As credit repair continues to evolve, businesses and individuals alike seek faster, more effective solutions. The right AI credit repair software can be a powerful tool for credit repair professionals looking to serve clients efficiently, improve accuracy, and build a scalable business. In 2024, choosing the best AI credit repair software is essential for staying competitive in an industry where speed, compliance, and customization matter more than ever.

In this guide, we’ll cover the top 5 game-changing features of the best credit repair software that can transform your business. Whether you’re an entrepreneur in the credit repair industry, a seasoned credit repair professional, or someone working on personal credit improvement, these features are designed to simplify the credit repair process and produce faster, more reliable results. Let’s dive into the features that set apart the best credit repair software for businesses in 2024.

Start Today and Explore the Features Firsthand!

#1: AI-Powered Dispute Engine: Streamlining the Dispute Process

Using AI credit repair software with a powerful AI-powered dispute engine is an efficient way to simplify the dispute process. This feature can analyze credit reports, identify errors, and automatically create dispute letters, reducing the workload and improving accuracy. For credit repair businesses aiming to provide faster services, an AI dispute engine is a crucial asset.

What is an AI Dispute Engine?

An AI-powered dispute engine in AI credit repair software identifies errors in credit reports, automating dispute creation. This tool examines credit data, spotting inaccuracies like outdated accounts or incorrect payment histories. With AI, credit repair specialists can generate accurate dispute letters quickly, without manual reviews. It allows businesses to serve more clients while maintaining quality.

The engine saves time and ensures accuracy, reducing human error in credit dispute processes. AI-driven automation helps businesses scale efficiently, making it easier to expand client bases without adding staff. This tool enhances productivity, allowing specialists to focus on personalized client support rather than repetitive tasks.

How the AI Dispute Engine Works?

The AI dispute engine in credit repair business software works by:

- Analyzing credit reports for inconsistencies, inaccuracies, or outdated information.

- Automatically generating dispute letters based on identified errors.

- Selecting specific dispute reasons to ensure accuracy and compliance with industry standards.

Benefits of an AI Dispute Engine for Credit Repair Businesses

With an AI dispute engine, credit repair businesses can improve client satisfaction by delivering faster results and increasing dispute success rates. This feature is essential for companies aiming to grow and handle more clients, making credit repair software for business a smart investment in 2024.

#2: Metro 2 Compliance-Based Letters: Ensuring Industry Standards

Compliance is essential for every credit repair business, and credit repair software for business that includes Metro 2 compliance-based letters can significantly improve your success rate with credit bureaus. Metro 2 compliance ensures your letters meet standardized formatting requirements, which can increase acceptance rates and reduce rejections.

Why Metro 2 Compliance Matters?

For effective credit repair, adhering to compliance standards is crucial. Metro 2 is the standardized format used by credit bureaus for reporting data, and compliance with Metro 2 requirements can increase the success of credit disputes. Some of the best AI credit repair software includes Metro 2 compliance-based letters to help specialists achieve favorable outcomes in disputes.

Start Today and Explore the Features Firsthand!

How Metro 2 Compliance-Based Letters Help Your Business

Metro 2 compliance-based letters help businesses maintain accuracy, reducing delays from formatting errors. These letters adhere to recognized standards, increasing acceptance rates for disputes. With credit repair software for business, specialists can ensure disputes follow best practices, which boosts client trust.

This feature strengthens a business’s reputation, showing professionalism and knowledge of industry standards. Using compliant letters helps resolve disputes faster, improving client satisfaction. For credit repair specialists, having Metro 2 compliance in software simplifies the dispute process and enhances reliability.

#3: A Library of 270+ Default Dispute Letters for Every Scenario

When it comes to dispute letters, variety and customization are essential. The best credit repair software provides a library of over 270 default dispute letters, enabling you to address various scenarios, from incorrect account balances to issues with payment history. This feature is especially beneficial for high-volume credit repair businesses.

The Value of a Comprehensive Dispute Letter Library

Having access to over 270 dispute letters saves time for specialists handling diverse client cases. Each letter addresses specific credit issues, such as incorrect balances or payment errors. The best credit repair software offers ready-made templates for nearly every dispute scenario, improving efficiency.

With a library, specialists can select a relevant letter instead of drafting each one from scratch. This helps ensure consistency and professionalism in client communications. Credit repair business software with pre-written letters allows specialists to serve more clients efficiently and maintain high-quality service.

How a Dispute Letter Library Can Elevate Your Credit Repair Business

Using a comprehensive letter library allows faster turnaround times, which clients appreciate. Specialists can handle more cases while maintaining a personalized approach. With credit repair software for business, selecting pre-made letters speeds up dispute resolution.

Clients benefit from this efficiency, as disputes are handled promptly. The library feature allows specialists to respond to clients’ needs quickly, enhancing satisfaction. This benefit is especially valuable for high-volume credit repair businesses seeking to grow.

#4: AI Rewriter for Unique and Customized Dispute Letters

To stand out in the credit repair field, using unique and customized letters can be highly effective. An AI rewriter feature in credit repair software for business creates fresh, individualized letters, helping your disputes get more attention from credit bureaus and reducing the risk of template-based rejections.

Start Today and Explore the Features Firsthand!

The Importance of Unique Letters in Credit Repair

An AI rewriter allows specialists to customize each dispute letter, reducing the chance of rejections. AI credit repair software uses this tool to create unique letters tailored to each case. Credit bureaus prefer unique letters, as they show a personalized approach rather than generic templates.

This feature helps businesses avoid template-based rejections, increasing dispute success rates. For clients, customized letters indicate their case is handled individually, which builds trust. With an AI rewriter, specialists offer a high level of service with minimal extra effort.

Practical Benefits for Credit Repair Specialists

The AI rewriter quickly modifies default letters, making them unique to each client. This customization improves dispute acceptance and shows personalized service. Credit repair software for business with an AI rewriter helps specialists deliver unique letters efficiently.

For businesses, the rewriter is a valuable tool for offering tailored service at scale. It supports high-volume operations without sacrificing quality. Using unique letters helps credit repair businesses stand out in a competitive market, boosting client satisfaction.

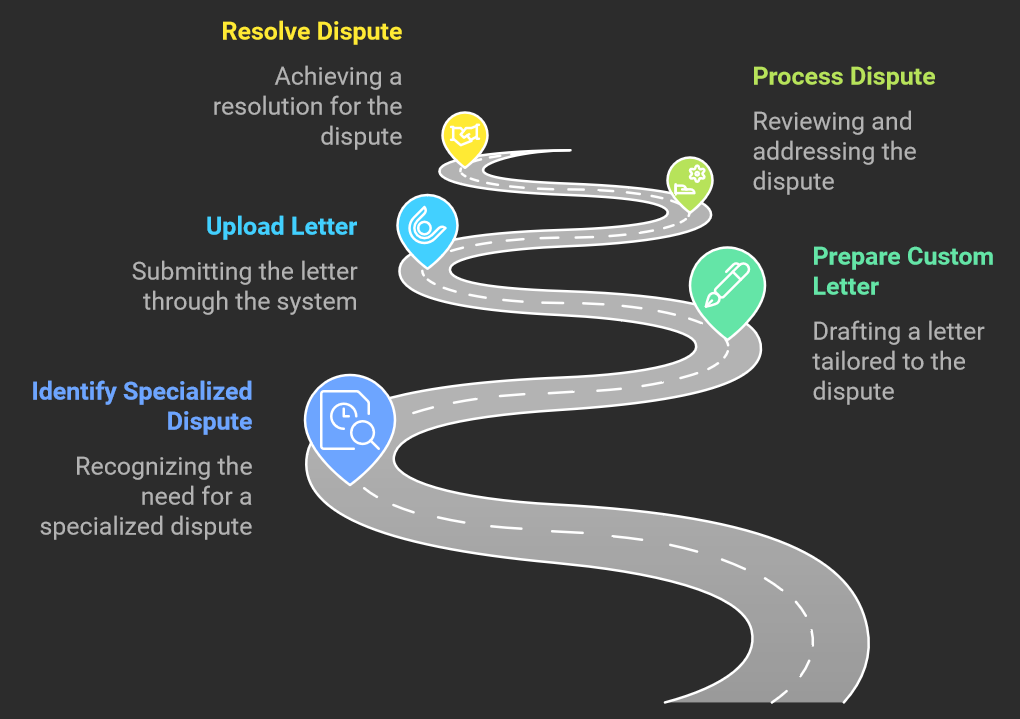

#5: Customizable Manual Letter Uploads for Specialized Disputes

For credit repair specialists with unique dispute strategies, AI credit repair software that allows for customizable manual letter uploads is a valuable asset. This feature lets you use your proven, specialized letters in the software, giving your business an edge when handling complex disputes.

The Benefits of Customizable Manual Letter Uploads

Some credit repair businesses develop effective custom letters for specific types of disputes. The best credit repair software allows users to upload and store these specialized letters. This flexibility ensures specialists can address unique client needs directly from the software.

Organizing custom letters improves efficiency, allowing specialists to quickly access proven dispute templates. This feature is essential for businesses dealing with diverse credit issues, from medical debts to student loans. Customizable uploads add versatility, enhancing the software’s functionality.

Example of Customizing Dispute Letters

If your business has a strong letter for medical debt disputes, you can upload and organize it in categories. Credit repair software for business with custom uploads lets specialists access relevant letters easily. This feature ensures each client benefits from a tailored dispute approach.

Uploading custom letters also reduces the need to rewrite letters from scratch. Specialists can rely on stored templates, ensuring consistency and saving time. For high-volume operations, customizable uploads provide a seamless, efficient workflow tailored to client needs.

Start Today and Explore the Features Firsthand!

Why the Best AI Credit Repair Software Matters in 2024

The best AI credit repair software doesn’t just simplify tasks; it makes your business more effective, scalable, and professional. By incorporating features like an AI dispute engine, Metro 2 compliance, default letters, an AI rewriter, and customizable uploads, credit repair software for businesses in 2024 offers unmatched value.

Key Benefits of AI Credit Repair Software for Business Growth

Investing in AI credit repair software is about more than saving time; it’s about creating a more efficient, scalable business that can handle client demands with professionalism and precision. The best AI credit repair software includes automation, compliance, a vast library of letters, customization tools, and flexibility that make it essential for credit repair businesses in 2024.

- Automation for Efficiency: Automate dispute processes, allowing your team to handle more clients without increasing the workload.

- Compliance Built-In: Ensure disputes meet industry standards and adhere to compliance, reducing rejection rates.

- Client Satisfaction: Deliver faster, more accurate dispute services, enhancing client satisfaction and loyalty.

- Flexibility for Customization: Tailor letters to each client’s needs, making your business stand out with personalized service.

Choosing credit repair software for business with these capabilities allows you to operate more effectively, providing higher-quality services that increase your clients’ success and build trust.

Tips for Choosing the Best Credit Repair Software for 2024

When selecting AI credit repair software, it’s important to consider what features will best serve your clients and business needs.

Here are some tips for choosing the best credit repair software:

- Review the Features: Make sure it includes essentials like AI dispute engines, Metro 2 compliance, and a default letter library.

- Evaluate Usability: Choose software that’s intuitive and easy for your team to navigate.

- Look for Customization Options: Check for features like manual letter uploads and an AI rewriter to ensure flexibility.

- Consider Cost and Support: Look for transparent pricing and reliable customer support to help your business grow without unexpected costs.

The best AI credit repair software offers more than basic functionality it provides advanced tools that allow your business to meet client needs while increasing efficiency and compliance.

Conclusion: Transform Your Credit Repair Business in 2024

The top 5 features in AI credit repair software can make a big difference in the efficiency and effectiveness of your services. By choosing credit repair software for business with advanced features like AI dispute engines, Metro 2 compliance, a robust letter library, an AI rewriter, and customizable letter uploads, you can elevate your business and enhance client satisfaction.

As you look ahead to 2024, consider how the best AI credit repair software can help your business succeed. Many providers offer free trials, so you can explore these features and discover firsthand how they can simplify your workflow and boost client outcomes. Embrace the future of credit repair and watch your business thrive with the right tools at your side.

Mark Clayborne

Mark Clayborne specializes in credit repair, running and growing a credit repair businesses. He's passionate about helping businesses gain freedom from their 9-5 and live the life they really want. You can follow him on YouTube.

Start Today and Explore the Features Firsthand!