Knowing how to remove inaccurate collection account is beneficial as it is detrimental to the health of your credit. They are not only dreadful but can also bring down the credit score by tens or even hundreds of points.

Even if you choose to pay it off, it’s likely to leave its marks on the credit report for seven years. If you are wondering how to remove an inaccurate collection account, you have landed in the right place. After a stipulated period, removing the inaccurate collection account from your report is essential. Should you wish to take it off sooner or think it’s included erroneously, you may take certain actions as early as possible.

Let’s take a look at the critical steps to get the job done without a fuss.

1. Conduct Comprehensive Research

To get all the important details on your collection account, reviewing all the credit reports is essential. Generally, you are eligible to receive a free copy of this report every fiscal year. This credit report will show you whether any collection is due, if there’s any balance you will receive, along with the date of delinquency.

Your next task is to compare these details listed on the credit report with your records for the said account. If you don’t have any records, you can log into the listed account to look at your payment details with the actual creditor.

2. Determine Whether The Account Is Legit

While reviewing the inaccurate collection account, you must ensure it belongs to you. If it doesn’t belong to you or you have made the payments on time, and it is not registered in your credit report, you must dispute the mistake to remove the inaccurate collection account.

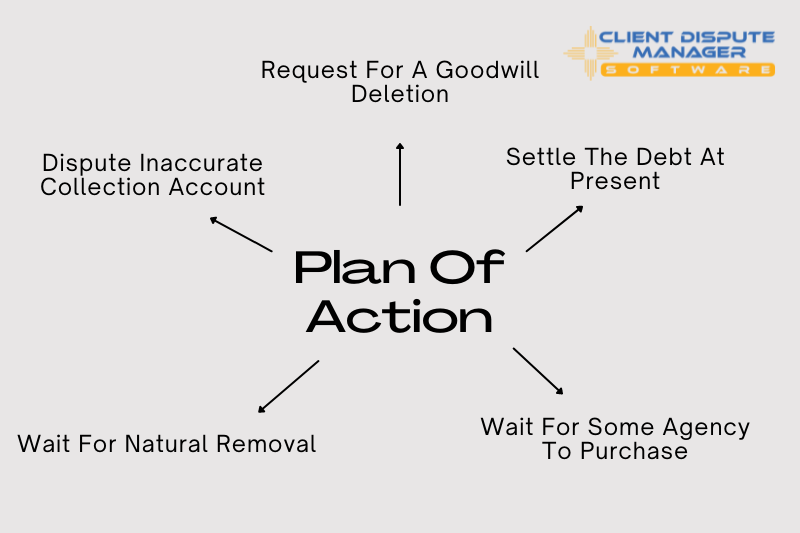

3. Select An Appropriate Plan Of Action to Remove Inaccurate Collection Account

When trying to get rid of an inaccurate collection account, you can choose among these five plausible steps-

Dispute Incomplete Or Inaccurate Collection Account

According to the Fair Credit Reporting Act, when you have such accounts enlisted on your credit report, you are endowed with the right to dispute the discrepancy directly to your creditor or credit bureaus. The dispute can be lodged on the website of the credit bureau. You can also access the sample dispute letters on the website of the Federal Trade Commission.

Once you submit the dispute, the credit reporting company will investigate the claim within 30 days. If they find that the information furnished by you is accurate, then they can easily remove the inaccurate collection account from your report.

On the flip side, if they find the information incorrect, the collection account will remain on the report for seven years.

Request For A Goodwill Deletion to Remove Inaccurate Collection Account

After paying the collection enlisted on your credit report, you have another chance to get rid of it. All you have to do is to ask the original or even the debt collector to rule out the collection.

Usually, you would have to send a goodwill deletion letter to the concerned agency explaining your error and plead for forgiveness by showing how the credit history has improved.

Although there is no certainty that you can remove an inaccurate collection account with this step, it’s definitely worth a try. When the account is removed, it will enhance your credit scores and qualify you with improved terms on mortgages, credit cards, and personal loans.

Settle The Debt At Present

Under certain circumstances, the debt collector will let you settle the debt by paying lesser than the amount you are indebted. Generally, the collectors accept about 50 percent of the amount you owe while ensuring they have a profit.

If this option interests you, you must contact the debt collection agency. In the first place, they will want to settle the full payment, but eventually, they can take off somewhere between 20 and 60 percent of the amount to settle the inaccurate collection account.

It’s worth noting that paying the debt alone will not improve your credit score or remove an inaccurate collection account. But it will give you the power to contact the credit bureau and lodge the dispute that the account is unpaid.

Likely, the creditor will not grant validation of the debt as you have cleared it. They might not have the authority to validate it and accept the requests of the credit bureau.

Wait For Some Agency To Purchase It

Another way to get rid of an inaccurate collection account is to wait for the account to be purchased by some other agency. After that, you can dispute the same. Today, debts are continually purchased by one agency or the other.

Suppose the first agency that buys it fails to receive the payment on that particular debt. All they do is sell the debt to some other agency. In such a scenario, the original creditor mentioned in the credit report will not have access to your credit account information. Now you are free to dispute the charge and may even get it removed.

Wait For Natural Removal

In case the concerned debt is legit, and you fail to convince the collection agency to remove it from your credit report, the only option you are left with is to wait.

From the date of the account first coming to delinquency, the collection account can stay up to seven years, after which it will be automatically removed from your report. While it’s true that it will consistently impact your credit score, its effectiveness will come down over time.

Final Thoughts

Even when all these efforts fail to remove inaccurate collection account, do not lose hope. Your goal to remove an inaccurate collection account may take some time to achieve.

If you allow some months to pass and then file for another dispute, you may find your way to success. Understanding how you can dispute it or seeking professional help from a credit specialist will play a big role in achieving your results.

Bonus: Now that you have read the article on removing inaccurate collection accounts, why not take your new skill and start your own credit business helping others? We have free training that can help you do just that. Click here to learn more.