Business credit is like a financial report card for your company. It tells lenders, suppliers, and potential partners how trustworthy your business is when it comes to handling money. But what happens if your business credit score isn’t looking great? That’s where business credit repair comes in.

In this guide, we’ll walk through the basics of business credit, common challenges, practical steps to repair your credit, and strategies to keep it strong.

Whether you’re a small business owner trying to grow your company or someone struggling with credit issues, this guide will help you get started with confidence.

The Fundamentals of Business Credit Score

Having a solid understanding of business credit is essential for long-term success. A strong business credit profile can help secure loans, attract partners, and foster growth. In this section, we’ll explore key components and practical strategies for effective business credit repair.

What Is Business Credit and How Is It Calculated?

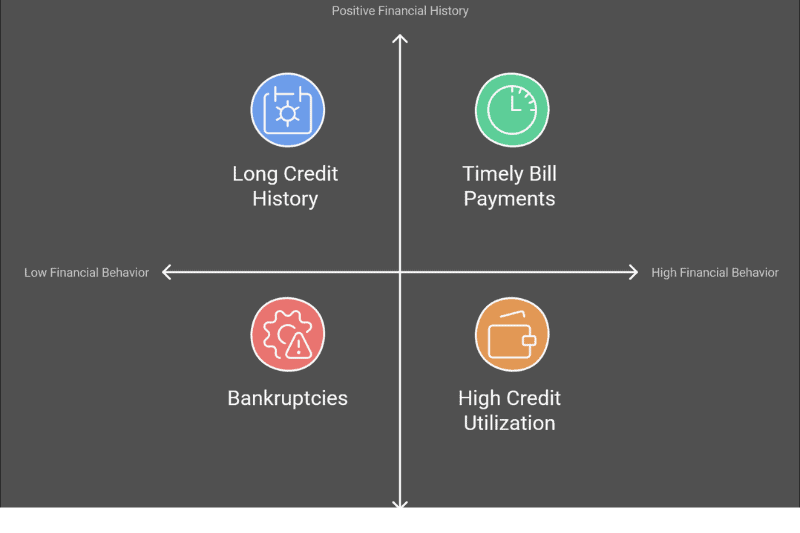

Business credit represents your company’s financial responsibility. Credit bureaus like Dun & Bradstreet, Experian, and Equifax track your credit activities and assign a score based on:

- Do you pay bills on time?

- How much of your available credit are you using?

- How long has your business been borrowing and repaying credit?

- Bankruptcies, liens, or judgments.

- The type of business you operate can also impact your credit score.

Understanding these factors is crucial for anyone looking to improve business credit. Regularly monitoring your credit and knowing how to fix business credit can make a significant difference in your company’s financial health.

Effective business credit repair involves staying proactive, correcting errors, and building a reliable credit history, which ultimately leads to better financing opportunities and business growth.

Understanding these factors helps you identify where to focus your business credit repair efforts.

Importance of a Strong Business Credit Score

A strong business credit score can significantly enhance a company’s financial prospects. It increases the likelihood of loan approvals, helps secure lower interest rates, builds trust with vendors, and provides access to better insurance rates.

A positive credit score also positions your business as reliable and stable, encouraging potential partners to collaborate with confidence. Maintaining a solid credit score is essential for long-term growth and financial health in today’s competitive market.

Achieving this requires a focus on business credit repair, understanding how to fix business credit, and implementing strategies that improve business credit score while creating a business credit boost that can open new doors for growth.

Consequences of a Poor Credit Profile

Ignoring your business credit can lead to several significant challenges that can negatively impact your business growth and financial health:

- Loan Rejections: Poor credit makes it difficult to qualify for loans, limiting access to necessary funds for growth and development. Effective business credit repair can help overcome this obstacle.

- Higher Interest Rates: Lenders view businesses with low credit scores as high-risk, leading to higher interest rates on loans and lines of credit. Learning how to improve business credit score can help reduce borrowing costs.

- Cash Flow Challenges: When credit terms become unfavorable due to poor credit, managing daily operational expenses becomes harder. Regularly monitoring your credit and understanding how to fix business credit is essential.

- Missed Growth Opportunities: Limited access to credit can cause businesses to miss out on expansion opportunities, partnerships, or bulk purchase discounts. Knowing how to clean up business credit helps maintain flexibility and readiness for growth.

Proactively addressing these issues through business credit repair can significantly improve your financial standing and open doors to new opportunities.

Business vs. Personal Credit: Key Differences

Unlike personal credit, business credit is public. Anyone can access your company’s credit report to gauge its financial stability.

This transparency makes business credit repair even more critical. Ensuring a healthy business credit profile requires consistent monitoring, timely payments, and strategic financial decisions.

Understanding how to fix business credit and applying methods to improve business credit score can significantly impact your company’s ability to grow and secure funding.

Moreover, proactively learning how to clean up business credit will prevent issues from escalating and help maintain trust with potential lenders and partners.

A well-maintained credit profile not only leads to a business credit boost but also establishes your company as a financially responsible and reliable partner in the industry.

Common Challenges in Business Credit: How to Fix Business Credit Issues

Understanding the challenges associated with business credit is essential for maintaining a healthy financial profile. Identifying these obstacles early on can simplify the process of business credit repair and set the foundation for long-term success.

In this section, we will explore common problems businesses encounter and discuss practical strategies like how to fix business credit, how to clean up business credit, and how to improve business credit score to help you navigate these issues effectively.

Late Payments and High Credit Utilization

High credit utilization can harm your credit score, even if you pay bills on time. Late payments show lenders that your business might struggle to manage its debts.

To avoid these pitfalls, it’s essential to understand how to fix business credit by reducing utilization rates and ensuring timely payments. Proactive business credit repair strategies, such as regularly monitoring your credit report, can help identify and resolve potential issues early.

Learning how to improve business credit score through responsible financial practices and maintaining a healthy credit mix is crucial for long-term business success.

Inaccurate Information on Credit Reports

Errors on credit reports are more common than you think. Incorrect balances, payment records, or even accounts you don’t recognize can drag down your score.

Learning how to fix business credit by disputing these inaccuracies is crucial. Inaccurate information can arise from clerical errors, identity theft, or outdated records.

To address these issues, it’s essential to regularly review your credit reports and understand how to clean up business credit by submitting disputes with proper documentation.

Partnering with a trusted credit repair business can simplify this process and help you achieve a noticeable business credit boost.

Additionally, adopting proactive strategies can improve business credibility and position your company for growth by enhancing your business credit repair efforts.

Lack of Credit History and Its Impact

Newer businesses often face this challenge. Without a proven history of responsible credit use, lenders hesitate to offer favorable terms. This is where understanding how to fix business credit becomes essential.

By building a positive payment history, using credit responsibly, and knowing how to clean up business credit through regular monitoring, new businesses can create a solid foundation.

Additionally, implementing strategies to improve business credit score and leveraging tools for a business credit boost can significantly enhance the chances of securing favorable credit terms and growing the business successfully.

Step-by-Step Guide: How to Fix Business Credit and Improve Business Credit Score

Fixing your business credit score is crucial for securing better financial opportunities. This section provides a step-by-step approach to effective business credit repair.

By understanding how to fix business credit, how to clean up business credit, and how to improve business credit score, you can achieve a significant business credit boost and position your company for long-term success.

Step #1: Obtain and Analyze Your Business Credit Report

Request your report from the major credit bureaus. This is a critical step in the process of business credit repair. When reviewing your report, look for key indicators that might impact your credit score, such as incorrect payment records, unauthorized accounts, and outdated information.

Understanding how to fix business credit starts with identifying these issues early. By regularly monitoring your credit report, you can take proactive steps to improve business credit score and implement strategies to achieve a sustainable business credit boost.

Step #2: Identify and Dispute Errors

If you find errors, you can dispute them by taking specific steps as part of your business credit repair process.

Start by contacting the credit bureau to report the discrepancies. Next, gather and submit providing documentation that supports your claim, such as payment receipts or correspondence records.

Lastly, ensure you are consistently following up with the bureau to track the progress of your dispute. Understanding how to fix business credit and being proactive in these efforts can lead to a noticeable business credit boost and help improve your overall business credit score.

Disputing errors is a core part of how to fix business credit.

Step #3: Pay Off Outstanding Debts Strategically

Use strategies like the snowball method (paying small debts first) or avalanche method (targeting high-interest debts first).

These methods are essential tools in business credit repair as they help reduce outstanding debt systematically. By applying these techniques, you can effectively manage payments, minimize high-interest costs, and ultimately improve your financial standing.

Additionally, understanding how to fix business credit through debt reduction is crucial. A well-executed debt repayment strategy not only helps improve business credit score but also contributes to a noticeable business credit boost, positioning your company for future financial growth.

Step #4: Build New, Positive Credit History

- Open New Accounts with Reliable Vendors: Choose vendors who report positive payment history to credit bureaus. This action supports effective business credit repair and can lead to a business credit boost.

- Use a Business Credit Card Responsibly: Apply for a business credit card and manage it with care by maintaining a low utilization ratio and paying off balances in full each month. Responsible usage can improve business credit score significantly.

- Make Timely Payments: Consistently paying bills on or before the due date is critical for maintaining a good credit history. On-time payments demonstrate reliability and contribute to business credit repair efforts.

- Pay Bills Early Whenever Possible: Early payments can sometimes be reported as favorable activity, giving your business a potential business credit boost.

- Monitor Your Credit Activity: Regularly review your credit reports to ensure new accounts are being reported correctly and to spot any inaccuracies. Proactively monitoring your credit activity is a fundamental part of learning how to fix business credit and ensuring long-term success.

Step #5: Monitor Your Credit Regularly

Set reminders to check your credit report every quarter. This helps you spot and correct issues before they cause damage.

Regular monitoring is a crucial aspect of business credit repair, as it enables you to identify and address potential problems early. By understanding how to fix business credit through consistent oversight, you can protect your financial standing.

Moreover, staying informed about your credit activities helps you improve business credit score and achieve a business credit boost, positioning your company for better lending opportunities and long-term success.

How to Clean Up Your Business Credit Report for a Business Credit Boost?

Cleaning up your business credit report is a critical step in achieving a strong financial standing. By understanding how to clean up business credit and applying proven strategies, you can correct inaccuracies, remove outdated information, and strengthen your business’s credit profile.

This process not only supports overall business credit repair but also contributes to a significant business credit boost, enabling better loan terms, increased funding opportunities, and improved vendor relationships.

Understand the Role of Credit Reporting Agencies

Agencies like Dun & Bradstreet, Experian, and Equifax track your business’s credit activities.

These popular credit reporting agencies collect and maintain data that lenders use to evaluate your creditworthiness.

Knowing how they work can simplify the process of how to clean up business credit. By understanding their role and the factors they assess, you can take proactive steps toward effective business credit repair and long-term financial stability.

Step-by-Step Guide to Dispute Inaccurate Information

- Review Your Credit Report: Reviewing your business credit report is a crucial step in the business credit repair process. It allows you to identify inaccuracies, outdated information, or signs of identity theft. By understanding how to fix business credit through regular report analysis, you can take proactive steps to improve your business credit score and secure better financial opportunities.

- Document The Errors with Supporting Evidence: Carefully go through your credit report to identify any discrepancies, such as incorrect account information, inaccurate payment records, or unrecognized debts. Proper documentation is crucial in the business credit repair process, as it serves as proof when disputing these errors.

- Submit Disputes Via The Bureau’s Online Portal or by Mail: Once you’ve gathered the necessary documentation, submit your dispute to the relevant credit reporting agency, such as Dun & Bradstreet, Experian, or Equifax. Understanding how to clean up business credit requires persistence, so make sure to track your dispute’s status and follow up if necessary.

This proactive approach is essential in how to fix business credit and improve business credit score for better financial stability and a significant business credit boost.

How Medical and Utility Debts Can Impact Your Business Credit?

Even unpaid utility bills can show up on your business credit report. Regular monitoring ensures these errors don’t go unnoticed. These seemingly minor debts can negatively affect your business credit score, making it harder to secure loans or favorable terms with vendors.

Understanding how to clean up business credit is essential in such cases.

By consistently reviewing your credit report and addressing these issues through proper business credit repair techniques, you can prevent long-term financial damage and maintain a strong, trustworthy credit profile with the major credit reporting agencies like Dun & Bradstreet, Experian, and Equifax.

Strategies to Boost Your Business Credit and Improve Your Business Credit Score

Boosting your business credit score is essential for gaining better financial opportunities and securing favorable terms with lenders.

By understanding how to improve business credit score and implementing effective business credit repair strategies, you can achieve a noticeable business credit boost.

Reduce Credit Utilization Ratio

Aim to use less than 30% of your available credit. Reducing utilization shows lenders that your business isn’t overly dependent on borrowed money.

Maintaining a low credit utilization ratio is a fundamental part of business credit repair. It signals to lenders that your business manages its credit responsibly. If you are looking for how to fix business credit, start by paying down high balances and keeping your usage below 30%.

This proactive approach not only helps improve business credit score but also contributes to a noticeable business credit boost, ensuring better loan terms and financial flexibility.

Establish Strong Vendor Relationships

Vendors who report positive payment activity can significantly impact your business credit repair efforts. Establishing relationships with reliable vendors who report payment history to credit bureaus can lead to a noticeable business credit boost.

These vendors provide a track record of timely payments, which helps improve your business credit profile.

Understanding how to fix business credit by working with such vendors can ultimately contribute to a stronger, more credible financial foundation. Consistent and responsible vendor payments are also a key factor in how to improve business credit score.

Apply for Additional Credit Wisely

Applying for too much credit at once can trigger multiple hard inquiries, lowering your score temporarily. When you apply for multiple credit lines within a short time frame, credit bureaus may view it as risky behavior, which can negatively impact your business credit repair efforts.

To avoid this, it’s essential to apply for credit strategically and understand how to fix business credit. Responsible credit applications can help maintain a stable profile and contribute to a gradual business credit boost while helping to improve business credit score over time.

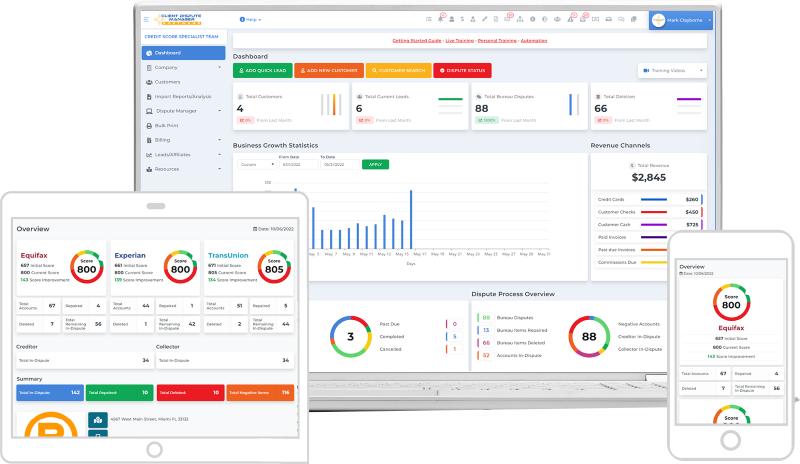

Client Dispute Manager Software: The Ultimate Tool for Business Credit Repair Success

Managing business credit disputes can be a time-consuming and complex process. That’s where Client Dispute Manager Software comes in. This powerful tool is designed to simplify and streamline the credit repair process for businesses of all sizes.

With its user-friendly interface, you can easily track, manage, and resolve credit disputes efficiently. The software provides step-by-step guidance on how to fix business credit, clean up inaccurate reports, and improve your business credit score.

Key features of Client Dispute Manager Software

- Automated Dispute Processing: Simplifies the process of sending dispute letters to credit bureaus, creditors, and collectors. This feature is crucial in business credit repair, helping users save time and effort when disputing inaccurate information and working to improve business credit score.

- Real-Time Credit Report Tracking: Helps monitor changes in your credit report, making it easier to spot discrepancies. By tracking your credit activity regularly, you can quickly identify issues that may require business credit repair and take steps to clean up business credit before they cause long-term damage.

- Comprehensive Reporting Tools: Generates detailed reports to track credit repair progress and outcomes. These reports provide valuable insights into your credit improvement efforts, making it easier to assess what strategies are working and where adjustments are needed for a business credit boost.

- Secure Client Portal: Allows clients to check their dispute status and communicate with your team in real-time. This transparency builds trust and demonstrates your commitment to delivering effective business credit repair services. The portal also educates clients on how to fix business credit and maintain strong financial practices.

Using Client Dispute Manager Software can give your business a competitive edge in the credit repair industry. It not only helps with business credit repair but also assists you in providing top-notch service to your clients, ensuring their satisfaction and long-term success.

Frequently Asked Questions (FAQs)

How Can I Improve My Business Credit Score Quickly?

Improving your business credit score quickly requires a strategic approach. Start by paying down outstanding debts, as high credit utilization can negatively impact your score. Next, regularly review your credit report to identify and dispute inaccuracies.

Learning how to improve business credit score also involves maintaining timely payments and building positive credit history through responsible financial behavior.

Utilizing a business credit repair service can streamline this process and provide professional guidance for long-term success.

Is It Possible to Fix Business Credit on My Own?

Yes. Fixing your business credit independently is entirely possible with dedication and knowledge. Start by obtaining your credit reports from major agencies like Dun & Bradstreet, Experian, and Equifax.

Learn how to fix business credit by reviewing these reports, identifying errors, and submitting disputes with proper documentation. Maintaining positive financial habits, such as timely payments and low credit utilization, can further enhance your credit profile and lead to a business credit boost.

How Often Should I Review My Credit Report?

It’s essential to review your business credit report at least once per quarter. Regular monitoring helps catch errors early and prevents potential credit damage.

Understanding how to clean up business credit requires a proactive approach to identifying inaccuracies, outdated information, or suspicious activity. Consistent oversight supports long-term business credit repair and positions your company for better financial opportunities.

What Is the Best Way to Clean Up Business Credit?

The best way to clean up your business credit involves reviewing reports, disputing inaccuracies, and ensuring timely payments. Learning how to clean up business credit means understanding the factors that influence your score, such as payment history and credit utilization.

By adopting reliable business credit repair practices and collaborating with vendors who report positive payment behavior, you can effectively improve your credit profile and secure a business credit boost.

Conclusion

In conclusion, maintaining a strong business credit profile is crucial for your company’s financial success.

By applying the principles outlined in this guide such as learning how to fix business credit, implementing business credit repair strategies, and monitoring your credit report regularly you can improve your credit standing and secure better financial opportunities.

Taking proactive steps to clean up business credit and seeking a business credit boost when needed will empower your business to access funding, build credibility, and achieve long-term growth.

Start today, and watch your business credit score become a tool for success.

Mark Clayborne

Mark Clayborne specializes in credit repair, starting and running credit repair businesses. He's passionate about helping businesses gain freedom from their 9-5 and live the life they really want. You can follow him on YouTube.