A collection account on your credit report can severely damage your credit score and limit your financial opportunities. Learning how to get collections removed is essential for rebuilding your credit and securing your financial future. This comprehensive guide will show you proven strategies to remove debt from credit report entries and improve your credit score.

Whether you’re dealing with one collection or several, these steps will help you take control of your credit and work toward a better financial position.

Start Today and Explore the Features Firsthand!

Why You Need to Get Rid of Collection Accounts?

Collection accounts are serious negative marks that can stay on your credit report for up to seven years. These accounts can drop your credit score significantly and make it difficult to get approved for loans, credit cards, or even housing. Understanding how to handle collections properly is crucial for credit recovery. Taking action to get rid of collection accounts can help you rebuild your credit faster.

The Impact of Collections on Your Credit Score

When a collection appears on your credit report, it can lower your score by up to 100 points immediately. Understanding how to get collections removed becomes crucial because these accounts affect every aspect of your credit profile. Credit scoring models view collection accounts as serious negative events that indicate payment risk.

Even small collection amounts can cause significant damage to your credit score. Collection accounts influence lenders’ decisions about loan approvals and interest rates. Most collection accounts continue hurting your score until they’re removed or expire after seven years.

Collection agencies must follow specific rules when reporting these accounts. Having multiple collections can make it nearly impossible to qualify for new credit. These accounts affect everything from loan approvals to interest rates.

How to Remove Collections Step by Step

Several proven methods exist for removing collection accounts from your credit report. Each approach requires careful attention to detail and proper documentation. Following the correct procedures increases your chances of successful removal. Different strategies work better depending on your specific situation and the type of collection account.

Methods to Remove Debt from Credit Report

Requesting debt validation should be your first step when working to remove debt from credit report entries. Collection agencies must prove they have the legal right to collect the debt within 30 days. Many collection accounts get removed because agencies can’t provide proper documentation.

The validation request must be made in writing and sent via certified mail. Proper timing and specific language in your request are crucial. Following up consistently helps ensure the best results.

The Debt Validation Process

Requesting debt validation is often the first step in working to remove debt from credit report entries. Collection agencies must prove they have the legal right to collect the debt. They must provide specific documentation about the debt within 30 days.

Many collection accounts get removed because agencies can’t properly validate them. You must know exactly what information to request and how to properly make the request. Documentation and timing are crucial for this strategy to work.

Start Today and Explore the Features Firsthand!

Negotiating Pay-for-Delete Agreements

Pay-for-delete offers one way to get rid of collection accounts through negotiation. This approach involves offering payment in exchange for complete removal from your credit reports. All agreements must be obtained in writing before making any payments. Collection agencies aren’t required to accept these agreements but often will.

Following up is essential to ensure the agency honors their agreement. Understanding proper negotiation tactics improves your chances of success.

Professional Help for Getting Rid of Collections

Sometimes professional assistance provides the best path to removing collection accounts. Credit repair companies and attorneys specialize in dealing with collections effectively. Their expertise can often achieve faster results than handling things yourself. Understanding when to seek professional help saves time and effort.

Working with Credit Experts

Credit repair companies understand how to navigate the process to how to get collections removed. They handle all communication with collectors and credit bureaus professionally.

These companies know which strategies work best for different types of collections.

Professional services often achieve faster results than individual efforts. Their experience helps avoid common mistakes that could hurt your case. Regular updates keep you informed about your progress.

Legal Rights and Protections

Federal laws provide important protections when dealing with collection accounts. Understanding these rights gives you leverage in getting accounts removed. The Fair Credit Reporting Act and Fair Debt Collection Practices Act both provide tools you can use. These laws set strict rules for how collection agencies must operate and what they can report.

Understanding The FDCPA

The Fair Debt Collection Practices Act provides significant protections when working to how to get collections removed. Collection agencies must follow specific rules about when and how they can contact you. They cannot harass you or make false statements about the debt.

Violations of these rules can give you leverage in negotiations for removal. The law requires collectors to validate debts when requested. Understanding these protections helps you recognize when collectors violate your rights.

Start Today and Explore the Features Firsthand!

Your Credit Reporting Rights

The Fair Credit Reporting Act gives you specific rights when trying to get rid of collection accounts. Credit bureaus must investigate disputes within 30 days of receiving them. They must remove information they cannot verify as accurate. You have the right to dispute any information you believe is incorrect.

The law limits how long negative information can stay on your report. These rights form the foundation for many successful dispute strategies.

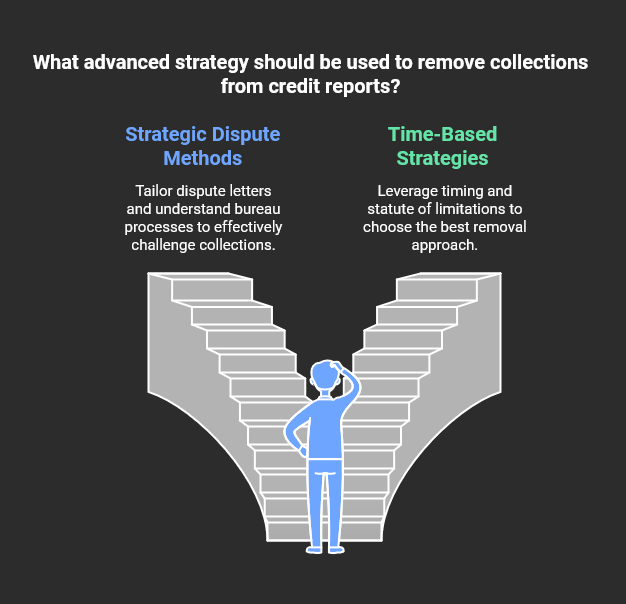

Advanced Techniques to Get Collections Removed

Credit repair requires understanding multiple approaches to achieve the best results. Different collection types often need different removal strategies to be successful. Advanced techniques can offer additional ways to get rid of collection accounts when basic methods don’t work. Knowledge of these strategies gives you more options for improving your credit.

Strategic Dispute Methods for Collections

The dispute process offers several advanced ways to how to get collections removed successfully. Different dispute reasons work better for different types of collection accounts. Writing effective dispute letters requires specific language and proper documentation.

Credit bureaus must follow strict timelines when investigating disputes. Understanding burden of proof requirements helps strengthen your case. Each credit bureau handles disputes differently, so adjusting your approach is important. Multiple rounds of disputes might be necessary for success.

Time-Based Strategies to Remove Debt from Credit Report

Understanding timing-related rules helps you remove debt from credit report entries more effectively. The statute of limitations affects how long collectors can legally pursue payment. Different types of debts have different time limits for reporting and collection.

Knowing these time limits helps you choose the best removal strategy. The age of your debt affects which approach will work best. Timing your disputes and negotiations properly increases success rates. Making wrong moves with timing can restart collection periods.

Prevention After Collections Are Removed

Creating good financial habits prevents future collection accounts from appearing. Regular monitoring helps catch potential issues before they become problems. Taking proactive steps maintains your improved credit status. Building strong financial practices ensures long-term success.

Keep Collections Off Your Credit Report

Developing strong financial habits prevents future needs to how to remove collections. Setting up automatic payments helps avoid missed due dates that lead to collections. Creating an emergency fund provides protection against unexpected bills. Maintaining good communication with creditors prevents many collection issues. Regular account monitoring catches potential problems early.

Monitor Your Credit After Removal

Regular credit monitoring protects your progress after successfully removing collections. Checking your reports ensures removed items stay off your credit report. Quick action on new issues prevents them from becoming collections. Maintaining records of successful removals provides important documentation. Understanding your credit report helps identify potential problems. Regular reviews help maintain your improved credit status.

Conclusion

Success in removing collection accounts requires patience and consistent effort. Following these strategies can help you effectively get rid of collection accounts and improve your credit score. Remember that credit repair takes time and proper documentation is essential. Taking action today by pulling your credit reports and identifying collections to address gives you the best start. With persistence and the right approach, you can rebuild your credit and work toward a stronger financial future.

Mark Clayborne

Mark Clayborne specializes in credit repair, starting and running credit repair businesses. He's passionate about helping businesses gain freedom from their 9-5 and live the life they really want. You can follow him on YouTube.

Start Today and Explore the Features Firsthand!

Below Is More Content For Your Review: