In today’s fast-moving digital world, businesses must adapt to technology that simplifies processes. Credit repair software for business is designed to streamline operations, and self-service signup is one of its most powerful features.

Entrepreneurs and credit repair professionals no longer need to rely on manual processes to onboard clients. Instead, AI credit repair software automates the experience, ensuring smooth, compliant, and professional onboarding.

This guide explores how self-service signup is revolutionizing credit repair CRM software, enhancing compliance, and improving client engagement.

If you’re looking to optimize your credit repair client onboarding process, read on!

Start Today and Explore the Features Firsthand!

What is Credit Repair Software for Business?

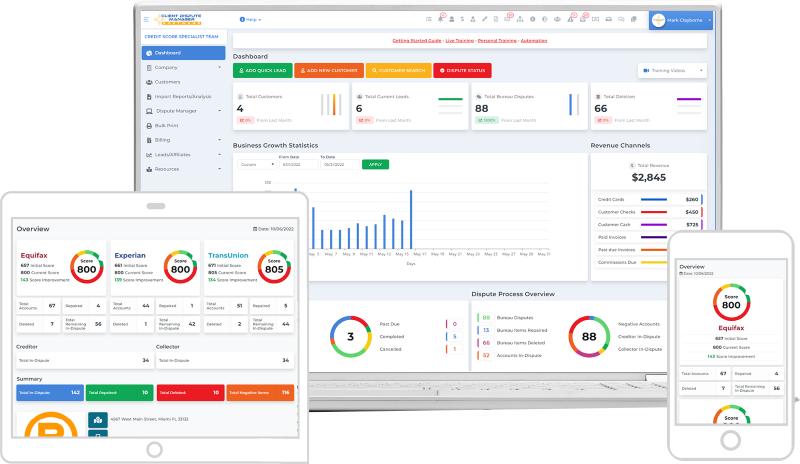

Credit repair professionals need efficient tools to manage clients, track progress, and stay compliant with regulations. Credit repair software for business provides a digital solution for managing client disputes, documentation, and communication.

By utilizing AI credit repair software, businesses can automate time-consuming tasks such as dispute tracking, credit report analysis, and document generation, making client management more efficient.

Additionally, Credit Repair CRM Software enhances workflow automation by integrating lead tracking, payment processing, and customer communication in one place.

This allows credit repair professionals to focus on providing value to their clients rather than spending excessive time on administrative work.

With credit repair business software, entrepreneurs can scale their operations, improve compliance, and provide a seamless experience for customers who need assistance in restoring their financial health.

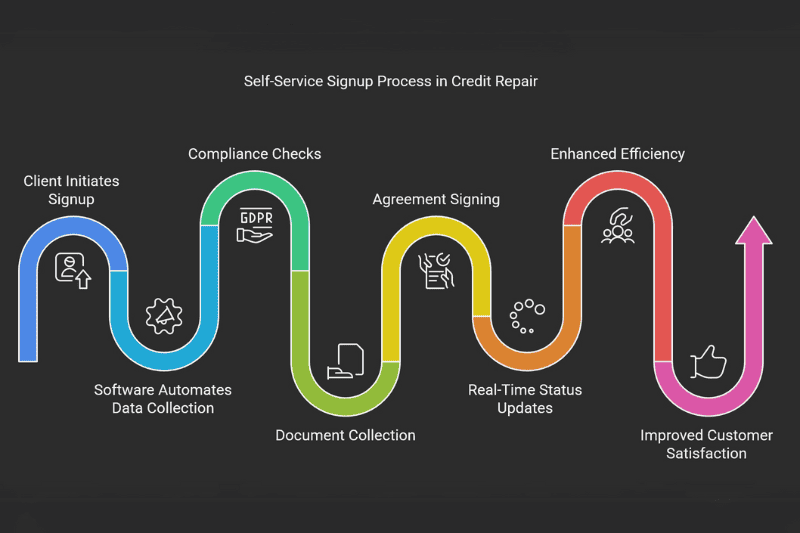

The Role of Self-Service Signup in Credit Repair Client Onboarding

Self-service signup eliminates the need for back-and-forth communication during the client onboarding process. Instead of waiting for a manual response, clients can complete their registration instantly, reducing frustration and streamlining the credit repair client onboarding experience.

By integrating credit repair business software, businesses can automate every step of the onboarding process, from document collection to agreement signing, ensuring a smooth transition for new clients.

Additionally, self-service signup within AI credit repair software provides real-time status updates, allowing clients to track their onboarding progress while minimizing manual intervention from business owners.

This not only enhances efficiency but also significantly improves customer satisfaction and retention.

Major benefits include:

- AI credit repair software automates data collection and processing.

- Ensures compliance with TSR & CROA while reducing legal risks.

- Simplifies lead conversion, boosting signups and business growth.

Start Today and Explore the Features Firsthand!

Why Businesses Need Self-Service Signup?

As the credit repair industry continues to grow, businesses must find ways to enhance efficiency, compliance, and customer experience.

Implementing self-service signup in credit repair software for business simplifies client onboarding, reduces administrative burdens, and improves customer satisfaction.

By leveraging AI credit repair software, businesses can automate document collection, agreement processing, and customer verification, ensuring a seamless and professional signup process.

Automating Client Onboarding with Credit Repair Software

Manual onboarding is outdated. With credit repair CRM software, business owners can let clients sign up at any time, ensuring a frictionless process.

By automating the credit repair client onboarding experience, businesses can eliminate unnecessary delays and provide a seamless way for customers to engage with their services.

AI credit repair software also ensures that client data is securely stored and processed, reducing errors and enhancing compliance.

Additionally, the ability to track onboarding progress in real-time improves transparency and strengthens customer trust.

Ensuring Compliance with TSR & CROA in Credit Repair

Using credit repair business software, companies remain compliant with telemarketing sales rules and consumer credit regulations. This is particularly important for businesses avoiding TSR violations.

With the help of AI credit repair software, companies can automate compliance checks, ensuring that all processes adhere to TSR and CROA regulations.

Additionally, credit repair CRM software helps businesses maintain accurate records of client interactions, reducing the risk of compliance violations.

This level of automation not only safeguards the company but also enhances the credibility of the business, building trust with customers who seek reliable credit repair services.

Start Today and Explore the Features Firsthand!

Cost & Time Savings with AI Credit Repair Software

Hiring staff for client onboarding is expensive. AI credit repair software reduces these costs by automating the process.

With credit repair CRM software, businesses can efficiently handle new client registrations without the need for additional personnel, saving both time and resources.

This technology enables real-time data entry, document verification, and automated follow-ups, ensuring that no lead is lost in the process.

Additionally, integrating credit repair business software allows for seamless communication between clients and service providers, further optimizing efficiency and improving overall customer experience.

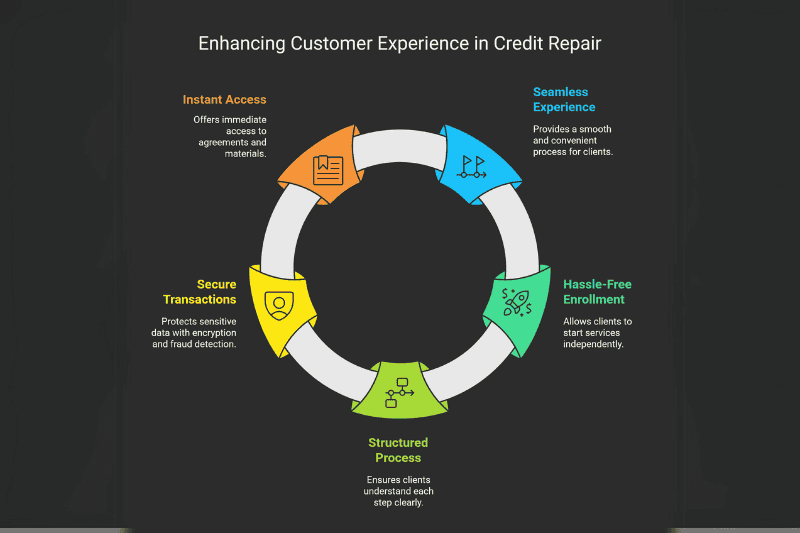

Enhancing Customer Experience with Credit Repair CRM Software

Customers appreciate ease and efficiency. Credit repair CRM software eliminates unnecessary paperwork and streamlines onboarding.

By automating document submission and verification, businesses can reduce delays and ensure a seamless onboarding process.

Additionally, integrating AI credit repair software allows for real-time updates and automated communication, keeping clients informed at every stage.

This not only enhances customer satisfaction but also strengthens client trust in the credit repair process.

Step-by-Step Guide: How Self-Service Signup Works in Client Dispute Manager Software

The Client Dispute Manager Software simplifies self-service signup, allowing credit repair businesses to onboard clients quickly and efficiently. By eliminating manual paperwork and streamlining registration, businesses can save time and enhance compliance.

Below is a step-by-step breakdown of how the process works and its benefits for both businesses and clients.

Start Today and Explore the Features Firsthand!

Step #1: Customers Visit Your Website & Start the Credit Repair Signup

Clients explore your website, pricing, and service options before clicking “Sign Up Now” to begin the credit repair client onboarding process.

By using AI credit repair software, businesses can automate this step, ensuring that customer data is securely captured and processed in real time. This seamless experience increases conversion rates and reduces drop-offs during the signup process.

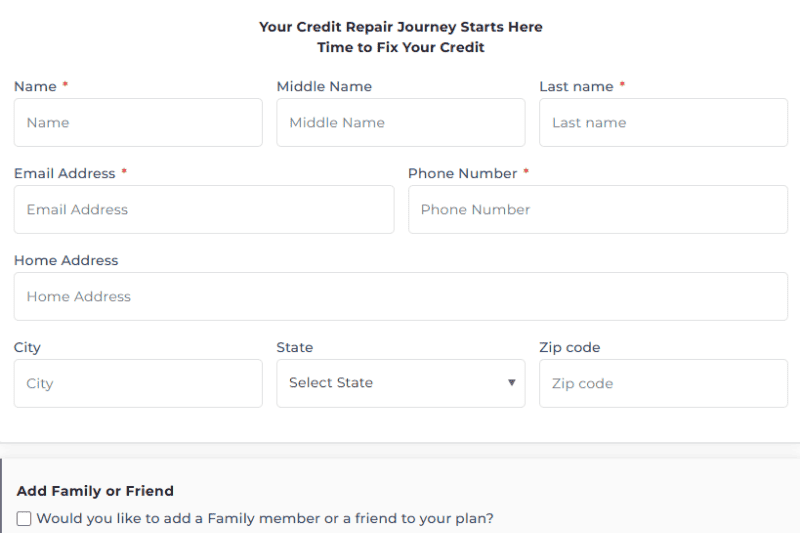

Step #2: Entering Personal Information in Credit Repair CRM Software

Clients input essential details, including their name, contact information, and address, with an option to add family members for joint credit repair services.

Using credit repair CRM software, businesses can securely store and manage this data while ensuring compliance with industry regulations.

This automated process enhances efficiency and provides clients with a seamless onboarding experience.

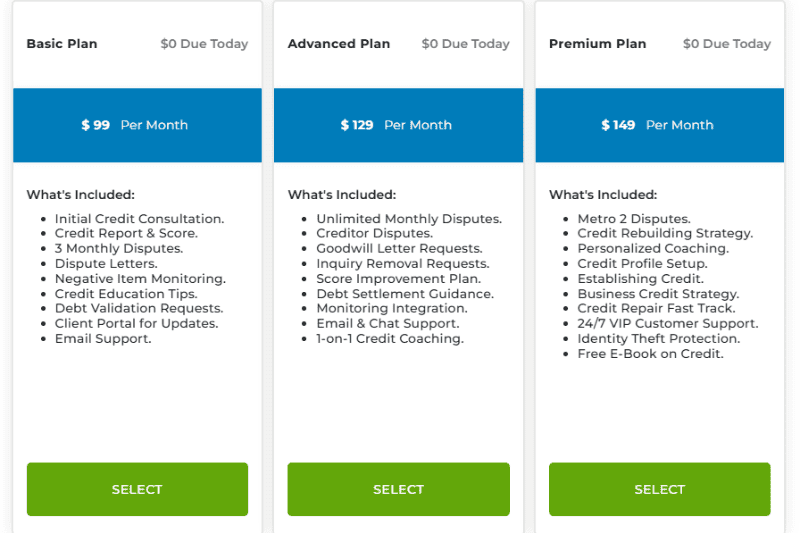

Step #3: Selecting a Plan Using Credit Repair Business Software

Customized pricing plans are displayed transparently, allowing clients to select the best option that suits their financial needs.

With the help of credit repair business software, businesses can automate plan selection, ensuring compliance with TSR and CROA regulations.

This structured approach enhances customer trust while streamlining the credit repair client onboarding process.

Start Today and Explore the Features Firsthand!

Step #4: Billing & Payment Information with Secure Processing

With credit repair CRM software, payments are encrypted, ensuring safe transactions while maintaining compliance with industry regulations.

This software also integrates with AI credit repair software, allowing businesses to automate invoicing, track payments, and provide customers with a seamless and secure billing experience.

By using credit repair business software, companies can enhance transaction security, reduce errors, and improve overall efficiency in financial processing.

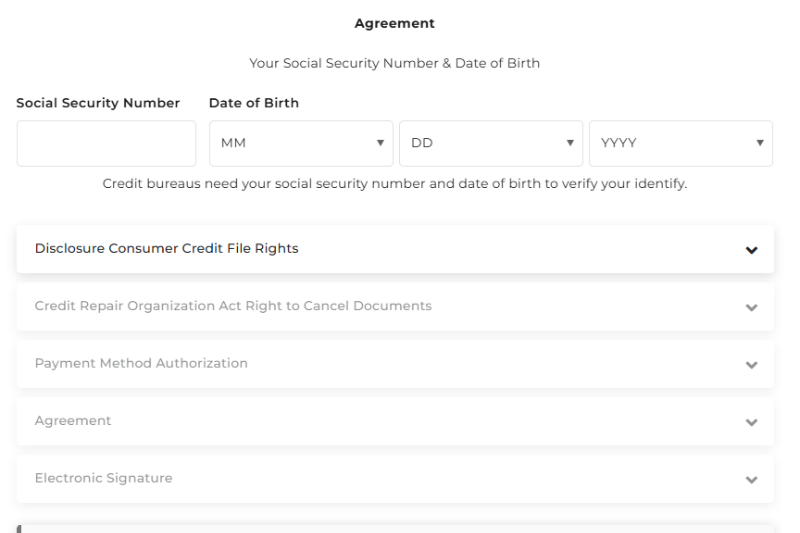

Step #5: Signing Agreements & Ensuring CROA Compliance

Agreements and disclosures are auto-generated within credit repair business software, ensuring transparency and legal compliance for both businesses and clients.

By leveraging AI credit repair software, businesses can automate contract generation, digital signatures, and secure document storage, reducing errors and ensuring adherence to CROA regulations.

This seamless integration enhances trust and streamlines the credit repair client onboarding process.

Step #6: Credit Monitoring Setup Through AI Credit Repair Software

Integrated credit monitoring tools help customers track their credit reports, ensuring they stay informed about changes in their credit history.

By utilizing AI credit repair software, businesses can seamlessly connect clients to real-time credit monitoring services, allowing for automatic updates and proactive financial management.

This integration not only enhances transparency but also empowers customers to take control of their credit improvement journey with ease.

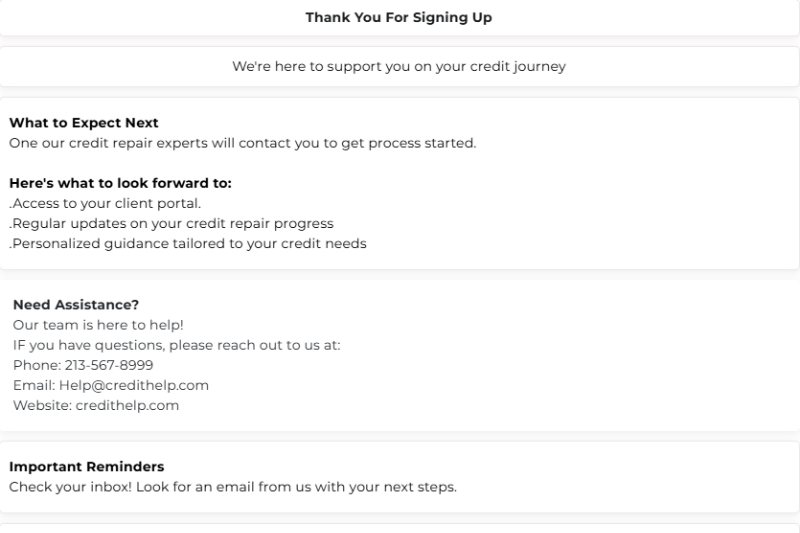

Step #7: Final Confirmation & Next Steps in Client Onboarding

Customers receive instant access to agreements and onboarding steps, ensuring a smooth transition into the credit repair client onboarding process.

With the help of AI credit repair software, clients can download important documents, review their next steps, and track their progress in real-time.

This level of automation not only enhances customer experience but also helps businesses maintain efficiency and compliance.

Start Today and Explore the Features Firsthand!

Key Benefits for Business Owners Using Credit Repair Software

The implementation of credit repair software for business with self-service signup significantly improves operational efficiency.

By automating credit repair client onboarding, businesses can reduce administrative burdens, minimize errors, and enhance client satisfaction.

Below are the key benefits that business owners can expect.

Fully Automated Client Onboarding in Credit Repair Business Software

With AI credit repair software, businesses no longer need to manually handle client registration, document collection, and agreement processing.

This automation speeds up the onboarding process, allowing companies to focus on delivering high-quality services and expanding their customer base.

Additionally, credit repair CRM software ensures that every step of the client journey is streamlined, from initial sign-up to final approval.

The system automatically verifies and stores customer data, reducing the risk of human error and ensuring compliance with regulatory standards.

By utilizing credit repair business software, companies can increase efficiency, enhance accuracy, and provide a superior experience for their clients.

Compliance-Friendly Solution for Credit Repair Businesses

Regulatory compliance is critical in the credit repair industry. Credit repair CRM software ensures that all processes align with TSR and CROA regulations, reducing the risk of legal issues.

Automated agreement generation, digital signatures, and secure document storage help businesses maintain compliance effortlessly.

Additionally, AI credit repair software streamlines record-keeping, ensuring businesses maintain a verifiable audit trail for legal protection.

By integrating credit repair business software, companies can reduce human error, improve data security, and enhance trust with clients who seek a professional and compliant credit repair solution.

Increased Lead Conversion with Credit Repair CRM Software

A smooth self-service signup process leads to higher lead conversion rates. With credit repair business software, potential clients can sign up instantly without waiting for manual approvals, reducing drop-offs and increasing customer acquisition.

Additionally, AI credit repair software enhances the process by automating follow-ups and sending timely reminders to potential clients. This ensures that no lead is lost due to delays, improving overall efficiency.

Furthermore, integrating credit repair CRM software allows businesses to track conversions in real time, providing valuable insights into customer behavior and engagement.

Start Today and Explore the Features Firsthand!

Secure & Professional System with AI Credit Repair Software

Security is a top priority in financial services. AI credit repair software encrypts sensitive client information, ensuring data protection and secure transactions.

Automated systems also provide audit trails, giving businesses complete visibility into their onboarding processes. Additionally, credit repair CRM software helps businesses monitor and restrict access to sensitive data, further strengthening security measures.

By integrating credit repair business software, companies can safeguard client information, prevent fraud, and comply with industry regulations effortlessly.

Key Benefits for Customers Using Self-Service Signup

For customers, self-service signup in credit repair software provides a seamless and convenient experience.

It allows clients to sign up, submit documents, and track their progress without delays, enhancing satisfaction and trust in the business.

Hassle-Free Signup with Do-It-Yourself Credit Repair Software

Customers appreciate the ability to enroll in services without speaking to a representative.

Do-it-yourself credit repair software makes it easy for clients to begin their credit repair journey on their own time, improving overall engagement.

This self-paced approach allows users to gather necessary documents, review their financial standing, and take control of their credit repair process with minimal assistance.

Additionally, integrating credit repair CRM software ensures a smooth and efficient experience, providing automated guidance and real-time updates.

By leveraging AI credit repair software, businesses can empower clients with a structured and transparent process, enhancing their overall satisfaction.

Clear & Transparent Process for Credit Repair Client Onboarding

A structured and automated credit repair client onboarding experience ensures that clients understand each step of the process.

Credit repair business software provides automated notifications and real-time updates, reducing confusion and improving communication.

Additionally, AI credit repair software enables personalized client interactions by sending timely reminders and progress updates. This level of automation builds trust, increases engagement, and enhances the overall client experience.

By leveraging credit repair CRM software, businesses can ensure smooth and transparent onboarding, minimizing errors and improving customer retention.

Secure Transactions Using Credit Repair CRM Software

With credit repair CRM software, clients can trust that their sensitive financial data is securely stored and processed. Encrypted payments, secure document uploads, and compliance-focused features provide peace of mind.

Additionally, AI credit repair software automates fraud detection, ensuring that all transactions and document submissions are verified for authenticity.

By integrating credit repair business software, companies can enhance cybersecurity, prevent unauthorized access, and maintain a reliable and transparent system for both business owners and clients.

Instant Access to Agreements for Credit Repair Business Software Clients

Upon completing the self-service signup process, customers receive immediate access to their agreements and onboarding materials. This eliminates delays, improves transparency, and enhances the overall experience of working with a credit repair business.

Additionally, AI credit repair software ensures that all documents are securely stored and easily accessible, reducing the need for manual intervention.

By utilizing credit repair CRM software, businesses can streamline document retrieval, automate reminders, and provide clients with a hassle-free onboarding experience.

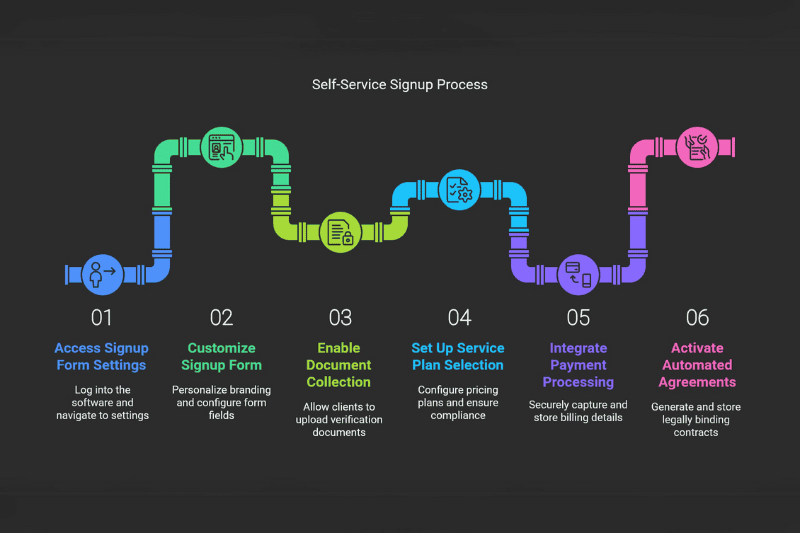

How to Use Self-Service Signup in Client Dispute Manager Software

The self-service signup feature in Client Dispute Manager Software allows credit repair businesses to onboard clients efficiently, eliminating manual processes and reducing workload.

This feature automates every step of credit repair client onboarding, ensuring compliance with industry regulations while providing a seamless customer experience.

Start Today and Explore the Features Firsthand!

Steps to Use Self-Service Signup in Client Dispute Manager Software

- Access the Signup Form Settings – Log into Client Dispute Manager Software and navigate to the self-service signup settings.

- Customize Your Signup Form – Personalize branding, set up form fields, and configure required client information.

- Enable Automated Document Collection – Allow clients to securely upload identity verification documents directly within the system.

- Set Up Service Plan Selection – Configure different pricing plans and ensure compliance with TSR and CROA regulations.

- Integrate Payment Processing – Securely capture billing details and store encrypted credit card information.

- Activate Automated Agreements – Generate, sign, and store legally binding contracts using AI credit repair software.

- Enable Credit Monitoring Integration – Connect to credit monitoring services, allowing clients to submit login credentials for seamless tracking.

- Review and Publish – Once configured, publish the form, making it accessible on your website for instant client signup.

By utilizing credit repair CRM software, businesses can streamline operations, reduce administrative burdens, and improve customer satisfaction. With Client Dispute Manager Software, onboarding new clients has never been easier, ensuring a compliant, professional, and efficient credit repair process.

Conclusion

The future of credit repair client onboarding lies in automation and self-service capabilities.

By implementing self-service signup in credit repair software for business, companies can enhance efficiency, compliance, and customer satisfaction.

AI credit repair software eliminates manual processes, speeds up onboarding, and provides a seamless experience for both businesses and clients.

Now is the time to upgrade your credit repair CRM software and optimize your client onboarding process. Start leveraging Client Dispute Manager Software today and take your credit repair business to the next level!

Mark Clayborne

Mark Clayborne specializes in credit repair, starting and running credit repair businesses. He's passionate about helping businesses gain freedom from their 9-5 and live the life they really want. You can follow him on YouTube.

Start Today and Explore the Features Firsthand!