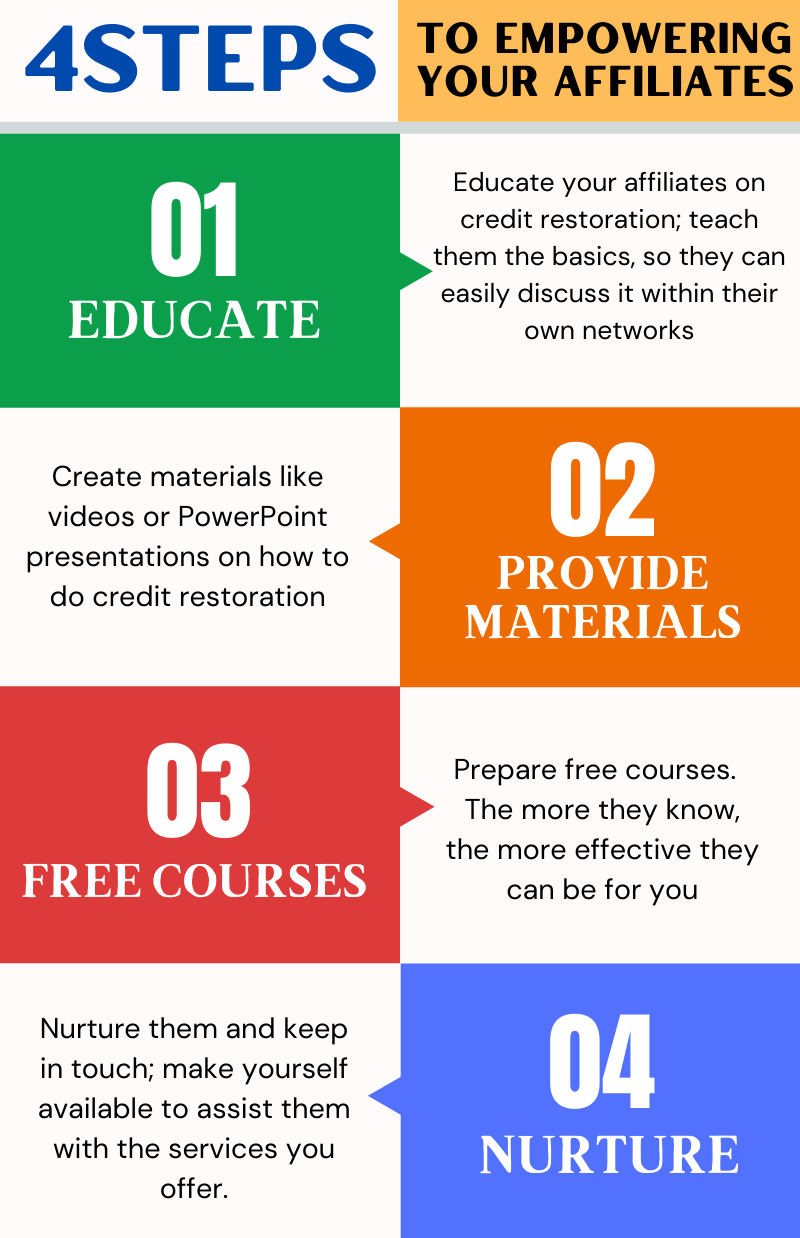

Creating your own network of affiliates can also help you grow your business. They basically send you potential clients without you having to really go out there and hustle for them.

The landscape of credit repair laws has undergone significant transformation since the industry’s inception. Initially operating with minimal oversight, the sector now adheres to strict regulations designed to protect consumers. Two foundational laws for credit repair have shaped the industry: The Fair Credit Reporting Act (FCRA) of 1970 and the Credit Repair Organizations Act (CROA) of 1996. These credit repair laws established clear guidelines for credit reporting agencies, credit repair organizations, and consumers, revolutionizing the way credit repair services are conducted.

The Fair Credit Reporting Act (FCRA) stands as a pillar among credit repair laws, empowering consumers in the credit reporting process. It grants individuals the right to access their credit reports annually at no cost, dispute inaccuracies, and understand how their credit information is used. For credit repair entities, FCRA compliance is not just a legal requirement but a fundamental aspect of ethical business practices.

FCRA compliance extends beyond simply following rules; it involves embracing the spirit of the law to ensure fair and accurate credit reporting.

Credit repair organizations must implement robust systems to assist clients in exercising their FCRA rights, including disputing inaccuracies and understanding the impact of negative items on their credit reports. By prioritizing FCRA compliance, credit repair companies demonstrate their commitment to consumer protection and transparency.

The Credit Repair Organizations Act (CROA) addresses specific challenges within the credit repair sector, setting a high bar for ethical practices. This pivotal law for credit repair mandates that credit repair organizations provide detailed written agreements, avoid charging upfront fees, allow a cooling-off period for contract cancellation, and maintain truthful advertising practices. Compliance with the Credit Repair Organizations Act is essential for any business operating in the credit repair industry.

By adhering to CROA, credit repair organizations elevate the professionalism of the entire industry. The act forces companies to be more transparent in their dealings, more ethical in their practices, and more focused on delivering real value to their clients. Understanding and implementing Credit Repair Organizations Act requirements is not just about legal compliance; it’s a fundamental aspect of building a reputable and successful credit repair business.

Credit repair compliance encompasses adherence to both the Fair Credit Reporting Act and the Credit Repair Organizations Act, as well as other relevant laws for credit repair. It’s not merely a legal obligation but a strategic imperative that builds trust, enhances reputation, and differentiates ethical operators in a competitive market.

To ensure comprehensive credit repair compliance, organizations should:

By adopting these strategies, credit repair companies can turn compliance into a competitive advantage, positioning themselves as trusted advisors in their clients’ financial journeys.

The regulatory environment for credit repair is constantly evolving, with frequent updates and new interpretations of existing laws. Staying compliant with credit repair laws requires continuous monitoring of legislative changes and regular policy reviews. Organizations must remain vigilant in their FCRA compliance efforts and stay abreast of any amendments to the Credit Repair Organizations Act or other relevant regulations.

This proactive approach to credit repair compliance helps organizations stay ahead of regulatory changes and adapt their practices accordingly. It demonstrates a commitment to ethical operations that can set a company apart in the credit repair industry.

These steps I have created for you will remove the confusion over how you can start your own credit repair business. Go through each step and always assess the results. There is no overnight success in this industry, but with hard work and consistency, it is possible to rise above your competition even if you are new.

So, do you think you’re ready to dive into the credit repair business? Of course, you are!

Learn more about the Client Dispute Manager Software and how it can help automate your business.

Click here for the Free 30-day Trial.