This 10-step guide will put you on the right path in starting your own credit restoration business.

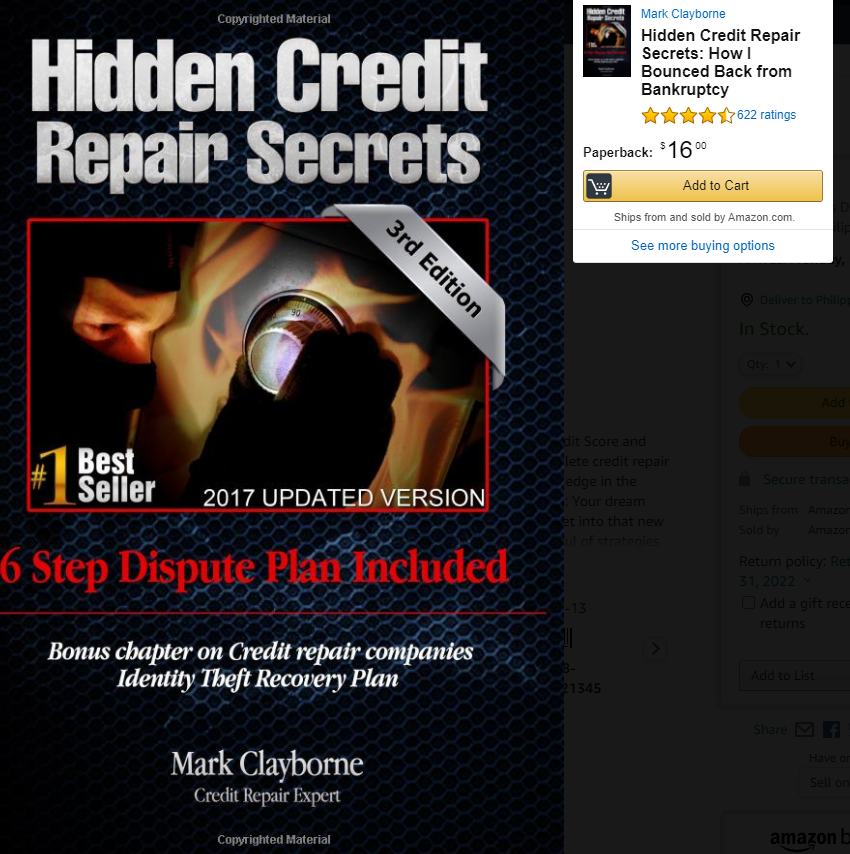

I have been in the credit improvement industry for many years now. I started my own credit restoration business because I wanted to leave my 9-5 job. I wrote a book called “Hidden Credit Secrets” which was the #1 book on Amazon for SEVEN years in a row.

From there, I also started coaching new entrepreneurs who wanted to start their own businesses as well. I took the opportunity and started my own software company and started Startup Credit Restoration Business Training Center.

When I started, I was just like you right now; I looked up tons of articles and resources that I ended up not knowing where to begin. This is what I don’t want to happen to you.

My years of experience and knowledge are what I am sharing with you now; that way, you know what you have to prioritize before any other.

So, without any further ado, let’s dive in!

Step #1: Why The Industry?

There are over 100 million consumers struggling with bad credit which is why it is a great idea to have your own credit restoration business. It will not only benefit you but also those who need your help. This business can help you start a whole new career and you can even start with it part-time. With the proper training and tools, you can thrive in this industry, turn it into a full-time career and make a big impact in your community.

Here are some of the reasons why you should start your own business in improving other people’s credit:

- You can start even with just low startup fees compared to other businesses.

- You have the option to work from anywhere may it be in your home or while you are traveling.

- Have the flexibility to work in your own schedule. Time to say goodbye to the 9-5.

- Be your own boss, do your own thing and finally live the life you deserve to have.

Step #2: Must Learn How to Improve Credit Scores

Credit Score Improvement Training and Certification

One way to thrive in the industry is to become credible in what you do. This is where credit score improvement training becomes valuable. There is a lot of free training you can get online. You can also look for paid training as mostly these are the ones that include certifications.

Other ways to expand your learning:

- Join Facebook and other online communities in your industry

- Watch online webinars

- Attend conferences and seminars

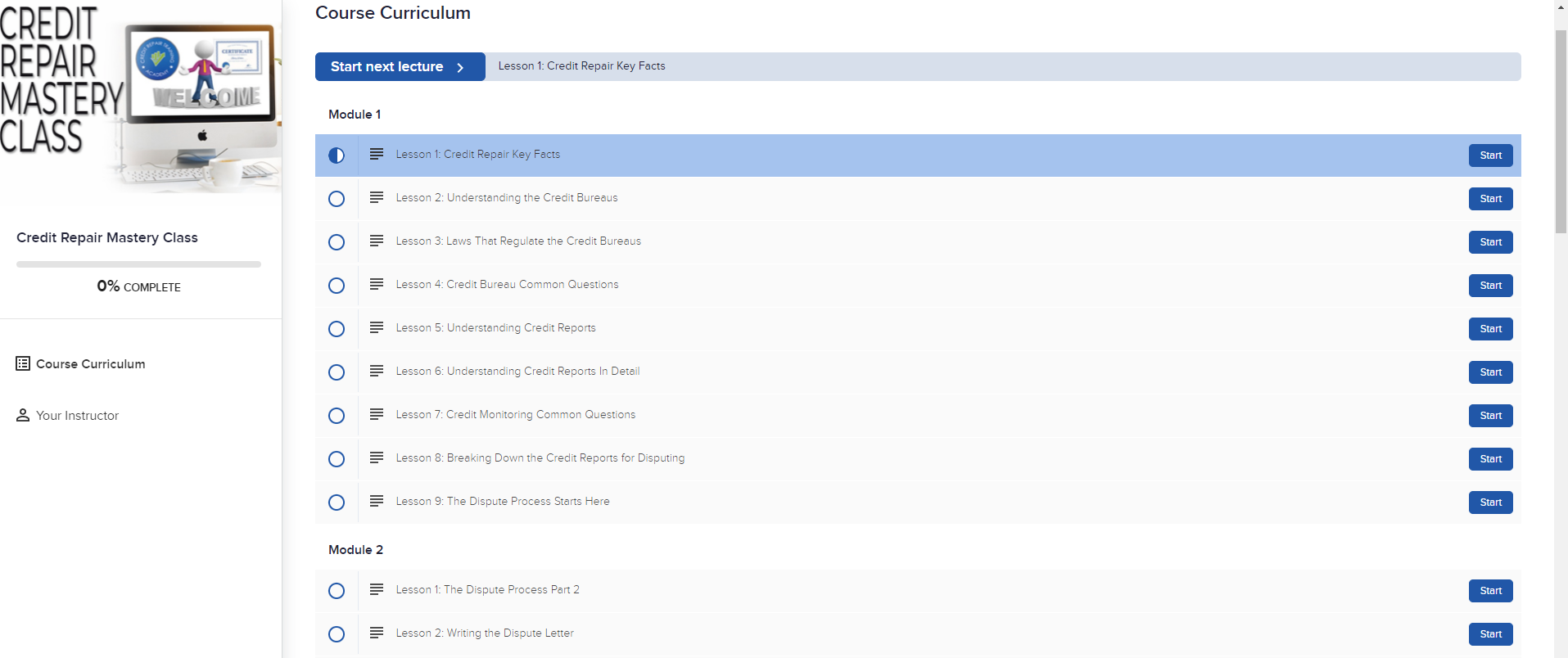

- Enroll in online courses

One of the best courses you can enroll in is our credit mastery class. It covers the A-Z’s of improving someone’s credit score all the way up to advanced strategies and you can even get a certificate once you pass the test. Learn more here: Credit Mastery Class

Step #3: What Will It Cost You to Start your Business

Starting any type of business requires a price. However, one thing to look forward to when you plan to be in the credit restoration industry is that it won’t be as much.

Here are some fees you will have to consider:

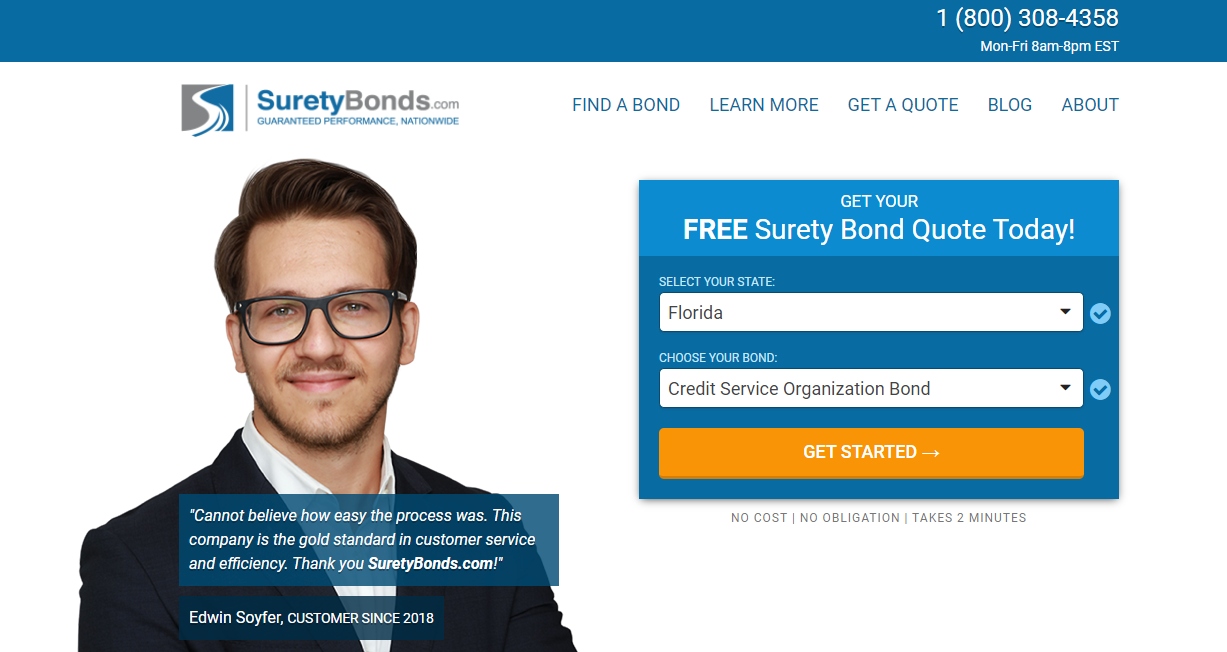

Surety bond

Every state in the US requires different conditions when it comes to a surety bond. Surety bond fees can run anywhere from 1% to 2% of whatever your state requires.

Want to know how much surety bond is in your area?

You can check suretybonds.com.

Licensing Fees

Not every state requires this, but when your state does, it can run anywhere from $25 to $100. You must check your state, though, on how much it will be.

Tools and Devices

This will depend on what you have available already. Basically, you need a computer or a laptop, a printer, paid online platforms (software, accounting tools), and other office materials.

Marketing Fees

Since you will be starting your business, you may want to invest in marketing materials may they be online or offline.

Step #4: Know the State and Federal Laws

Following the laws, regulations, and rules in the credit restoration industry is a must. You can’t compromise this because you will be putting your business at risk. Hence, it is important that you know what these are:

CROA

CROA is a law put in place by Congress to protect the consumers and regulate companies that offer credit score improvement services. You must know the details of this law as it includes what are prohibited and what are allowed in the industry.

State and Federal Laws

Being aware of the State and Federal laws will allow you to know the needed requirements to start and run your credit restoration business. Not only that, but they also detail when you can charge, the right way to advertise, and the things that you can and can’t do.

Step #5: Setting Up Business Name and Email

I know a lot of you are looking forward to this… naming your business. Coming up with a business name can be both fun and challenging.

Below are some of the tips I want to share:

- Your business name should represent you and your services.

- Do not pick hard-to-spell or easy-to-forget names. You have to stand out, but at the same time, be memorable.

- Make sure your business name won’t limit your growth. Don’t limit your name to a specific service if you plan to offer more in the future.

- Research and make sure your business name is available. You can visit legalzoom.com to check business name availability.

Get a business email.

If you already decided on your business name, then next thing is for you to get your own custom business email. Having your own business email gives you a more professional impression.

Why you need to have a professional business email:

- Promotes trust. It gives assurance to your clients that you are a legit business and in turn will motivate them to trust you.

- Build awareness. When you email customers using your email business address, you remind them of your business hence they will recognize it.

- Consistency with your brand. Being a new business, it is important that you establish who you are and make your contacts easily identify you.

Here are some tips on having your own business email:

- Your email domain should also be the same as your business domain.

- Make your email simple and easy to remember.

- Find the best professional email hosting option.

- Test your email address.

Step #6: Getting a Virtual Office Address

In starting your own credit restoration business, you have to decide whether your clients will go to a physical location to learn about your services or if you will do everything online. If you chose the latter and want the freedom to work from your home then you have to consider getting a virtual office address.

What can a virtual office do for your business?

- Save time and money as you no longer have to travel, pay rent or hire a staff.

- Clients will be impressed as you can get a prestigious business address

- Can set up mail handling and mail forwarding

- You can meet with clients in a well-appointed office or conference room without renting full-time.

You can also check https://www.regencyexecutiveoffices.com/ and other similar platforms if you are interested in getting your own Virtual Office

Step #7: Picking Your Business Structure

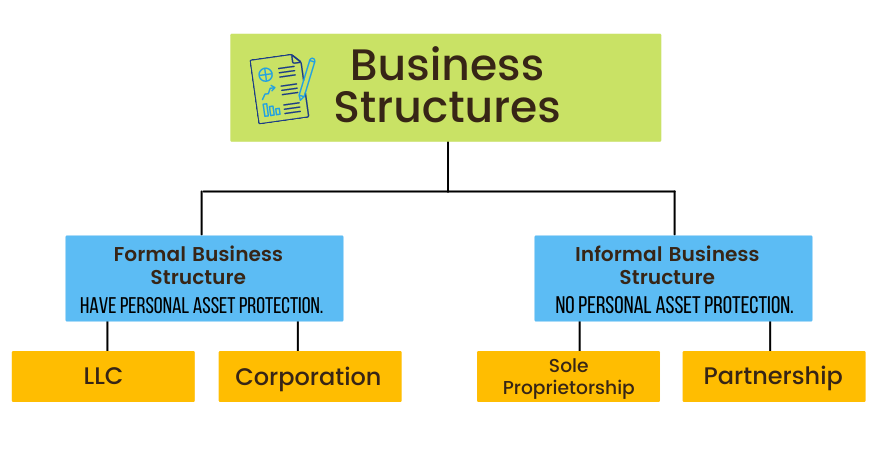

When you are forming your business, it is important that you decide on what your business structure is. Your business structure will impact how your business is set up, how it operates, and how it is taxed.

There are two categories: Formal and Informal

- Formal Business Structures: LLC and Corporation

- Informal Business Structure: Sole Proprietorship and Partnership

The formal business structure has personal asset protection, which means it will protect you if your business is sued.

You should decide whether you want to become a sole proprietor, an LLC, or a corporation.

Step #8: Brand and Marketing

When you are starting, it is important that you start preparing for your launch. You need to get the word out because your business is futile if nobody knows about it, no matter how great your service is.

Also, marketing is something that you need to constantly do, so better start it as early as you can. When we talk about marketing, we also talk about branding, which is essential for your business.

Branding is all about how people see you as a business; it reflects what you stand for.

Create a style guide or a mood board that will include elements like your logo, color, font style you use, and even your communication style. This is one way for you to be consistent wherever you promote your services.

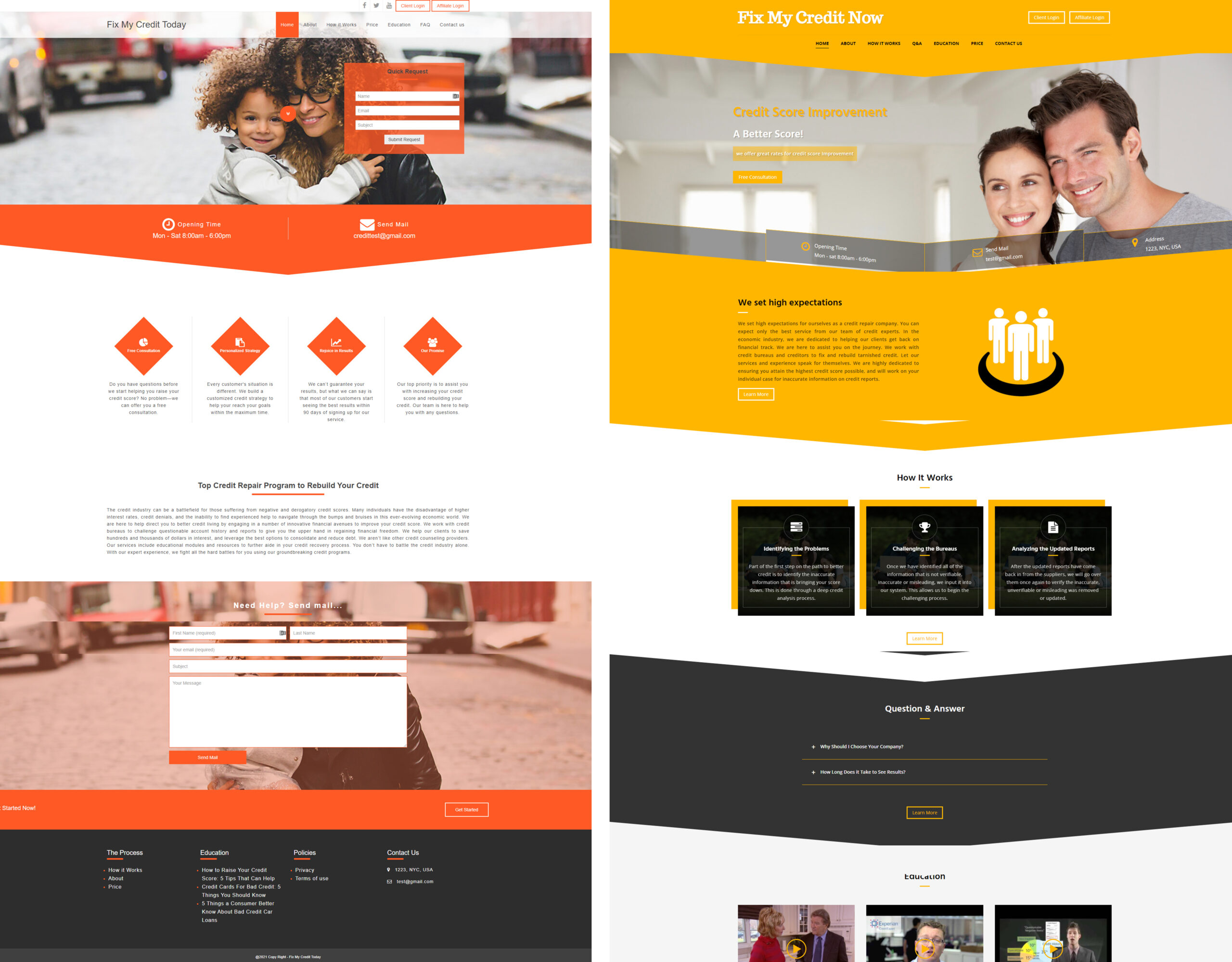

Step #9: Your Own Website

Where do you go for information when you want to buy something or plan to look for services? The internet! So is your target market.

This is why having a website is no longer just an option but a necessity if you want people to take your business seriously. A website can help increase your credibility and also authority in the industry.

So, how do you set up one?

Get our own domain:

Make sure this reflects your business, or get one that is your business name.

Find your hosting provider:

There are several hosting companies to choose from, and they offer packages based on your needs. Choose a hosting provider that has a high uptime rate and offers great tech support.

Website Look and Design

Finding the right design or website template is important. You need to pick one that is in line with your services. There are ready-made templates available where you can just add your own content and won’t have to worry about doing the designing and layout. You can find them on https://clientdisputemanagersoftware.com/credit-repair-websites/

Decide on a website builder

There are a lot of website platforms as well that you can choose from. There’s WordPress, Squarespace, and Wix, among others. Though, I would highly recommend WordPress as it has more customizations available. Plus, it can easily grow with your business.

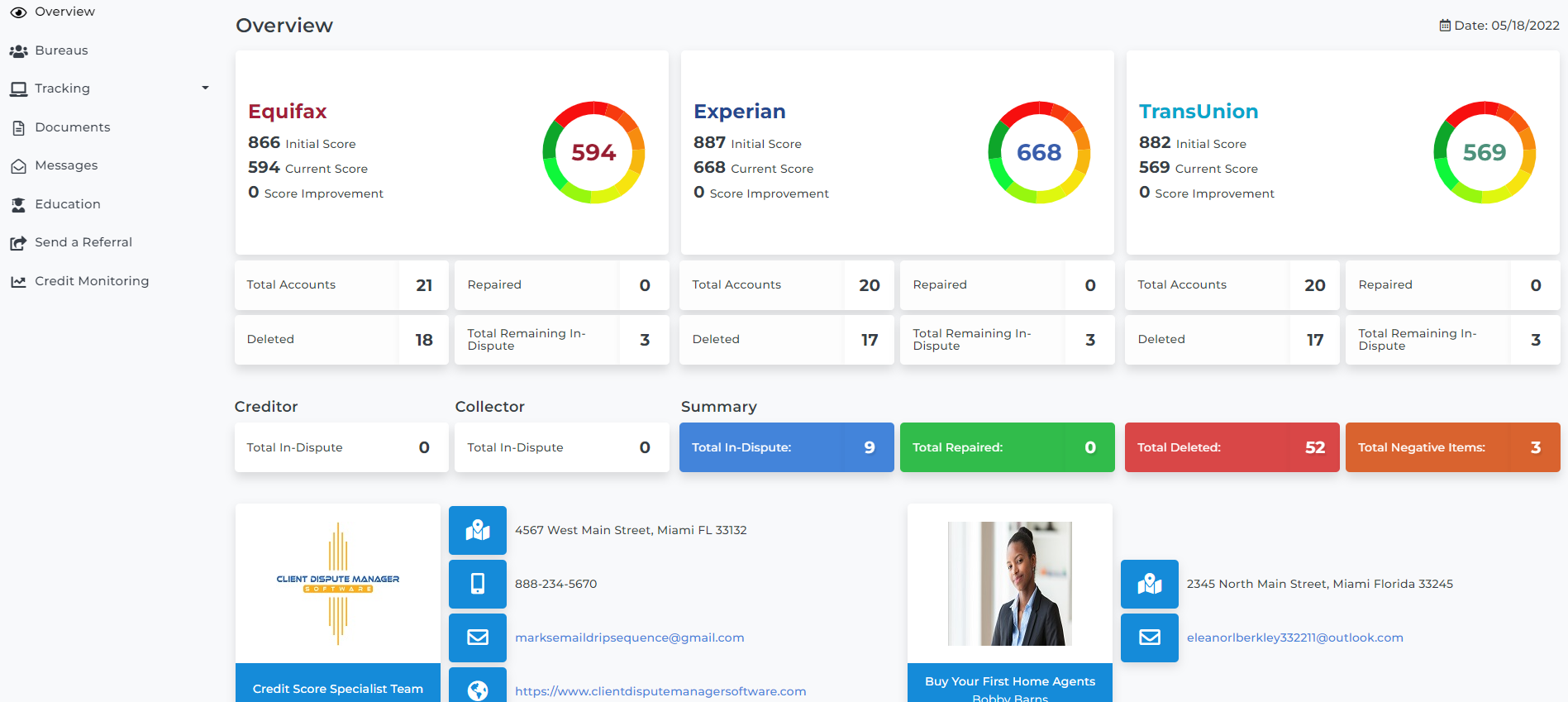

Step #10: Manage and Automate with a Software

Right now, you may be wondering if you need software. Before you decide whether you need one or not, let me tell you what credit software can do.

Here are some of the reasons credit restoration businesses, especially startups, use our Client Dispute Manager Software:

- Automate customer onboarding

- It helps streamline the business processes

- You can easily manage and nurture your customers

- Our smart interviewer feature automates the interview process

- Quick import feature lets you upload credit reports in the software in less than a minute

- The dispute process becomes easier and can be tracked properly

- Dispute letter templates that you can readily use or customize to your liking

- Your customers will have their own portal where they can see what you are working on and the progress

Conclusion:

Anyone can start a credit restoration business. However, knowing how to properly do it will not only ensure you are off to the right start but will also give your business a stronger foundation.

Focus on the guide I provided and also add what you learn along the way. Having your own business is always a work in progress and is all about continuous growth.

Do you think you are more ready now than you were before? You should be!

Don’t forget to download the FREE Step-by-Step Blueprint and the 15-day Email Series.

Bonus: Now that you have read this article, why not take your new skill and start your own credit business helping others? We have free training that can help you do just that.

Click here to learn more.