A smooth credit repair client onboarding process is the foundation of a successful business, setting the stage for trust, efficiency, and long-term client satisfaction. When new clients sign up, they need a clear, structured pathway that eliminates confusion, accelerates document submission, and ensures compliance.

Without an optimized onboarding process, businesses risk delays, frustrated clients, and lost opportunities.

By implementing streamlined steps in client onboarding, using a credit repair onboarding template, and leveraging automation, you can enhance client experience while saving time. A well-structured system boosts client acquisition strategies for credit repair businesses, improves retention, and establishes credibility.

In this guide, we’ll explore best practices, tools, and strategies to simplify onboarding, helping you grow your credit repair business efficiently.

Understanding the Importance of Client Onboarding

An efficient credit repair client onboarding process is more than just paperwork—it’s the first step in building trust, transparency, and long-term success with your clients. When done right, it helps clients feel confident in your services, reduces delays in gathering essential documents, and ensures legal compliance from the start.

A confusing or unstructured onboarding experience, however, can lead to frustrated clients, miscommunication, and lost business opportunities.

For credit repair businesses, a well-structured client onboarding process improves client acquisition, enhances operational efficiency, and sets clear expectations. By using a credit repair onboarding template and automating key steps, businesses can reduce manual tasks, improve accuracy, and create a seamless experience.

In this section, we’ll explore the key steps in client onboarding and how streamlining this process can drive business growth and client satisfaction.

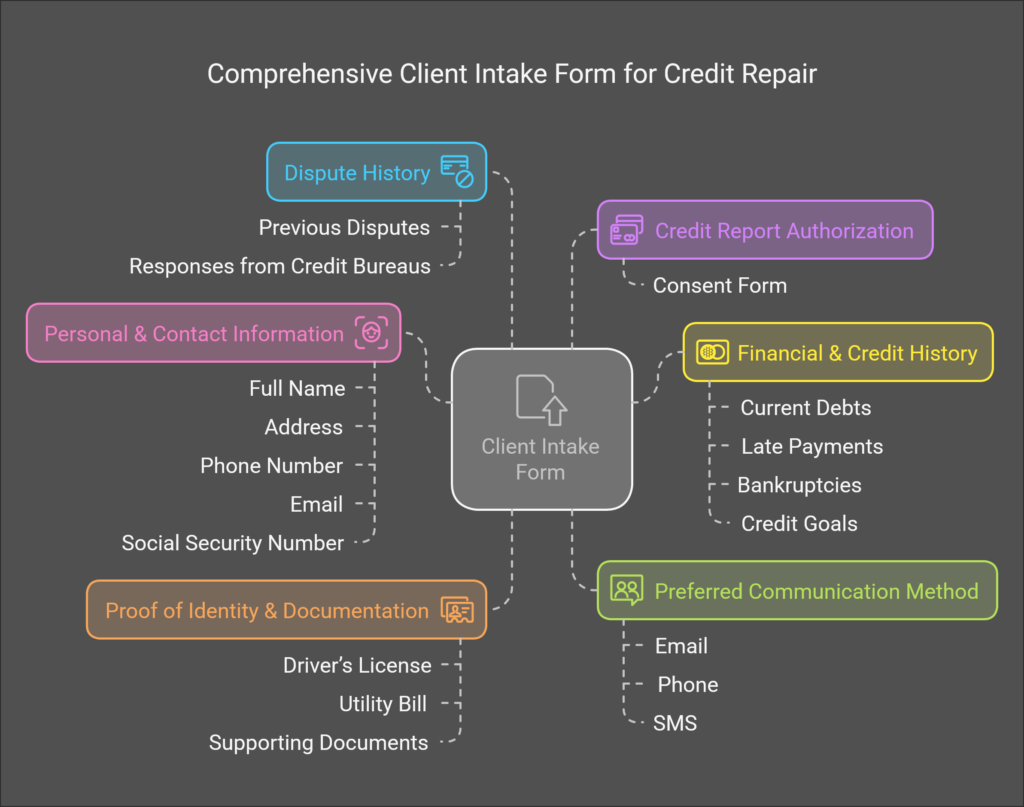

Design a Comprehensive Client Intake Form

A well-structured client intake form is the foundation of an efficient credit repair client onboarding process. It helps gather essential information, ensuring that your business can accurately assess a client’s credit situation and provide the best solutions.

A clear, organized intake form reduces back-and-forth communication, accelerates dispute processing, and improves the overall client experience.

Without the right details upfront, businesses may face delays, compliance risks, and missed opportunities to help clients effectively.

By designing a credit repair onboarding template that collects key details while maintaining legal compliance, you can streamline the onboarding process and protect your business.

Below, we’ll cover the must-have information in an intake form and how to ensure compliance with industry regulations.

Key Information to Collect

A comprehensive client intake form should cover essential details that allow your business to evaluate credit issues and develop a tailored action plan. Here are the key sections every intake form should include:

- Personal & Contact Information – Full name, address, phone number, email, and Social Security Number (SSN) (if required for disputes).

- Credit Report Authorization – Consent from the client to access and review their credit report.

- Financial & Credit History – Information about current debts, late payments, bankruptcies, and credit goals.

- Dispute History – Details on previous credit disputes and any responses received from credit bureaus.

- Proof of Identity & Documentation – Driver’s license, utility bill, and any supporting documents for disputes.

- Preferred Communication Method – Whether the client prefers email, phone, or SMS updates for progress tracking.

A well-designed credit repair onboarding template ensures that all necessary details are captured efficiently, reducing delays and ensuring a seamless client experience.

Ensuring Legal Compliance

Legal compliance is crucial when handling client data and credit disputes in a credit repair business. Failure to follow federal and state regulations can lead to legal penalties and loss of trust. Here’s how to ensure compliance while designing your intake form:

- Fair Credit Reporting Act (FCRA) Compliance – Ensure clients give explicit permission to access and dispute their credit reports.

- Credit Repair Organizations Act (CROA) Compliance – Clearly state that results are not guaranteed and provide written contracts outlining services.

- Data Protection & Security – Use secure digital intake forms and encryption to protect sensitive client information.

- Clear Consent & Disclosures – Include sections where clients acknowledge terms of service, dispute limitations, and payment agreements.

By integrating compliance measures into your intake process, you can protect both your business and your clients while maintaining trust and credibility in the industry.

Streamline Data Collection Processes

An efficient credit repair client onboarding process starts with seamless data collection. Relying on manual paperwork and scattered emails can lead to delays, errors, and frustrated clients. By switching to digital intake forms and CRM systems, businesses can centralize client information, reduce redundancies, and improve accuracy.

A secure document upload portal allows clients to submit required files effortlessly, while automated email or SMS reminders ensure they complete the process on time without constant follow-ups.

Additionally, incorporating e-signature solutions like DocuSign speeds up contract approvals, eliminating the need for printing and scanning. Pre-filled forms for returning clients further streamline the process, reducing unnecessary steps.

A well-structured data collection system not only saves time but also enhances client trust, compliance, and business efficiency, allowing credit repair companies to focus on delivering results rather than chasing paperwork.

Leverage CRM Systems for Efficiency

Managing multiple clients manually can be overwhelming, leading to missed follow-ups, misplaced documents, and inefficient workflows. A Customer Relationship Management (CRM) system streamlines credit repair client onboarding by organizing client data, automating tasks, and ensuring seamless communication.

With a CRM designed for credit repair businesses, you can track client progress, set automated reminders for follow-ups, and store important documents securely in one place. This eliminates the need for spreadsheets and scattered files, improving efficiency and client satisfaction.

Beyond organization, CRM automation helps businesses scale by reducing repetitive tasks. Features like automated client updates, task assignments, and email templates allow teams to focus on credit repair strategies rather than administrative work.

Integrating CRM with e-signatures and dispute management tools further enhances the onboarding process, ensuring compliance and a faster resolution for clients. By leveraging CRM technology, credit repair businesses can boost productivity, enhance client experience, and improve long-term retention.

Establish Transparent Communication with Clients

Clear and transparent communication is key to building trust during credit repair client onboarding. Clients often feel overwhelmed by the credit repair process, so setting clear expectations from the start helps reduce confusion and frustration.

Providing a welcome email or onboarding packet that outlines the process, timelines, and required documents ensures clients know what to expect. Regular updates through automated emails, SMS notifications, or a client portal keep them informed about their case progress, reinforcing confidence in your services.

Beyond updates, open communication means addressing client concerns proactively. Encourage questions, provide FAQ resources, and use simple, jargon-free language to explain credit repair steps. Offering dedicated support channels, such as a direct phone line or chat support, can make clients feel valued and supported.

When clients clearly understand the process, they are more likely to stay engaged, follow through with required steps, and trust your expertise in helping them improve their credit.

Provide Educational Resources for Clients

Educating clients about credit repair and financial literacy not only empowers them but also builds trust in your services. Many clients enter the process with limited knowledge of how credit repair works, leading to unrealistic expectations or frustration.

By providing clear, easy-to-understand educational resources, such as guides, FAQs, webinars, or blog content, you can help clients make informed decisions and stay engaged throughout the onboarding process.

A well-informed client is more likely to follow through with the necessary steps, improving results and overall satisfaction.

Benefits of Client Education

Educated clients are more proactive, engaged, and patient during the credit repair process. When they understand credit scoring factors, dispute processes, and the importance of timely payments, they can actively contribute to improving their financial situation.

Additionally, providing educational resources reduces the volume of repetitive inquiries, allowing your team to focus on dispute resolution and strategy rather than answering the same questions multiple times.

Ultimately, informed clients tend to have higher retention rates and better long-term financial success.

Training for Staff on Client Interaction

Effective client education starts with a well-trained staff that can communicate complex credit topics in a simple, clear, and supportive manner. Your team should be trained to answer common questions, set realistic expectations, and provide actionable financial guidance.

Implementing role-playing exercises, customer service scripts, and continuous education on credit laws ensures that your staff delivers consistent, professional, and empathetic support. A knowledgeable and well-trained team not only improves the client experience but also strengthens your company’s credibility in the industry.

Seek Client Feedback for Continuous Improvement

A successful credit repair client onboarding process isn’t just about efficiency—it’s about continuously refining your approach to meet client needs. Gathering honest client feedback allows businesses to identify pain points, improve communication, and enhance service quality.

When clients feel heard, they are more likely to trust your services and refer others. Proactively seeking feedback shows your commitment to improvement and helps you stay competitive in the credit repair industry.

Methods for Gathering Feedback

Collecting feedback should be a seamless and structured process. One of the easiest methods is sending post-onboarding surveys via email or SMS, asking clients about their experience with intake forms, communication, and service clarity.

Additionally, businesses can use automated CRM follow-ups, conduct one-on-one check-ins, or encourage feedback through Google reviews and social media. Anonymous feedback options can also help clients provide honest insights without hesitation.

Implementing Changes Based on Feedback

Collecting feedback is only valuable if you use it to enhance the client experience. Identify recurring concerns and take action by simplifying forms, improving response times, or providing clearer onboarding instructions.

Regularly updating training materials, FAQs, and CRM automation based on feedback ensures a client-centered approach. By continuously refining your onboarding process, you create a more efficient, professional, and client-friendly experience, leading to higher satisfaction and retention rates.

Understand the Role of Technology in Onboarding

Technology plays a crucial role in optimizing credit repair client onboarding, making the process faster, more accurate, and less labor-intensive. Manual data entry, paperwork, and back-and-forth communication can slow down onboarding and lead to errors.

By leveraging automation tools, CRM systems, and dispute management software, businesses can streamline workflows, enhance compliance, and improve overall efficiency. Integrating technology not only saves time but also creates a seamless experience for both clients and staff.

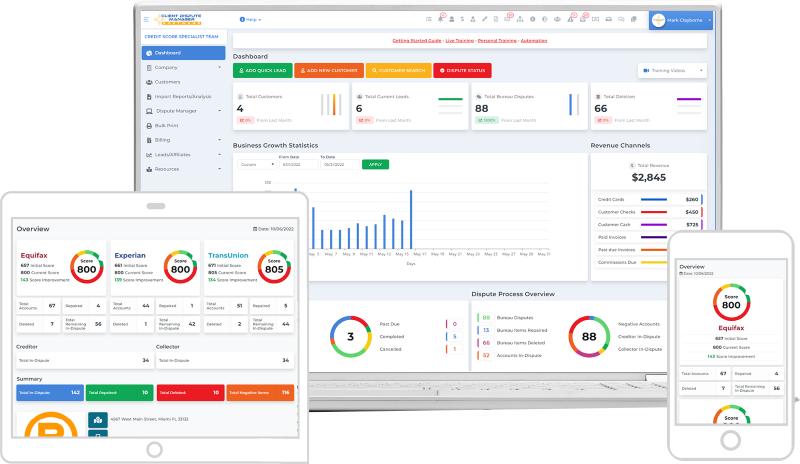

Overview of Client Dispute Manager Software

One of the most powerful tools for credit repair businesses is Client Dispute Manager Software, which simplifies the dispute process while keeping client information organized.

This software allows businesses to track dispute progress, automate letters, and manage client cases from a single dashboard. It also provides pre-built templates, workflow automation, and reporting tools to ensure that every step in the credit repair process is handled efficiently.

With a structured system like this, businesses can eliminate manual errors, reduce processing time, and improve client satisfaction.

Benefits of Automation in Onboarding

Automation helps businesses reduce administrative workload and enhance productivity. With tools like automated intake forms, document uploads, email follow-ups, and e-signature solutions, onboarding becomes faster and more reliable.

Automated workflows ensure that clients receive timely updates, documents are processed efficiently, and compliance is maintained without manual intervention.

Additionally, automation minimizes human errors and allows credit repair professionals to focus on strategy and client success rather than repetitive administrative tasks.

By embracing technology, businesses can scale operations, increase efficiency, and provide a smoother onboarding experience for their clients.

Build Positive Client Relationships

Successful credit repair businesses don’t just fix credit; they build lasting relationships with their clients. A strong client relationship starts with a transparent, supportive, and personalized onboarding experience.

Clients often come in feeling anxious about their financial situation, so establishing trust and clear communication early on is key. Providing regular updates, setting realistic expectations, and offering educational resources helps clients feel more involved and confident in the process.

Personalized engagement such as sending progress reports, check-in emails, or offering one-on-one consultations can make a significant impact on client satisfaction.

When clients feel valued and informed, they are more likely to stay engaged, refer others, and continue working with your business for future financial needs. A client-centric approach not only enhances customer loyalty but also strengthens your reputation in the credit repair industry.

Strategies for Long-term Business Growth

Scaling a credit repair business requires more than just onboarding new clients—it demands a sustainable growth strategy that focuses on efficiency, client retention, and brand credibility. One of the best ways to achieve this is by optimizing onboarding workflows, reducing manual tasks through automation, and continually refining client acquisition strategies.

A well-structured credit repair client onboarding system ensures smoother operations, freeing up time to focus on marketing, customer service, and business expansion.

Investing in CRM software, digital marketing, and referral programs can also drive long-term success. Encouraging satisfied clients to leave reviews and refer others can create a steady pipeline of new business.

Additionally, expanding services such as offering financial education, credit-building tools, or small business credit consulting can help businesses diversify revenue streams. By focusing on efficiency, client engagement, and industry expertise, credit repair businesses can achieve sustainable growth and long-term success in a competitive market.

Conclusion

A well-structured credit repair client onboarding process is the key to building trust, improving efficiency, and driving long-term success. By streamlining data collection, leveraging automation, and maintaining transparent communication, businesses can enhance client satisfaction while reducing administrative burdens.

Ensuring regulatory compliance and providing educational resources further strengthens credibility and positions your business as a trusted authority in the credit repair industry.

Implementing these best practices not only improves client acquisition and retention but also sets the foundation for scaling your business. By continuously refining your onboarding workflow, seeking client feedback, and embracing technology, you can create a seamless, professional experience that leads to better results and long-term growth.

Now is the time to audit your onboarding process, implement these strategies, and take your credit repair business to the next level!

Mark Clayborne

Mark Clayborne specializes in credit repair, starting and running credit repair businesses. He's passionate about helping businesses gain freedom from their 9-5 and live the life they really want. You can follow him on YouTube.