- Understand Your Target Audience – Know their pain points, dreams, and what keeps them up at night.

- Build a Strong Online Presence – Use SEO, content marketing, and social media to get credit repair leads organically.

- Use Tools like Client Dispute Manager Software – Stay organized, automate workflows, and manage client progress efficiently.

- Leverage Outsourcing and Partnerships – Delegate tasks and partner with professionals like mortgage brokers and loan officers.

- Stay Compliant and Build Trust – Follow CROA laws, avoid false promises, and be transparent to convert leads into loyal clients.

If you’ve ever asked yourself, “how to get credit repair clients”, you’re not alone. Every credit repair business owner faces the challenge of finding people who need help and convincing them to trust your services.

But doing it legally and effectively? That’s where most get stuck.

In this guide, we’ll walk through proven methods to attract credit repair leads, grow your business, and stay compliant with the law.

Whether you’re brand new or looking to scale, you’ll discover strategies that work and some things you absolutely must avoid.

Let’s dive into how to get credit repair clients the smart and legal way.

How to Get Credit Repair Clients by Understanding Your Target Audience

Before you spend a single dollar on credit repair marketing, you need to know who you’re talking to. Understanding your target audience is the foundation of any successful strategy because it helps you tailor your messaging to speak directly to their needs, fears, and desires.

The better you understand their credit struggles whether it’s recovering from bankruptcy, dealing with collections, or trying to get approved for a home loan the more effective your content and outreach will be in turning them into loyal credit repair clients.

Your ideal client might be:

- Someone denied for a mortgage

- A person going through divorce or bankruptcy

- A young adult trying to build credit

- Small business owners needing funding

These individuals are more than just credit repair leads they’re people with real problems. You must understand their pain points and emotions. When you do, your messages will connect more deeply.

Ask yourself: What keeps them up at night? What do they fear? What do they dream of?

The better you know your audience, the easier it becomes to figure out how to get clients for credit repair who actually want your help.

Credit Repair Marketing 101: Building a Strong Online Presence

Online visibility is everything. If your potential clients can’t find you online, they won’t become your credit repair leads.

Building a strong digital footprint not only helps establish trust but also makes it easier to capture qualified credit repair leads through organic search and social media.

When your brand consistently shows up online, you’re far more likely to attract people actively searching for how to get credit repair clients or solutions to their credit problems.

How to Use Social Media to Attract Credit Repair Leads?

Social media isn’t just for selfies and memes. Platforms like Facebook, TikTok, and Instagram are goldmines for credit repair lead generation.

These platforms give you a direct line to people already searching for credit help or financial tips.

With consistent posting and engagement, you can build trust, establish authority, and drive high-quality credit repair leads straight to your inbox or website.

- Share real stories of credit success

- Post simple educational videos or reels

- Run free Q&A sessions or Facebook Lives

- Join and participate in local Facebook groups

Remember: credit repair marketing on social media must be honest. Don’t promise quick fixes. Stay compliant with the Credit Repair Organizations Act.

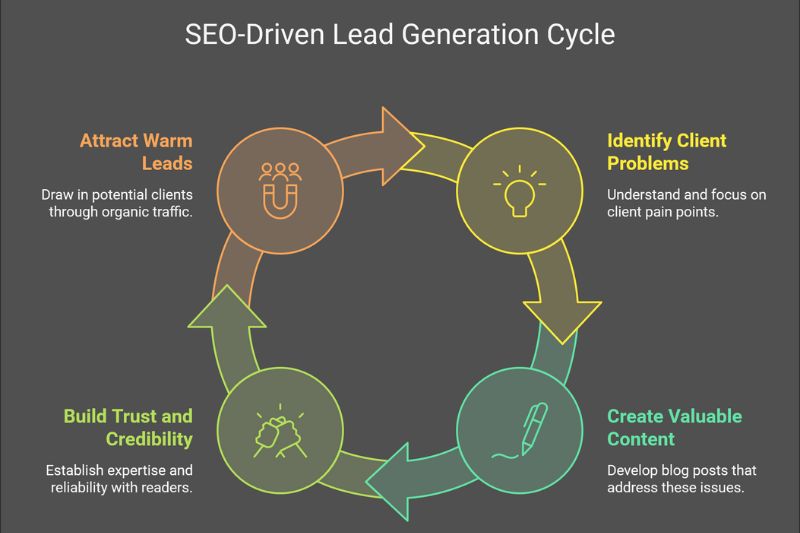

Credit Repair SEO Strategies to Generate Organic Leads

Want credit repair leads to come to you instead of chasing them? Focus on SEO (Search Engine Optimization).

As a credit repair business owner, your blog should be your strongest sales tool not by pitching your service, but by solving the exact problems your ideal clients face.

Think about topics like how to rebuild credit after bankruptcy, how to deal with charge-offs, or how to dispute collections legally.

These are the questions people are typing into Google, and by answering them, you’re attracting warm credit repair leads.

Here’s what works:

- Write detailed blog posts focused on specific problems, like “how to remove late payments” or “how to get credit repair clients” who need help with student loan issues

- Focus your blog content around real problems your potential clients face, such as how to remove late payments, deal with charge-offs, or rebuild credit after financial hardship

- Provide actionable tips and realistic expectations that reflect compliance with the Credit Repair Organizations Act

- Share real case examples to build trust and credibility

This value-first content approach does two things: it positions you as an expert, and it builds trust with readers who are likely to become credit repair clients.

If you want sustainable credit repair lead generation, solving problems through content is one of the most ethical and effective methods available.

Content Marketing That Brings in Credit Repair Clients

Great content builds trust. It also turns strangers into warm credit repair leads. But to truly attract people ready to take action, your content must solve their credit problems directly.

Think about what your ideal client is struggling with maybe it’s a recent collection account, a misunderstanding about credit utilization, or confusion around dispute processes.

When you create content that addresses these pain points clearly and with compassion, you naturally build authority.

Try this content strategy:

- Write blog posts about common credit myths and practical solutions

- Offer a free downloadable credit checklist with action steps

- Create a YouTube channel breaking down topics like “how to remove charge-offs” or “what impacts your credit score”

- Start an email newsletter that shares weekly tips on fixing and understanding credit

By addressing real-world issues and offering clear, easy-to-follow advice, you show your audience that you’re not just selling a service you’re offering solutions.

The more value you give, the more you’ll build a brand people remember when they finally decide they need help.

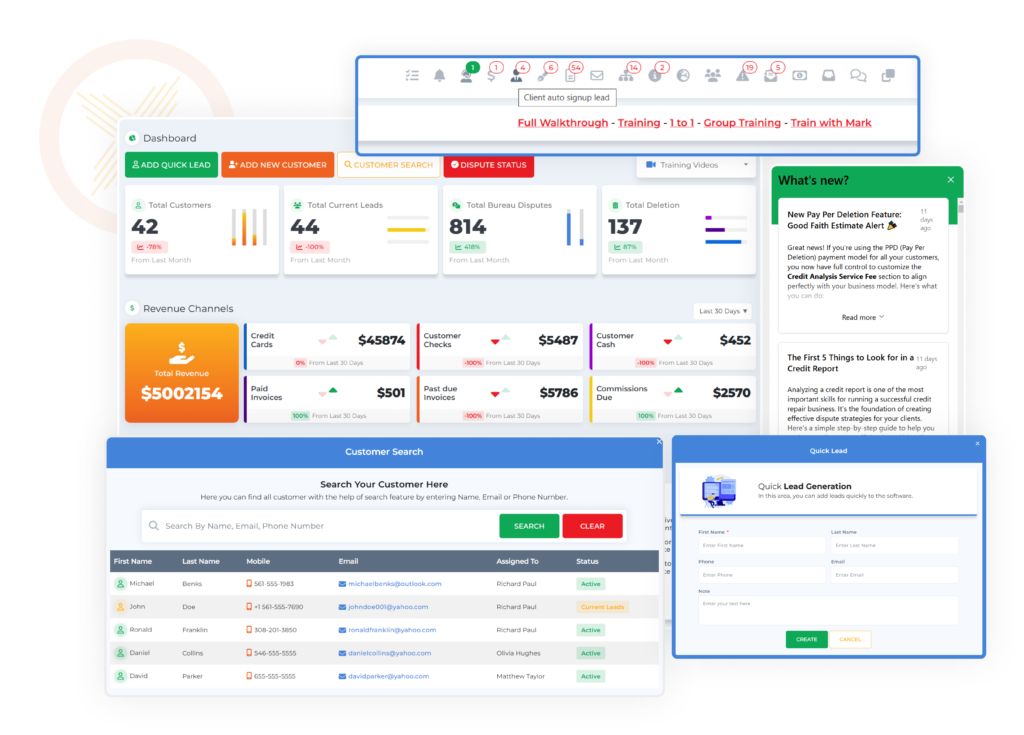

Client Dispute Manager Software: Solve Client Problems and Stay Organized

If you’re serious about credit repair lead generation, then using the right software can make a huge difference. Client Dispute Manager Software is more than a dispute tool.

It’s a full business system that helps you solve real client problems while keeping your operations streamlined and compliant.

Whether you’re helping someone remove inaccurate collections, fix late payments, or understand their credit reports, this software makes the process faster and more efficient.

It gives you the tools to manage client progress, stay on top of disputes, and ensure every communication is timely and professional.

Here’s how it helps you get credit repair clients:

- Automates dispute letters, saving you time and reducing manual errors during the credit dispute process

- Tracks every lead and their status so you always know where each potential client stands in the pipeline

- Sends automatic follow-ups to keep your communication consistent and professional

- Stores contact details and lead sources for better client organization and reporting

- Generates reports to help you measure progress, analyze performance, and improve client service

- Offers secure document storage, so clients can upload and access sensitive documents safely

- Integrates with email and CRM tools, making your entire credit repair workflow seamless and efficient

When you’re running a growing business, staying organized is key. That’s why this software is a must-have for anyone focused on credit repair lead generation.

Outsourcing to Boost Credit Repair Lead Conversion and Efficiency

Growing your business means focusing on high-value tasks and delegating the rest. As a credit repair professional, your time is best spent solving complex credit issues, building relationships with clients, and improving your knowledge of compliance.

By outsourcing time-consuming or repetitive tasks, you free up your energy to deliver better results and grow faster.

Delegation also helps you stay consistent in your processes so your credit repair leads turn into loyal clients without burning you out.

Delegating Dispute Management Without Losing Quality

Doing all the disputes yourself? That’s a fast track to burnout. Outsourcing this part of your process allows you to focus your energy on growing your business and solving more complex client credit issues.

By assigning dispute tasks to trained virtual assistants, you can still maintain a high level of quality while freeing up your time. This means you can bring in more credit repair leads, provide quicker turnaround for your clients, and ensure every client gets consistent support.

It also helps you scale your business without sacrificing service quality or compliance. As your team takes over routine disputes, you can shift your attention to educating clients, analyzing more challenging credit reports, and offering tailored solutions.

This not only boosts efficiency but also enhances your reputation for delivering personalized, high-quality service in the credit repair industry.

Outsourcing VA for Credit Repair Lead Generation and Follow-Up

Lead generation doesn’t have to be all you. Virtual assistants can handle key outreach activities that help bring in qualified credit repair leads.

They can send cold emails, manage SMS campaigns, or engage with potential clients on social media all while staying within compliance guidelines.

In addition to outreach, they can handle appointment scheduling and follow-ups, ensuring that no potential client slips through the cracks.

This type of consistent support allows you to build momentum and create a steady pipeline of prospects. Want to know how to get clients for credit repair more consistently?

Build a system with help and let your team handle the legwork so you can focus on delivering results.

Strategic Partnerships That Help You Get Credit Repair Clients

Sometimes, the best way to grow is to connect with others already serving your ideal clients. These partnerships not only extend your reach but also build credibility, since referrals often come with built-in trust.

For example, when a mortgage broker or tax professional introduces you to a client in need of credit help, that person is more likely to listen and take action.

By positioning yourself as a problem-solver who complements their existing services, you can create long-term referral streams that generate consistent credit repair leads.

This strategy is especially powerful because it aligns with helping people solve their credit issues while staying compliant and professional.

Partnering with Financial Experts to Gain Credit Repair Leads

Take time to educate these partners on how your services help their clients achieve better financial outcomes. Provide them with brochures, success stories, and an easy referral process so they feel confident recommending you.

Offering a small thank-you gift or referral incentive (where legally permitted) can also motivate consistent collaboration.

The key is to show how your credit repair services solve problems their clients face like getting denied for loans so they see your partnership as valuable to their own business.

- Mortgage brokers

- Auto dealers

- Loan officers

- Tax professionals

These individuals interact daily with people who are struggling to qualify for financing or are being denied due to credit issues.

By forming referral partnerships, you position yourself as a reliable solution when their clients need help improving their credit profile.

A simple agreement or mutual understanding can turn each referral into a warm credit repair lead, often with little to no upfront marketing cost.

This approach not only expands your network but also helps more people access the services they need to improve their financial future.

How Local Organizations Can Bring in Credit Repair Clients

Don’t underestimate your community: Local organizations can be a powerful channel for finding and serving credit repair clients who are often overlooked by digital marketing strategies.

Many individuals in your local area may be struggling with credit problems but don’t know where to turn for help.

By actively showing up in your community and being a visible, trustworthy resource, you increase the likelihood that people will seek your guidance.

This grassroots approach can establish long-term credibility and lead to steady credit repair lead generation through word-of-mouth and local partnerships.

- Speak at churches or community centers

- Host free workshops at libraries

- Offer financial literacy classes at schools

These partnerships create trust and attract credit repair clients who already know your face and your value. When you consistently show up and deliver value in your local community, people begin to associate your name with reliable credit help.

This recognition helps lower the barrier of skepticism and makes it easier for individuals to reach out when they’re finally ready to fix their credit. It’s not just about visibility it’s about building relationships rooted in trust and consistent presence.

Building a Credit Repair Marketing Strategy That Actually Works

You can’t wing it. You need a real credit repair marketing strategy that you work consistently, one that’s built around understanding your audience’s pain points and offering solutions that genuinely help them improve their credit.

A strong strategy combines visibility, education, compliance, and trust-building to bring in qualified credit repair leads regularly.

Without structure, it’s easy to waste time on random tactics that don’t move your business forward.

Online Marketing Techniques to Attract Credit Repair Leads

Online marketing offers powerful ways to connect with people actively looking for help with their credit.

When done correctly, it becomes more than just promotion it becomes a tool for solving problems, building trust, and guiding potential clients toward real solutions.

The goal is to meet them where they are, answer their questions, and show them how your services can improve their credit situation.

- Use retargeting ads on Facebook to bring people back to your site

- Collect emails through free guides or webinars

- Run a YouTube channel for long-term trust

Each of these methods plays a crucial role in attracting credit repair leads who are already interested in improving their credit.

By staying visible online and delivering helpful content, you build trust over time and encourage potential clients to take the next step toward working with you.

Email Marketing for Credit Repair Client Follow-Up

An email list is one of the best tools for follow-up and building trust with potential credit repair leads. Start with a short welcome series that offers helpful credit tips, explains your services, and shows how you can help.

After that, send simple updates or client success stories to keep readers engaged. Over time, these small touches build credibility and help turn leads into paying clients.

This is a proven way many professionals figure out how to get credit repair clients consistently.

Community Involvement: A Powerful Tool for Getting Credit Repair Clients

Becoming a local authority leads to natural credit repair lead generation. When you’re consistently involved in your community, hosting workshops, sponsoring local events, or offering free credit education, you position yourself as the go-to expert.

People begin to associate your name and business with trustworthy credit repair help, which results in referrals, word-of-mouth growth, and long-term client relationships.

- Sponsor a community event

- Host a credit workshop with a nonprofit

- Volunteer at job fairs or housing expos

People do business with people they see and trust. By being consistently present at local events, sharing useful information, and offering genuine support, you become a familiar and reliable face in the community.

This familiarity breaks down barriers and creates a natural sense of comfort and credibility that drives potential clients to reach out when they need help with their credit.

Stay Legal While Generating Credit Repair Leads

You can have the best credit repair marketing plan in the world but if it’s not legal, it can destroy your business.

Non-compliant advertising or charging upfront fees can result in serious penalties and damage your reputation.

Staying informed about legal guidelines protects not only your business but also builds long-term trust with your clients.

What the Credit Repair Organizations Act Says About Marketing?

CROA rules include: These legal standards are designed to protect consumers from deceptive or unfair credit repair practices, and following them is essential for any credit repair business. Violating these guidelines can result in hefty fines, legal trouble, and long-term damage to your brand. By understanding and applying these rules in your day-to-day operations and marketing, you ensure your services are both ethical and trustworthy.

- No False Promises: You cannot guarantee results or specific credit score increases, as each credit situation is different and results will vary.

- No Charging Upfront Fees: You must complete the work before requesting payment, in accordance with CROA regulations.

- Written Contracts and a 3-day Cancellation Policy: Clients must receive a written agreement outlining services and be given three business days to cancel without penalty.

Following these rules not only keeps your business compliant but also builds long-term trust with clients, showing them that your services are both legitimate and customer-focused.

When you understand the law, you can confidently promote and grow your credit repair lead generation without fear. It gives you a clear framework for marketing and serving clients while avoiding risky practices.

Legal knowledge not only protects your business but also reassures potential clients that you operate with integrity and professionalism.

Trust-Building Practices That Turn Leads into Credit Repair Clients

Build trust by being honest, reliable, and helpful in every interaction. Clients facing credit issues are often anxious and skeptical, so it’s essential to show them you’re genuinely here to help not just to sell. You can build even more trust by:

- Sharing real testimonials (with permission)

- Showing your process transparently

- Keeping communication simple and clear

These actions increase your credit repair leads turning into paying clients. When clients see that you’re transparent, consistent, and truly focused on their credit improvement not just making a sale they’re far more likely to trust your services.

Trust leads to loyalty, and loyalty leads to referrals, which keeps your business growing through word-of-mouth and long-term client satisfaction.

Conclusion: Start Getting Credit Repair Clients the Right Way

You now have a roadmap. You’ve learned how to get credit repair clients, attract quality credit repair leads, and stay within the law. These insights are not just theories they’re proven, practical steps you can begin using right away to grow your credit repair business.

Here’s what to do next: Choose one strategy from this guide and commit to taking action on it today. Whether it’s writing your first problem-solving blog, reaching out to a referral partner, or setting up your client pipeline in Client Dispute Manager Software, the key is momentum.

Staying consistent, being helpful, and always following legal best practices will not only bring in more credit repair leads it will help you build a reputation that attracts clients for the long haul.

Remember, there’s no shortcut but there is a smart, legal path. Stay consistent.

Stay compliant. And soon, you’ll never have to wonder how to get clients for credit repair again.

Mark Clayborne

Mark Clayborne specializes in credit repair, starting and running credit repair businesses. He's passionate about helping businesses gain freedom from their 9-5 and live the life they really want. You can follow him on YouTube.

Below Is More Content For Your Review: