Are you thinking about starting a credit repair business? Meet Hueton, a successful entrepreneur who turned his passion for helping others into a thriving credit repair company. In this article, we’ll explore Hueton’s journey and how Client Dispute Manager Software played a crucial role in his credit repair success.

From Personal Struggle to Starting a Credit Repair Business

Hueton didn’t start as a credit expert. He faced his own credit challenges first. This experience sparked his desire to help others and ultimately led him to start a credit repair business from home.

Hueton’s journey began with a realization that his own credit struggles were not unique. He saw friends and family facing similar issues, often feeling helpless and overwhelmed. This personal connection to the problem fueled his passion for finding solutions.

Recognizing the Need for Credit Education

Hueton discovered that many didn’t understand how credit really works. This lack of knowledge was holding people back, and Hueton saw an opportunity to make a difference.

“I come to find out that that was due to a lack of understanding of how credit really works,” Hueton explains.

“I wanted to provide a service that not only repairs credit but educates clients on maintaining a healthy credit score.”

The Journey of Starting a Credit Repair Business

Embarking on the path of entrepreneurship is never easy, and starting a credit repair business comes with its own unique challenges. Hueton’s journey was no exception.

“I’ve been officially in business for seven months,” Hueton shares, “but prior to that, I’ve been working on repairing my clients, you know, family and friends.”

Growth Through Results and Education

Hueton’s company, just seven months old, is already seeing growth. How? By focusing on results and education. He doesn’t just fix credit scores. He teaches clients how to maintain good credit.

“Business is going well, thank God,” Hueton reports.

“We’re seeing a steady increase in new clients, I’d say thanks to the positive results that we’re able to achieve for our clients.”

Key Steps to Start a Credit Repair Business

When asked about the steps to start a credit repair business, Hueton emphasizes the importance of education – both for yourself and your clients.

“Understanding the credit repair process inside and out is crucial when you’re starting a credit repair business,” he advises.

Overcoming Challenges in the Credit Repair Industry

What’s the biggest hurdle for consumers? According to Hueton, it’s understanding credit scores. Many don’t know how their choices impact their credit. Misinformation makes this problem worse.

“I think one of the biggest struggles consumers face is understanding how the credit score really works and how what they… the choices they make impacts their credit score,” Hueton explains.

“Because there’s a lot of misinformation out here.”

The Power of Empathy in Credit Repair

Hueton’s personal experience helps him connect with clients.

“I see myself in their same situations because, you know, I went through it. I mean, I had my ups and downs in my credit scores,” he shares.

This empathy drives his commitment to provide needed services and sets him apart in the credit repair industry.

The Role of Technology in Starting a Credit Repair Business from Home

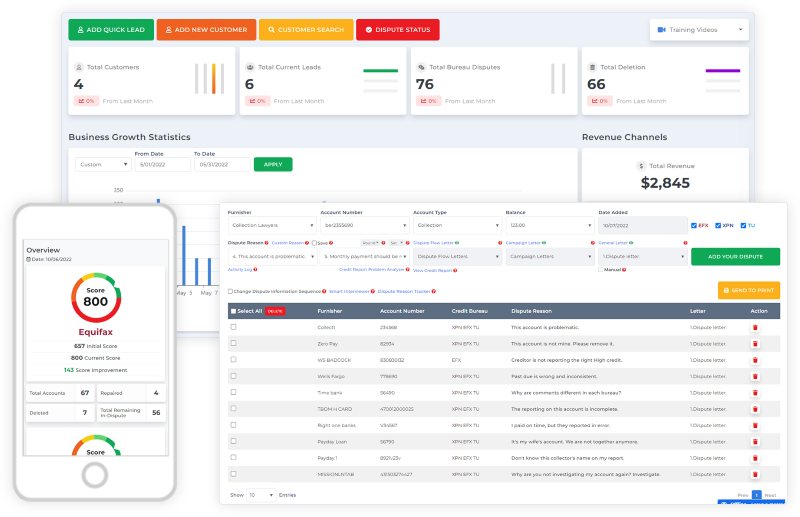

Starting a credit repair business from home is easier with the right tools. Hueton credits Client Dispute Manager Software for his efficiency. The software streamlines processes, allowing him to help more clients effectively.

“Client Dispute Manager has been extremely instrumental in streamlining our processes,” Hueton shares.

“It makes managing client disputes much more efficient, allowing us to handle more… handle clients more effectively and provide better service to our clients.”

Essential Steps to Start Your Own Credit Repair Business

Thinking about following in Hueton’s footsteps? Here are his top recommendations for starting a credit repair business:

“I would say my recommendations would be to focus both on education and service,” Hueton advises.

“Educate your clients about their credit and provide exceptional service. Also, invest in a good software like Client Dispute Manager.”

The Importance of Client Education

Hueton emphasizes, “Educate your clients about their credit and provide exceptional service.”

These are crucial steps to start a credit repair business that stands out from the competition.

Choosing the Best Credit Repair Software for Your Business

When starting a credit repair business from home, selecting the right software can make or break your success. As Hueton’s experience demonstrates, the best credit repair software can streamline your operations, improve client satisfaction, and ultimately contribute to your business growth.

Key Features to Look For:

When evaluating credit repair software options, consider these essential features:

- Automated Dispute Tracking: This feature allows you to monitor the status of each dispute effortlessly. “It makes managing client disputes much more efficient,” Hueton notes, emphasizing how this automation has improved his workflow.

- Client Management Tools: Look for software that offers comprehensive client profiles, including contact information, credit reports, and communication history.

- Customizable Letter Templates: Pre-written, customizable templates for various scenarios can save you significant time and ensure consistency in your communications.

- Compliance Monitoring: Given the strict regulations in the credit repair industry, software that helps you stay compliant with laws like the Credit Repair Organizations Act (CROA) is crucial.

- Secure Client Portal: A client portal allows your customers to check their progress, enhancing transparency and reducing the number of status update calls you need to handle.

- Integration Capabilities: The ability to integrate with other tools you use, such as CRM systems or accounting software, can greatly enhance your efficiency.

- Reporting and Analytics: Comprehensive reporting features can help you track your business performance and identify areas for improvement.

Why Hueton Chose Client Dispute Manager Software?

For Hueton, Client Dispute Manager stood out as the best credit repair software for his needs. “Client Dispute Manager has been extremely instrumental,” he shares.

The software’s user-friendly interface and comprehensive feature set were key factors in his decision.

When asked if he would change anything about the software, Hueton’s response was emphatic: “I wouldn’t change a thing. I love it.” This enthusiastic endorsement speaks volumes about the software’s effectiveness in meeting the needs of a growing credit repair business.

The Impact of the Right Software on Business Growth

Choosing the right software isn’t just about making your day-to-day operations easier; it’s about setting your business up for long-term success and scalability. Hueton found that Client Dispute Manager Software allowed him to take on more clients without sacrificing the quality of his service.

“It makes managing client disputes much more efficient, allowing us to handle more… handle clients more effectively and provide better service to our clients,” Hueton explains.

This efficiency has been a key factor in the rapid growth of his business in just seven months.

Your Path to Credit Repair Success

Hueton’s journey from credit struggler to successful business owner is more than just an inspiring story—it’s a blueprint for aspiring entrepreneurs in the credit repair industry. His experience demonstrates that with the right motivation, education, and tools, you can build a thriving credit repair business from home.

Conclusion

Ready to start your own credit repair business? Remember Hueton’s advice: educate, serve, and use the best credit repair software available. With dedication and the right approach, you could be the next credit repair success story.

Are you inspired to start a credit repair business from home? What steps will you take first? Share your thoughts and plans in the comments below!

Starting a credit repair business can be a rewarding venture. By following these steps to start a credit repair business and investing in the best credit repair software, you’re setting yourself up for success. Remember, every successful credit repair business started with a single step – why not take yours today?

Mark Clayborne

Mark Clayborne specializes in credit repair, starting and running credit repair businesses. He's passionate about helping businesses gain freedom from their 9-5 and live the life they really want. You can follow him on YouTube.

Below Is More Content For Your Review:

- How to Start a Credit Repair Business at Home

- How Can You Start a Credit Repair Business From Home in 2024?