Have you ever wished you could remove a negative item from your credit report? A pay for delete letter might seem like a quick fix, but how effective is it?

Many people try a pay for removal letter or a delete letter for credit to improve their financial standing. However, understanding the process, legal implications, and alternatives is essential before using this method.

In this article, we’ll break down how a pay to delete collections letter works, its impact on credit scores, and whether it’s a reliable strategy. We’ll also provide a paid debt removal letter template, step-by-step guidance, and effective alternatives.

What Is a Pay for Delete Letter?

A pay for delete letter is a written request to a creditor or collection agency asking them to remove a negative account from your credit report in exchange for payment.

Unlike a deletion letter from a creditor, which may be granted as a goodwill gesture, a pay and delete letter sample explicitly offers money for deletion.

When you have a debt in collections, simply paying it off does not erase the record from your credit history.

A pay to delete template attempts to negotiate this removal, though success rates vary. Some creditors are willing to provide a deletion letter sample, while others strictly follow credit reporting guidelines and refuse these requests.

Legal Implications of Pay for Delete Agreements

Before sending a pay for delete letter template, it’s essential to understand the legal side. The Fair Credit Reporting Act (FCRA) does not require creditors to remove accurate negative information from your report.

Additionally, under the Credit Repair Organizations Act (CROA) and FTC guidelines, making misleading claims about credit repair can have legal consequences.

While a paid to delete letter is not illegal, some collection agencies may refuse to acknowledge them.

Even if a deletion letter from a collection agency is granted, there’s no guarantee it will be removed from all credit bureaus.

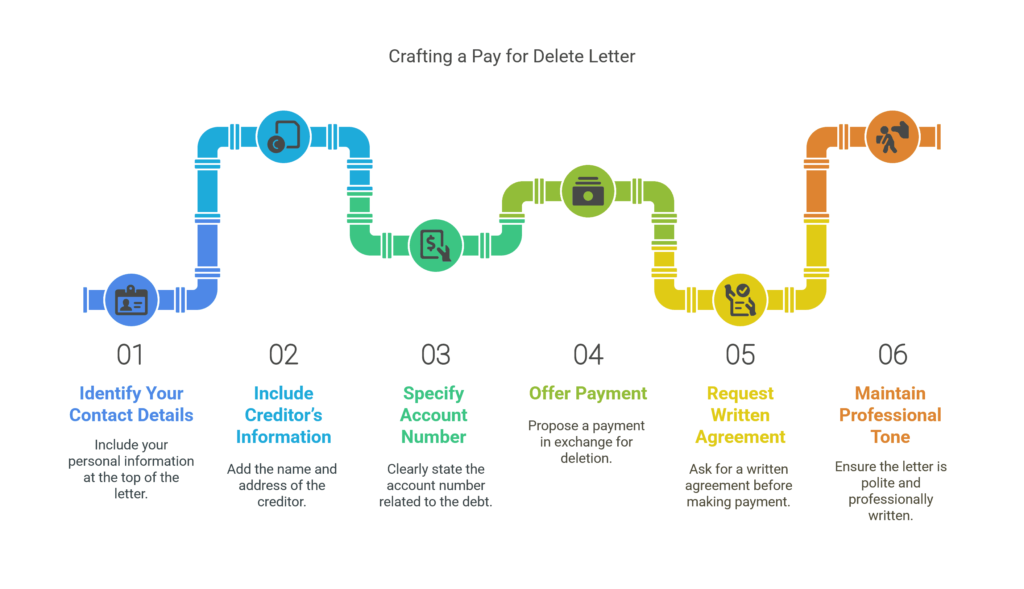

How to Write an Effective Pay for Delete Letter?

If you decide to pursue a pay for delete letter, follow these steps to increase your chances of success.

First, ensure that the creditor or collection agency is willing to negotiate a pay for removal letter before you proceed.

Some agencies have strict policies and may not accept a pay to delete collections letter, so it’s important to get confirmation in writing.

Additionally, always request a deletion letter from a creditor as proof before making any payment to avoid potential disputes.

Essential Components of a Pay for Delete Letter

A well-crafted pay for delete letter increases the likelihood of a creditor agreeing to remove a negative item from your credit report.

To ensure effectiveness, a pay to delete collections letter should clearly outline the debt details, your payment offer, and a formal request for removal.

Including these essential elements makes it easier for creditors to process your request and provide a deletion letter from a creditor as confirmation of the agreement.

Without these key details, a creditor may reject your request or fail to process it correctly.

By ensuring that your pay for removal letter is complete and professionally written, you improve your chances of receiving a favorable response.

Below are the critical components you should include in your paid debt removal letter template to maximize effectiveness:

- Your contact details (name, address, phone number, email)

- Creditor’s information (name of collection agency or lender)

- Account number associated with the debt

- Offer of payment in exchange for written confirmation of deletion

- Request for written agreement before sending any money

- Polite and professional tone

Sample Pay for Delete Letter Templates for Guidance

Here’s an example of a pay for delete letter template:

Subject: Request for Pay for Delete Agreement – [Your Account Number]

Dear [Creditor’s Name],

I am writing regarding the account referenced above. I acknowledge the debt and am willing to settle the outstanding balance of [$X] in exchange for the removal of this account from my credit report.

If you agree, please provide a deletion letter from a creditor on official letterhead confirming the account’s removal.

Please confirm this agreement in writing before I proceed with payment. Thank you for your time and consideration.

Sincerely,

[Your Name]

Impact of Pay for Delete Agreements on Credit Scores

While a pay to delete collections letter may remove negative items, its impact on your score depends on several factors. Some collection agencies may delete accounts after payment, while others report them as “paid collections,” which still affects your credit.

Additionally, even if a deletion letter from a collection agency is granted, credit bureaus may still retain records of past delinquencies, impacting your overall credit history.

Furthermore, not all creditors honor a pay for delete letter template, making it important to explore other options such as a goodwill deletion letter from a creditor or disputing inaccuracies on your credit report.

Understanding how a paid to delete letter works and its limitations will help you make an informed decision about improving your credit score.

Advantages of Pay for Delete Strategies

One of the primary benefits of a pay for delete letter is that it can potentially remove collections from your credit report, helping you rebuild your credit profile.

In some cases, a pay to delete collections letter can improve your credit score, especially if the negative account was significantly affecting it.

Additionally, resolving outstanding debts through a paid debt removal letter template can help clear financial obligations and prevent further damage to your creditworthiness.

By securing a deletion letter from a creditor, you gain assurance that the negative mark will no longer impact your score, allowing you to move forward with better financial health.

Disadvantages and Risks of Pay for Delete Requests

Not all creditors accept a pay for delete letter. While some collection agencies may agree to a pay for removal letter, others strictly adhere to credit reporting policies and refuse to remove negative items even after payment.

Additionally, paying off a debt does not guarantee that all credit bureaus will erase the record from your report. Many creditors may report the account as “paid,” but the negative history remains, which can still impact your credit score.

Some agencies also require full payment before even considering a deletion letter from a creditor, and in some cases, they may fail to follow through with the deletion altogether.

Understanding these risks before sending a pay to delete collections letter is crucial to making informed financial decisions.

Alternatives to Pay for Delete Agreements

If a pay for deletion letter PDF doesn’t work, consider these alternative solutions to improve your credit. Many people find success by disputing errors on their credit reports, especially if inaccurate or outdated information is being reported.

Another option is to request a deletion letter from a creditor through a goodwill adjustment, which may work for accounts with a history of timely payments before a financial hardship occurred.

Additionally, negotiating a pay to delete template isn’t the only way to resolve debt; working out a structured repayment plan can help improve your financial standing while keeping your credit intact.

Exploring these options ensures you take the most effective route toward credit recovery.

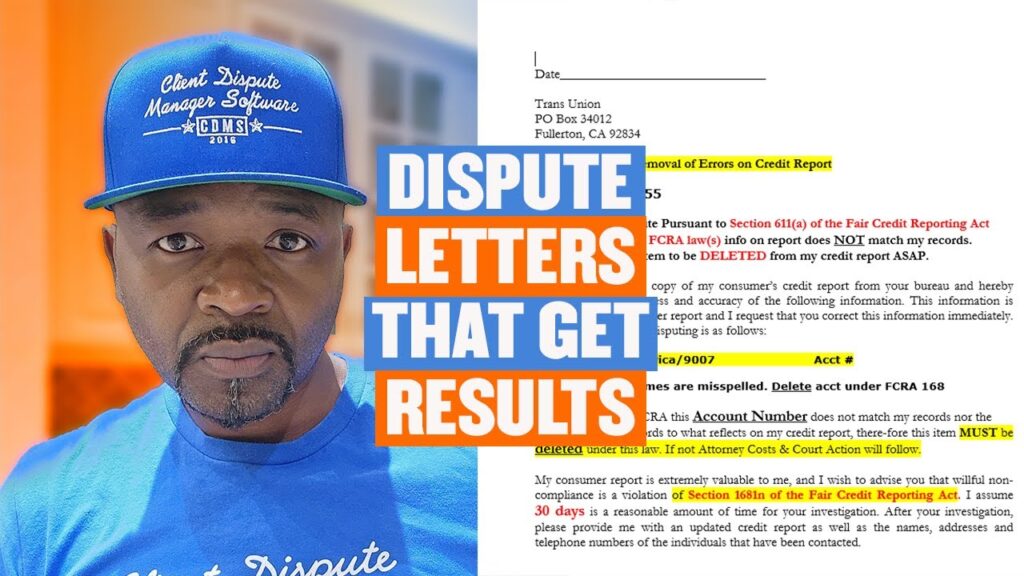

Disputing Errors on Credit Reports

If a collection is reported incorrectly, it is important to dispute it directly with the credit bureaus to ensure accurate reporting.

Filing a dispute can help remove errors that negatively impact your credit score, especially if the account was reported in error.

Instead of relying solely on a delete for payment letter, which may not always be honored by creditors, using the official dispute resolution process ensures compliance with credit laws.

By taking the appropriate steps, you improve your chances of having inaccurate negative marks removed while maintaining a transparent record of the resolution.

Requesting a Goodwill Deletion Letter from a Creditor

A deletion letter from a creditor may be possible for accounts with an otherwise good history, especially if the delinquency was due to a temporary financial hardship.

A goodwill deletion letter from a creditor is often considered for minor delinquencies, such as a single missed payment, rather than accounts with a history of repeated late payments.

While not guaranteed, many creditors grant these requests as a courtesy to responsible customers who have since maintained timely payments.

By drafting a respectful and compelling pay to delete template, you can improve your chances of receiving a deletion letter from a collection agency, which may help remove negative marks from your credit report.

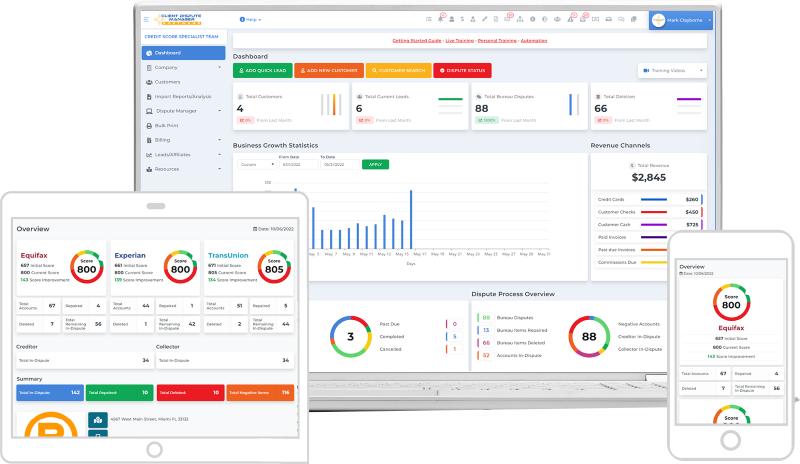

Client Dispute Manager Software: A Powerful Tool for Credit Repair

Managing credit disputes and sending a pay for delete letter can be time-consuming, but with the right tools, the process becomes much easier. Client Dispute Manager Software is designed to streamline credit repair efforts, making it simple to generate a pay to delete collections letter, track disputes, and manage communication with creditors.

This software provides automated templates for crafting a pay for delete letter template, ensuring that each request is professionally formatted and legally compliant.

Additionally, it helps credit repair businesses and individuals organize their records efficiently, increasing the chances of securing a deletion letter from a creditor while maintaining accurate documentation.

Whether you are a business owner helping clients improve their credit or an individual looking to remove negative items from your report, Client Dispute Manager Software is an essential tool for optimizing the credit repair process.

Frequently Asked Questions About Pay for Delete Letters

How Much Is a Pay for a Delete Letter?

The cost of a pay for delete letter varies depending on the creditor and the amount owed. Some creditors may accept partial payment to settle the account, while others may require full repayment before providing a deletion letter from a collection agency.

It is crucial to negotiate the terms carefully and ensure you receive written confirmation before making any payments.

What Is an Example of a Pay for Delete Letter?

An example of a pay for delete letter includes key components such as your contact details, the creditor’s information, the account number, and an offer to settle the debt in exchange for removal from your credit report.

A properly formatted pay to delete template increases the chances of success and ensures clear communication with the creditor.

It is important to be clear and professional in your request, as some creditors may be hesitant to provide a deletion letter from a creditor without a well-structured agreement.

Additionally, including a specific pay for delete letter template that outlines your offer and expectations can help speed up the negotiation process.

Creditors are more likely to respond positively when you provide clear terms, making a well-prepared paid debt removal letter template a valuable tool in credit repair efforts.

How to Get a Deletion Letter from a Collection Agency?

If you are wondering, do pay for delete letters really work?, the answer depends on the creditor. Some collection agencies honor these requests, while others do not.

If you negotiate a settlement, request a deletion letter from a collection agency before making payment. Ensure they confirm removal in writing to avoid any misunderstandings.

If you negotiate a settlement, request a deletion letter from a collection agency before making payment. Ensure they confirm removal in writing.

Is a Pay for Delete Letter Legal?

Many consumers ask, is pay for delete illegal? The short answer is no, but it is not a guaranteed or widely accepted practice.

Creditors are not obligated to honor a pay for delete letter template, and some may decline the request based on company policies.

While it is legal to ask for a deletion letter from a creditor, not all creditors are willing to remove accurate negative information from your credit report.

Yes, but it’s not guaranteed to work. Creditors are not obligated to honor a pay for delete letter template.

Tips for Managing Debt and Securing a Deletion Letter from a Creditor

Always request written agreements before paying off collections. This ensures that you have documented proof if a creditor fails to provide a deletion letter from a creditor as agreed.

Additionally, it is essential to monitor your credit reports regularly to verify that any updates, including a successfully processed pay for delete letter, are reflected correctly.

Staying proactive in tracking your credit helps you detect inaccuracies early and dispute any errors that may harm your financial standing.

Moreover, making timely payments is key to building positive credit, as consistent, on-time payments contribute to long-term credit health.

Combining responsible credit habits with strategic use of a pay for delete letter template can improve your financial future.

Importance of Keeping Records with Collection Agencies

Keeping documentation of your pay to delete template is crucial for protecting yourself in case of any disputes with creditors or collection agencies.

If a deletion letter from a collection agency is promised, save all written correspondence, including emails, physical letters, and agreements, as proof of the arrangement.

Additionally, keeping a copy of any pay for delete letter template you send ensures you have a reference in case follow-ups are needed.

Without proper documentation, it can be difficult to hold creditors accountable for removing negative items, even if payment has been made.

Organized record-keeping strengthens your ability to resolve potential discrepancies and safeguard your financial progress.

Conclusion

A pay for delete letter can be a useful tool, but it’s not always reliable. If your request is denied, consider disputing errors, requesting goodwill deletions, or focusing on overall credit improvement.

Always be cautious when negotiating with collection agencies, and keep all communication documented.

By understanding your options and using legitimate strategies, you can work towards better credit health.

Whether you use a pay for delete letter template, seek a deletion letter from a creditor, or explore alternatives, the key is to stay informed and proactive.

Mark Clayborne

Mark Clayborne specializes in credit repair, starting and running credit repair businesses. He's passionate about helping businesses gain freedom from their 9-5 and live the life they really want. You can follow him on YouTube.