- Pay on Time, Every Time – On-time payments are the most important factor in improving credit scores and avoiding long-term damage.

- Keep Credit Utilization Low – Use less than 30% of your credit limit—under 10% is ideal for the fastest way to improve credit score.

- Dispute Errors on Your Credit Report – Mistakes can unfairly lower your score. Disputing inaccuracies is one of the quickest ways to improve credit.

- Avoid Unnecessary Credit Inquiries – Too many hard pulls can hurt your score. Only apply for new credit when necessary.

- Use Strategies like Becoming an Authorized User – Piggybacking on someone else’s good credit can be a fast boost when done responsibly.

Your credit score is a crucial part of your financial health, affecting everything from loan approvals to interest rates. But how can you effectively improve your credit score and ensure long-term financial stability?

This guide breaks it down step-by-step, answering common questions and providing actionable advice for entrepreneurs, individuals with credit issues, and those curious about credit repair strategies.

Whether you’re looking for ways to improve credit score or the fastest way to improve credit score, this article has you covered.

Understanding Credit Scores: The Basics

Understanding how credit scores work is the first step in improving your financial health. Credit scores reflect your credit habits, and knowing the basics can help you make informed decisions to boost your score and maintain it over time. Improving credit scores often starts with understanding what goes into calculating them.

What Is a Credit Score and How to Improve It?

A credit score is a numerical representation of your creditworthiness, typically ranging from 300 to 850. It acts as a summary of how well you manage credit and helps lenders assess risk. Higher scores often unlock better financial opportunities, including lower interest rates and faster loan approvals.

Understanding the factors influencing your score is essential to improving credit scores effectively. For example, a good credit score can mean paying 3% instead of 5% on a mortgage, saving you money.

Lenders heavily rely on these scores to make decisions, so learning ways to improve credit score ensures financial stability. By focusing on strategies to enhance your score, you can achieve long-term financial goals.

Why Does Your Credit Score Matter for Improving Credit Scores?

Your credit score holds significant weight in various aspects of your financial life. It impacts whether you’ll get approved for loans, what interest rates you’ll pay, and even your ability to rent an apartment. A strong score means you’re a reliable borrower in the eyes of lenders, while a poor score can result in missed opportunities.

Exploring the fastest way to improve credit score can be crucial when you need to enhance your financial standing quickly. By prioritizing ways to improve credit score, you can unlock financial opportunities more easily.

Your credit score matters because it impacts loan and credit card approvals, rental applications, and even job prospects. Whether you’re looking to start a business or secure a new apartment, maintaining a good credit score opens doors to financial opportunities. Exploring ways to improve credit score can ensure you are ready for these financial milestones.

How Credit Scores Are Calculated?

Knowing what factors contribute to your credit score allows you to identify areas for improvement. Each component has a specific weight, making some factors more impactful than others when trying to improve your score. Improving credit scores requires focusing on these key components.

Key Factors Influencing Credit Scores and Ways to Improve Them

Several elements influence your credit score, with payment history being the most significant. This aspect accounts for 35% of your score and reflects your consistency in paying debts.

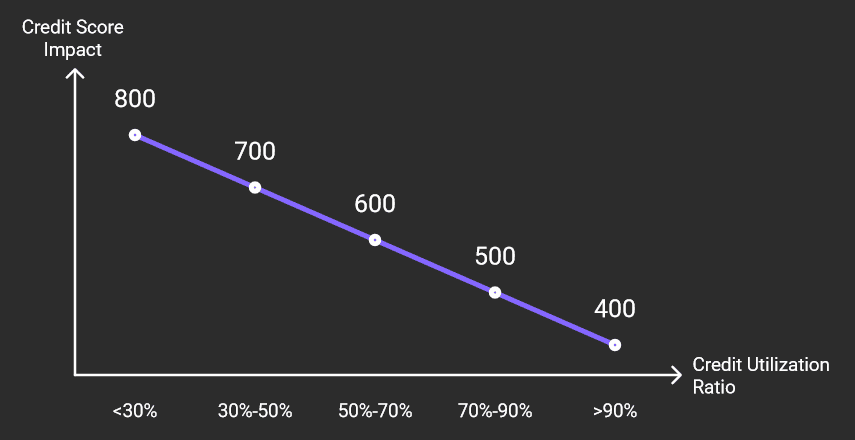

Credit utilization, which measures how much of your credit limit you’re using, makes up 30%.

The remaining factors include the length of your credit history (15%), credit mix (10%), and new credit inquiries (10%). Understanding these components can help you focus on improving credit score effectively.

Prioritizing payment history and credit utilization are among the most impactful ways to improve credit score.

Credit scores are calculated using five main factors:

Payment History: This accounts for 35% of your score and tracks whether you’ve made payments on time. Even one missed payment can have a significant impact.

Credit Utilization: Representing 30% of your score, this measures how much of your available credit you’re using. Keeping this percentage below 30% is considered optimal.

Length of Credit History: Making up 15% of your score, this factor considers how long your accounts have been open. A longer history demonstrates stability.

Credit Mix: Accounting for 10% of your score, having a variety of credit types (like credit cards, auto loans, and mortgages) shows you can manage different types of credit responsibly.

New Credit Inquiries: The final 10% comes from recent applications for new credit. Multiple inquiries in a short period can temporarily lower your score.

Common Misconceptions About Credit Scores and How to Avoid Them

Many people wrongly assume that checking their own credit report harms their score. However, soft inquiries, like those made during personal credit checks, do not impact your score. Another myth is that closing old accounts improves your credit, but this often shortens your credit history and reduces your score.

These misconceptions can hinder your progress when you’re looking for the fastest way to improve credit score. Being informed about these nuances ensures you take effective steps toward improving credit scores.

Some people believe checking your own credit report hurts your score—this is a myth. Soft inquiries, like those made when you check your own report, have no impact on your score. Understanding such nuances can help you better manage your credit and find the fastest way to improve credit score.

Make On-Time Payments: Consistency is Key

Paying your bills on time consistently is a simple yet powerful way to build and maintain a strong credit score. Late payments are one of the most common reasons for a declining score, but this can be avoided with proactive strategies.

Why Timely Payments Matter for Improving Credit Scores?

Timely payments are the backbone of a strong credit score. Lenders value consistency, as it shows reliability and trustworthiness. Missed or late payments can stay on your credit report for seven years, lowering your score. Addressing payment issues is one of the fastest ways to improve credit score and build financial stability.

Automating payments or setting reminders helps ensure on-time payments. These habits are crucial for improving credit score over time and maintaining lender confidence. Making timely payments is often the first step toward improving credit scores effectively.

Strategies for Staying on Track

Staying on top of your payments requires a proactive approach. Automating payments is an excellent way to avoid forgetting due dates, especially for recurring bills. Using digital calendars or financial apps can also help you stay organized. If financial challenges arise, contacting creditors to arrange alternative payment plans is a crucial step.

These strategies are proven ways to improve credit score and maintain long-term financial stability. Consistent effort in this area goes a long way toward improving credit scores.

To avoid missing payments, consider setting up automatic payments for your bills or using digital calendar reminders. If you’re struggling to meet due dates, contact your creditors to discuss payment plans or hardship programs.

By addressing issues proactively, you can minimize the damage to your credit score and find ways to improve credit score over time.

Reduce Credit Utilization: Manage Your Balances

Managing your credit utilization effectively can quickly improve your credit score. This involves using a smaller percentage of your available credit, which signals to lenders that you are financially responsible.

What Is Credit Utilization and How to Use It to Improve Credit Scores?

Credit utilization measures how much of your available credit you’re using at any given time. For example, if your total credit limit is $10,000 and your balances equal $3,000, your utilization rate is 30%. Keeping this rate below 30% is generally recommended for a healthy score.

A high utilization rate signals to lenders that you might be overextended, while a low rate indicates good financial management.

Why Does Credit Utilization Matter for Improving Credit Scores?

Addressing credit utilization is one of the fastest ways to improve credit score. It accounts for 30% of your overall credit score, making it a crucial factor in your financial health. Reducing high balances and spreading debt across multiple accounts can effectively lower your utilization rate.

This helps demonstrate to lenders that you use credit responsibly, which is key to improving credit scores. Lowering your utilization not only improves your score but also boosts your chances of securing better loan terms.

Tips to Lower Your Credit Utilization

Lowering your credit utilization starts with paying down high balances as quickly as possible. If this isn’t feasible, requesting a credit limit increase can improve your utilization rate, provided you don’t increase spending.

Another approach is to redistribute balances across multiple cards to keep individual utilization rates low. These steps are among the most practical ways to improve credit score, especially when tackling credit utilization issues.

By taking control of this factor, you’ll make significant progress in improving credit scores.

One effective strategy is to pay down high balances as quickly as possible. If you’re unable to do so, consider requesting a credit limit increase.

While this won’t reduce your balances, it will increase your overall credit limit, thereby lowering your utilization rate. Just be careful not to increase your spending as a result. Additionally, spreading balances across multiple accounts can help manage your utilization rate more effectively.

Diversify Your Credit Types: A Balanced Portfolio

Having a variety of credit types can make a positive difference in your credit score. It shows lenders that you are capable of managing multiple types of debt responsibly.

What Is a Credit Mix?

Having a mix of different credit types can positively impact your score. Lenders like to see that you can handle various forms of credit, such as installment loans (like auto loans or mortgages) and revolving credit (like credit cards). A diverse credit portfolio demonstrates financial responsibility and the ability to manage different obligations.

Steps to Diversify Your Credit

If you’ve only ever used one type of credit, consider adding another. For instance, if you primarily use credit cards, you might look into a small personal loan or auto loan to diversify your credit profile. However, only take on new credit if it aligns with your financial goals and budget. Improving credit scores often involves balancing credit types effectively.

Limit New Credit Applications: Avoiding Hard Inquiries

Applying for new credit frequently can harm your credit score due to hard inquiries. Limiting these applications is essential for maintaining a healthy score, especially if you’re planning a major financial move.

How Hard Inquiries Affect Your Score?

Every time you apply for credit, the lender performs a hard inquiry on your credit report. While a single inquiry has a minor effect, multiple inquiries in a short period can lower your score significantly. To avoid unnecessary damage, only apply for new credit when absolutely necessary. Reducing hard inquiries is a fast way to improve credit score.

Smart Practices for Managing Inquiries

If you’re shopping for a major loan, like a mortgage or auto loan, try to complete all applications within a short timeframe. Credit scoring models typically group inquiries made within a 14-45 day period as a single inquiry, minimizing their impact on your score.

Dispute Inaccuracies: Ensure Your Report Is Accurate

Errors on your credit report can have serious consequences, but they are fixable. Regularly checking your credit report ensures you catch inaccuracies early and address them promptly.

Common Errors to Watch For

Errors on your credit report can drag down your score unfairly. Common mistakes include incorrect account balances, outdated information, or accounts that don’t belong to you. Regularly reviewing your credit report can help you identify and correct these errors. Fixing errors is one of the fastest ways to improve credit score.

How to Dispute Credit Report Errors?

Start by obtaining a free copy of your credit report from Annual Credit Report. If you find inaccuracies, file a dispute with the credit bureau reporting the error. Provide any supporting documentation, such as account statements or correspondence with creditors. Follow up to ensure the issue is resolved promptly.

Become an Authorized User: Boost Your Score

Joining a trusted individual’s credit account as an authorized user can help you benefit from their good credit habits. This strategy can provide a quick boost, especially for those with limited credit history.

What It Means to Be an Authorized User?

Becoming an authorized user on someone else’s credit card account can help you build or improve your credit score. As an authorized user, you benefit from the primary cardholder’s positive payment history and credit utilization. This method is often recommended as a fast way to improve credit score.

Best Practices for Authorized Users to Improve Credit Scores

This strategy works best when the account is in good standing with a long history of timely payments. For example, if a trusted family member or friend has a credit card with low balances and consistent on-time payments, you can benefit significantly.

Being added as an authorized user on such accounts often boosts your credit score quickly. Make sure the account is managed responsibly to avoid negative impacts on your report.

Before joining, confirm that the cardholder has a reliable payment record. Setting clear expectations with the primary cardholder ensures no misunderstandings arise. This method is one of the fastest ways to improve credit score for those building or rebuilding credit.

Conclusion: Taking Action for a Better Credit Future

Improving your credit score is not an overnight process, but it’s achievable with consistent effort and smart financial habits. By making on-time payments, managing your credit utilization, and monitoring your credit report, you can build a strong foundation for long-term financial health. These ways to improve credit score are actionable steps that lead to measurable results.

Whether you’re an entrepreneur seeking better financing options or an individual aiming to secure a mortgage, taking control of your credit score will unlock financial opportunities. Start today by reviewing your credit report, setting up payment reminders, and creating a plan to address outstanding debts. The journey to better financial health begins with the first step.

Mark Clayborne

Mark Clayborne specializes in credit repair, starting and running credit repair businesses. He's passionate about helping businesses gain freedom from their 9-5 and live the life they really want. You can follow him on YouTube.