Are you searching for the best credit repair software to streamline your business? If you run a credit repair business or are just starting in the industry, you know how overwhelming it can be to manage disputes, track clients, and ensure compliance.

That’s where Client Dispute Manager Software comes in. It’s one of the best AI credit repair software options available, offering tools that make your operations more efficient, your clients happier, and your life easier.

In this article, we’ll explore the top 10 features of Client Dispute Manager Software and show you how they can transform your credit repair business. Whether you’re an entrepreneur or someone curious about improving financial literacy, you’ll walk away with valuable insights into how this software works.

Start Today and Explore the Features Firsthand!

Why Choose Credit Repair Software for Your Business?

Let’s start with the basics. Have you ever struggled with tracking multiple client disputes, writing compliant letters for different credit bureaus, or ensuring client onboarding is seamless? These are common challenges for credit repair specialists. Client Dispute Manager Software is designed to solve these problems with its all-in-one platform.

With its easy-to-use features, you can stay organized, automate tasks, and provide a better experience for your clients. This is why it stands out among the best credit repair software options.

Now, let’s dive into the software’s standout features and see why it’s a preferred choice for those looking for the best AI credit repair software on the market.

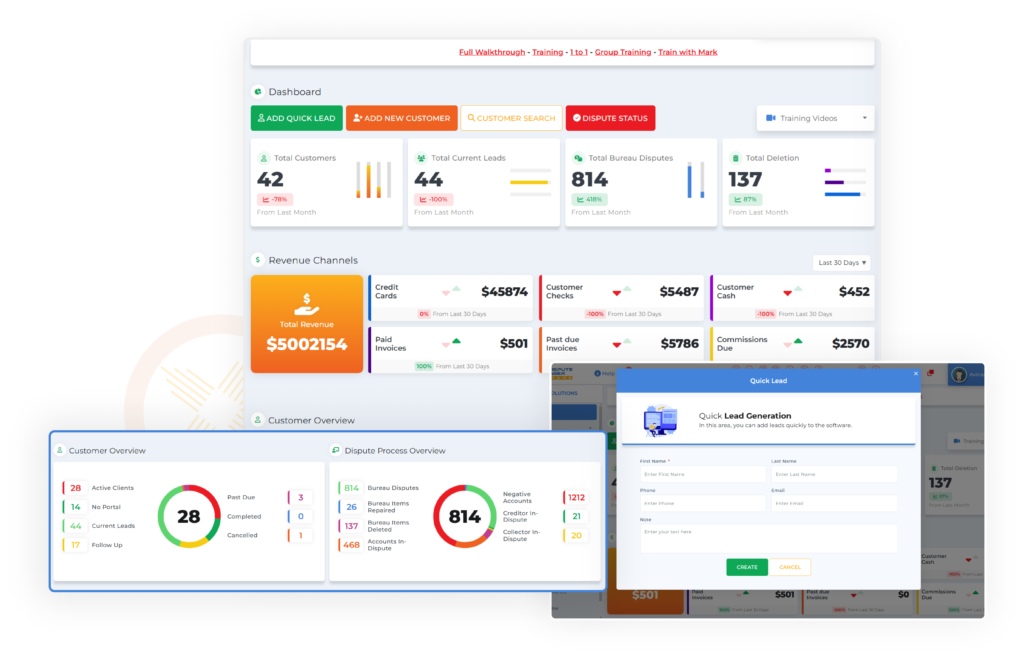

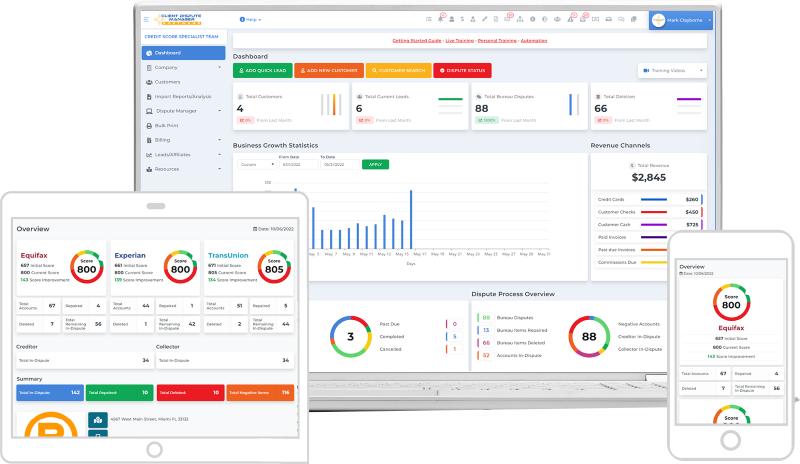

A Comprehensive Dashboard: The Core of Credit Repair Software

The dashboard is the central hub where you can manage all your operations. It allows you to access training resources, monitor customer details, and track key metrics such as disputes, deletions, and revenue. With its organized layout, the dashboard also helps you manage internal tasks, reminders, and messages, ensuring that your workflow stays efficient.

Start Today and Explore the Features Firsthand!

Key Benefits of the Dashboard

- Centralized access to important tools and metrics.

- Real-time monitoring of disputes and customer statuses.

- Simplified task management with internal reminders.

When evaluating software for credit repair, having a powerful and intuitive dashboard like this one makes all the difference.

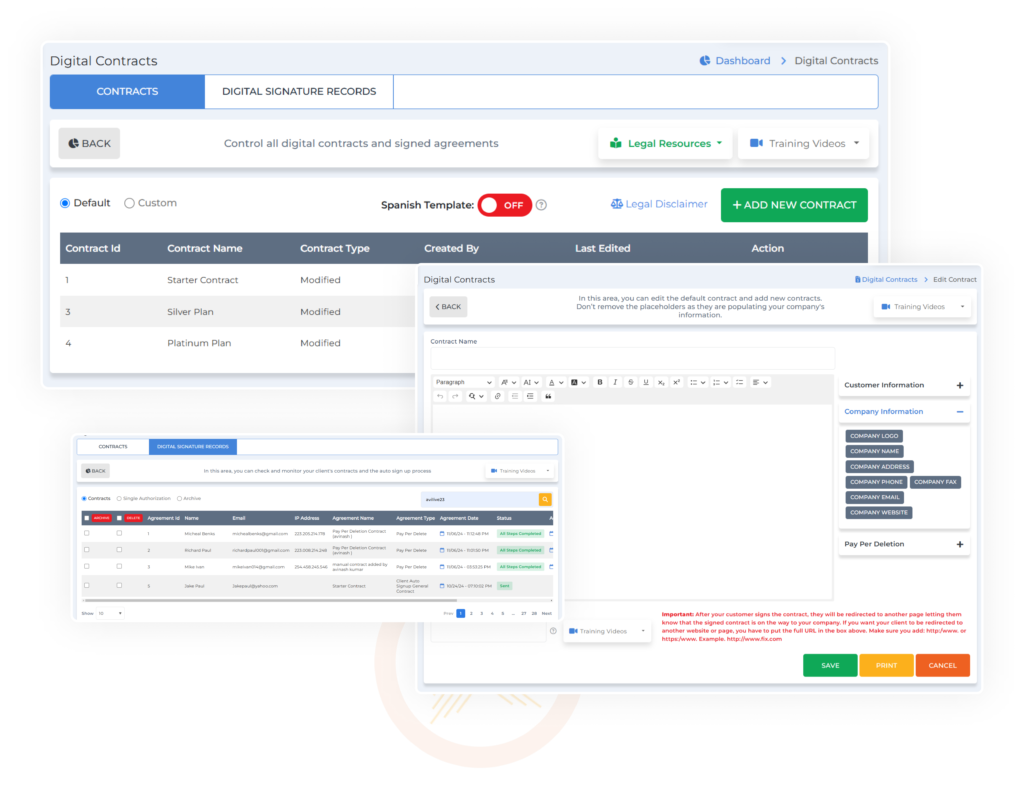

Digital Contracts: A Feature of the Best Credit Repair Software

Managing client contracts becomes effortless with the digital contracts feature. This tool eliminates the need for paperwork and ensures that every agreement is professional and compliant.

You can customize templates to suit your business needs or upload your own contracts. Adding your company’s branding helps build trust and maintain a professional image.

Start Today and Explore the Features Firsthand!

Highlights of Digital Contracts

- Customizable templates that fit your business requirements.

- Options to create or upload new contracts easily.

- Built-in compliance with state laws to simplify processes.

Among the best credit repair software features, the ability to manage digital contracts efficiently truly stands out.

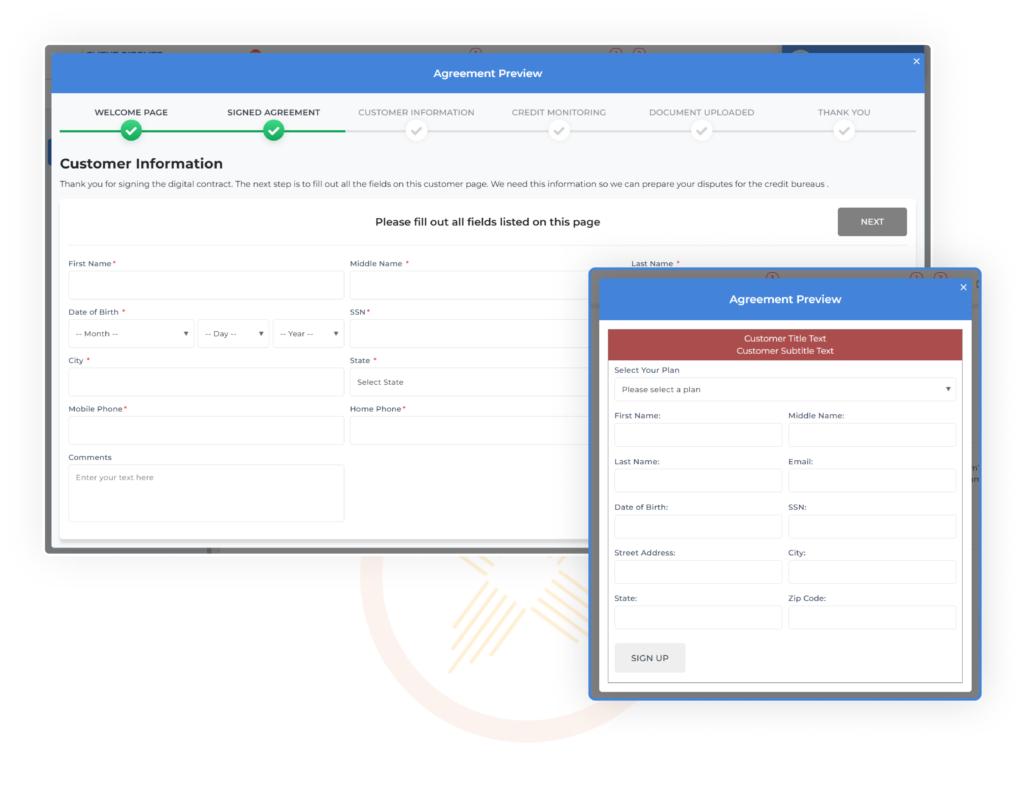

Client Auto Signup Form and Link: A Must-Have in Credit Repair Software

The client auto signup form and link make onboarding seamless by automating the process. Clients can sign up directly through your website or via a shared link. Once a client selects a service, the software automatically sends them the appropriate contract and collects their details, freeing up your time for other tasks.

This feature is perfect for businesses that want to simplify client intake while maintaining a professional approach. It’s particularly useful for integrating contracts into your marketing campaigns. No other software for credit repair makes onboarding this effortless.

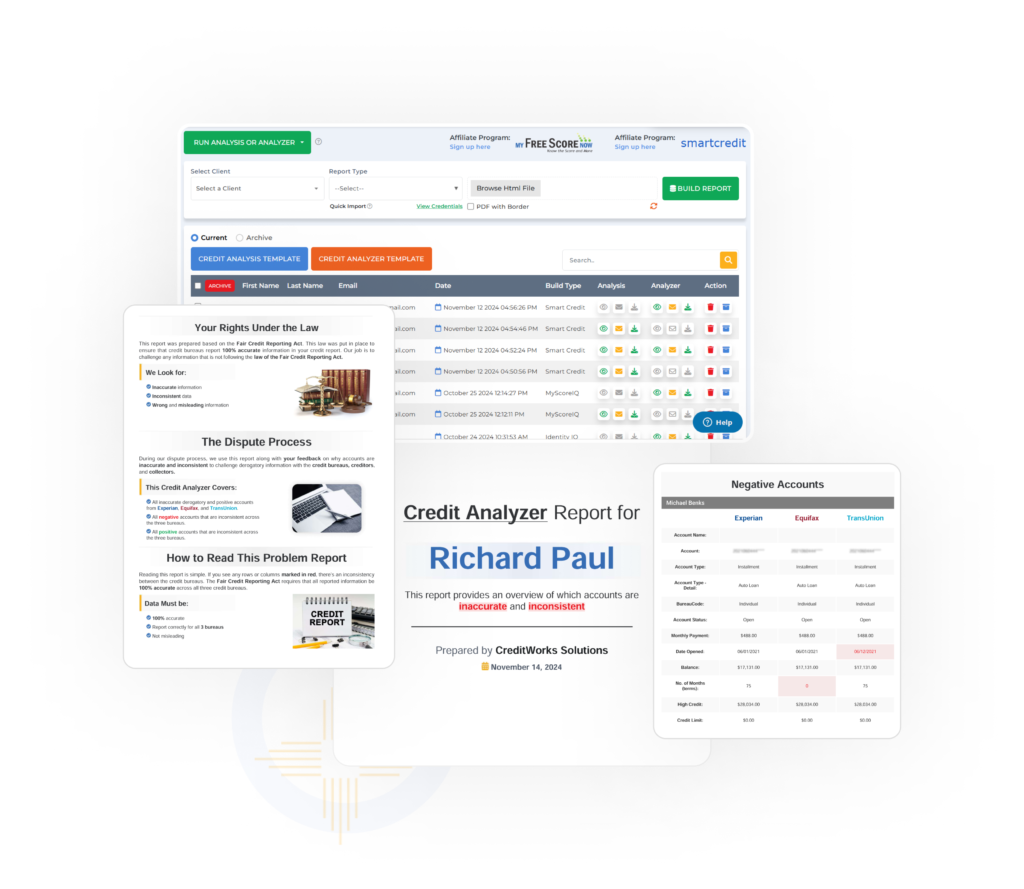

Credit Analysis and Analyzer: Key in AI Credit Repair Software

Analyzing credit reports is often a tedious task, but the credit analysis and analyzer feature streamlines this process. It provides actionable insights, helping clients understand how they can improve their credit scores. The tool generates detailed reports that you can share during consultations, making it easy to communicate the steps clients need to take.

Start Today and Explore the Features Firsthand!

Benefits of Credit Analysis and Analyzer

- Creates detailed, actionable reports for clients.

- Highlights key areas for improvement in credit scores.

- Customizable templates to suit various scenarios.

For those seeking the best AI credit repair software, this feature is a must-have for simplifying credit audits.

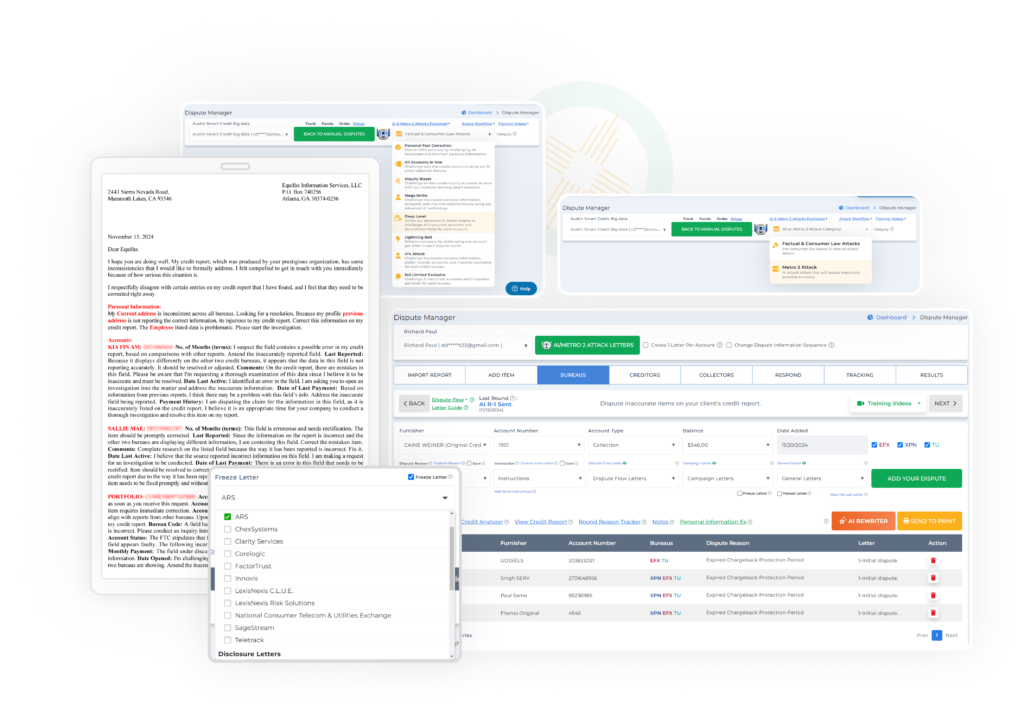

Dispute Manager Screen: Organize Every Dispute Like the Best Credit Repair Software

Handling disputes is at the core of any credit repair business, and the dispute manager screen is a game-changer. This feature lets you import credit reports directly, track disputes across bureaus, creditors, and collectors, and monitor updates all in one place.

Instead of juggling spreadsheets, you can rely on this system to keep your workflow organized and efficient.

This centralized system ensures that you never lose track of a dispute’s progress or outcomes, making it easier to manage multiple clients simultaneously. It’s a standout tool in any software for credit repair.

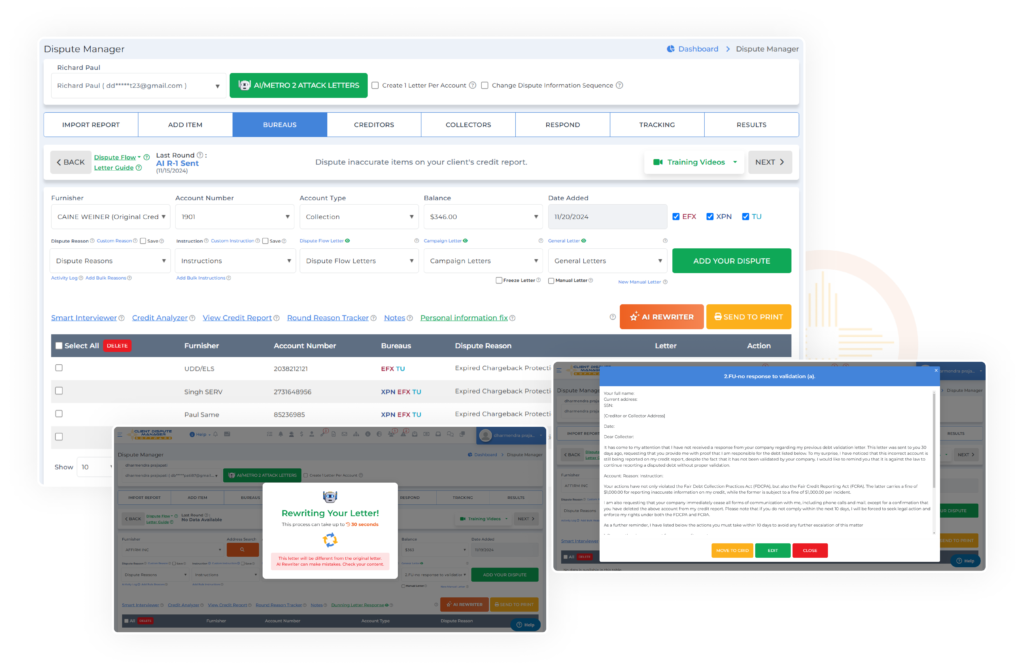

AI Rewriter: The Best AI Credit Repair Software Tool for Letters

Writing unique dispute letters for each client is time-consuming, but the AI Rewriter automates this task. It generates tailored versions of default templates, ensuring that each letter is customized and compliant. This tool is perfect for businesses looking to save time while maintaining high-quality correspondence.

Start Today and Explore the Features Firsthand!

Why Use the AI Rewriter?

- Automates the creation of unique dispute letters.

- Ensures compliance with legal standards.

- Reduces the need for manual editing.

The AI Rewriter is one of the reasons why this is considered the best AI credit repair software available today.

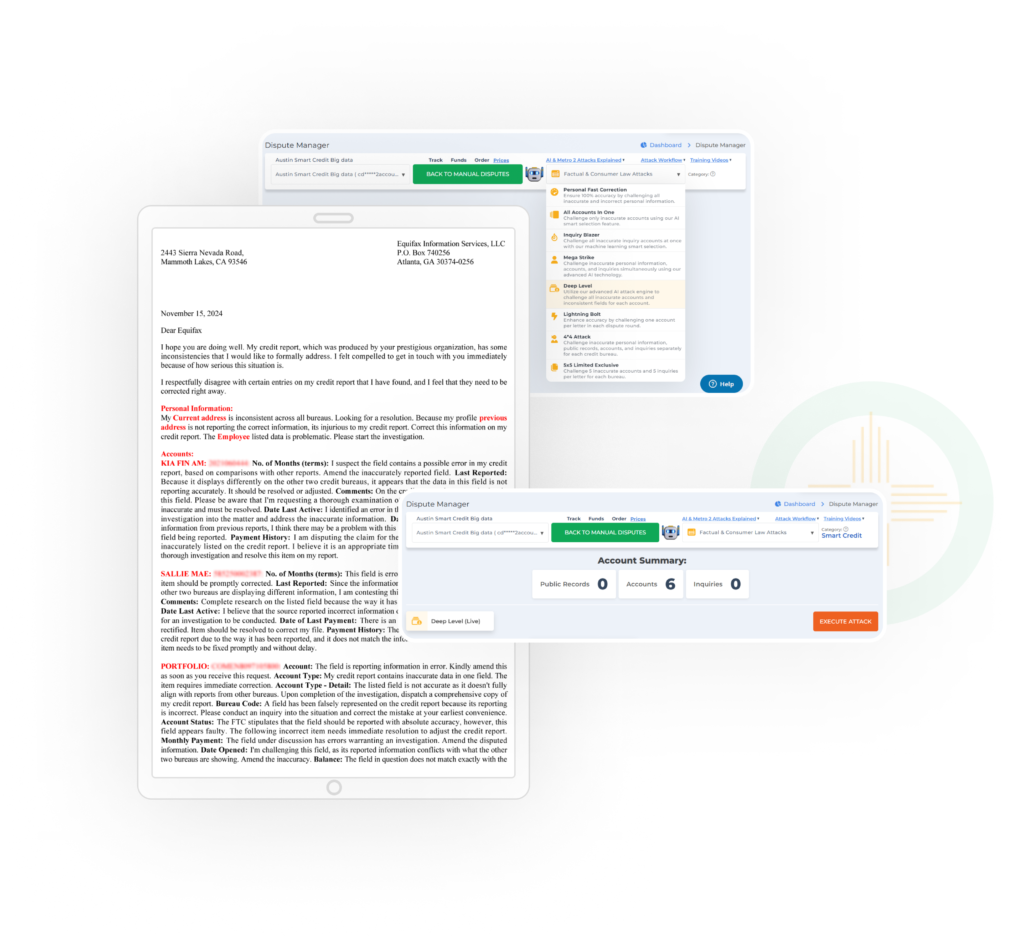

AI and Metro 2 Compliance: Advanced Software for Credit Repair

Staying compliant with credit dispute regulations is crucial, and the AI and Metro 2 compliance feature simplifies this process. It uses advanced AI to create consumer-law-based or Metro 2-compliant letters tailored to specific client situations.

Whether you need to address inaccuracies or demand corrections from credit bureaus, this feature ensures that all letters are professional and meet legal requirements.

By leveraging AI technology, this feature eliminates guesswork and allows you to create tailored dispute letters for each client.

Training resources and step-by-step workflows are available within the software to guide you through this powerful feature. As one of the highlights of the best credit repair software, this tool provides businesses with a competitive edge.

One-Click Print Automation with LetterStream

Printing and mailing dispute letters can be tedious, but the LetterStream integration automates this task completely. After creating your dispute letters within the software, you can use this feature to send them directly to LetterStream for printing and mailing.

The entire process, from generation to delivery, becomes seamless and efficient. One-click print automation saves countless hours that would otherwise be spent manually printing, stuffing envelopes, and sending mail.

This feature is especially valuable for businesses handling a high volume of disputes. With tracking capabilities, you can also ensure timely delivery and maintain transparency with your clients. If you’re looking for software for credit repair that makes mailing effortless, this feature is indispensable.

Start Today and Explore the Features Firsthand!

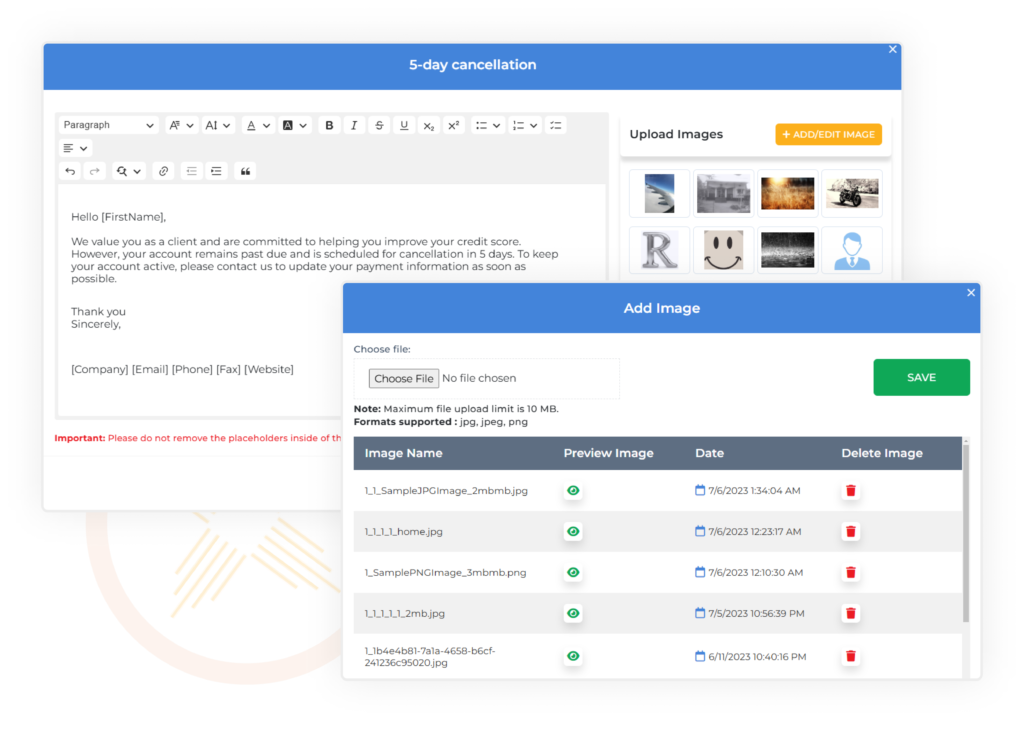

Email Nurturing Scheduler: Keep Clients Engaged with AI Credit Repair Software

Client engagement is vital for long-term success, and the email nurturing scheduler is designed to help you maintain consistent communication with your clients. This built-in email campaign tool allows you to set up automated sequences that inform and educate your clients about their credit repair journey.

Pre-designed email templates are available, but you also have the flexibility to create customized messages tailored to your business needs.

For example, you can set up a series of emails that explain the dispute process, share credit improvement tips, or update clients on their progress. This feature not only keeps your clients engaged but also reinforces your expertise and professionalism.

No other software for credit repair combines automation and personalization as effectively, making it a standout feature in the best AI credit repair software solutions.

Fast Tracker: Monitor Credit Report Changes with the Best AI Credit Repair Software

Tracking updates to credit reports is critical, and the Fast Tracker makes it simple. This feature compares updated credit reports with previous ones, highlighting changes such as deletions, updates, or new negative items.

By automating data comparison, the Fast Tracker saves you time and ensures you stay on top of your clients’ progress.

With this tool, you can identify results quickly and provide clients with timely updates. For example, if a negative item has been successfully removed, the software immediately notifies you so you can share the great news with your client.

Additionally, the Fast Tracker helps prepare your next steps for future dispute rounds. It’s another reason why this is among the best AI credit repair software options.

Start Today and Explore the Features Firsthand!

How Client Dispute Manager Software Stands Out?

Client Dispute Manager Software isn’t just a tool; it’s a comprehensive solution that covers every aspect of the credit repair process. Its user-friendly interface, automation features, and advanced tools make it an indispensable resource for businesses looking to scale.

Whether you’re an experienced credit repair specialist or just starting, this software offers the functionality you need to succeed.

With its reputation as one of the best credit repair software platforms, it’s clear why so many professionals rely on it.

Conclusion: Is This the Right Software for You?

If you’re serious about growing your credit repair business, Client Dispute Manager Software is a must-have. Its automation, AI-powered tools, and user-friendly design make it one of the best credit repair software options on the market.

Whether you’re an entrepreneur or an individual looking to improve financial literacy, this software can help you achieve your goals.

Mark Clayborne

Mark Clayborne specializes in credit repair, starting and running credit repair businesses. He's passionate about helping businesses gain freedom from their 9-5 and live the life they really want. You can follow him on YouTube.

Start Today and Explore the Features Firsthand!

Below Is More Content For Your Review: