In today’s financial landscape, your credit report plays a crucial role in many aspects of your life. From securing loans and credit cards to renting an apartment or even landing a job, your credit history can significantly impact your opportunities. That’s why it’s essential to ensure that the information on your credit report is accurate.

If you’ve discovered an inaccurate late payment on your credit report, don’t panic. This comprehensive guide will walk you through the process of writing an effective late payment removal letter, a powerful tool in your credit repair arsenal.

Start Today and Explore the Features Firsthand!

Understanding Inaccurate Late Payments and the Need for a Late Payment Removal Letter

Before diving into the process of writing a late payment removal letter, it’s essential to understand what constitutes an inaccurate late payment and why it’s crucial to address these errors. This section will explore the definition of inaccurate late payments, their common causes, and the significant impact they can have on your credit score and overall financial well-being.

What is an Inaccurate Late Payment?

An inaccurate late payment occurs when your credit report shows a payment as late when it was actually made on time, or when a late payment is reported for an account that isn’t yours. It’s crucial to distinguish between accurate late payments (which cannot ethically be removed) and inaccurate ones that warrant a late payment removal letter.

Common Causes of Inaccurate Late Payments

Common scenarios that lead to inaccurate late payments include:

- Payment processing errors by the creditor

- Reporting mistakes by the credit bureau

- Identity theft or mixed credit files

- Incorrect reporting of account status during debt transfers or company mergers

Impact on Your Credit Score and the Importance of a Late Payment Removal Letter

Inaccurate late payments can have a substantial impact on your credit score, potentially causing an unwarranted drop of 50 to 100 points or more. They can remain on your credit report for up to seven years if not disputed with a late payment removal letter, unfairly affecting your ability to:

- Secure loans with favorable interest rates

- Obtain new credit cards

- Rent an apartment

- Get approved for a mortgage

- Pass employment background checks

This underscores the importance of addressing these issues promptly with a well-crafted 609 letter to remove late payments or a goodwill letter to remove late payments.

Regular Credit Report Monitoring Before Writing a Late Payment Removal Letter

Regular monitoring of your credit report is a critical step in maintaining your financial health. This proactive approach allows you to quickly identify and address any inaccuracies, including incorrectly reported late payments.

In this section, we’ll discuss effective strategies for monitoring your credit report and how to review it thoroughly to identify any issues that may require a late payment removal letter template.

How to Monitor Your Credit Report?

Regular credit report monitoring is crucial for identifying potential issues that may require an inaccurate late payment removal letter. Here are some key steps:

- Request Free Annual Reports: You’re entitled to one free credit report from each of the three major credit bureaus (Equifax, Experian, and TransUnion) every year through AnnualCreditReport.com.

- Use Credit Monitoring Services: Many banks and credit card companies offer free credit monitoring services. These can alert you to changes in your credit report, including new late payments that may require an inaccurate late payment removal letter.

- Set Up Account Alerts: Most creditors allow you to set up email or text alerts for account activity. This can help you catch potential errors early, before they necessitate an inaccurate late payment removal letter.

Start Today and Explore the Features Firsthand!

Reviewing Your Credit Report for the Need for a Letter to Remove Late Payments

When reviewing your credit report, pay close attention to the following:

- Review Your Reports Carefully: When you receive your credit reports, review them meticulously. Look for any unfamiliar accounts, incorrect payment statuses, or other discrepancies that might necessitate a letter to remove late payments.

- Act Quickly on Errors: If you spot an inaccurate late payment or any other error, take action immediately by drafting a goodwill letter to remove late payments.

Types of Letters to Remove Late Payments

When it comes to addressing inaccurate late payments on your credit report, you have two primary options: a goodwill letter to remove late payments or a 609 letter to remove late payments. Each type of late payment removal letter serves a specific purpose and is appropriate in different situations.

Goodwill Letter to Remove Late Payments

A goodwill letter to remove late payments is a polite request to the creditor to remove an inaccurate late payment from your credit report. This approach relies on the creditor’s willingness to correct the error as a gesture of goodwill, particularly if you have an otherwise positive history with them. A well-written letter of goodwill to remove late payments can be highly effective.

609 Letter to Remove Late Payments

A 609 letter to remove late payments, named after Section 609 of the Fair Credit Reporting Act, formally challenges the accuracy or completeness of the inaccurate late payment information on your credit report. Unlike a goodwill letter, a 609 letter to remove late payments invokes your legal rights to have accurate information reported about you.

How to Write a Goodwill Letter To Remove Late Payments?

A goodwill letter can be an effective tool in removing inaccurate late payments from your credit report, especially when you have a positive history with the creditor. This section will guide you through the process of crafting a compelling goodwill letter, including key elements to include, tips for effective communication, and a template to help you get started.

Steps to Write an Effective Goodwill Letter To Remove Late Payments

When crafting your goodwill letter to remove inaccurate late payments, follow these steps:

- Start With Your Personal Information: Include your name, address, and account number at the top of the letter of goodwill to remove inaccurate late payments.

- Address The Letter Properly: If possible, find out the name of the person responsible for reviewing goodwill requests for inaccurate late payment removal.

- Explain Your Situation: Clearly state why you’re writing a goodwill letter to remove inaccurate late payments and provide context for the inaccurate late payment. Be honest and straightforward about the error.

- Provide Evidence: Include any documentation that proves the payment was made on time or that the account doesn’t belong to you.

- Highlight Your Good Payment History: If you’ve been a reliable customer before and after this incident, mention it in your goodwill letter to remove inaccurate late payments.

- Explain The Impact: Describe how the inaccurate late payment is affecting your credit and why its removal would be beneficial.

- Make Your Request: Politely ask for the inaccurate late payment to be removed to correct your credit report.

- Express Gratitude: Thank the creditor for their time and consideration of your goodwill letter to remove inaccurate late payments.

Start Today and Explore the Features Firsthand!

Goodwill Letter To Remove Late Payments

[Your Name]

[Your Address]

[City, State ZIP Code]

[Date]

[Creditor’s Name]

[Creditor’s Address]

[City, State ZIP Code]

Re: [Account Number]

Dear [Creditor’s Name],

I hope this letter finds you well. I’m writing to request a goodwill adjustment to remove the inaccurate late payment reported on [date] for my account [account number].

I’ve been a loyal customer of [Company Name] for [X] years, and I’ve always maintained a positive payment history. Upon reviewing my credit report, I noticed that a late payment was incorrectly reported for [date]. [Provide a brief explanation of the error and any supporting evidence]

This inaccurate late payment is significantly impacting my credit score, which is affecting my ability to [mention specific impact, e.g., “secure a mortgage for my first home”]. I’m hoping you might consider removing this inaccurate late payment to correct my credit report, given the evidence provided and my otherwise consistent payment history.

I greatly appreciate your time and consideration of this matter. Thank you for your understanding and for being a valued financial partner.

Sincerely,

[Your Signature]

[Your Name]

How to Write a 609 Letter to Remove Late Payments?

When a goodwill letter isn’t appropriate or hasn’t been successful, a 609 letter can be a powerful alternative. This formal dispute letter invokes your rights under the Fair Credit Reporting Act to challenge inaccurate information on your credit report.

In this section, we’ll explore the legal basis for 609 letters, provide a step-by-step guide to writing an effective 609 letter, and offer a template to assist you in crafting your own.

Understanding Your Rights Under the FCRA for Inaccurate Late Payment Removal

A 609 letter to remove inaccurate late payments is named after Section 609 of the Fair Credit Reporting Act (FCRA). This type of inaccurate late payment removal letter is used when you believe the late payment on your credit report is inaccurate or incomplete. Unlike a goodwill letter, which appeals to the creditor’s sense of fairness, a 609 dispute letter is a formal request for investigation and correction of errors.

Steps to Write an Effective 609 Letter for Inaccurate Late Payment Removal

When writing a 609 letter to remove late payments, follow these steps:

- Gather all relevant documents related to the inaccurate late payment.

- Review your credit reports from all three major credit bureaus to identify the specific inaccurate late payment entry you’re disputing.

- In your letter to remove inaccurate late payments, clearly and concisely explain why you believe the late payment is inaccurate or incomplete.

- Request that the credit bureau verify the accuracy of the information with the creditor, using language directly from Section 609 of the FCRA to strengthen your request.

- Demand that the inaccurate information be removed if it cannot be verified.

609 Letter To Remove Late Payments

[Your Name]

[Your Address]

[City, State ZIP Code]

[Date]

[Credit Bureau Name]

[Credit Bureau Address]

[City, State ZIP Code]

Re: Dispute of Inaccurate Late Payment Information in Credit Report

Dear Sir/Madam,

I am writing to dispute the following inaccurate information in my file. I have circled the items I dispute on the attached copy of the report I received.

This item [identify item(s) disputed by name of source, such as creditors or tax court, and identify type of item, such as credit account, judgment, etc.] is inaccurate because [describe what is inaccurate and why]. I am requesting that the inaccurate late payment be removed to correct the information.

Enclosed are copies of [use this sentence if applicable and describe any enclosed documentation, such as payment records or court documents] supporting my position. Please reinvestigate this matter and delete the disputed inaccurate late payment as soon as possible.

Pursuant to Section 609 of the Fair Credit Reporting Act, I am requesting that you provide me with the following:

- A description of the procedure used to determine the accuracy and completeness of the information.

- A description of all the sources of information for the disputed items.

- A copy of my full consumer file.

If you find that this information is indeed inaccurate, please contact the source of the information and request that they update their records accordingly.

Sincerely,

[Your Signature]

[Your Name]

Start Today and Explore the Features Firsthand!

Tips for Success with Inaccurate Late Payment Removal Letters

Writing an inaccurate late payment removal letter is just the first step in the process of correcting your credit report. To maximize your chances of success, there are several best practices you should follow. This section will provide valuable tips on how to approach the letter-writing process, follow up effectively, and manage the overall dispute process to achieve the best possible outcome.

General Tips for Writing Effective Removal Letters

- Be Honest: Never provide false information in your inaccurate late payment removal letter. Focus on the inaccuracy of the reported late payment and provide truthful evidence.

- Be Concise: Keep your letter to remove inaccurate late payments brief and to the point, clearly stating why the late payment is inaccurate.

- Be Polite: A respectful tone can go a long way in getting a positive response to your inaccurate late payment removal letter. Remember, you’re asking for assistance in correcting an error.

Follow-up and Record Keeping for Inaccurate Late Payment Removal Letters

- Follow Up: If you don’t receive a response to your inaccurate late payment removal letter within 30 days, send a follow-up letter. Persistence can often pay off in these situations.

- Keep Records: Maintain copies of all correspondence and document all phone calls related to your inaccurate late payment removal letter.

- Be Persistent: If your first attempt at inaccurate late payment removal is unsuccessful, try again. Sometimes, it takes multiple letters to remove inaccurate late payments successfully.

What to Do If Your Inaccurate Late Payment Removal Letter Is Unsuccessful?

Sometimes, despite your best efforts, your initial attempt to remove an inaccurate late payment may be unsuccessful. However, this doesn’t mean you’re out of options. This section will explore several strategies you can employ if your first removal letter doesn’t achieve the desired result, including escalating your complaint to regulatory bodies, adding a consumer statement to your credit report, and seeking legal advice.

File a Complaint with the CFPB

If your attempts to remove an inaccurate late payment through a removal letter are unsuccessful, one avenue is to file a complaint with the Consumer Financial Protection Bureau (CFPB). The CFPB accepts complaints about credit reporting companies and can help mediate disputes when inaccurate late payment removal letters have been ineffective.

Add a Consumer Statement

Another option if your inaccurate late payment removal letter doesn’t succeed is to add a consumer statement to your credit report. You have the right to add a brief statement explaining the dispute. While this doesn’t remove the inaccurate late payment, it allows you to tell your side of the story to potential creditors.

Seek Legal Advice

In some cases, particularly if the inaccurate information is causing significant harm and your inaccurate late payment removal letters have been unsuccessful, it may be worth consulting with a consumer protection attorney. An attorney experienced in credit reporting issues can provide guidance on your rights and may be able to take legal action if necessary to resolve the dispute.

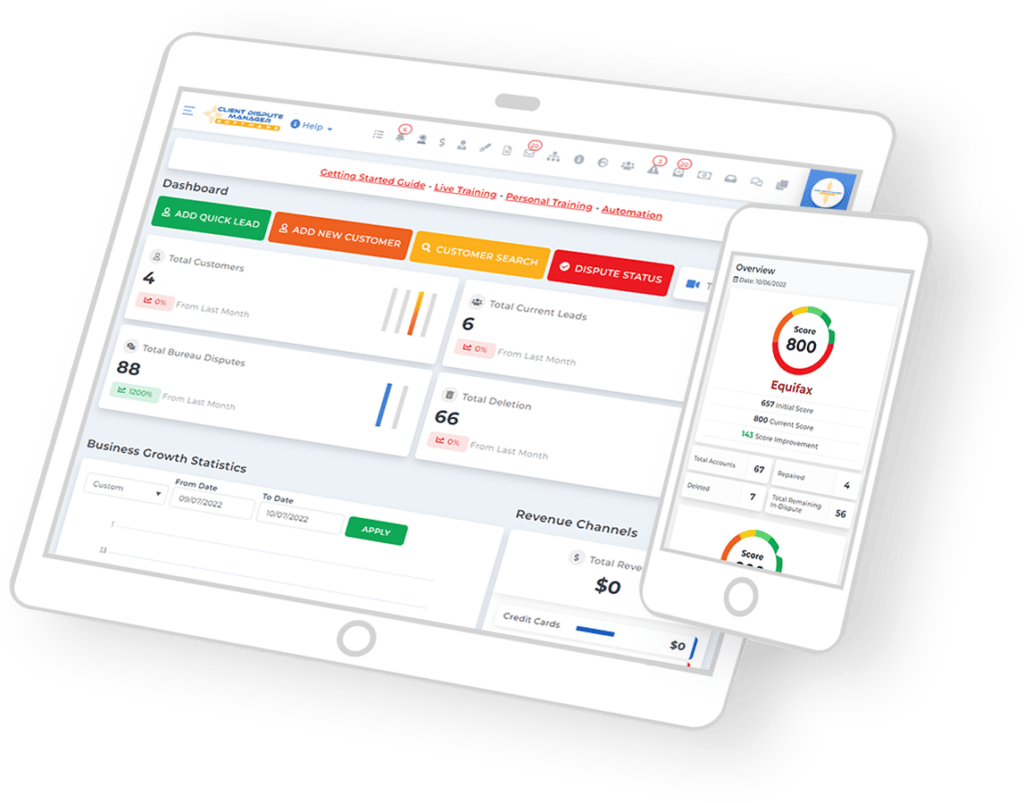

Client Dispute Manager Software: Streamlining Your Inaccurate Late Payment Removal Process

In today’s digital age, technology can significantly simplify and streamline the process of disputing inaccurate late payments. Client Dispute Manager Software is a powerful tool that can help you organize, track, and manage your efforts to remove inaccurate late payments from your credit report. This section will explore how this software can enhance your dispute process and improve your chances of success.

Understanding Client Dispute Manager Software

Client Dispute Manager Software is a specialized application designed to assist individuals and credit repair professionals in managing the dispute process. It typically offers a range of features to help you create, send, and track inaccurate late payment removal letters and other credit dispute communications.

Key Features of Client Dispute Manager Software

- Letter Templates: Most software includes pre-written templates for goodwill letters and 609 letters to remove inaccurate late payments. These templates can be customized to fit your specific situation.

- Document Management: Easily store and organize all your credit reports, correspondence, and supporting documents in one secure location.

- Automated Follow-ups: Set reminders for follow-up actions and receive notifications when it’s time to send a follow-up letter for your inaccurate late payment removal request.

- Progress Tracking: Monitor the status of each dispute and track improvements in your credit score over time.

- Multi-Bureau Support: Manage disputes with all three major credit bureaus (Equifax, Experian, and TransUnion) from a single platform.

Start Today and Explore the Features Firsthand!

Benefits of Using Client Dispute Manager Software

- Automating much of the administrative work allows you to focus on the content of your inaccurate late payment removal letters.

- Ensure all your communications are professional, complete, and consistent by using standardized templates and processes.

- Keep all your dispute-related information in one place, making it easier to stay on top of multiple disputes or complex cases.

- Reduce the risk of errors in your inaccurate late payment removal letters by using pre-vetted templates and automated data entry.

- By helping you stay organized and persistent, this software can potentially improve your chances of successfully removing inaccurate late payments from your credit report.

Conclusion

In conclusion, writing an inaccurate late payment removal letter can be an effective strategy for improving your credit score and ensuring the accuracy of your credit report. Whether you choose a goodwill letter to remove inaccurate late payments or a 609 letter to remove inaccurate late payments, the key is to be honest, clear, and persistent in addressing the inaccuracies.

Remember, credit repair is a journey, and every step you take to correct inaccurate information, including sending well-crafted inaccurate late payment removal letters, brings you closer to your financial goals.

By understanding the process and your rights, you can effectively use inaccurate late payment removal letters to maintain a healthy credit profile and open doors to better financial opportunities.

Mark Clayborne

Mark Clayborne specializes in credit repair, starting and running credit repair businesses. He's passionate about helping businesses gain freedom from their 9-5 and live the life they really want. You can follow him on YouTube.

Start Today and Explore the Features Firsthand!

Below Is More Content For Your Review:

- Erase Your Mistakes: How to Craft the Perfect Inaccurate Late Payment Removal Letter

- Steps to Removing an Inaccurate Late Payment