If you know the steps to removing inaccurate inquiries, then you can do something to help improve your credit standing.

There is a correlation between having inquiries on your personal credit report and a slight decrease in your credit score; hence, you may choose to have them removed.

However, hard inquiries made because you requested an increase in your credit limit cannot be erased from your credit report unless they were made in error or were obtained fraudulently.

It will be smart not to waste too much of your time seeking to get hard inquiries removed from your report because they have a minimal impact on credit scores and disappear after two years.

Instead, you should focus on improving your credit score. The more sensible approach would be to restrict the number of credit applications you submit within a short time frame.

When do Credit Checks or Credit Pulls Happen

When you make an application for services with a company that offers credit, such as a credit card issuer or a lender for a mortgage, the company will verify your credit. These companies will check your credit history to assess whether you are eligible for the type of account or service you have applied for.

The three primary credit agencies: Equifax, TransUnion, and Experian, each maintains a record of the companies that have requested your credit report or credit score. This record can be accessed by the businesses who have requested it. This entry is included in a portion of your credit report reserved exclusively for queries.

On your individual credit report, you will see a listing of all credit inquiries, also known as credit pulls, that have been made on your personal report within the past 24 months.

Identifying Hard or Soft Credit Inquiries

When someone checks into your credit account, this is considered an inquiry on your credit report. Credit reporting agencies make a note of this information and also record the date as well as the business name or organization that accessed your file.

Soft inquiries happen if an authorized person or a company wants to look at your credit standing as part of a background check. A good example would be a potential employer who wants to know your background before hiring you.

Hard inquiries are the precise situations in which a lender examines your credit report to evaluate you as a potential borrower. Hard inquiries can impact your credit rating negatively. To put it another way, a hard credit inquiry is when a lender examines the facts in your report, so they make a decision about whether or not to grant the credit you have applied for.

Are Hard Inquiries Bad?

Tough questions aren’t always a negative thing to ask. They are merely an element of the functioning of the credit report process. Additionally, it is to everyone’s advantage that this knowledge is documented. You ought to be able to know who accessed your personal credit information and the reason they did so.

Having said that, in-depth investigations are not objective. Because of their potential influence on your credit, it is in your best interest to maintain as few of them as possible. Soft inquiries are removed from your report after six months.

Providing the inquiries for the same type of loan take place within a reasonable amount of time of one another, FICO will consider them to be part of a single inquiry. This is because FICO is aware that there are times when you might be shopping around for the best rate on a specific sort of loan.

The potential borrower can make a request to the lender regarding the length of the shopping period, which could range anywhere from 14 to 45 days. Additionally, FICO disregards shopping sessions that took place within the 30 days before the establishment of a score or less.

Eliminating Incorrect Inquiries

Your credit report will not be updated if you try to have valid hard inquiries removed from it. But what if you find inaccurate hard inquiries or credit pulls that you didn’t authorize?

In this situation, you have the right to know the steps to removing inaccurate inquiries. (dispute them and seek documentation that you were authorized to make those transactions).

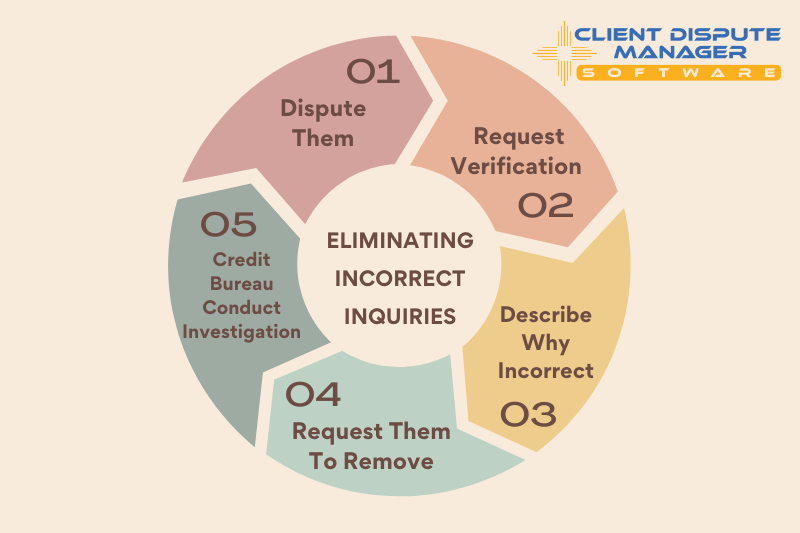

Steps to Removing Inaccurate Inquiries

- Dispute them: You can dispute inaccurate information on your credit report by writing a letter to the credit agency.

- Show the inaccurate information and request verification of the inaccuracy.

- Inform them of the problem and why you think the information is incorrect.

- Request that they remove the inquiry from your record.

- The credit bureau must look into your claim and delete the query from your report if they conclude that it has been included in error after conducting the investigation.

You can get inaccurate information deleted from your private credit report by disputing it with the credit agency. According to the guidelines on the credit bureau website, you can do this in a number of different ways, including online, over the phone, or in writing.

The company whose inquiry you are challenging has a legal requirement to cooperate with the investigation that the credit bureau will conduct. If the investigation reveals that the inquiry was included in your report inadvertently, the inquiry will be withdrawn from your report.

More on Removing Inaccurate Inquiries

It is quite difficult to successfully remove an inquiry that was the direct outcome of an application you submitted. Credit bureaus have the responsibility and the right to submit correct information within the appropriate time limit for credit reporting.

You cannot have inquiries removed from your credit report merely because you decided against opening a new line of credit or because you are uncomfortable with the inquiry being there.

Thankfully, difficult queries are not a major reason for anxiety at this time. Your credit score will only be marginally impacted for one year. And you can control the number of hard inquiries that are made on your personal credit report by limiting the number of credit applications you make during one year.

Strategy to Avoid Getting Inquiries

If you aren’t somewhat confident in yourself, don’t bother applying. You should avoid applying for credit only to check if you are eligible for it. Learn your credit score and the types of credit for which you are likely to be approved, and don’t apply for credit until you absolutely require it. If you don’t do this, you’ll end up with many hard inquiries for no good reason.