Imagine checking your credit report and finding a credit card account you never opened. Identity theft is more common than ever, and taking steps to protect yourself is crucial. One of the most effective ways to do this is to freeze your credit. But many people wonder, “how do you freeze your credit?” or “how to freeze your credit report?”

The good news is that it’s a straightforward process, and in this guide, we will walk you through everything you need to know.

By the end of this article, you’ll understand how to freeze your credit for free, how to freeze your credit report, and when it makes sense to do so. Let’s dive in.

What is a Credit Freeze?

A credit freeze is a security measure that prevents new accounts from being opened in your name. When you freeze your credit report, lenders and creditors cannot access your credit file, which blocks identity thieves from using your personal information to apply for loans or credit cards.

It’s important to note that a credit freeze does not affect your existing credit cards or accounts. You can still use your credit cards, but no one including you can open new lines of credit until you lift the freeze.

Why is a Credit Freeze Important for Identity Protection?

Every year, millions of people become victims of identity theft, suffering financial losses and long-term credit damage. Cybercriminals exploit stolen personal information to open fraudulent credit accounts, take out unauthorized loans, and compromise financial security.

Many people wonder, “how do you freeze your credit?” because taking this crucial step can safeguard your financial future. When you freeze your credit report, you create a protective barrier against unauthorized access, preventing identity thieves from misusing your personal details.

Learning how to freeze your credit for free allows you to take proactive measures without any cost, ensuring your credit profile remains secure.

By following a simple process with each credit bureau, you can significantly reduce the risk of financial fraud and gain peace of mind knowing your identity is protected.

Top Reasons to Freeze Your Credit

Freezing your credit is a powerful tool that offers multiple layers of financial protection. It is particularly useful for those who have experienced identity theft, had their personal information exposed in a data breach, or simply want to safeguard their credit from unauthorized activity.

By choosing to freeze your credit, you are taking a proactive step toward securing your financial future and preventing fraudulent transactions.

- Protects against unauthorized credit accounts.

- Prevents fraudsters from applying for loans in your name.

- Does not affect your credit score.

- It’s a free service provided by credit bureaus.

- Easy to unfreeze when needed.

If you’ve ever asked, “how do you freeze your credit?”, the answer is simple: follow a few steps with each credit bureau, and you can secure your credit file immediately.

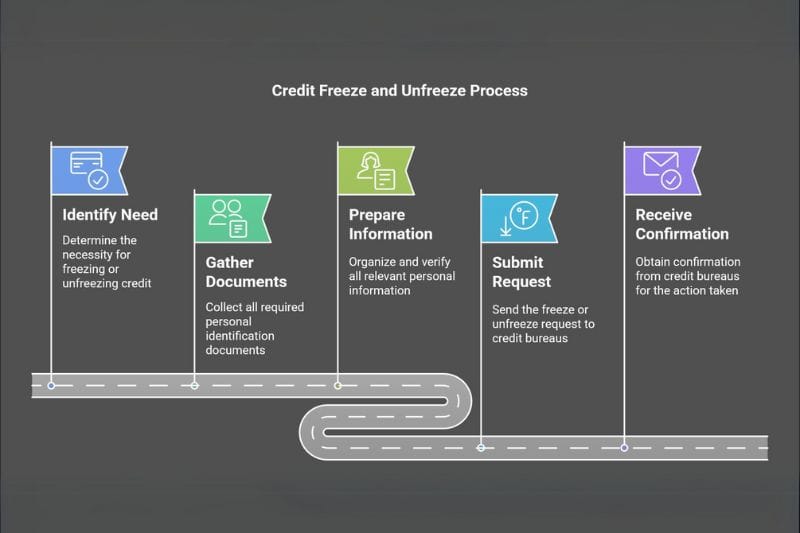

Step-by-Step Process: How to Freeze Your Credit

To freeze your credit report, you must request a freeze with all three major credit bureaus. This process is essential to prevent fraudsters from opening accounts in your name.

Whether you’re looking to freeze your credit for free or simply enhance your financial security, following these steps ensures your personal information remains protected.

Below is the process for each one:

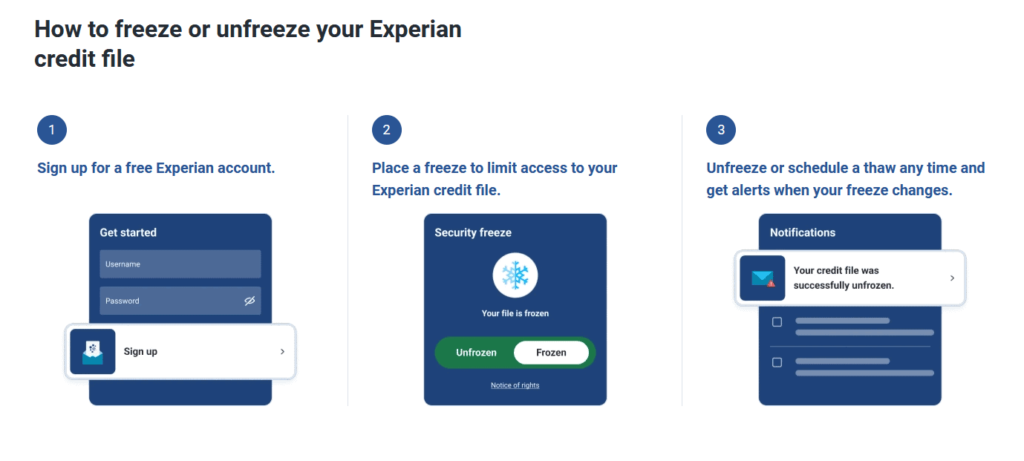

How to Freeze Your Credit with Experian

Taking the necessary steps to freeze your credit report with Experian is an essential way to protect yourself from fraud. This process ensures that no unauthorized accounts can be opened in your name, providing a crucial layer of security against identity theft. Follow these steps to successfully secure your credit with Experian:

- Visit the Experian website or call their customer service.

- Provide personal information, including Social Security Number and proof of identity.

- Request the credit freeze and receive a PIN or password to manage it.

- Your credit report freeze takes effect immediately.

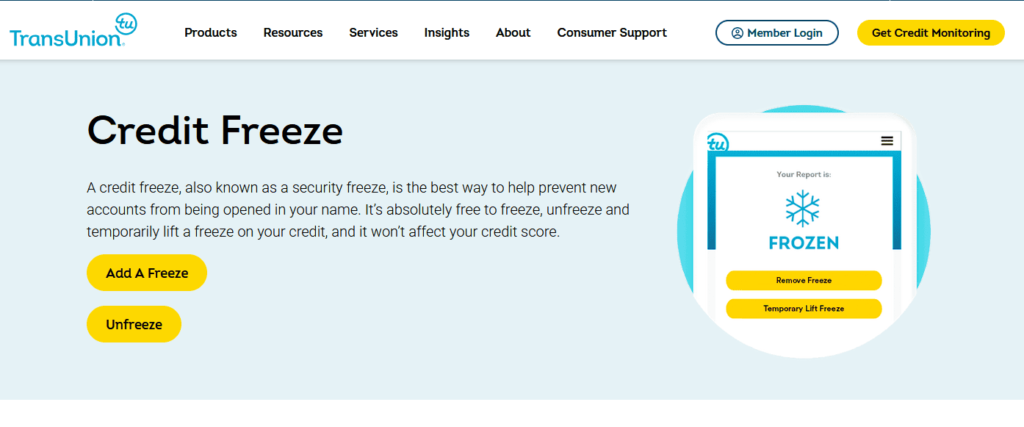

How to Freeze Your Credit with TransUnion

Securing your credit with TransUnion is a crucial step in preventing identity theft and financial fraud. By learning how to freeze your credit report, you can restrict access to your financial information, ensuring that no unauthorized accounts are opened in your name.

Below are the necessary steps to successfully initiate a credit freeze with TransUnion.

- Access TransUnion’s official site or call their helpline.

- Submit your details and choose to freeze your credit.

- Get your security PIN for future modifications.

- The freeze is active within a few minutes.

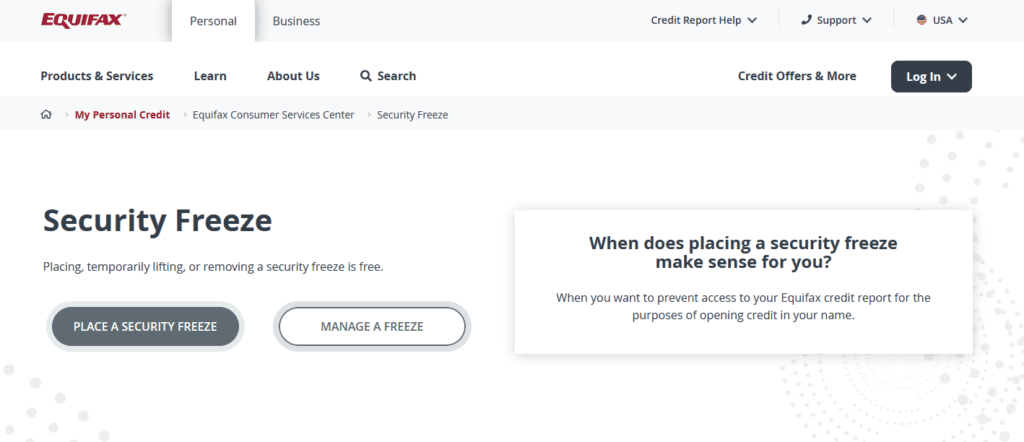

How to Freeze Your Credit with Equifax

Protecting your credit with Equifax is an essential step in preventing unauthorized access to your financial information. Understanding how to freeze your credit report with Equifax ensures that identity thieves cannot open new accounts in your name.

Below are the steps you need to follow to successfully secure your credit with Equifax.

- Go to Equifax’s website or dial their toll-free number.

- Enter required verification information.

- Request a credit freeze and store your PIN safely.

- You will receive confirmation once your credit report is frozen.

How to Freeze Your Credit for Free

A common misconception is that freezing credit comes with a fee. However, you can freeze your credit for free at any time, thanks to federal law. This means you have access to an effective and cost-free way to protect your financial well-being without worrying about hidden fees or recurring charges.

When you freeze your credit report, there are no charges for setting it up, lifting it, or removing it. If you ever hear about a service charging for credit freezes, it’s likely a paid credit monitoring program, which is different.

By choosing to freeze your credit for free, you take a proactive step toward safeguarding your identity without incurring additional costs, ensuring your personal and financial data remain secure.

How to Unfreeze Your Credit When Necessary?

While a credit freeze is an excellent protection tool, there might be times when you need to temporarily lift or remove it. Whether you’re applying for a new credit card, mortgage, or loan, knowing how to unfreeze your credit report quickly can help streamline the process.

Fortunately, unfreezing is just as simple as freezing, and it allows you to regain access to your credit without compromising your security. Here’s how:

How to Unfreeze Your Credit with Experian

Unfreezing your credit with Experian is a straightforward process that allows you to regain access to your credit file when needed. Whether you’re applying for a mortgage, a car loan, or a new credit card, knowing how to unfreeze your credit report efficiently ensures that your financial activities are not delayed.

Below are the necessary steps to lift your credit freeze with Experian:

- Log in to your Experian account or call customer service.

- Enter your security PIN and select “lift freeze.”

- Choose temporary or permanent unfreeze.

How to Unfreeze Your Credit with TransUnion

Unfreezing your credit with TransUnion is a quick and secure process that allows you to regain control of your financial profile whenever needed. Whether you are applying for a new loan, renting an apartment, or making a major purchase, knowing how to unfreeze your credit report ensures you don’t face unnecessary delays.

Below are the steps to successfully lift a credit freeze with TransUnion:

- Access your TransUnion portal or contact support.

- Use your security PIN to request an unfreeze.

- Decide whether to lift it for a specific timeframe or permanently.

How to Unfreeze Your Credit with Equifax

If you need to regain access to your credit file for a loan application, rental approval, or other financial transactions, knowing how to unfreeze your credit report with Equifax is essential. The process is simple, ensuring you can lift your credit freeze quickly and securely while maintaining financial protection.

Follow these steps to efficiently manage your credit freeze with Equifax:

- Visit Equifax’s site or call their helpline.

- Input your freeze management password.

- Select a temporary or full credit unfreeze.

Required Information for Freezing and Unfreezing Your Credit

Before initiating a credit freeze or unfreezing your credit, it’s essential to have the necessary documents and details ready. Being prepared can help streamline the process and prevent unnecessary delays.

When requesting a credit freeze, you’ll need:

- Full name and Social Security Number.

- Date of birth and mailing address.

- Government-issued ID (driver’s license or passport).

- PIN (if managing an existing freeze).

Having these details readily available can help you complete the process quickly and efficiently. Ensuring that your documents are accurate and up to date is crucial for a smooth experience when you freeze your credit report or unfreeze it when needed.

How Long Does a Credit Freeze Last?

A credit freeze remains in place indefinitely until you choose to remove it. This means that your credit report is fully secured from unauthorized access until you decide to lift the freeze.

If you plan to apply for a new credit card, mortgage, or loan, you can temporarily lift the freeze and set it to reinstate automatically after a specific period.

This flexibility ensures that you can safely manage your credit while still protecting yourself from fraud. Always remember to freeze your credit again after completing any necessary financial transactions to maintain security.

Client Dispute Manager Software: Streamline Your Credit Repair Process

Managing your credit and protecting your financial identity can be challenging, but with the right tools, you can take control of your financial well-being. Client Dispute Manager Software is a comprehensive and user-friendly platform that empowers individuals and credit repair businesses to efficiently handle disputes, monitor credit reports, and improve credit scores.

This powerful software provides automation, organization, and real-time tracking, allowing users to streamline the dispute process and stay informed about changes in their credit profiles. By using Client Dispute Manager Software, you can proactively manage your credit and take the necessary steps to build a stronger financial future.

Key Benefits of Client Dispute Manager Software

Using Client Dispute Manager Software can revolutionize the way individuals and credit repair businesses handle credit disputes. This powerful tool simplifies the process, automates tedious tasks, and enhances efficiency, ensuring that users can take proactive steps to improve credit scores and protect financial stability.

- Automated Credit Dispute Processing – Easily manage and send disputes to credit bureaus.

- Comprehensive Credit Report Tracking – Stay informed about changes to your credit file.

- Time-Saving Automation – Reduce manual efforts and streamline credit repair workflows.

- User-Friendly Dashboard – Access all your credit management tools in one place.

Whether you are repairing your own credit or running a credit repair business, Client Dispute Manager Software provides the necessary tools to navigate the complexities of credit protection and improvement. Take control of your financial future today.

Frequently Asked Questions

Is Freezing Your Credit a Good Idea?

Yes, freezing your credit is an excellent strategy to safeguard your financial identity from fraud and unauthorized credit activity. By implementing a credit freeze, you prevent potential identity thieves from accessing your credit file, reducing the risk of fraudulent loans or accounts being opened in your name.

This added layer of protection enhances financial security and gives you control over who can access your credit information, ensuring peace of mind.

How Do You Freeze Your Own Credit?

To freeze your credit, you must contact each of the three major credit bureaus—Experian, TransUnion, and Equifax—through their official website, phone, or mail. The process requires providing key personal details such as your Social Security Number, date of birth, and a government-issued ID for verification.

Once the request is successfully processed, your credit report will be frozen, effectively preventing unauthorized individuals from opening new accounts in your name. This is a critical step in securing your financial identity and safeguarding your personal information against fraud.

Can Someone Use My SSN If My Credit Is Frozen?

Even if your credit is frozen, identity thieves may still attempt to misuse your Social Security Number for fraudulent activities such as tax fraud, employment fraud, or medical identity theft.

However, implementing a credit freeze adds a strong layer of security by preventing unauthorized individuals from opening new credit accounts in your name.

This significantly reduces the risk of financial fraud and ensures that your personal and financial data remain protected against potential cyber threats.

What Are the Disadvantages of Freezing Your Credit?

While freezing your credit significantly enhances security, it can be inconvenient when applying for new credit, as you must first unfreeze your credit before lenders can review your report. This extra step may cause delays in loan approvals, mortgage applications, or credit card issuances.

Additionally, some financial services, such as pre-approved credit card offers or instant loan approvals, may no longer be accessible while your credit is frozen.

However, despite these minor drawbacks, the added protection against identity theft and fraudulent activity makes a credit freeze a highly beneficial financial safeguard.

Conclusion

Now that you know how to freeze your credit, you can take control of your financial security with confidence. Freezing your credit report is a proactive step that helps prevent unauthorized access to your financial information, giving you peace of mind. Since the process is free and easy to complete, there is no reason to delay taking action.

By choosing to freeze your credit, you significantly reduce the risk of identity theft and ensure that your credit remains protected.

Don’t wait until it’s too late secure your financial future today!

Mark Clayborne

Mark Clayborne specializes in credit repair, starting and running credit repair businesses. He's passionate about helping businesses gain freedom from their 9-5 and live the life they really want. You can follow him on YouTube.

Below Is More Content For Your Review: