If you’re wondering how to build credit from scratch, you’re not alone. A strong credit score is essential for securing loans, renting apartments, and achieving financial success. However, starting from zero can feel overwhelming.

This guide breaks down the best ways to build credit from scratch with simple, effective strategies. Whether you’re just starting or rebuilding, you’ll learn how to build credit fast from scratch and avoid common pitfalls.

For entrepreneurs, we’ll also cover how to build business credit from scratch, ensuring you establish a solid financial foundation.

Let’s dive into building business credit from scratch, ways to build credit from scratch, and how to build your credit score from scratch effectively.

Why Credit Matters: Building a Credit Score from Scratch

Your credit score is more than just a number it represents your financial responsibility. When you apply for a loan, mortgage, or even a job, lenders and employers often check your credit. If you’re focused on building credit from scratch, understanding its importance is the first step.

Key Reasons to Build Credit from Scratch

- It helps you qualify for better loan and credit card offers.

- It improves your chances of renting an apartment or buying a home.

- Many employers check credit scores for job applications in financial roles.

- It can save you money on interest rates and insurance premiums.

Now that you know why credit matters, let’s explore the best ways to build credit from scratch effectively.

Best Ways to Build Credit from Scratch

Establishing credit can feel overwhelming, but there are several ways to build credit from scratch that are both simple and effective.

Whether you’re looking for the best way to build credit from scratch or need strategies for building business credit from scratch, starting with responsible habits will help you achieve financial success.

Let’s explore the most effective steps to get started.

How to Start Building Credit from Scratch?

If you have no credit history, lenders don’t have any data to assess your financial behavior. The goal is to start with small credit-building strategies that will lay the foundation for long-term success.

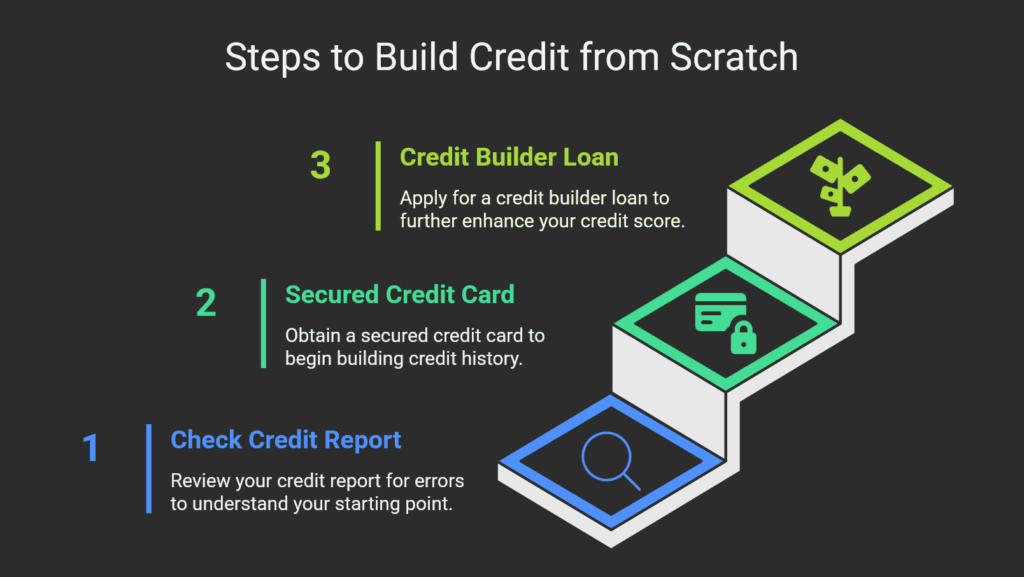

Here’s how to start building credit from scratch effectively:

- Check Your Credit Report – Even if you think you have no credit history, review your credit report for errors. You can get a free credit report at Annual Credit Report

- Get a Secured Credit Card – One of the best ways to build credit from scratch is using a secured credit card, which requires a refundable deposit.

- Apply for a Credit Builder Loan – These small loans are specifically designed to help individuals build credit score from scratch.

Open a Secured Credit Card to Build Credit from Scratch

A secured credit card is one of the best ways to build credit from scratch, especially if you have no credit history. These cards require a refundable deposit, which acts as your credit limit.

When used responsibly, they can help in building a credit score from scratch by reporting your payments to the major credit bureaus.

To make the most of a secured credit card, always keep your balances low and make payments in full and on time each month. This will establish a positive payment history, which is crucial in how to build your credit score from scratch.

Over time, with responsible usage, you may qualify for an upgrade to an unsecured credit card, further solidifying your credit profile.

Become an Authorized User to Build Your Credit Score from Scratch

Another effective way to build credit score from scratch is by becoming an authorized user on a trusted person’s credit card. This allows you to benefit from their strong credit history, as their on-time payments and low credit utilization can positively impact your score.

Before taking this step, ensure that the primary cardholder has a solid track record of responsible credit use. Additionally, confirm that the credit issuer reports authorized users to the major credit bureaus, as this will ensure that your credit profile is actively being built.

This strategy is particularly useful for those looking for ways to build credit from scratch without taking on personal debt.

How to Build Credit Fast from Scratch: Smart Credit Habits

If you need to build credit from scratch quickly, adopting smart financial habits is key. The best way to build credit from scratch is through consistent and responsible use of credit.

By making timely payments, keeping your balances low, and monitoring your credit, you can establish a strong credit history.

Whether you’re building a credit score from scratch or looking for ways to build credit from scratch, focusing on these habits will help you achieve financial success faster.

Make Payments on Time to Build Good Credit from Scratch

Your payment history accounts for 35% of your credit score, making it one of the most crucial factors when trying to build credit from scratch. The key to improving your credit is consistently making on-time payments.

Setting up automatic payments for credit cards and loans can help ensure you never miss a due date. Additionally, using payment reminders on your phone or calendar will keep you aware of upcoming bills.

Always aim to pay at least the minimum amount due, but for the best results, try to pay your balance in full each month. These habits will help in building a credit score from scratch effectively and efficiently.

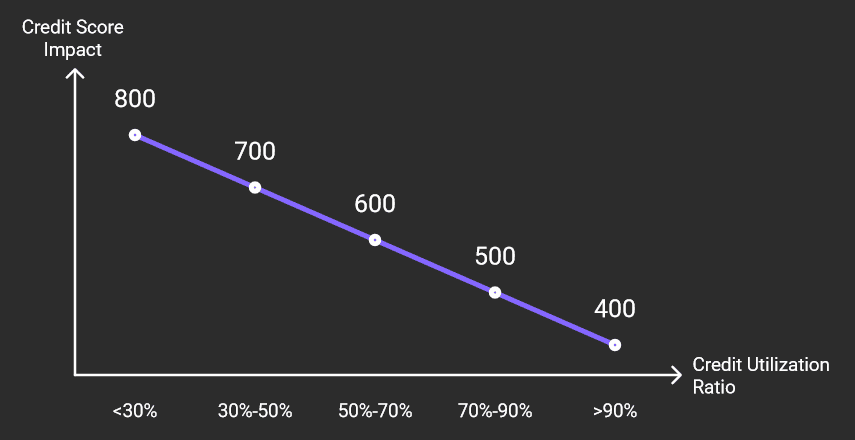

Keep Your Credit Utilization Low While Building Credit from Scratch

Credit utilization—the percentage of available credit you’re using—is a crucial factor when trying to build credit from scratch. Keeping this ratio low shows lenders that you manage credit responsibly, helping in building a credit score from scratch more effectively.

Ideally, your credit utilization should remain below 30%, but keeping it under 10% can improve your score faster.

If you’re wondering how to build your credit score from scratch, consider paying off balances before your statement closes or making multiple payments throughout the month.

These small habits can significantly impact your ability to build credit from scratch quickly and maintain financial health.

How Long to Build Credit from Scratch? Realistic Expectations

If you’re asking, “How long to build credit from scratch?”, the answer depends on how quickly you establish a consistent credit history.

Some people may see progress in just a few months, while others might take a year or more to reach a solid credit score. The speed at which you build credit from scratch depends on factors like payment history, credit utilization, and account diversity.

If you’re focused on building a credit score from scratch, following responsible credit habits and avoiding financial mistakes can help accelerate the process.

Timeline for Credit Building:

- 3-6 months – You may see the first signs of credit activity.

- 6-12 months – You could reach a fair credit score (580-669).

- 12-24 months – With consistent payments, you can achieve a good credit score (670-739).

Avoid These Mistakes When Building Your Credit from Scratch

When learning how to build credit from scratch, avoiding common pitfalls is just as important as adopting good habits.

Many people make mistakes that slow down their progress in building a credit score from scratch, such as mismanaging credit cards or neglecting their credit reports.

Understanding these missteps can help you take smarter actions and avoid setbacks while working on ways to build credit from scratch effectively.

Applying for Too Many Credit Cards Too Soon

Each application results in a hard inquiry, which can temporarily lower your score and make building a credit score from scratch more difficult.

Too many hard inquiries within a short period can signal financial risk to lenders. Instead, apply for one or two credit-building options at first, such as a secured credit card or a credit-builder loan.

This strategic approach can help you build credit from scratch without unnecessary setbacks.

Ignoring Your Credit Report Can Slow Down Building Credit from Scratch

Monitoring your credit regularly is essential when trying to build credit from scratch. Checking your credit report frequently allows you to catch errors early and dispute any inaccuracies before they negatively impact your score.

If you’re building a credit score from scratch, addressing incorrect items promptly can prevent score damage and improve your financial standing.

Additionally, keeping track of your credit activity helps you recognize patterns and adjust habits to strengthen your credit over time.

By staying proactive, you can avoid setbacks and accelerate the process of how to build your credit score from scratch.

How to Build Business Credit from Scratch?

Establishing business credit is essential for entrepreneurs who want to separate personal and business finances.

If you’re looking for ways to build business credit from scratch, starting with the right financial foundation is crucial. A strong business credit profile can help secure loans, get better vendor terms, and improve overall financial stability.

Learning how to build business credit from scratch ensures that your company gains credibility and financial flexibility over time.

If you’re an entrepreneur, you’ll also want to focus on building business credit from scratch. Here’s how:

- Register your business with a legal entity (LLC, Corporation, etc.).

- Obtain an EIN (Employer Identification Number).

- Open a business bank account.

- Apply for a business credit card.

- Establish trade lines with vendors who report to credit bureaus.

FAQs: Common Questions on Building Credit from Scratch

How Long Does It Take to Build a Good Credit Score from Scratch?

Building a credit score from scratch requires patience and consistency. Typically, it takes 6-24 months of responsible credit behavior to establish a solid credit profile.

Factors such as on-time payments, low credit utilization, and maintaining different types of credit accounts can influence the speed of improvement.

If you’re wondering how to build credit fast from scratch, prioritizing these habits can help you achieve a good score more quickly.

Can I Build Credit Without a Credit Card?

Yes, you can build credit from scratch without a credit card by exploring alternative options. Credit-builder loans are designed specifically for those building a credit score from scratch, allowing you to make fixed monthly payments that are reported to credit bureaus.

Another option is rent reporting services, which enable you to include your monthly rent payments in your credit history.

Additionally, becoming an authorized user on someone else’s credit card can help you build your credit score from scratch by benefiting from their responsible credit habits.

What’s the Fastest Way to Build Credit from Scratch?

The fastest way to build credit from scratch is by using a secured credit card, making consistent on-time payments, and keeping your credit utilization low.

A secured credit card provides an excellent opportunity for those with no credit history to start building their score.

Additionally, ensuring that your balances remain low—ideally below 30% utilization—demonstrates responsible credit management.

If you’re wondering how to build credit fast from scratch, combining these strategies will accelerate your progress.

How Do I Start Building My Credit History from Scratch?

To start building credit from scratch, consider opening a secured credit card or applying for a credit-builder loan. Both options allow you to demonstrate responsible credit usage and develop a positive payment history.

Ensuring that you make timely payments each month is crucial for increasing your score. Monitoring your credit regularly and avoiding unnecessary inquiries will also help you build credit score from scratch more effectively.

Conclusion

Now that you know how to build credit from scratch, it’s time to take action and implement these strategies consistently.

Whether you’re focused on building a credit score from scratch for personal financial growth or building business credit from scratch to strengthen your company’s financial standing, the key is patience and responsible credit management.

Credit building takes time, but by making on-time payments, keeping your credit utilization low, and monitoring your credit report, you can steadily improve your score.

Developing these habits early will set you up for long-term financial success and open doors to better credit opportunities in the future.

Mark Clayborne

Mark Clayborne specializes in credit repair, starting and running credit repair businesses. He's passionate about helping businesses gain freedom from their 9-5 and live the life they really want. You can follow him on YouTube.