The credit repair industry demands precision, compliance, and efficiency, especially when managing multiple clients. This is where AI credit repair software like Client Dispute Manager becomes a game-changer. By automating complex tasks and ensuring accuracy, these tools simplify credit analysis and dispute management.

Whether you’re a seasoned credit repair professional or just starting out, learning to leverage the best AI credit repair software can transform your operations.

In this guide, we’ll explore the key features, benefits, and step-by-step use of credit repair business software, all while optimizing for the keywords you need.

Start Today and Explore the Features Firsthand!

What Is AI Credit Repair Software and Why Is It Important?

AI credit repair software is a tool designed to streamline and automate credit analysis and dispute processes. It simplifies tasks like identifying errors in credit reports, generating dispute letters, and managing compliance requirements. The best credit repair software not only saves time but also ensures that credit repair businesses remain effective and compliant.

How AI Credit Repair Software Benefits Your Business?

AI technology revolutionizes credit repair by automating labor-intensive processes. Traditional credit analysis requires manual reviews that can take hours, while credit report repair software reduces this to minutes. This efficiency allows businesses to onboard more clients without compromising quality. By using credit repair software for business, professionals can focus on growing their operations while maintaining compliance.

Features That Make AI Credit Repair Software Stand Out

The best AI credit repair software integrates tools like Smart Interviewer, which allows clients to self-complete credit audits. This feature reduces manual work and ensures accurate data collection.

Other essential features include automated credit monitoring integrations, compliance safeguards, and customizable templates. These capabilities make credit repair business software an indispensable tool.

Why Accuracy and Compliance Matter?

Accurate credit analysis is the cornerstone of effective credit repair. Using credit repair software for business, professionals can ensure that no errors or discrepancies go unnoticed. Compliance features, such as automated audit logs and pre-designed dispute templates, help businesses adhere to industry regulations like TSR and FCRA.

Start Today and Explore the Features Firsthand!

Key Features of the Best AI Credit Repair Software

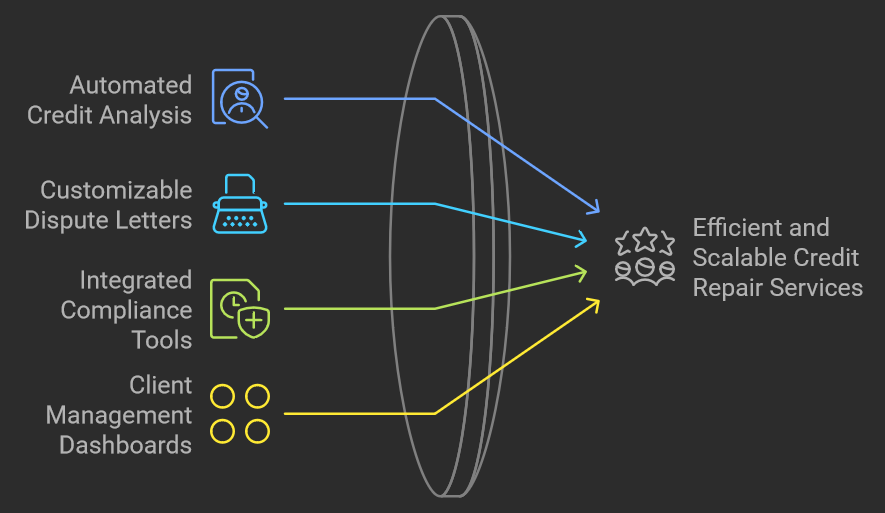

The best credit repair software offers tools that enhance accuracy, scalability, and client satisfaction. These features are especially crucial for businesses aiming to expand their operations without increasing their workload.

Automated Credit Analysis

One standout feature of AI credit repair software is automated credit report analysis. By importing credit monitoring data, the system identifies errors, inconsistencies, and outdated information across Experian, Equifax, and TransUnion reports. This automation ensures thorough reviews and eliminates human error, saving time for both professionals and clients.

Customizable Dispute Letter Generation

Customizing dispute letters is a core task in credit repair. The best AI credit repair software provides pre-designed templates that can be tailored to each client’s unique needs. These templates are compliant, professional, and efficient, helping businesses craft effective disputes that improve client outcomes.

Integrated Compliance Tools

Regulations like the FCRA and TSR require businesses to operate transparently and legally. Credit repair software for business includes features like audit logs, secure client onboarding, and built-in compliance checks. These safeguards protect businesses from legal risks and build trust with clients.

Client Management Dashboards

Managing multiple clients becomes easier with centralized dashboards. These tools organize client data, track progress, and streamline communication. For businesses looking to scale, credit repair business software ensures that growth doesn’t come at the expense of service quality.

Step-by-Step Guide to Conducting Credit Analysis with AI Tools

Conducting a thorough credit analysis is essential for effective credit repair. Here’s how to use credit report repair software like Client Dispute Manager to streamline the process.

Step #1: Onboarding Clients

Before starting a credit audit, ensure clients are onboarded properly. Have them sign a contract and provide payment details. Compliance rules require that audits begin only after a client officially enrolls in your services. Using credit repair software for business, you can automate this process with tools like Smart Interviewer.

Step #2: Importing Credit Monitoring Data

Secure credit monitoring credentials from clients using platforms like SmartCredit or MyFreeScoreNow. These integrations allow AI credit repair software to pull credit reports directly into the system. By automating data collection, you save time and reduce errors.

Start Today and Explore the Features Firsthand!

Step #3: Analyzing Credit Reports

The software’s automated credit analysis feature identifies errors, inconsistencies, and outdated information across credit bureaus. This includes discrepancies in account balances, payment dates, and public records. By using credit repair software for business, you ensure every detail is accounted for.

Step #4: Drafting Dispute Letters

Once inaccuracies are identified, generate dispute letters using the software’s customizable templates. These letters address specific issues highlighted during the analysis. With the best AI credit repair software, you can automate this process while ensuring compliance.

Step #5: Tracking Progress and Taking Notes

During the audit, log client information and progress in the software’s dashboard. This feature keeps all client details organized, making follow-ups and dispute management more efficient. Credit report repair software also allows you to share updates with clients, fostering transparency.

How AI Credit Repair Software Supports Compliance?

Compliance is a critical aspect of credit repair, as non-compliance can lead to penalties and loss of trust. AI credit repair software ensures that every step of the process adheres to industry regulations.

Ensuring TSR and FCRA Compliance

Using credit repair business software, businesses can follow TSR rules by onboarding clients correctly before conducting audits. The software also includes templates for compliant dispute letters, reducing the risk of legal violations. By leveraging credit repair software for business, you protect your operations and build credibility.

Automating Secure Data Management

Data security is essential in credit repair. The best AI credit repair software includes encrypted storage for client information, ensuring compliance with privacy laws. This feature safeguards sensitive data while maintaining client trust.

Tracking and Audit Logs

The software’s automated audit logs document every action taken during the credit repair process. This transparency is invaluable for demonstrating compliance and resolving disputes. Credit report repair software makes it easy to access these logs whenever needed.

Start Today and Explore the Features Firsthand!

Scaling Your Business with AI Credit Repair Software

Growth is a priority for every business, but scaling can be challenging without the right tools. AI credit repair software simplifies scaling by automating processes and centralizing client data.

Streamlining Workflows

Automation reduces the time spent on repetitive tasks like credit analysis and dispute generation. This efficiency allows businesses to onboard more clients without increasing their workload. Credit repair business software ensures that quality remains consistent, even as operations expand.

Improving Client Satisfaction

Clients value timely and accurate results. By using credit repair software for business, businesses can meet these expectations consistently. Automated updates and detailed reports keep clients informed, fostering trust and loyalty.

Increasing Profitability

Efficiency translates into profitability. By optimizing workflows and reducing manual workloads, credit report repair software helps businesses increase revenue without additional operational costs. This scalability is a major advantage for growing credit repair companies.

Conclusion: Transform Your Credit Repair Business with AI

The credit repair industry is evolving, and AI credit repair software is leading the way. By automating processes, ensuring compliance, and improving accuracy, these tools empower businesses to deliver exceptional results. Whether you’re starting or scaling your credit repair business, investing in the best AI credit repair software is a step toward long-term success.

Take advantage of these tools to streamline operations, enhance client satisfaction, and achieve sustainable growth. Credit repair software for business is not just a tool—it’s a competitive advantage.

Mark Clayborne

Mark Clayborne specializes in credit repair, running and growing a credit repair businesses. He's passionate about helping businesses gain freedom from their 9-5 and live the life they really want. You can follow him on YouTube.

Start Today and Explore the Features Firsthand!

Below Is More Content For Your Review:

- Unlock the Power of DIY Credit Repair Software: A Comprehensive Guide

- Revolutionizing Financial Recovery: The Rise of Automation in Credit Repair