Buying a home is a major milestone, but if your credit score isn’t where it needs to be, getting approved for a mortgage can feel like an impossible challenge. Lenders rely heavily on your credit score to determine whether you qualify for a home loan and what interest rate you’ll receive.

The better your credit, the better your chances of securing a loan with favorable terms.

But what if your credit score isn’t high enough right now? How can you improve your credit score to buy a house?

The good news is that building credit for homeownership is achievable with the right strategy—and it doesn’t have to take years.

Whether you’re starting from scratch or working to repair past financial mistakes, this guide will walk you through exactly how to build and improve your credit score step by step.

In this guide, you’ll learn:

- What credit score you need to buy a home and how it impacts your mortgage approval.

- The key factors that affect your credit score—and how to optimize them.

- Proven strategies to improve your credit score fast, from paying off debt to using credit-building tools.

- How to check for errors on your credit report and dispute inaccuracies that could be holding you back.

- How to maintain good credit long-term, even after buying your home.

If you’ve been asking, “How can I fix my credit to buy a house?” or “How do I improve my credit score fast for a mortgage?”, you’re in the right place.

Let’s dive in and take the first step toward building the credit score you need to achieve homeownership!

Key Takeaways:

- Your credit score controls your mortgage approval, interest rate, and down payment. Lenders usually want a score of 620 or higher, but 700+ gets you better terms and lower monthly payments.

- Payment history makes up 35% of your score, and credit utilization makes up 30%. Always pay bills before the due date and keep balances under 30% of your total credit limit.

- Start improving your credit at least 12 months before applying for a home loan. Order free credit reports from AnnualCreditReport.com, review each one, and dispute any inaccurate or outdated information.

- Use Client Dispute Manager Software to automate dispute letters, track credit report updates, and ensure all actions follow FTC, FCRA, and CROA rules. This helps you stay organized and compliant while building credit.

- After buying your home, keep your accounts active, avoid applying for too many new credit lines, and pay all bills on time to protect your score and financial stability.

Why a Good Credit Score Matters When Buying a Home?

If you’re dreaming of homeownership, your credit score plays a crucial role in making that dream a reality.

Lenders use your credit score to assess how risky you are as a borrower, which affects your ability to qualify for a mortgage and the interest rate you’ll receive.

A higher credit score doesn’t just make it easier to get approved—it can also save you thousands of dollars over the life of your loan.

Let’s break down exactly why a good credit score is essential when buying a home.

Your Credit Score Determines Your Mortgage Approval

When you apply for a home loan, lenders evaluate your credit score to decide whether you qualify for a mortgage. Different types of loans have varying minimum credit score requirements:

Key Takeaway: If your credit score is below 620, you may struggle to qualify for a conventional mortgage and may need to explore government-backed loan options like FHA or VA loans.

A Higher Credit Score Means Lower Interest Rates

Your credit score directly affects the interest rate lenders offer you. A higher score means lower risk for lenders, so they reward you with a lower mortgage interest rate, which translates to smaller monthly payments and long-term savings.

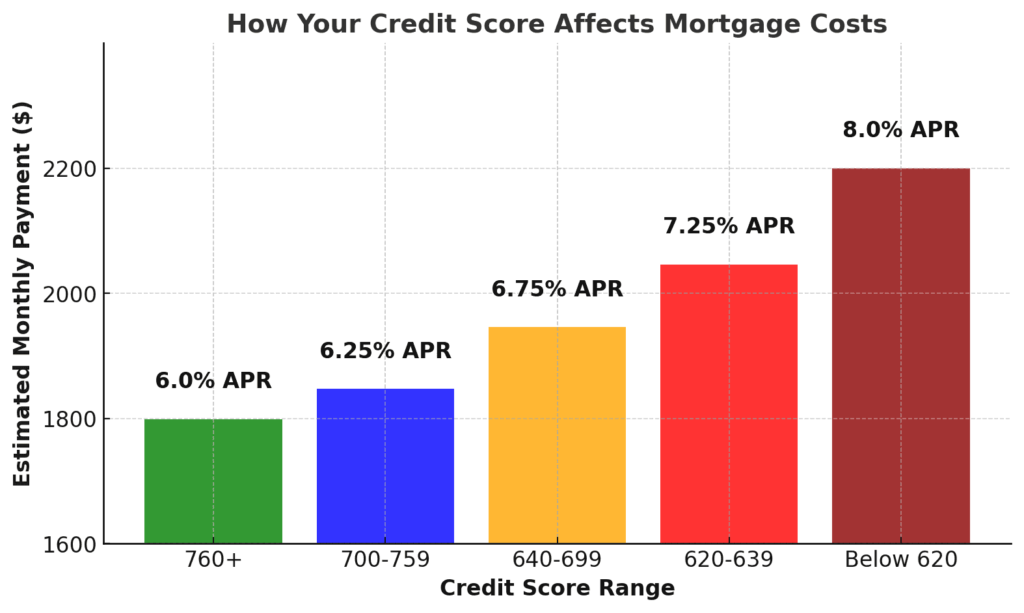

Imagine you’re applying for a 30-year fixed mortgage on a $300,000 home:

Key Takeaway: A 100-point increase in your credit score could save you over $50,000 in interest over 30 years!

A Low Credit Score Can Require a Larger Down Payment

If you have a low credit score, some lenders might require a higher down payment to offset their risk.

For example:

- FHA loans require just 3.5% down if your score is 580+, but if your score is between 500-579, you need at least 10% down.

- Conventional lenders may ask for 20% down if your credit is below 640.

This means a low credit score could make homeownership more expensive upfront.

Key Takeaway: If you want to put less money down, improving your credit score can help secure a lower down payment requirement.

What Factors Affect Your Credit Score?

Understanding the factors that influence your credit score is the first step toward improving it. Your credit score isn’t just a random number—it’s based on specific data from your credit report.

Lenders look at these factors to determine how likely you are to repay your debts. Let’s break down the key components that affect your credit score and how you can optimize them.

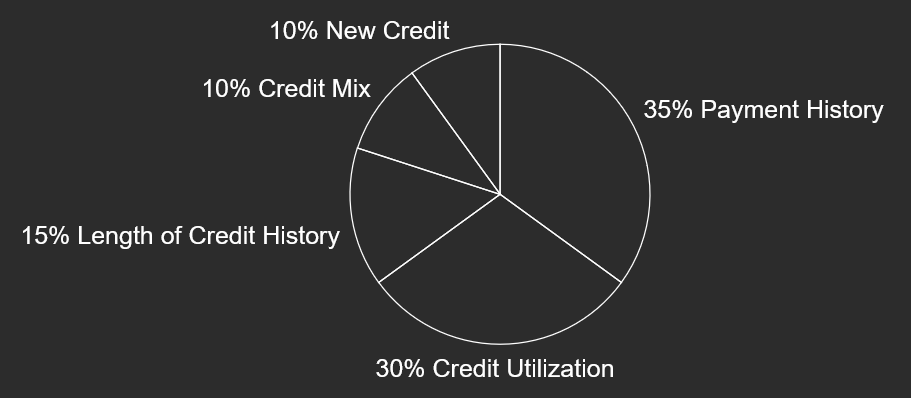

Payment History (35% of Your Score)

Your payment history is the single most important factor in your credit score, accounting for 35% of the total. Lenders want to see that you can consistently pay your bills on time. If you have a history of late payments, missed payments, or defaults, your credit score will take a hit.

How to Improve Your Payment History:

- Set Up Automatic Payments: Automate payments to ensure you never miss a due date.

- Use Payment Reminders: Set calendar alerts or app reminders a few days before payments are due.

- Catch Up on Late Payments: If you’ve missed any payments, catch up as soon as possible to prevent further damage.

Tip: Even one missed payment can lower your score significantly, so consistency is key.

Credit Utilization (30% of Your Score)

Credit utilization is the ratio of your credit card balances to your credit limits, and it makes up 30% of your credit score. A lower credit utilization ratio is better, as it shows lenders that you’re not overly reliant on credit.

For example if your credit card limit is $10,000 and you have a balance of $3,000, your credit utilization is 30%.

How to Improve Credit Utilization:

- Keep Utilization Below 30%: Aim to use less than 30% of your available credit, and under 10% if possible.

- Pay Down Balances Frequently: Make multiple payments throughout the month to keep balances low.

- Request a Credit Limit Increase: A higher credit limit can lower your utilization ratio—just be careful not to overspend.

Length of Credit History (15% of Your Score)

The length of your credit history shows how long you’ve been using credit. Lenders prefer borrowers with a long, stable credit history because it gives them more data to assess your creditworthiness.

How to Improve the Length of Your Credit History:

- Keep Old Accounts Open: Even if you’re not using an old credit card, keeping the account open can boost your average account age.

- Avoid Opening Too Many New Accounts: Each new account lowers your average credit history length, so be strategic about applying for credit.

Tip: The longer your credit history, the more trustworthy you appear to lenders.

Credit Mix (10% of Your Score)

Credit mix refers to the variety of credit accounts you have, such as credit cards, auto loans, mortgages, and student loans. A diverse mix of credit types shows lenders that you can manage different kinds of debt responsibly.

How to Improve Your Credit Mix:

- Add a New Type of Credit: If you’ve only used credit cards, consider taking out a small personal loan or a credit-builder loan.

- Don’t Apply for Unnecessary Credit: Only diversify your credit when it makes financial sense.

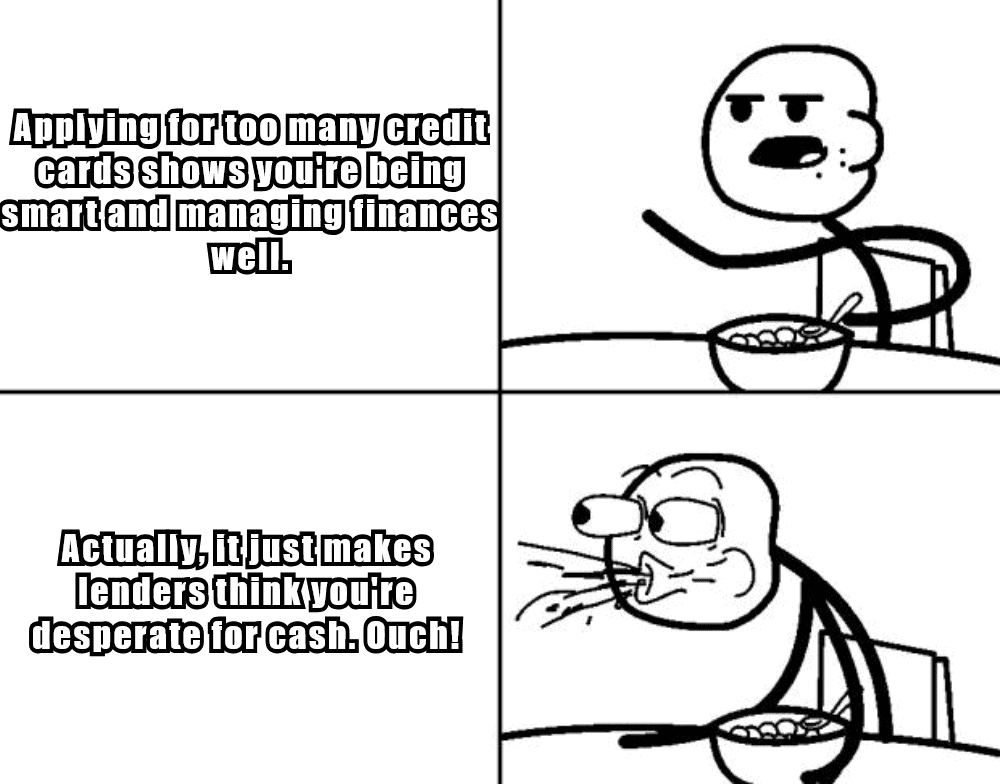

New Credit Inquiries (10% of Your Score)

When you apply for new credit, lenders perform a “hard inquiry” on your credit report, which can temporarily lower your score. Too many hard inquiries in a short period can signal that you’re desperate for credit, which is a red flag to lenders.

How to Minimize the Impact of New Credit Inquiries:

- Limit New Credit Applications: Apply for credit only when you really need it.

- Rate-Shop Smartly: If you’re shopping for a mortgage or auto loan, multiple inquiries within a short window (usually 14-45 days) are often treated as a single inquiry.

Mastering the Key Factors to Improve Your Credit Score

By understanding the factors that affect your credit score, you can take targeted steps to improve it. Remember:

- Pay your bills on time to boost your payment history.

- Keep your credit utilization low by managing your balances wisely.

- Maintain a long credit history by keeping old accounts open.

- Diversify your credit mix when it makes sense.

- Minimize hard inquiries by applying for credit strategically.

Improving these factors can significantly raise your credit score, bringing you closer to your goal of buying a home. Next, we’ll explore how to check your current credit score and what it means for mortgage approval.

How to Check Your Credit Score Before Buying a House?

Before you start house hunting, one of the most important steps is to check your credit score. Knowing your credit score upfront helps you understand where you stand, what loan options may be available, and what improvements you might need to make before applying for a mortgage.

Let’s walk through how to check your credit score, what to look for in your credit report, and how to interpret the results.

Where to Check Your Credit Score for Free?

You don’t need to pay to check your credit score. There are several reliable ways to get it for free. You can request a free credit report once per year from each of the three major bureaus—Experian, Equifax, and TransUnion at Annual Credit Report.

Many banks and credit card companies provide free credit score access through online banking dashboards.

Also services like Credit Karma, Credit Sesame, and Experian offer free credit score tracking.

Tip: Since different lenders may pull from different bureaus, it’s a good idea to check reports from all three to get the full picture.

Understanding Your Credit Score Range

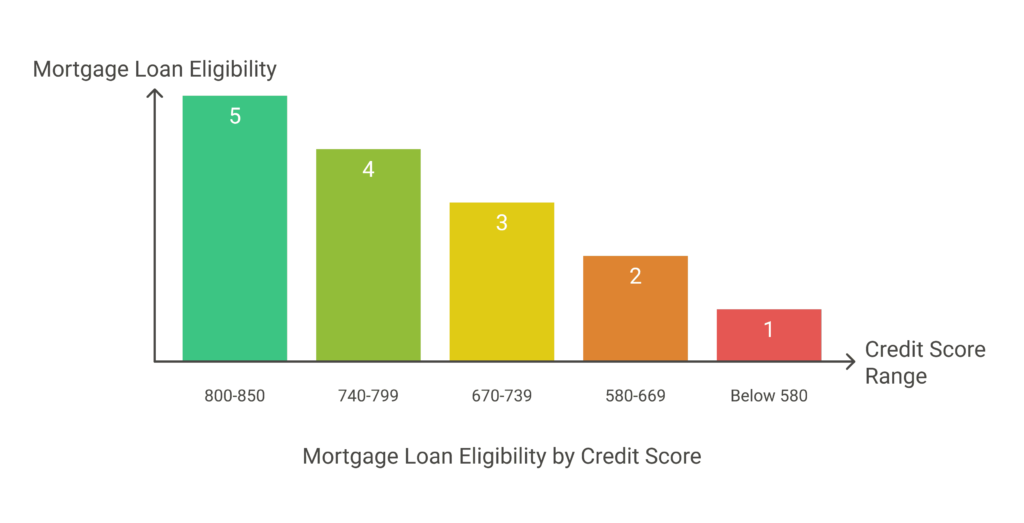

Credit scores typically fall within a range of 300 to 850, and the higher your score, the better your mortgage terms will be. Here’s what different credit score ranges mean when buying a house:

Key Takeaway: If your credit score is below 620, you may struggle to qualify for a conventional mortgage, but you may still be eligible for an FHA or VA loan.

How to Read Your Credit Report?

Your credit report is a detailed record of your financial history. When you check your credit, look for the following key details:

- Ensure your name, address, and social security number are correct.

- Check for open credit cards, loans, and any accounts listed in your name.

- Look for any late or missed payments, as these impact your score the most.

- Review your credit balances and credit limits to determine your utilization ratio.

- Identify hard inquiries, which occur when you apply for new credit. Too many inquiries can lower your score.

- Look for any collections, bankruptcies, or charge-offs that could affect mortgage approval.

Tip: Even small errors on your credit report can hurt your score. If you find any inaccuracies, you have the right to dispute them and request corrections.

When to Check Your Credit Before Applying for a Mortgage?

Checking your credit score well in advance of applying for a mortgage is essential for securing the best loan terms. The earlier you check, the more time you have to address any issues, improve your score, and prepare for the home-buying process.

Ideally, you should start monitoring your credit 6 to 12 months before applying for a home loan to ensure you’re in the best financial position possible.

12 Months Before Buying a Home: Initial Credit Check & Planning

At least a year before purchasing a home, you should pull your credit reports from all three major credit bureaus—Experian, Equifax, and TransUnion. This initial review allows you to identify any errors, late payments, or outstanding debts that might need attention.

If there are any inaccuracies, you should dispute them immediately, as the correction process can take several weeks or even months. Reviewing your credit reports early also gives you enough time to improve your score if it falls below the recommended range for mortgage approval.

6 Months Before Buying a Home: Strengthening Your Credit Profile

By the six-month mark, you should be actively working on strengthening your credit profile. Paying down existing credit card balances, ensuring that all bills are paid on time, and avoiding new credit inquiries are crucial steps in this phase.

If you have a high credit utilization ratio, reducing your balances can significantly improve your score. It’s also important to keep old accounts open, as closing them can shorten your credit history and lower your score.

Monitoring your credit during this period will help you track improvements and avoid unexpected drops.

3 Months Before Buying a Home: Fine-Tuning Your Credit Readiness

Three months before applying for a mortgage, you should focus on fine-tuning your credit readiness. Checking your score again will confirm that it meets lender requirements.

At this stage, it’s essential to maintain financial stability and avoid any significant financial changes, such as switching jobs, taking on new debt, or making large purchases.

Even financing furniture or a car during this time can negatively impact your debt-to-income ratio, which is a key factor in mortgage approval. Keeping your finances steady ensures that your credit score remains strong when lenders assess your application.

Right Before Pre-Approval: The Final Credit Check

Right before applying for pre-approval, perform one last credit check to ensure everything is in order.

Any sudden drops in your score should be addressed immediately, and you should avoid making large financial moves, such as transferring large sums of money, which could raise red flags with lenders.

Once you are confident in your credit status, you can move forward with the pre-approval process. Pre-approval will give you a clear understanding of how much house you can afford and position you as a serious buyer when making offers.

Client Dispute Manager Software: Complete Control Over Every Dispute

Client Dispute Manager Software gives you a structured system to manage, track, and automate every part of the credit repair process. It’s built for both beginners and professionals who want consistent, compliant results.

Key Features:

- Automated Dispute Creation: Generate dispute letters with pre-built templates. Choose the right letter type, insert client data, and send it in minutes.

- Credit Report Importing: Pull credit report data directly from major bureaus. Identify negative items quickly, then mark and dispute them without manual entry.

- Progress Tracking: View every client’s credit repair progress on one dashboard. Track dispute rounds, results, and follow-ups in real time.

- Client Portal Access: Give your clients their own login to view dispute updates, uploaded documents, and results. This builds transparency and trust.

- Compliance Tools: Stay aligned with the FTC, CROA, and TSR. Built-in compliance reminders and templates help you avoid errors that can lead to violations.

- Business Management: Manage client intake forms, contracts, billing history, and communications inside one platform. Everything stays organized and secure.

- Team Collaboration: Assign tasks, monitor workloads, and maintain control over your staff’s dispute activities from the admin dashboard.

Client Dispute Manager Software replaces manual spreadsheets, scattered emails, and time-consuming edits. With automation, compliance tracking, and easy reporting, you can handle more clients, stay organized, and deliver visible results faster.

Start Today and Explore the Features Firsthand!

What Credit Score Do You Need to Buy a House?

One of the biggest questions homebuyers ask is, “What credit score do I need to qualify for a mortgage?” Your credit score plays a major role in determining whether you’ll be approved for a loan and what interest rate you’ll receive. While there’s no single minimum credit score required to buy a house, different loan programs have their own credit score thresholds.

Below, we’ll break down the minimum credit score requirements for different mortgage types, how your score affects loan approval, and what you can do if your credit isn’t high enough yet.

What Credit Score is Needed for a Conventional Loan?

A conventional loan is not backed by the government and typically requires a credit score of at least 620. Borrowers with higher scores above 740—qualify for the best interest rates and lower down payments.

If your score is below 620, lenders may consider you a higher-risk borrower, making approval more difficult. In some cases, you may still qualify, but you’ll likely need a higher down payment (10-20%) or a strong financial profile with low debt and steady income.

Tip: If you’re aiming for a conventional loan, work on improving your credit score to at least 700+ to secure better mortgage terms.

What Credit Score is Needed for an FHA Loan?

An FHA loan, backed by the Federal Housing Administration, is a popular option for first-time homebuyers and borrowers with lower credit scores. The minimum credit score requirement depends on the size of your down payment:

- 580+ credit score: You can qualify with a 3.5% down payment.

- 500-579 credit score: You’ll need at least a 10% down payment to qualify.

FHA loans have more lenient credit requirements but also require mortgage insurance premiums (MIP), which increase the overall loan cost.

Tip: If your credit score is below 580, work on improving it to at least 580+ to qualify for a lower down payment option.

What Credit Score is Needed for a VA Loan?

VA loans, available to veterans, active-duty service members, and some surviving spouses, offer zero down payment options with no private mortgage insurance (PMI).

While the VA does not set a minimum credit score requirement, most lenders prefer a score of at least 580-620. Some lenders may approve borrowers with lower scores, but they may face higher interest rates or stricter underwriting conditions.

Tip: If you’re a veteran with a lower credit score, shop around with different VA lenders, as requirements vary.

What Credit Score is Needed for a USDA Loan?

A USDA loan, backed by the U.S. Department of Agriculture, is designed for low-to-moderate income borrowers purchasing homes in rural or suburban areas. These loans require no down payment but typically require a minimum credit score of 640 for streamlined approval.

If your score is below 640, you may still qualify, but manual underwriting may be required, meaning a lender will take a closer look at your income, debt, and financial history.

Tip: Check the USDA eligibility map to see if homes in your desired area qualify for this program.

How to Maintain Good Credit After Buying a Home?

Buying a home is a major financial milestone, but your credit journey doesn’t end once you receive the keys. Maintaining good credit after purchasing a home is essential for financial stability, future refinancing opportunities, and access to lower interest rates on other loans.

A strong credit profile can also help you qualify for better credit cards, home equity loans, or investment properties in the future.

Continue Making On-Time Mortgage Payments

Your mortgage is likely the biggest financial obligation you’ll ever have, and making on-time payments is crucial to keeping your credit in good standing. Payment history makes up 35% of your credit score, so missing even one mortgage payment can significantly lower your score and lead to penalties or late fees.

To avoid missed payments, consider setting up automatic payments or scheduling reminders through your bank. If you ever face financial hardship and think you might miss a payment, contact your lender immediately—some may offer temporary hardship programs or loan modifications to help you stay on track.

Tip: The longer you maintain a perfect mortgage payment history, the better your credit score will become, making it easier to refinance or apply for future loans.

Avoid Taking on Too Much New Debt

After buying a home, you may be tempted to finance furniture, appliances, or home improvements with new credit cards or loans. While this can be helpful for spreading out costs, too much new debt can increase your debt-to-income (DTI) ratio and impact your credit utilization, which can lower your credit score.

Before opening new credit accounts, consider whether the purchase is necessary or if you can save up for it instead. If you must use credit, aim to keep balances low and pay them off quickly to prevent high-interest charges from accumulating.

Tip: Avoid applying for multiple credit cards or loans at once, as each hard inquiry can temporarily lower your credit score.

Build an Emergency Fund to Avoid Relying on Credit

Unexpected home repairs, medical bills, or job loss can lead to financial stress, causing some homeowners to rely on credit cards or loans to cover expenses.

To protect your credit and avoid high-interest debt, focus on building an emergency savings fund that covers at least three to six months of expenses.

Setting aside money for home maintenance and unexpected costs can prevent you from maxing out credit cards or missing payments, both of which can damage your score.

Consider automating small deposits into a high-yield savings account each month to gradually build your safety net.

Tip: Homeownership comes with additional costs—property taxes, repairs, and insurance. Preparing for these expenses in advance will help you maintain financial stability.

Avoid Closing Old Credit Accounts

Closing old credit accounts might seem like a smart way to simplify finances, but it can actually hurt your credit score. The length of your credit history accounts for 15% of your score, and keeping older accounts open helps maintain a longer average credit age.

If you no longer use an old credit card, consider keeping it open with occasional small purchases to keep it active. The exception is if the card has a high annual fee—in that case, you might want to close it, but be aware that this could cause a slight drop in your score.

Tip: Closing a credit card lowers your total available credit, which increases your credit utilization ratio, potentially lowering your score.

Consider Refinancing Your Mortgage Wisely

If interest rates drop significantly after you purchase your home, refinancing your mortgage could save you money on monthly payments and long-term interest. However, refinancing often requires a credit check and a solid payment history to qualify for the best rates.

Before refinancing, check your credit score and compare loan offers from multiple lenders. Refinancing can be a smart move if it lowers your interest rate, reduces your loan term, or eliminates Private Mortgage Insurance (PMI). However, if you plan to sell your home soon, refinancing may not be worth the closing costs.

Tip: A refinance involves a hard credit inquiry, so only apply when you’re sure it makes financial sense.

Frequently Asked Questions (FAQs)

How Long Does It Take to Build Credit to Qualify for a Home Loan?

Building solid credit for a mortgage typically takes 6 to 12 months of focused effort. If your score is below 600, expect closer to a year of consistent progress. Pay every bill on time, reduce revolving balances below 30% of credit limits, and avoid opening new accounts during this period.

Regularly monitor your reports to confirm positive updates are being reported.

What Is the Minimum Credit Score Needed to Buy a House?

Most conventional lenders look for a minimum score of 620, though stronger applicants usually exceed 680. FHA loans may approve applicants with scores as low as 580 with a 3.5% down payment.

VA and USDA loans can be more flexible but still expect responsible credit behavior and low debt-to-income ratios. A score of 700 or higher often secures the most favorable rates.

Can Disputing Errors on My Credit Report Help Me Qualify for a Mortgage?

Yes. Correcting inaccurate or outdated items is one of the fastest ways to increase your score. Late payments or collections reported in error can lower your score by 50 to 100 points.

Always dispute with supporting evidence, track responses from all three bureaus, and follow up until the errors are removed or corrected.

What Tools Can Help Me Manage Credit Disputes and Improve My Score?

Client Dispute Manager Software is one of the most efficient tools available for credit improvement. It automates dispute creation, tracks your progress across credit bureaus, and maintains compliance with FTC, FCRA, and CROA standards.

Using automation saves time, ensures accuracy, and helps you document every step of your credit improvement process before applying for a mortgage.

Where Can I Start Using Client Dispute Manager Software to Build My Credit?

You can start your free trial on the Client Dispute Manager Software website. The platform walks you through importing your credit reports, identifying negative accounts, creating compliant dispute letters, and tracking every update in real time.

It’s a complete system for first-time buyers who need structured, expert-level credit management before applying for a home loan.

Conclusion

Your credit score plays a vital role in buying a home and securing the best mortgage terms. If your score isn’t where it needs to be, start by making on-time payments, lowering debt, disputing errors, and using credit-building tools. Even small improvements can lead to better loan options and lower interest rates.

Once you’ve purchased a home, maintaining good credit is just as important. Pay your mortgage on time, monitor your credit, avoid unnecessary debt, and keep credit utilization low to protect your financial health.

Building and maintaining good credit takes time, but every responsible financial decision moves you closer to your goals. Start today by checking your credit score and taking steps to strengthen your financial future.

Mark Clayborne

Mark Clayborne specializes in credit repair, starting and running credit repair businesses. He's passionate about helping businesses gain freedom from their 9-5 and live the life they really want. You can follow him on YouTube.