Everyone wants to know how to get 850 credit score and experience all the financial freedom that comes with it. Prime customers are upping their game in the golden 850 credit score target. After all, borrowers with this credit score pose little to no risk to lenders. But how do you get an 850 credit score? Well, that’s the catch!

You may wonder what’s the buzz around getting an 850 credit score? In reality, the necessity of a good credit score needs no introduction. Even those with zero financial know-how are aware that credit score is a factor that cannot be negotiated when you need credit.

Why Would You Need A Higher Credit Score?

Credit scores can range between 300 and 900. The higher your score, the better creditworthy you will be. This signifies that an 850 is quite premium to aim for. And you must realize that it would require you to invest your time and effort to achieve.

Of course, any credit score of more than 750 shows a higher level of creditworthiness. considering how to get an 850 credit score will not just give you access to the amount of credit you want but also put you in a position to negotiate competitive interest rates.

An excellent credit score can help you save hundreds to thousands of dollars over the span of your lifetime. If you consider how to get a credit score of 850 and achieve the same, you can pave the way for lower interest rates on auto loans, home loans, and everything else that requires financing.

This is because people with higher credit ratings are classed as low-risk borrowers. And more businesses, banks, and organizations competing to provide lesser rates, fees, and perks. On the flip side, those with poor credit ratings are regarded as high-risk borrowers, and only a handful of lenders will be interested in offering them credit. As a result, more businesses will get away with higher APR or Annual Percentage Rates.

Most importantly, a low credit score can also impact the individual’s ability to find rental housing, a rented car, or even secure life insurance. This is because credit score is directly linked with insurance scores. And it shows that it is high time you found out how to get perfect 850 credit score.

How Is Your Credit Score Calculated?

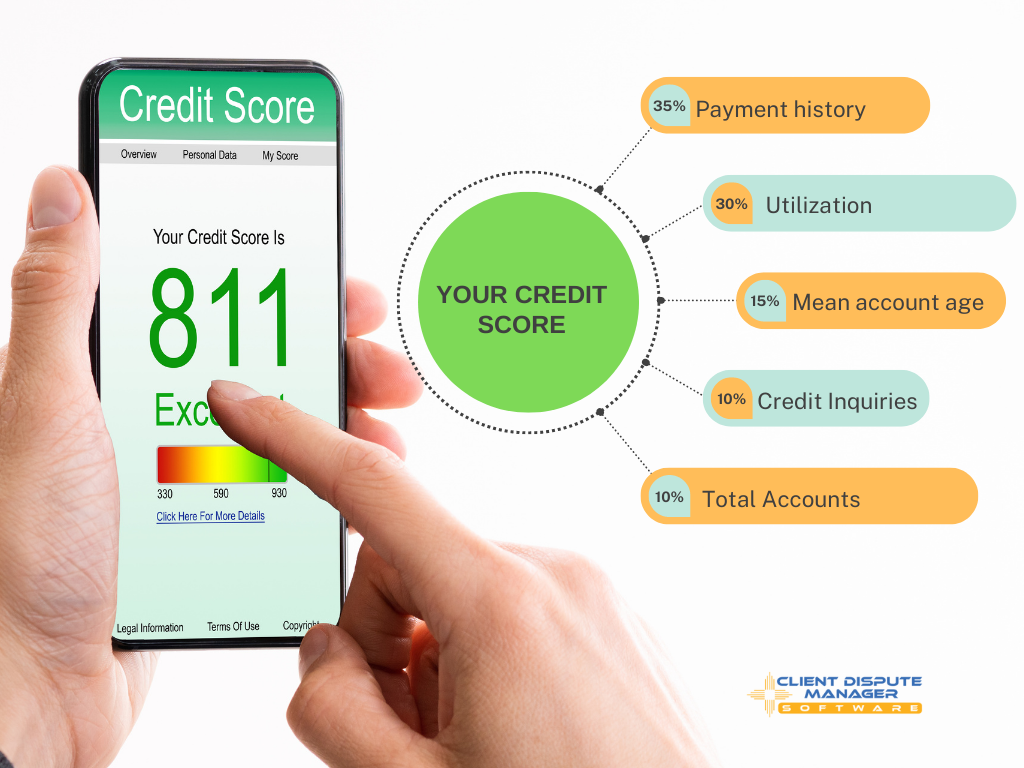

Before you start working your way to achieve a good credit score or search for answers to how to get 850 credit score, it’s important to know the variables affecting your credit score.

The credit score of any individual is based on five primary factors. In case you haven’t checked your score for a while, there are loads of free resources available on the internet. In addition, numerous credit card companies like Citi, Discover, and American Express provide it for free. Let’s take a look at the six different factors and their worth in determining your credit score:

- Payment history: 35 percent

- Utilization: 30 percent

- Mean account age: 15 percent

- Credit inquiries: 10 percent

- Total accounts: 10 percent

To touch an excellent credit score of 850, you need to be incredible in each of these categories. A breakdown of the same can help you understand better.

Payment History

The first factor is quite straightforward. You will need to have 100 percent to make it to the excellent category. And all you have to do is to pay all your bills on time. If you have missed payments in the past, it will be reflected in your credit score. Hence, you have to keep paying the minimum balance needed for the credit card, and you will be good to go.

Even if you have missed one payment in the past, it will invariably bring down the credit score into the “good” category. The payment history is calculated in terms of payments made on time divided by the total number of payments.

Many people opt for a single credit card to avoid bad debt. But the issue here is that missing even a single payment will take you into the category of poor payment history. This implies that even if you made a mistake 2 years ago, it would impact your credit score today.

Utilization

The most viable means of bringing down utilization without altering your spending habits is to pay the balance much ahead of statement closure. It may be unnecessary to prepay the cards, but if your spending habits imply this, you may go for it. If you are a person who carries forth balances every month, try to find out what you may curtail.

The Average Age Of Accounts

The higher the age of your accounts, the better it is. But when thinking about how to get perfect 850 credit score, you have to aim for at least 9 years to come under the excellent score.

Credit Inquiries

It falls under the category of hard inquiry when you aim to get a new credit card. On the other hand, when renting a property, they might run a credit check which is a soft inquiry. Applying for a car loan or a credit card is a hard inquiry since you will be building on debts. But the good aspect is that they get removed from the credit report after 2 years.

Total Accounts

You will need to have more than 21 accounts to score excellent. Credit agencies will see you as financially responsible if you own 20 accounts with minimal utilization. Although owning 21 cards may sound ridiculous, that’s how it goes.

How To Get 850 Credit Score?

While it is true that calculations can vary to a certain degree, some key aspects are applicable for maximizing the various credit scores. And these are having a prolonged and reliable credit record and, of course, a low credit utilization ratio. You might have another question in this regard. How long does it truly take to get 850 credit score? Let’s take a step-by-step approach to understand this better.

Step 1: Building Or Rebuilding The Credit History

As the duration of the credit history makes up to 15 percent of the credit history, having a minimum, negative, or no credit record will prevent you from touching the 850 credit score. To solve this issue, you should rather concentrate on assembling your credit. You may do this by accepting a credit builder loan or applying for a card.

Step 2: Paying Bills On Time

If you are thinking about how to get 850 credit score, you have to pay attention to your payment history. When your charges are 30 days past the due date, the credit company can report them to the bureau.

And once it is listed in your credit report, it can cause significant deterioration to your score. You may also employ a spreadsheet to maintain a trace of all the due dates. Most people with 800 or higher credit score, pay their charges and bills on time.

Step 3: Keeping The Credit Utilization Rate To The Minimum

As already mentioned, the credit utilization ratio is an important factor when thinking how to get 850 credit score. The credit utilization ratio assesses the level of credit you borrow and the total credit threshold you are eligible for.

If the total credit limit is 10,000 USD, you should aim to keep it below 30 percent of the limit. To increase the credit score further, you must try keeping this ratio as close to 0 percent as possible.

Step 4: Reviewing The Credit Scores Along With The Credit Reports

When you are thinking about how to get 850 credit score, you should regulate the credit scores and reports from time to time. As the credit score is built by the data enlisted in the credit summaries, reviewing them will ensure that any of them doesn’t show negative or inaccurate information.

A credit reporting error may occur even when you pay all the bills on time. Therefore, you should lodge a dispute without delay should there be any error in your credit reports.

Step 5: Not Closing Unused Accounts

When considering how to get 850 credit score, people often close old accounts which are no more in use. Keeping an account you might have opened in college running will do no harm. On the contrary, closing it may bring down your credit score.

Now you might be thinking, how long does it take to get 850 credit score? You may need to invest years together in building 850 credit score based on where you start and your individual financial position.

Conclusion

An individual’s credit score is the most critical yardstick of his financial health. At a glance, the lenders would know how responsibly you manage credit. The higher the score, the more effortless it would be to get approval for new loans. Moreover, it can open up an opportunity to tap the lowest interest rates while borrowing.

If you are thinking about how to get a credit score of 850, it’s time to act. There are hordes of simple yet effective things that you may do to achieve this golden score. Although it can take months to see progress in your credit score, you may start building it in just a couple of hours.

Bonus: Now that you have read this article, why not take your new skill and start your own credit business helping others? We have free training that can help you do just that.

Click here to learn more.