Imagine waking up one morning to find a credit card you never opened sitting on your kitchen counter—or worse, a loan in your name for thousands of dollars. Identity theft isn’t some distant threat anymore; it happens every day, often without victims realizing until the damage is done.

In today’s digital world, your personal information is constantly at risk from data breaches, phishing scams, and unauthorized credit checks.

Freezing your credit is one of the simplest and most powerful ways to stop fraudsters in their tracks. It works by restricting access to your credit reports, making it nearly impossible for criminals to open new accounts in your name—even if they have your personal information. And the best part? It’s completely free, backed by federal law, and takes just minutes to set up.

In this step-by-step guide, we’ll walk you through exactly how to freeze your credit the right way, how to thaw it when needed, and the key tips to keep your identity secure over the long term.

Whether you’ve experienced a data breach or just want to strengthen your financial defenses, this guide will give you everything you need to take control of your credit profile.

Key Takeaways:

- Credit freezes block unauthorized access to your credit reports. They stop lenders and identity thieves from opening new accounts in your name without permission.

- The process is simple and free. You can freeze your credit with Experian, TransUnion, and Equifax online, by phone, or by mail in under 10 minutes.

- A credit freeze doesn’t lower your credit score. It protects you from fraud, data breaches, and phishing scams without affecting existing accounts.

- Keep your PINs safe and know when to lift a freeze. You’ll need these to temporarily unlock your credit when applying for loans or credit cards.

- Client Dispute Manager Software enhances protection. It helps you track disputes, manage reports, and stay compliant with FTC, FCRA, and CROA rules while monitoring your credit freezes.

Start Today and Explore the Features Firsthand!

Understanding Credit Freezes: What You Need to Know About How to Freeze Credit

A credit freeze, also called a security freeze, is a protective measure that lets you control who can access your credit reports. When your credit is frozen, lenders and creditors can’t pull your credit file—meaning no one can open a new credit card, loan, or line of credit in your name without your explicit permission.

This simple action creates a powerful barrier between your personal information and potential identity thieves.

When you request a credit freeze, each of the three major credit bureaus—Equifax, Experian, and TransUnion—places a block on your credit file. This block prevents any “hard inquiries” from being approved until you lift or temporarily thaw the freeze.

Legitimate lenders rely on these inquiries to verify creditworthiness, so if someone tries to apply for credit fraudulently, the application gets denied automatically.

Data breaches are happening more frequently than ever, exposing millions of Social Security numbers, addresses, and financial records each year. Once stolen, this information can circulate on the dark web for years.

A credit freeze acts like a digital lock, ensuring that even if criminals get hold of your data, they can’t use it to harm your credit or financial future.

What is a Credit Freeze? The Basics of How to Freeze Your Credit

A credit freeze, also known as a security freeze, is a powerful tool that restricts access to your credit report. When you freeze your credit, you essentially lock down your credit file, making it much harder for identity thieves to open new accounts in your name.

Most creditors need to see your credit report before approving a new account, so a freeze acts as a strong deterrent against fraud.

Understanding the mechanics of a credit freeze is the first step in learning how to freeze your credit effectively. By implementing a credit freeze, you’re taking proactive steps to protect your financial identity.

Why Should You Freeze Your Credit? Understanding "How Do I Freeze My Credit"

You might be wondering, “How do I freeze my credit, and is it really necessary?” The answer is a resounding yes. A credit freeze provides enhanced protection against identity theft, prevents unauthorized credit applications, and gives you peace of mind during major life changes.

What’s more, it doesn’t impact your credit score, and it’s free and relatively easy to implement.

With these benefits in mind, learning how to freeze your credit is an essential skill for anyone serious about protecting their financial future. By understanding how to freeze credit, you’re equipping yourself with a powerful tool against financial fraud.

Step-by-Step Guide: How to Freeze Your Credit with Each Bureau

Now that we understand the importance of a credit freeze, it’s time to learn the practical steps of how to freeze credit with each major credit bureau. This section will provide you with detailed instructions for Experian, TransUnion, and Equifax. By following these steps, you can ensure comprehensive protection for your credit.

How to Freeze Credit with Experian: The Credit Freeze Experian Process

Experian is one of the three major credit bureaus, and freezing your credit with them is a crucial step in protecting your financial identity. The process of initiating a credit freeze Experian is straightforward and can be done online, by phone, or by mail.

Let’s explore how to freeze credit Experian using different methods. Remember, the freeze credit Experian process is an important part of your overall credit protection strategy.

Start Today and Explore the Features Firsthand!

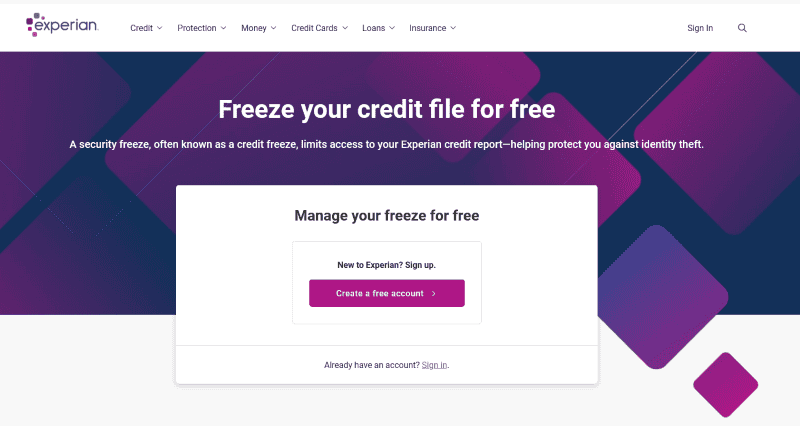

Online Method: How to Freeze Credit Experian via Website

The online method is often the quickest and most convenient way to freeze credit Experian. To begin, visit the official Experian website and click on “Add a security freeze.” You’ll need to select “For myself” and then either create an Experian account or log in to an existing one.

During the process, you’ll be required to provide personal information to verify your identity. This typically includes your full name, address, Social Security number, and date of birth. Once you’ve entered this information, follow the prompts to complete your credit freeze Experian request.

The online freeze credit Experian method is user-friendly and can typically be completed in just a few minutes.

Phone Method: Initiating a Credit Freeze Experian by Call

If you prefer to freeze credit Experian over the phone, you can call Experian at 1-888-397-3742. The process is similar to the online method, but you’ll be speaking with a representative who will guide you through the steps.

Be prepared to provide the same personal information as you would online. Remember to have a pen and paper ready to write down any PINs or passwords provided, as you’ll need these to lift the freeze in the future.

The credit freeze Experian process by phone is just as effective as the online method. Some people find the phone method for freeze credit Experian more comfortable, especially if they’re not as familiar with online processes.

Mail Method: How to Freeze Credit Experian via Post

For those who prefer traditional correspondence, you can also freeze credit Experian by mail. To do this, send a letter to Experian Security Freeze, P.O. Box 9554, Allen, TX 75013. In your letter, include your full name, address, Social Security number, and date of birth.

Also, clearly state that you wish to place a security freeze on your Experian credit report. While this method takes longer than the online or phone options, it’s still an effective way to freeze credit Experian.

After processing your request, Experian will send you a confirmation letter with a PIN, which you’ll need for future management of your freeze credit Experian.

Start Today and Explore the Features Firsthand!

Credit Freeze TransUnion: Steps to Protect Your TransUnion Report

TransUnion, another major credit bureau, also offers a straightforward process for freezing your credit. Completing a credit freeze TransUnion is an essential step in fully protecting your credit. Let’s explore how to initiate a credit freeze TransUnion using different methods.

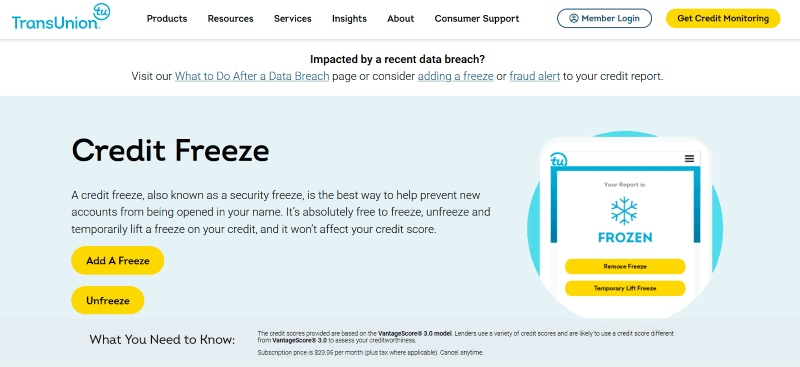

Online Method: How to Implement a Credit Freeze TransUnion on the Web

To initiate a credit freeze TransUnion online, start by visiting their freeze page. Click on “Add a freeze” and you’ll be prompted to either create a TransUnion account or log in to an existing one.

When setting up your account, you’ll need to provide personal information to verify your identity, similar to the Experian process.

This includes your full name, address, Social Security number, and date of birth. It’s crucial to choose a strong, unique password for your account to ensure maximum security when managing your credit freeze TransUnion.

Mobile App Method: Managing Your Credit Freeze TransUnion on the Go

TransUnion offers a mobile app called “myTransUnion” which provides a convenient way to manage your credit freeze TransUnion. To use this method, download the app from your device’s app store and create an account or log in.

The app allows you to initiate a credit freeze, temporarily lift it, or permanently remove it, all from your smartphone. This can be particularly useful if you need to quickly adjust your credit freeze TransUnion status while on the go.

The mobile app method offers the same level of protection as the online method for your credit freeze TransUnion.

Equifax Freeze Credit: Securing Your Equifax Credit Report

To complete your credit protection trifecta, you’ll need to know how to freeze credit with Equifax. This section will guide you through the process of initiating an Equifax freeze credit, ensuring that your credit is fully protected across all three major bureaus.

Let’s explore the different methods to Equifax freeze credit.

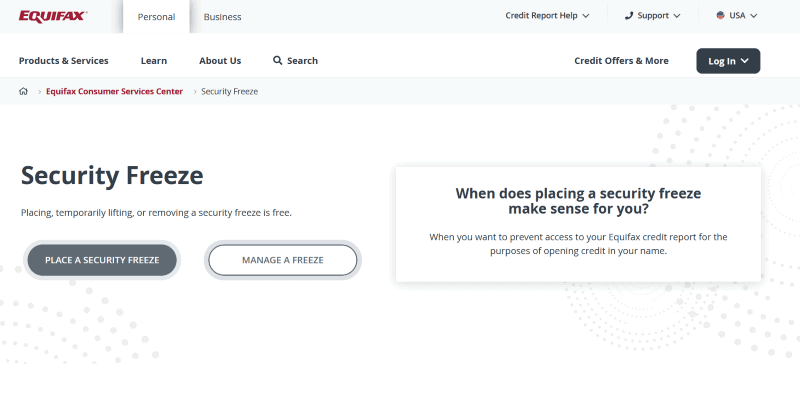

Online Method: How to Equifax Freeze Credit via Website

The online method is typically the fastest way to place an Equifax freeze credit. Start by visiting the Equifax freeze page and click on “Get Started.” If you don’t already have a myEquifax account, you’ll need to create one.

This involves providing personal information to verify your identity and answering a series of security questions. Choose a strong, unique password for your account to ensure its security.

Once your account is set up, follow the prompts to place an Equifax freeze credit on your report.

Alternative Methods: Phone and Mail Options for Equifax Freeze Credit

Equifax also offers the option to Equifax freeze credit by phone or mail. To freeze by phone, call Equifax at 1-800-349-9960 and follow the automated prompts. If you prefer to Equifax freeze credit by mail, send your request to Equifax Security Freeze, P.O. Box 105788, Atlanta, GA 30348-5788.

In your letter, include your full name, address, Social Security number, and date of birth. Regardless of the method you choose, remember that freezing your credit is a free service provided by law. The Equifax freeze credit process is equally effective whether done online, by phone, or by mail.

Managing Your Credit Freeze: Beyond "How to Freeze Your Credit"

Once you’ve successfully frozen your credit with all three bureaus, it’s important to know how to manage and maintain your credit freeze effectively. This section will cover key aspects of credit freeze management, including maintenance, when to lift your freeze, and how to stay informed about changes in credit freeze laws and procedures.

Maintaining Your Credit Freeze: Ongoing Protection

Maintaining your credit freeze is an ongoing process that requires attention and care. Regularly checking your credit reports for any suspicious activity is crucial, even with a freeze in place. Keep your freeze PINs and account information in a safe place – you’ll need these when you want to temporarily lift your freeze or permanently remove it.

It’s also a good idea to periodically log into your accounts with each credit bureau to ensure your contact information is up to date. Remember, maintaining your freeze is as important as knowing how to freeze your credit in the first place.

Start Today and Explore the Features Firsthand!

When to Lift Your Credit Freeze: Balancing Protection and Access

There are several situations where you might need to temporarily lift your credit freeze. This typically occurs when you’re applying for new credit, such as a credit card or loan. You may also need to lift your freeze during job applications that require credit checks, when renting a new apartment, or if you’re shopping for insurance rates.

Most bureaus allow you to do this online or by phone, and you can usually specify a date range for the lift or limit the lift to a specific creditor. Knowing when and how to lift your freeze is an essential part of managing your credit freeze Experian, credit freeze TransUnion, and Equifax freeze credit.

Staying Informed About Credit Freeze Laws: Keeping Your "How to Freeze Credit" Knowledge Current

Credit freeze laws and procedures can change over time, so it’s important to stay informed. While the process of how to freeze your credit is currently standardized across the U.S., new protection methods may become available in the future.

Regularly check the websites of the major credit bureaus and consumer protection organizations for updates. Being proactive in staying informed will help you maintain the strongest possible protection for your credit.

Understanding the latest developments in credit freeze laws is crucial for effectively managing your credit freeze Experian, credit freeze TransUnion, and Equifax freeze credit.

Alternatives to Credit Freezes: Other Ways to Protect Your Credit

While learning how to freeze your credit is crucial, it’s also important to be aware of alternative methods for protecting your credit. These alternatives can complement a credit freeze or serve as options for those who find a full freeze too restrictive.

Credit Locks

Credit locks are similar to freezes but often offer more flexibility. They allow you to quickly lock and unlock your credit report, usually through a mobile app or online portal. Both TransUnion and Equifax offer free credit lock services.

While credit locks can be more convenient, they may not offer the same legal protections as a credit freeze, so it’s important to understand the differences before choosing this option.

Fraud Alerts

Fraud alerts are another tool for protecting your credit. When you place a fraud alert on your credit report, creditors are required to verify your identity before opening new accounts in your name.

You only need to place a fraud alert with one credit bureau, and they’ll notify the others. Fraud alerts can be particularly useful if you suspect you’ve been a victim of identity theft or if you want an added layer of protection without fully freezing your credit.

Identity Theft Monitoring Services

Identity theft monitoring services provide ongoing surveillance of your credit activity. These services can alert you to potential fraudulent activity, changes in your credit report, and even scan the dark web for your personal information. While these services can be helpful, they often come with a monthly or annual fee, so weigh the costs and benefits before signing up.

Client Dispute Manager Software: Enhancing Your Credit Protection Strategy

Start Today and Explore the Features Firsthand!

While learning how to freeze your credit is crucial, it’s also important to be aware of tools that can help you manage your credit health more comprehensively. Client Dispute Manager Software is one such tool that can complement your credit freeze strategy and provide additional layers of protection and management for your credit.

What is Client Dispute Manager Software?

Client Dispute Manager Software is a specialized tool designed to help individuals and credit repair professionals manage the process of disputing inaccuracies on credit reports.

This type of software can be particularly useful if you’ve frozen your credit but still need to address existing issues on your credit report. It can help you track disputes across all three major credit bureaus – Experian, TransUnion, and Equifax – even when you have a credit freeze Experian, credit freeze TransUnion, or Equifax freeze credit in place.

Benefits of Using Client Dispute Manager Software

- Streamlined Dispute Process: The software can help automate and streamline the process of filing disputes with credit bureaus and creditors, saving you time and effort.

- Comprehensive Tracking: It allows you to track the progress of multiple disputes across all three credit bureaus, which can be especially helpful when managing a complex credit situation.

- Document Management: These tools often include features for storing and organizing important documents related to your credit disputes, making it easier to maintain records and follow up on disputes.

- Compliance Assistance: For credit repair professionals, this software can help ensure compliance with relevant laws and regulations, reducing legal risks.

- Integration with Credit Freeze Management: Some advanced Client Dispute Manager Software can help you keep track of your credit freezes, reminding you when you might need to temporarily lift a freeze to resolve a dispute.

Start Today and Explore the Features Firsthand!

Frequently Asked Questions (FAQs)

What Exactly Is a Credit Freeze and How Does It Work?

A credit freeze, also known as a security freeze, locks your credit file so lenders can’t pull your credit report without your approval. This prevents identity thieves from opening fraudulent accounts in your name.

Each major bureau—Equifax, Experian, and TransUnion—offers free credit freezes under federal law. When you need new credit, you can lift the freeze temporarily or permanently using your PIN or account credentials.

Does Freezing My Credit Affect My Credit Score?

No, a credit freeze has no impact on your score. It simply restricts access to your report. Your existing accounts, payment history, and balances continue to function normally.

A freeze is a security tool, not a scoring factor, so it provides extra protection without any downside to your credit standing.

How Do I Freeze My Credit with Each Bureau?

You can complete the process online in minutes:

- Experian: Visit the official Experian freeze center, create or log in to your account, and select “Add a security freeze.”

- TransUnion: Go to the TransUnion freeze page or use the myTransUnion mobile app.

- Equifax: Access the Equifax freeze portal or call their security freeze line.

Each bureau requires your name, address, date of birth, and Social Security number to verify your identity before placing the freeze.

When Should I Lift or Thaw My Credit Freeze?

You may need to lift your freeze temporarily when applying for new credit, renting a home, or purchasing insurance. Most bureaus allow you to lift the freeze online or by phone for a specific time period or for certain creditors.

Always re-freeze your credit afterward to maintain full protection.

Where Can I Start Using Client Dispute Manager Software to Manage Credit Freezes and Disputes?

You can start your free 30-day trial on the Client Dispute Manager Software website. The platform helps you monitor your credit reports, automate dispute letters, track bureau updates, and manage your freeze status in one place.

It’s ideal for individuals and professionals who want full control and compliance with FTC, FCRA, and CROA standards while improving credit protection.

Conclusion: Mastering How to Freeze Your Credit for Financial Security

Learning how to freeze your credit is a crucial step in protecting your financial identity in today’s digital age. By following this comprehensive guide, you now know how to freeze your credit like a pro with all three major credit bureaus: Experian, TransUnion, and Equifax. Remember, while it may seem like a hassle to freeze credit with each bureau separately, the peace of mind and security a credit freeze provides far outweigh the minor inconveniences.

Whether you choose to freeze credit Experian, complete a credit freeze TransUnion, or initiate an Equifax freeze credit, you’re taking a significant step towards safeguarding your financial future. Take action today to protect your credit. Freeze your credit, stay informed about credit protection methods, and remain proactive in managing your financial health. Your future self will thank you for the extra layer of protection you’ve put in place.

Mark Clayborne

Mark Clayborne specializes in credit repair, starting and running credit repair businesses. He's passionate about helping businesses gain freedom from their 9-5 and live the life they really want. You can follow him on YouTube.

Start Today and Explore the Features Firsthand!

Below Is More Content For Your Review: