Looking for the best credit repair software for business success? You’re in the right place! This guide will help you choose the perfect software for your needs. Whether you’re just starting out or wanting to upgrade your current system, we’ll cover everything you need to know to make the right choice for your business.

Many business owners struggle with this decision because there are so many options available. Let’s break it down into simple steps that will help you make the best choice.

Key Takeaways:

- Choosing the right software saves time and boosts productivity. It helps you manage disputes, automate workflows, and track client progress efficiently.

- Top software includes client management, dispute letter templates, and credit report analysis. These features simplify operations and improve dispute accuracy.

- Security and compliance are essential. The best platforms include encryption, secure data storage, and tools that ensure FTC, FCRA, and CROA compliance.

- Value matters more than price. Look for platforms that combine automation, support, and scalability rather than focusing only on low cost.

- Client Dispute Manager Software leads the market. It offers automated dispute handling, CRM integration, billing tools, and real-time client portals designed to help businesses scale responsibly.

Start Today and Explore the Features Firsthand!

Why The Best Software for Credit Repair Business Matters?

Running a credit repair business without good software is like trying to build a house without tools. You need the right tools to succeed. The best credit repair software for small business owners makes everything easier and faster.

Having the right software can mean the difference between struggling to keep up with clients and running a smooth, profitable business. Every day you spend using inadequate tools costs you time and money.

Your software choice affects every part of your business, from how many clients you can help to how much profit you make.

How The Best Credit Repair Software for Business Saves Time?

Good software helps you work smarter, not harder. Instead of spending hours on paperwork, you can focus on helping your clients and growing your business.

The best software for credit repair business automates many daily tasks, from tracking client progress to creating dispute letters. It watches credit report changes automatically and helps you stay organized. This means you can help more clients and make more money without working longer hours.

Many business owners find they can double or triple their client load with the right software. The time you save can be spent on marketing and building relationships with clients.

Features of the Best Credit Repair Software for Credit Repair Business

A complete software solution should include everything you need to run your business effectively. The right features will save you time and help you provide better service to your clients.

When looking at different options, pay attention to how easy the software is to use and whether it includes all the tools you need. Your software should make running your business simpler, not more complicated.

Think about which features you’ll use every day and which ones might help you grow in the future.

Client Management Tools in the Best Credit Repair Software for Business

The best software for credit repair business needs should make managing clients simple and straightforward. Your software needs to store all client information in one easy-to-access place.

This includes contact details, credit reports, dispute letters, and progress notes. Good client management software will send automatic reminders about important dates and keep track of all client communications.

You should be able to see each client’s progress at a glance and quickly find any information you need. The system should also help you stay in touch with clients regularly and track important deadlines.

Dispute Letter Templates and Tracking Systems

Writing effective dispute letters is a key part of credit repair. The best credit repair software for small business should include a variety of letter templates that you can easily customize for each client. Your software should help you track when letters are sent and received.

The best credit repair software for credit repair business makes it simple to follow up on disputes and track their progress. The system should also keep records of all correspondence and help you maintain a consistent dispute process.

Good letter management helps you work more efficiently and increases your success rate with disputes.

Credit Report Analysis Features in the Best Credit Repair Software for Small Business

The best software for credit repair business must include powerful tools for analyzing credit reports. These tools should help you quickly spot items that can be disputed and track changes in credit scores.

You need to be able to import credit reports easily and compare them over time to show progress.

The software should highlight important information and help you explain credit issues to clients in simple terms. Good analysis tools make it easier to create effective dispute strategies and show clients their improvement.

Pricing and Value of Credit Repair Software for Business

Different software packages come with different price tags. Basic plans usually start around $100-200 each month. These plans work well for new businesses or those with fewer clients.

Mid-level plans cost between $200-400 monthly and include more features and client capacity. The most complete plans cost over $400 per month but offer everything you need to run a large credit repair business.

The best software for credit repair business options offer different tiers to match your needs and budget. Remember that the cheapest option isn’t always the best value for your money.

Understanding Total Costs Beyond Monthly Fees

When picking the best credit repair software for business needs, you need to think about more than just the monthly fee. Some companies charge extra for setting up your account or training your team. You might also need to pay more for pulling credit reports or adding extra users to your account.

Make sure you understand all the costs before you choose your software. The best credit repair software for small business should be transparent about all fees and charges. Ask about any hidden fees or extra costs that might surprise you later.

Start Today and Explore the Features Firsthand!

Cost vs. Value When Selecting the Best Software for Credit Repair Business

The best credit repair software for credit repair business provides value that goes beyond its price tag. Think about how much time the software will save you and how many more clients you can handle. Good software might cost more upfront but can help you make more money in the long run.

Consider how the software’s features can help you grow your business and serve clients better. Some key value points to consider include:

- Time saved on routine tasks

- Ability to handle more clients

- Better organization and tracking

- Professional appearance to clients

- Reduced errors and improved compliance

Getting the Best Deal

Many providers of the best software for credit repair business offer special deals or discounts. You might get a better price if you pay annually instead of monthly. Some companies offer deals for new businesses or during certain times of the year.

Ask about any available discounts or promotions before you sign up. Make sure to read the terms carefully and understand what happens when any promotional period ends.

Security in the Best Credit Repair Software for Small Business

Keeping client information safe is extremely important in the credit repair business. The best credit repair software for credit repair business must have strong security features to protect sensitive data.

This includes secure password systems, encrypted data storage, and regular automatic backups. Good security helps protect both your clients and your business. Your clients trust you with their personal information, so you need software that takes security seriously.

Modern security threats change constantly, so your software should update regularly to stay protected.

Data Protection in the Best Credit Repair Software for Small Business

The best software for credit repair business must help you follow all the legal rules in the credit repair industry. This includes federal laws about credit repair, privacy rules, and state regulations. Your software should make it easy to create compliant contracts and follow proper procedures.

It should also help you stay up to date with any changes in the laws. The best credit repair software for business includes built-in compliance tools that keep you on the right side of the law.

Data Protection in the Best Credit Repair Software for Small Business

Look for these important security features in the best credit repair software for small business:

- Strong Data Encryption: Modern encryption keeps client data safe even if someone tries to steal it. Your software should use current encryption standards to protect all stored information. This includes client personal details, credit reports, and financial information.

- Secure Access Controls: Different team members need different levels of access. The best credit repair software for credit repair business lets you control who can see and change different types of information. This helps prevent unauthorized access to sensitive client data.

- Regular Backups: Your client data is valuable and needs to be backed up regularly. The best software for credit repair business should automatically save your data in secure locations. You should be able to recover information quickly if something goes wrong.

Legal Compliance Features for Credit Repair Businesses

The credit repair industry has strict rules about:

- How you can advertise your services?

- What you must tell clients?

- How you handle client payments?

- What records you need to keep?

- How you protect client information?

The best credit repair software for business helps you follow all these rules automatically. It should include features that:

- Generate compliant contracts

- Create required disclosures

- Track important deadlines

- Maintain proper records

- Monitor regulatory changes

Regular Security Updates and Access Controls

Your software should actively protect against new security threats. The best credit repair software for small business providers regularly update their security features. They should monitor for potential problems and fix them before they cause issues.

Good software companies tell you about important security updates and help you keep your system secure.

Support for the Best Credit Repair Software for Credit Repair Business

When you’re using new software, you need good support to help you succeed. The best credit repair software for business comes with comprehensive training and support.

This ensures you can make the most of your software investment and serve your clients effectively.

Good support can make the difference between struggling with your software and using it to grow your business quickly. Look for companies that offer multiple ways to get help when you need it.

Start Today and Explore the Features Firsthand!

Getting Help When Needed

Good support makes a big difference when you’re running your business. The best credit repair software for small business should offer fast customer service during business hours.

They should have helpful training videos and written guides that explain how to use the software.

The best software for credit repair business providers understand that good support is crucial for your success. You shouldn’t have to wait days for answers to important questions.

Training Resources for the Best Credit Repair Software for Credit Repair Business

The best credit repair software for credit repair business should provide thorough training materials. These should include:

- Getting Started Guides: Clear instructions help you set up your software correctly from the start. The best software for credit repair business makes it easy to understand basic features quickly. Good getting started guides walk you through each step of the setup process.

- Video Tutorials: Video training helps you learn features faster than just reading about them. The best credit repair software for small business should offer a library of training videos. These videos should cover both basic and advanced features.

- Live Training Sessions: Regular live training sessions let you ask questions and learn from experts. The best credit repair software for business often includes group training calls. These sessions help you learn new features and best practices.

Support Options for Credit Repair Software Users

Look for software that offers multiple ways to get technical help:

- Phone Support: Sometimes you need to talk to a real person. The best credit repair software for credit repair business should offer phone support during business hours.

- Email Support: Email support works well for less urgent questions. You should get clear, helpful responses within one business day.

- Chat Support: Quick questions often get answered fastest through chat. Look for software that offers instant chat support when you need it.

- Knowledge Base: A good knowledge base lets you find answers to common questions yourself. The best credit repair software for small business maintains an updated library of help articles.

Growing Your Business with the Best Credit Repair Software for Credit Repair Business

As your business grows, your software needs will change. The best software for credit repair business grows with you. It should handle more clients and users without slowing down.

Look for software that offers easy upgrades when you need more features or capacity. Your software should make growth easier, not hold you back. Many businesses fail to plan for growth and have to switch software later, which costs time and money.

Scaling Your Operations

Growth brings new challenges and opportunities. The best credit repair software for small business helps you handle more clients without getting overwhelmed. You should be able to add new team members easily and give them the right access levels.

The software should help you maintain quality service even as you take on more clients. Good scaling features help you grow smoothly without disrupting your existing business.

Automation for Sustainable Growth

Growing businesses need effective automation to maintain quality while increasing volume. The best credit repair software for small business should automate routine client communications like welcome emails, progress updates, and appointment reminders. This ensures consistent communication without overwhelming your team.

Document management becomes increasingly important as you grow. Your software should handle file organization and sharing while maintaining security. The best credit repair software for business makes it easy to store and retrieve documents when needed, while keeping everything organized and secure.

Making the Most of the Best Credit Repair Software for Business

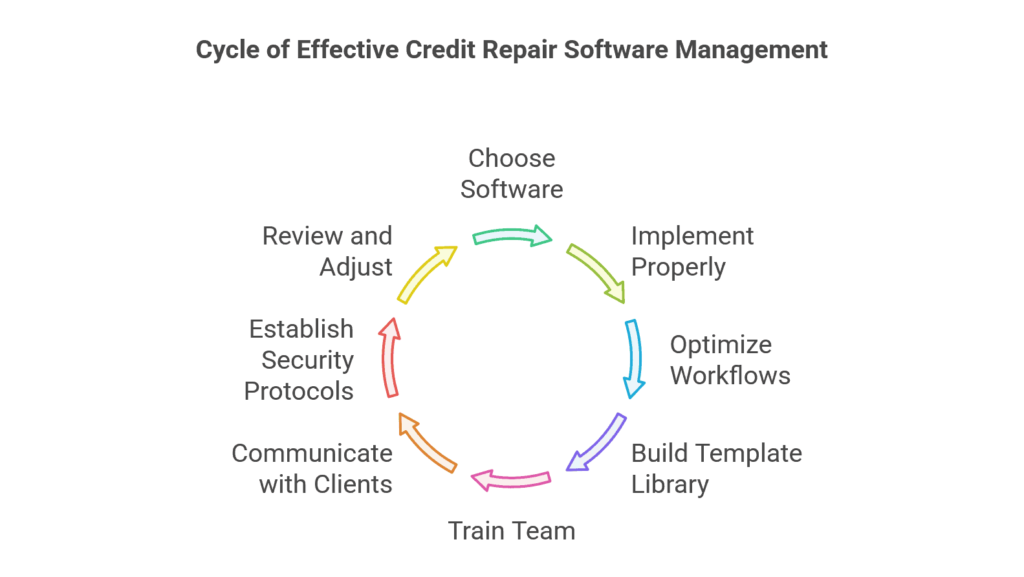

Once you’ve chosen your software, proper implementation becomes crucial for success. The best software for credit repair business needs careful setup to work well for your needs. Many business owners rush this step and miss out on important features. Take time to set up your software properly from the start, and you’ll avoid problems later on.

Setting Up Your Workflow

The best credit repair software for credit repair business helps you create efficient workflows for every task.

Start by planning how you’ll handle common situations like new client onboarding and dispute filing. Write down each step in your process so you can set up your software to match your needs.

Think about how information should flow from one step to the next. The best credit repair software for small business should make these workflows natural and easy to follow.

Building Your Template Library

Creating a good template library saves time and ensures consistency. The best software for credit repair business usually comes with basic templates, but you should customize them for your needs. Start with your most commonly used letters and documents.

Add your company’s tone and style while keeping the legal requirements intact. Having a well-organized template library makes daily work much faster and more consistent.

Start Today and Explore the Features Firsthand!

Training Your Team

Even the best credit repair software for business requires proper training to be effective. Start with basic features and gradually introduce more advanced tools. Make sure everyone understands the security requirements and compliance rules.

Create simple guides for common tasks that your team can reference when needed. Regular training sessions help keep everyone up to date and working efficiently.

Setting Up Client Communication

Good client communication builds trust and reduces questions. The best credit repair software for small business should help you create a clear communication plan. Set up automatic updates for important milestones in the credit repair process.

Create standard responses for common client questions. Plan how often you’ll update clients on their progress. Clear communication helps clients feel confident in your service.

Establishing Security Protocols

The best credit repair software for credit repair business needs proper security setup. Create strong password requirements for all team members. Set up access levels based on job roles. Plan how you’ll handle sensitive client information.

Make sure everyone understands the importance of data security. Regular security reviews help keep client information safe.

Regular Review and Adjustment

The credit repair industry changes often. The best credit repair software for credit repair business helps you adapt to these changes. Plan regular reviews of your processes and templates. Update your procedures when needed.

Stay current with software updates and new features. Regular reviews help keep your business running smoothly.

Making Your Final Choice for Credit Repair Software

Choosing the best credit repair software for business is a significant decision that impacts your daily operations and future success. Take time to evaluate all your options carefully.

Remember that the right choice depends on your specific business needs, budget, and growth plans. Your software will be the backbone of your credit repair business, so it’s worth investing time in making the right choice.

Evaluating Your Options

When comparing the best credit repair software for small business options, focus on what matters most for your situation. Consider how each software handles your most common tasks.

Think about the features you’ll use every day. The best software for credit repair business should feel natural to use and make your work easier. Don’t get distracted by fancy features you might never use.

Understanding Total Value

The best credit repair software for credit repair business provides value beyond its price tag. Think about how much time you’ll save and how many more clients you can handle. Consider the professional image good software helps you present.

Calculate the potential return on your investment. Sometimes paying more for better software saves money in the long run.

Understanding Client Dispute Manager Software

One of the leading options in the industry is Client Dispute Manager Software, a comprehensive solution designed to assist credit repair professionals in managing clients and disputes efficiently. This software is built to help businesses of all sizes streamline their operations, automate tasks, and improve overall efficiency.

Start Today and Explore the Features Firsthand!

Dispute Automation and Compliance

Client Dispute Manager Software offers dispute automation, allowing users to generate, track, and send dispute letters with ease.

Compliance management is another key aspect, as it includes built-in FCRA-compliant legal templates and guidelines that ensure businesses operate within legal regulations.

The software helps credit repair businesses avoid common compliance issues and maintain credibility in the industry.

Lead Generation and CRM Integration

The software also features lead generation and customer relationship management (CRM) tools, making it easier to attract and manage potential clients.

These tools assist in organizing client data, tracking interactions, and following up with prospects, helping businesses build long-term relationships and improve retention rates. Additionally, automated workflows streamline the lead nurturing process, ensuring timely engagement with potential clients.

The system also provides advanced analytics to track conversion rates, helping businesses optimize their marketing efforts and improve customer acquisition strategies.

Billing and Invoicing System

Billing and invoicing are automated, providing seamless management of customer payments and subscription-based services.

The software integrates with various payment gateways, ensuring smooth transactions and reducing the need for manual processing. Businesses can set up recurring payments, issue invoices, and track financial records efficiently.

Additionally, businesses can customize invoicing settings to align with their pricing structures, offering flexible payment options to clients. The system also includes automated reminders for overdue payments, reducing the risk of missed revenue and enhancing financial stability.

Start Today and Explore the Features Firsthand!

Client Portal and Real-Time Updates

A client portal is included, giving clients real-time updates on the status of their disputes. This feature enhances transparency and builds trust with customers by keeping them informed throughout the credit repair process.

Clients can log in anytime to check their dispute progress, upload necessary documents, and communicate with their service providers. The portal is designed with a user-friendly interface, ensuring that even those with minimal technical expertise can navigate it with ease.

Additionally, the system provides automated notifications and alerts, ensuring that clients receive timely updates about the status of their disputes and any necessary actions required on their part.

Frequently Asked Questions (FAQs)

What Makes Credit Repair Software “the Best” for Business Use?

The best software combines automation, compliance, and scalability. It must let you manage client disputes, generate letters quickly, track results, and ensure all actions follow FTC and CROA rules.

Tools like Client Dispute Manager Software also include built-in templates, customizable workflows, and reporting dashboards that make dispute handling faster and more organized.

How Does Credit Repair Software Save Time for Small Business Owners?

Automation replaces manual dispute creation, tracking, and mailing tasks. Instead of writing letters and updating client records by hand, you can process multiple disputes at once.

Real-time tracking, automatic reminders, and pre-filled templates reduce workload, allowing you to focus on client acquisition and results.

Why Is Compliance Important When Choosing Credit Repair Software?

Compliance ensures your business operates within FTC, FCRA, and CROA laws. Noncompliance can lead to fines, license suspension, or legal issues.

The best software helps prevent violations by offering audit trails, consent documentation, and automatic updates when regulations change.

How Can I Grow My Credit Repair Business Using Software Tools?

Credit repair software allows you to scale without losing efficiency. Features like CRM integration, automated billing, client portals, and lead tracking support steady growth.

With tools to manage multiple clients and generate reports, your business can handle more volume without increasing administrative effort.

Where Can I Start Using Client Dispute Manager Software for My Credit Repair Business?

You can start your free 30-day trial directly on the Client Dispute Manager Software website. The platform offers automated dispute management, secure client tracking, invoicing, and built-in compliance tools.

It’s specifically built for credit repair professionals who want to grow efficiently and stay compliant while managing every dispute in one dashboard.

Conclusion

Selecting the best credit repair business software is crucial to your success. The right software can automate workflows, ensure compliance, manage clients, and scale your business effectively. With features like dispute automation, billing, lead capture, and compliance tools, the right credit repair software can significantly boost your efficiency and business growth.

Investing in reliable credit repair software not only simplifies daily operations but also helps businesses maintain a strong reputation by ensuring accurate and legally compliant credit repair processes.

Additionally, advanced analytics and reporting features provide insights into business performance, helping owners refine their strategies and make informed decisions. If you’re serious about growing your credit repair business, investing in the best credit repair software for credit repair business is a must.

Mark Clayborne

Mark Clayborne specializes in credit repair, starting and running credit repair businesses. He's passionate about helping businesses gain freedom from their 9-5 and live the life they really want. You can follow him on YouTube.

Start Today and Explore the Features Firsthand!

Below Is More Content For Your Review: