Good credit is an essential pillar of financial stability, yet many find its intricacies hard to grasp. This guide is dedicated to simplifying credit repair fundamentals for everyone. Moreover, we’ll explore how credit repair software streamlines this process, making it more accessible. Dive in as we unravel the essentials of credit repair, combined with the modern tools designed to assist you.

Understanding Your Credit Report

At its core, credit is a reflection of trust, indicating how responsibly one has managed borrowed funds over time. It acts as a financial report card, providing lenders a glimpse into an individual’s financial behavior and habits.

Here’s a breakdown of the key elements that constitute credit:

Payment History

This component reveals your track record of paying off debts. Have you been timely with your payments or missed a few along the way? Regular and prompt payments can greatly enhance this aspect of your credit.

Credit Utilization

This term describes the ratio of your current credit card balances to your credit limits. Essentially, it’s a measure of how much of your available credit you’re actively using. Keeping this ratio low is a hallmark of good credit management.

Length of Credit History

Time is a pivotal factor in the realm of credit. A longer history with credit accounts suggests stability and reliability. When these accounts are consistently in good standing, it paints a picture of a trustworthy borrower. This enduring financial responsibility resonates positively with lenders and strengthens your overall credit profile.

Credit Mix

In the credit landscape, diversity is more than just a buzzword. A varied mix of credit types, such as credit cards, loans, and mortgages, demonstrates versatility in financial management. To lenders, this variety showcases your adeptness in handling different financial commitments, positioning you as a reliable and multifaceted borrower.

New Credit Inquiries

Every hard inquiry from a potential lender can slightly reduce your credit score. These inquiries, over time, accumulate and can be perceived as financial desperation. It’s imperative to understand the impact of frequent applications. Being selective and strategic about seeking new credit can help maintain your credit’s health.

Credit Repair Fundamentals

Navigating the world of credit can seem complex, but understanding the fundamentals can significantly simplify the journey.

Here’s a concise breakdown to help you grasp these basics:

Understanding Your Credit Report

The first step is familiarizing yourself with your credit report. This document, provided by credit bureaus, showcases your credit history, including loans, payment habits, and any outstanding debts.

Identifying Errors

Mistakes on credit reports are more common than many realize. An oversight, like an incorrect late payment or an unfamiliar account, can slip through. It’s essential to regularly review your report for these inaccuracies. Such errors, even if unintended, can significantly and unfairly impact your credit score.

Disputing Inaccuracies

Once you’ve pinpointed errors, it’s time to dispute them. This involves contacting the credit bureau and providing evidence to support your claim. Timely and accurate disputes can lead to corrections that boost your score.

Debt Management

Credit repair extends beyond correcting report inaccuracies; it’s about managing real debts effectively. This can mean dialogue with lenders for better terms or setting up structured payment plans. For those juggling multiple debts, consolidation can be a valuable strategy, merging multiple obligations into one manageable repayment plan.

Maintaining Good Habits

Repairing credit is merely the beginning; sustaining it is a continuous endeavor. It’s essential to keep an eye on your credit regularly, ensuring timely payments and thoughtful decisions. While new credit offers can be appealing, it’s crucial to be discerning. This ongoing commitment lays the foundation for long-term financial health.

Introduction to Credit Repair Software

In the digital era we live in, technology is simplifying complex tasks, and credit repair is no exception. Enter the world of credit repair software: a tool designed to streamline and automate the process of identifying, disputing, and correcting errors in credit reports.

For those unfamiliar, credit repair software serves as a bridge between individuals and credit bureaus. Instead of manually sifting through credit reports and drafting letters, these platforms offer templates, tracking, and reminders to ensure timely follow-ups.

They reduce human error, save time, and offer a structured approach to what can otherwise be an overwhelming task.

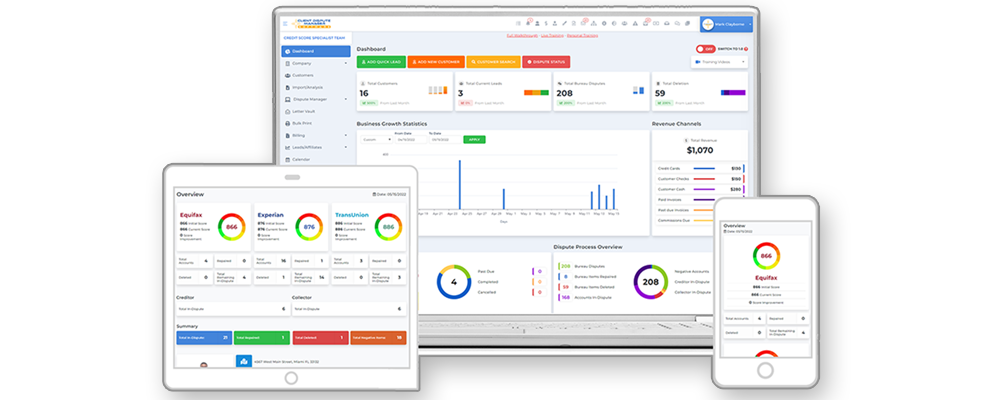

One notable software in this domain is Client Dispute Manager. With a user-friendly interface and a comprehensive toolkit, Client Dispute Manager Software stands out by making credit repair more accessible for both professionals and individuals alike.

Embracing credit repair software, especially trusted names like Client Dispute Manager, can be a game-changer. It not only simplifies the credit repair journey but also empowers users to take control of their financial destinies with confidence.

Best Credit Repair Software Options: Features to Look for

Embarking on the path of credit repair can seem daunting, but the right software can simplify and demystify the process. There are several options out there, including popular choices like Client Dispute Manager. So, how do you identify the right fit for your needs?

Here are some pivotal features to keep an eye on:

User-Friendly Interface

Ease of use is essential in credit repair software. A straightforward and intuitive layout eliminates unnecessary complexities. This not only accelerates the learning process but also ensures tasks are completed efficiently. Ultimately, user-friendly design translates to a more seamless and productive credit repair journey.

Dispute Management

A top-tier credit repair software should streamline the dispute process. Client Dispute Manager, for instance, offers tools that let you efficiently track and handle disputes with credit bureaus. Bonus points for those that come with pre-built dispute letter templates.

Credit Report Integration

Seamless integration with major credit bureaus is crucial for effective credit monitoring. This feature enables users to effortlessly pull recent credit reports. With real-time updates at their fingertips, users can swiftly identify and address any discrepancies, ensuring their credit profile remains accurate and up-to-date.

Client Management Tools

For credit repair professionals, managing multiple clients demands specialized tools. The ability to monitor client progress and communicate updates efficiently is essential. These features not only streamline operations but also foster transparency and trust, solidifying client-professional relationships.

Robust Security

Protecting your financial data is non-negotiable in our digital era. When evaluating credit repair software, it’s imperative to prioritize robust security measures. The best platforms will integrate strong encryption and adhere to stringent security protocols, ensuring your data’s confidentiality and safety.

Educational Resources

The best platforms do more than just aid in credit repair; they equip users with valuable resources such as comprehensive guides and informative videos. These offerings aim to deepen users’ understanding of credit repair basics, ensuring they’re well-prepared for future financial decisions.

Accessible Customer Support

Whether you’re a newbie or a seasoned professional, questions can pop up unexpectedly. Reliable customer service ensures that you have a dependable source of guidance, ensuring you’re never left stranded or feeling overwhelmed.

How to Maximize the Use of Credit Repair Software

Harnessing the full potential of credit repair software can significantly streamline your journey towards better credit. While these tools are designed to simplify the credit repair process, knowing how to maximize their features ensures you get the best results.

Here’s a guide to getting the most out of your credit repair software:

Familiarize Yourself with the Interface

Before diving deep, spend time exploring the software’s interface. Understand where different features are located, the purpose of various tools, and any shortcuts that can speed up tasks. The more comfortable you are navigating, the more efficiently you can operate.

Utilize Automated Dispute Templates

One of the main advantages of credit repair software is the built-in dispute templates. Rather than crafting letters from scratch, customize these templates with your details. This not only saves time but ensures your disputes are articulated effectively.

Set Up Notifications and Reminders

Consistency is key in the credit repair process. Make sure to enable notifications, so you’re alerted of important dates, like when to follow up on disputes or check for credit report updates.

Continuously Update Your Information

Your financial situation can change, as can credit laws and regulations. Regularly input new financial data and ensure your software is updated to reflect current standards and practices.

Leverage Reporting Tools

Most software offers in-depth reporting features. These can help you track your progress, understand which actions yield results, and pinpoint areas that need further attention.

Educate Yourself

Many credit repair software options, given the emphasis on credit repair fundamentals, include educational resources. Engage with these materials – be it articles, videos, or webinars – to better grasp the intricacies of credit repair.

Seek Support When Needed

Even with user-friendly software, you might hit roadblocks or have questions. Don’t hesitate to reach out to customer support or access available help guides. Often, these resources can provide clarity or solutions to common issues.

Consistently Monitor Your Credit

Use the software’s monitoring features to keep an eye on your credit score and report. Regular checks will help you identify any new discrepancies quickly and act on them, ensuring your credit remains in the best possible shape.

Backup Your Data

Given the sensitive nature of financial data, ensure you regularly backup any information you input into the software. This safeguards against potential data loss and ensures you always have access to your credit repair journey’s historical data.

Engage with User Communities

Many credit repair software platforms have associated forums or user groups. Engaging with these communities can provide additional tips, best practices, and insights from other users who are on a similar journey.

Conclusion

Understanding and managing credit is an essential skill in today’s financial landscape. While the world of credit repair may seem daunting, the fundamentals, when broken down, are quite approachable. By mastering these basics, anyone can take charge of their financial health and work towards achieving a better credit score.

In the end, the path to improved credit is a combination of knowledge, diligence, and the right resources. By equipping yourself with the essentials of credit repair and harnessing the power of modern software, a brighter financial future is not just a dream—it’s a tangible goal within reach.

Bonus: Now that you have read this article, why not take your new skill and start your own credit business helping others? We have free training that can help you do just that.

Click here to learn more.