- Send a Medical Debt Validation Letter – Legally verify the debt under the FDCPA before it impacts your credit.

- Dispute Medical Bills with Credit Bureaus – If the debt is inaccurate or unverified, you can request it be removed.

- Use HIPAA and Pay-for-Delete Strategies – Leverage HIPAA violations or negotiate with collectors to delete valid debts.

- Request a Goodwill Deletion – If the medical bill was paid or resulted from a hardship, ask for removal as a courtesy.

- Take Advantage of New Credit Reporting Laws – Collections under $500 or paid medical debt may now be removed automatically.

Struggling with medical debt on your credit report? You’re not alone. Medical debt can significantly impact your credit score and prevent you from qualifying for loans, mortgages, or even jobs.

Fortunately, you don’t have to live with medical collections on your credit report forever.

In this guide, we’ll walk you through the steps to remove medical debt from your credit report legally and effectively.

Whether you’re dealing with billing errors, insurance denials, or unfair collection practices, there are proven methods to dispute and eliminate medical collections.

We’ll explore how you can leverage tools like the medical debt validation letter, HIPAA violation claims, and new credit reporting regulations to clear your record and improve your financial future.

Let’s dive in and take control of your credit today.

Why You Must Remove Medical Debt from Your Credit Report?

Medical debt is one of the most common financial burdens in the U.S., affecting millions of individuals, including those with health insurance.

Unpaid medical bills can lower your credit score, increase loan rejection rates, and even impact your ability to rent an apartment or secure employment.

That’s why it’s important to understand how to remove medical debt before it damages your financial future.

Fortunately, recent changes in credit reporting rules have made it easier to remove medical debt from your credit report, but you must take the right steps.

You should begin by sending a Medical Debt Validation Letter to verify the debt and identify any inaccuracies.

Failing to address medical debt collections can lead to severe financial consequences, including legal action. It’s also critical to dispute medical bills that appear incorrect or that your insurance should have covered.

Whether your debt was caused by a billing error, insurance denial, or unexpected medical emergency, knowing how to remove medical debt is essential for protecting your financial health.

The Hidden Risks If You Don’t Dispute Medical Bills

Many people assume that medical collections don’t have a major impact on their finances, but that’s a dangerous myth. If a medical bill is sent to collections, it remains on your credit report for up to seven years, severely affecting your ability to get approved for credit or loans.

Ignoring unpaid medical debt can result in:

- Credit Score Drop – A medical collection account can lower your FICO score by 50-100 points or more.

- Loan Denials – Lenders see medical debt on credit reports as a high-risk factor, leading to rejections for mortgages, auto loans, and credit cards.

- Debt Collection Harassment – Once your medical bill goes to collections, you may receive aggressive calls and letters from debt collectors.

- Legal Consequences – Some debt collection agencies and hospitals may sue you for unpaid medical bills, leading to wage garnishment or bank levies.

- Difficulty Renting or Getting a Job – Many landlords and employers check credit reports, meaning medical debt can hurt your housing and employment opportunities.

- Emotional Stress – The burden of medical debt collection can lead to anxiety, stress, and financial instability.

Taking action early can help you prevent these risks and protect your financial well-being.

How Medical Debt Hurts Your Credit Score and Financial Future?

Once a medical bill is sent to collections, it is reported to the credit bureaus, affecting your credit history. Even if you had excellent credit before, a single medical collection account can lower your credit score by 50 to 100 points or more.

This drop can make it difficult to qualify for new credit, increase interest rates on loans, and affect future borrowing power. That’s why it is important to learn how to remove medical debt as soon as possible.

Many lenders use medical debt as a factor when evaluating creditworthiness. If you have outstanding medical collections, you may struggle to secure financing for a car, home, or personal loan.

Even if you manage to get approved, lenders may charge you a significantly higher interest rate because of the increased risk associated with unresolved medical bills. To protect your credit, be proactive and dispute medical bills that may be inaccurate or inflated.

Beyond loans and credit cards, medical debt can also impact your ability to rent an apartment. Many landlords check credit reports during the tenant screening process, and a low credit score due to unpaid medical debt may lead to rejection.

Sending a Medical Debt Validation Letter early in the process can help confirm the legitimacy of the charges and potentially stop them from damaging your report.

Additionally, some employers, particularly in finance and government positions, conduct credit checks as part of the hiring process.

If your report shows delinquent medical debt, it may raise concerns about financial responsibility. Knowing how to remove medical debt before it affects your livelihood is a powerful financial move.

How to Remove Medical Debt and Take Back Control of Your Finances

Medical debt is one of the leading causes of credit report damage, yet many people don’t realize how severely it can impact their credit score and overall financial stability.

Unlike credit card or loan debt, medical bills often go unnoticed until they are sent to collections, at which point they become a major red flag for lenders.

If you have unpaid medical bills, your ability to qualify for loans, rent an apartment, or even get a job may be affected.

Medical debt collections are seen as a sign of financial distress, and even if the debt is eventually paid, it may still remain on your credit report for years. This is why learning how to remove medical debt and taking the right steps to dispute medical bills is essential.

Understanding how medical bills affect your credit score and why they appear on credit reports can help you take action before the damage becomes permanent.

One of the best ways to get started is by sending a Medical Debt Validation Letter to verify the debt and initiate the credit repair process.

Why Medical Debt Is Different from Other Types of Debt?

Many people assume that medical collections work the same way as credit card debt, but they are actually handled differently by credit bureaus and lenders. Unlike credit card balances, medical bills don’t affect your credit until they are sent to collections. This means you may not even realize your bill is past due until you see a medical collection account on your credit report.

Another key difference is that medical debt is often caused by unexpected emergencies, not reckless spending. Unlike personal loans or auto financing, where borrowers choose to take on debt, medical expenses can arise suddenly due to accidents, illnesses, or surgeries.

However, despite these differences, unpaid medical bills still damage your credit score just like other types of debt. If your medical provider reports your debt to a collection agency, the consequences can be just as severe as missing payments on a credit card or mortgage.

Can Medical Bills Be Sent to Collections Even If You Have Insurance?

Yes, and this is one of the biggest frustrations for consumers. Even if you have health insurance, medical debt can still appear on your credit report if there is a delay or dispute with your provider.

Billing errors, insurance claim denials, and slow processing times can all cause unpaid balances to be reported as delinquent medical debt.

Some of the most common reasons why insured patients end up with medical collections include:

- Insurance Claim Denials – If your insurance denies a claim, the balance may become your responsibility, even if you were told it was covered.

- Incorrect Billing Codes – Mistakes in medical coding can result in insurance refusing to pay a bill.

- Deductibles and Out-of-Pocket Costs – Even with insurance, you may still owe thousands in deductibles, co-pays, and uncovered services.

- Lack of Communication from Providers – Many patients don’t receive proper notification before their medical debt is sent to collections.

If you have medical debt in collections due to insurance issues, it is crucial to verify the charges and dispute any inaccuracies before they impact your credit score.

How to Remove Medical Debt from Credit Reports Before Damage Is Done

Preventing medical debt from reaching your credit report is far easier than trying to remove it later. Many people don’t realize that medical collections often result from billing errors, insurance disputes, or miscommunication with healthcare providers. If left unaddressed, these unpaid medical bills can severely impact your credit score and overall financial health.

The good news is that new credit reporting rules have made it harder for medical debt collectors to impact your credit, but you must still act quickly to prevent negative marks on your credit report. Taking proactive steps now can save you from future financial headaches.

Verify the Accuracy of Your Medical Bills

One of the biggest reasons people end up with medical debt collections is billing errors. Hospitals and insurance companies frequently overcharge, apply incorrect billing codes, or fail to process insurance claims properly. If you receive a medical bill, never assume it is correct—always verify before paying or ignoring it.

Start by requesting an itemized bill from your healthcare provider. This will allow you to cross-check every charge and ensure there are no unnecessary or duplicate charges. Then, compare this bill with the Explanation of Benefits (EOB) from your insurance company to confirm what has been covered. If there’s a discrepancy, contact your insurer immediately to clarify the issue.

If you suspect a billing mistake, reach out to the hospital or medical provider’s billing department to dispute the charge. In some cases, you may need to file a formal dispute to have errors corrected before the debt is sent to collections. The sooner you catch a mistake, the better your chances of avoiding unnecessary medical debt.

Communicate with Healthcare Providers Before Accounts Go to Collections

Many people assume that once they receive a medical bill, they have no choice but to pay it in full or risk having it sent to collections. However, most healthcare providers are willing to negotiate payment options if you reach out early.

Hospitals and clinics understand that medical expenses can be overwhelming, so they often offer payment plans or financial assistance programs for patients struggling to cover their bills.

Before your bill becomes delinquent, ask about available discounts, extended payment arrangements, or charity care programs. Some hospitals, especially nonprofit ones, are required to provide financial assistance to eligible patients.

If you agree to a payment plan, make sure the terms are reasonable and that the agreement is documented in writing. This will ensure that the provider does not accidentally send your account to collections while you are making payments.

Set Up a Payment Plan to Avoid Collections

If your medical bill is too large to pay all at once, setting up a structured payment plan can prevent it from going to collections. Unlike credit card companies or banks, most hospitals and healthcare providers offer interest-free payment plans, making it easier to spread out the cost without financial penalties.

Start by contacting your provider’s billing department to ask about available payment plan options. Many providers allow you to make small monthly payments as long as you consistently pay on time.

Be sure to negotiate a payment amount that fits within your budget—agreeing to terms you can’t meet may result in a default, which could still lead to medical debt collections.

Once you finalize a plan, request a written agreement that outlines the terms. This will help ensure that your account remains in good standing and is never mistakenly sent to collections.

Take Action Before Medical Debt Hurts Your Credit

Medical debt can severely impact your financial health, but it is preventable. By verifying medical bills, negotiating with providers, setting up payment plans, monitoring insurance payments, and checking your credit report regularly, you can stop medical debt from damaging your credit score before it happens.

If you’re already dealing with medical collections, don’t panic. In the next section, we’ll cover how to remove medical collections from your credit report legally and effectively using debt validation letters, HIPAA protections, and credit dispute strategies.

How to Remove Medical Collections from Your Credit Report?

If medical collections have already appeared on your credit report, don’t panic—there are legal ways to remove them and improve your credit score. Recent changes in credit reporting laws have made it easier for consumers to dispute medical debt, especially if the debt is incorrect, outdated, or paid off.

In this section, we’ll go over the step-by-step process to remove medical collections from your credit report, including how to verify the debt, dispute errors, leverage HIPAA protections, and use debt validation letters to challenge collection agencies.

Step #1: Send a Medical Debt Validation Letter to the Collection Agency

Before doing anything else, you need to verify whether the debt is valid. Under the Fair Debt Collection Practices Act (FDCPA), you have the right to request proof that the medical collection is legitimate. Many medical debt collectors cannot provide proper documentation, which may result in the debt being removed from your credit report.

How to Request Debt Validation:

- Send a Medical Debt Validation Letter to the collection agency within 30 days of being notified about the debt.

- Ask for a detailed breakdown of the charges, including the original medical provider’s name, service dates, and proof that the collection agency has the right to collect the debt.

- If they fail to provide validation, request that they remove the collection account from your credit report.

If the collection agency cannot verify the debt, they must stop reporting it to the credit bureaus under federal law.

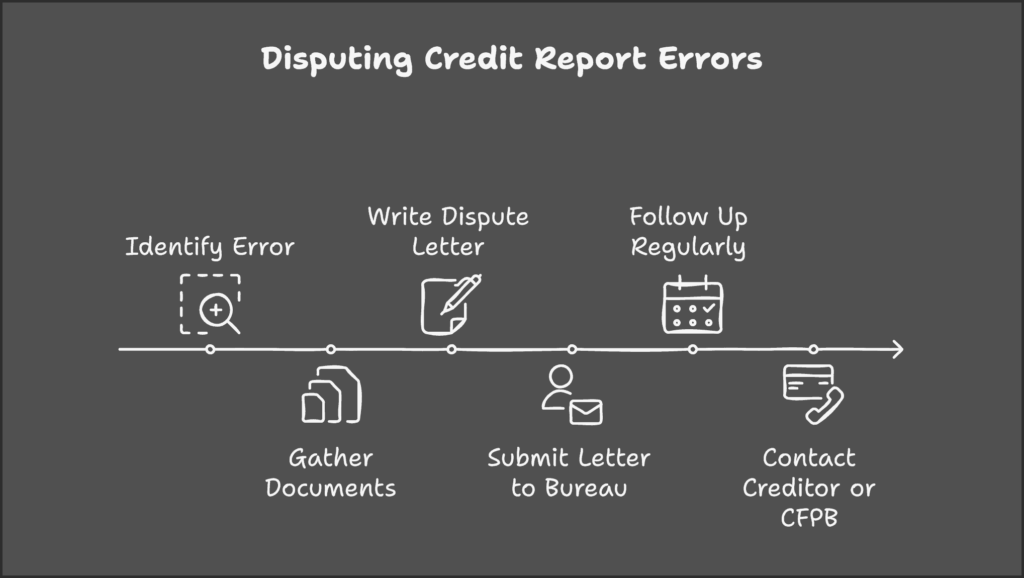

Step #2: Dispute Medical Bills with the Credit Bureaus

Even if the medical debt is valid, you still have the right to dispute any incorrect or unfair information on your credit report. Credit bureaus make mistakes, and many consumers have medical collections listed incorrectly due to billing errors, incorrect amounts, or identity mix-ups.

To dispute medical debt collections, follow these steps:

- Get a copy of your credit report from Annual Credit Report to check for medical collections that should not be there.

- Write a dispute letter to Experian, Equifax, and TransUnion, explaining why the debt is incorrect.

- Provide supporting documents, such as proof of payment, insurance EOB statements, or billing records.

- The credit bureaus must investigate within 30 days—if they can’t verify the debt, it must be removed.

Many consumers successfully remove medical collections simply by disputing errors or inconsistencies.

Step #3: Use a HIPAA Violation Letter to Remove Medical Debt

Under the Health Insurance Portability and Accountability Act (HIPAA), your medical information is protected, meaning debt collectors cannot access or report certain details without authorization. If a collection agency improperly obtained your medical debt information, you may be able to demand its removal from your credit report.

A HIPAA Violation Debt Collection Letter is a powerful tool to challenge how your medical debt was reported. If a collection agency cannot provide legal proof of how they obtained your medical debt details, they may be forced to delete the collection account from your credit report.

Step #4: Use a Pay-for-Delete Agreement to Remove Medical Debt

If you owe the medical debt and the collection is legitimate, you may be able to request a Pay-for-Delete Agreement. This means that you negotiate with the collection agency to remove the collection from your credit report in exchange for payment.

However, not all debt collectors agree to pay-for-delete, so it’s essential to get the agreement in writing before making any payments. If they accept the offer, ensure they send a written confirmation stating that they will remove the medical collection account from your credit report once payment is made.

Step #5: Send a Goodwill Letter After You Dispute Medical Bills

If you have already paid off a medical collection, you can ask the collection agency or original provider to remove the account from your credit report as a goodwill gesture. This works best if:

- The medical collection was due to an error or misunderstanding.

- You have a history of on-time payments before the debt issue.

- You politely explain the situation and request credit report deletion.

While creditors are not required to grant goodwill removals, many have done so for consumers who make a reasonable request.

Step #6: Use New Laws to Remove Medical Debt Automatically

The three major credit bureaus—Experian, Equifax, and TransUnion—have introduced new medical debt reporting rules that make it easier for consumers to remove medical debt from credit reports.

Key 2023/2024 credit reporting updates include:

- Medical collections under $500 are no longer reported—If your unpaid medical debt is below $500, it should not appear on your credit report.

- Paid medical collections are automatically removed—If you settle a medical debt, it is deleted from your credit report immediately.

- Extended 12-month grace period before reporting—Consumers now have one year (instead of six months) before unpaid medical bills can be sent to collections.

If any medical debt collections on your credit report should have been automatically removed under these rules, you can dispute them with the credit bureaus to have them erased.

Conclusion

Medical debt can feel overwhelming, but it doesn’t have to control your financial future. Whether your medical collections are the result of billing errors, insurance disputes, or unexpected healthcare expenses, you have legal options to remove them from your credit report and restore your credit score.

Thanks to new credit reporting rules, it’s now easier than ever to eliminate medical debt collections, especially if they are under $500, paid off, or inaccurately reported. By verifying medical bills, disputing incorrect debts, leveraging HIPAA protections, and negotiating debt removals, you can successfully erase medical collections and improve your financial standing.

The key is taking action as soon as possible. Check your credit report, dispute medical collections, and work with credit bureaus or healthcare providers to resolve outstanding debts. Every step you take brings you closer to a stronger credit profile and greater financial freedom.

Mark Clayborne

Mark Clayborne specializes in credit repair, starting and running credit repair businesses. He's passionate about helping businesses gain freedom from their 9-5 and live the life they really want. You can follow him on YouTube.