Get Started for as Low a $107 for the First Month: Click Here

Google

- 4.9 Excellent

- 100 + Reviews

Get Started for as Low a $107 for the First Month: Click Here

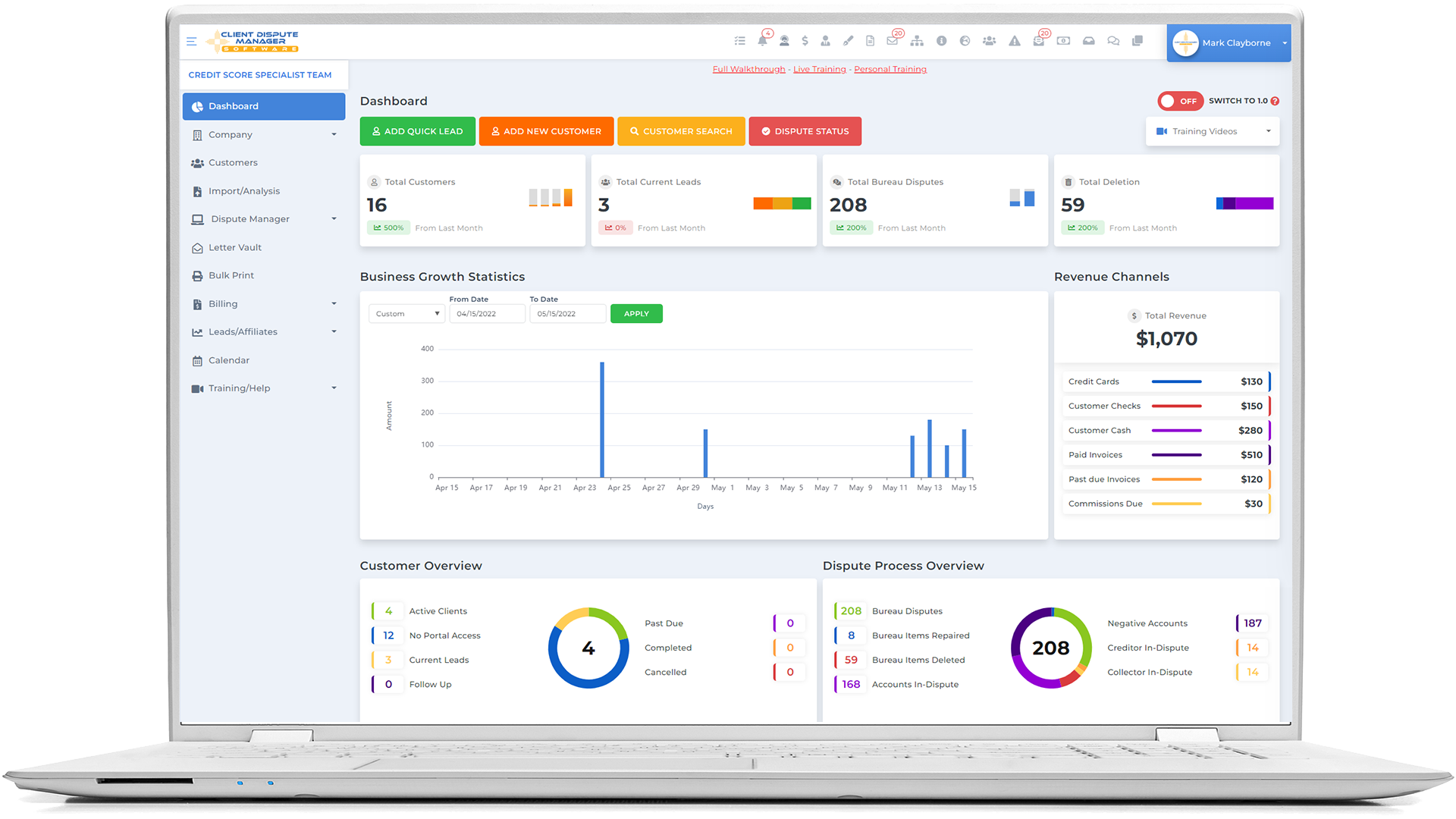

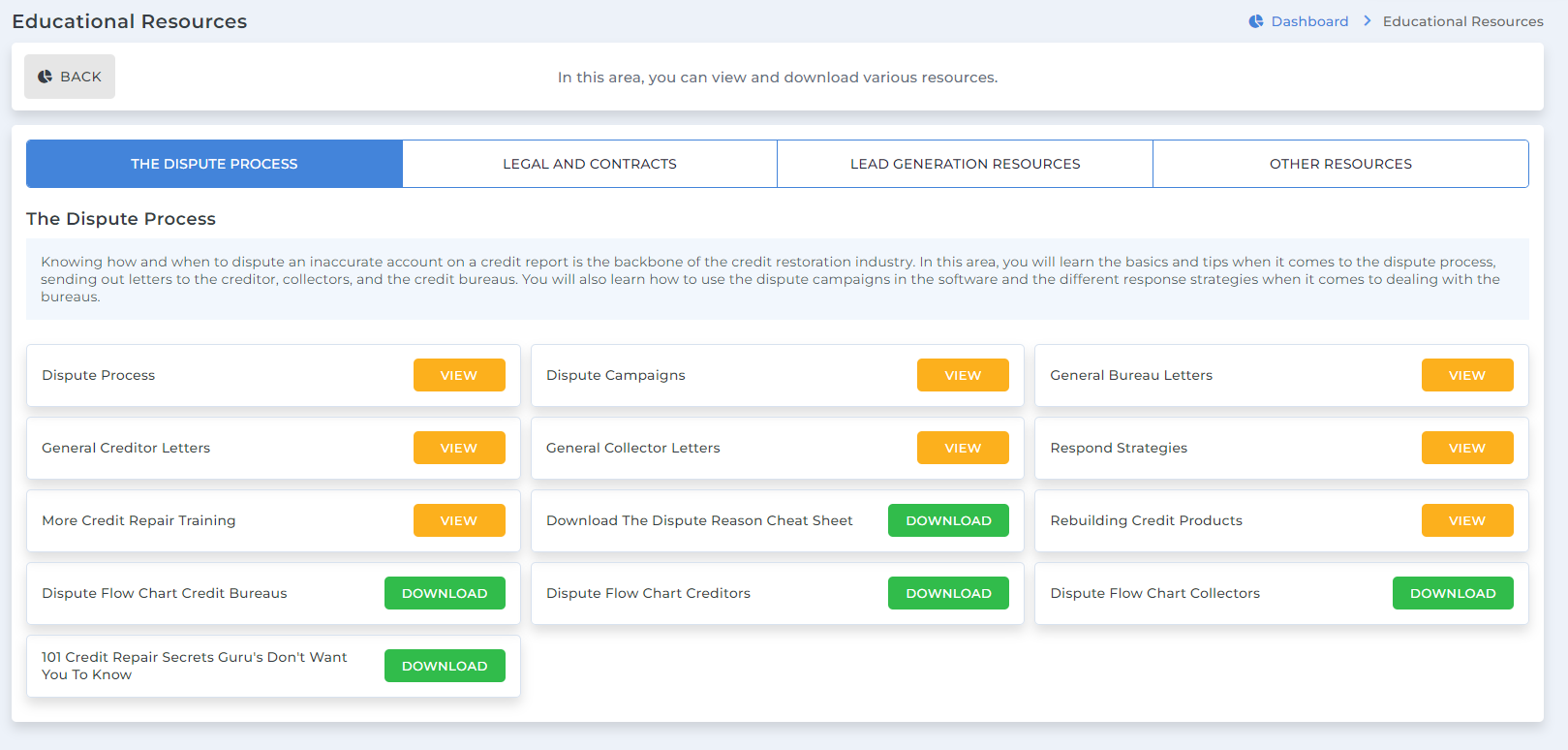

Client Dispute Manager Software is a Credit Repair Business Software that allows you to take your business from zero to the next level. It is a complete business-in-a-box that delivers the core training you need to start, run, and grow your credit repair business.

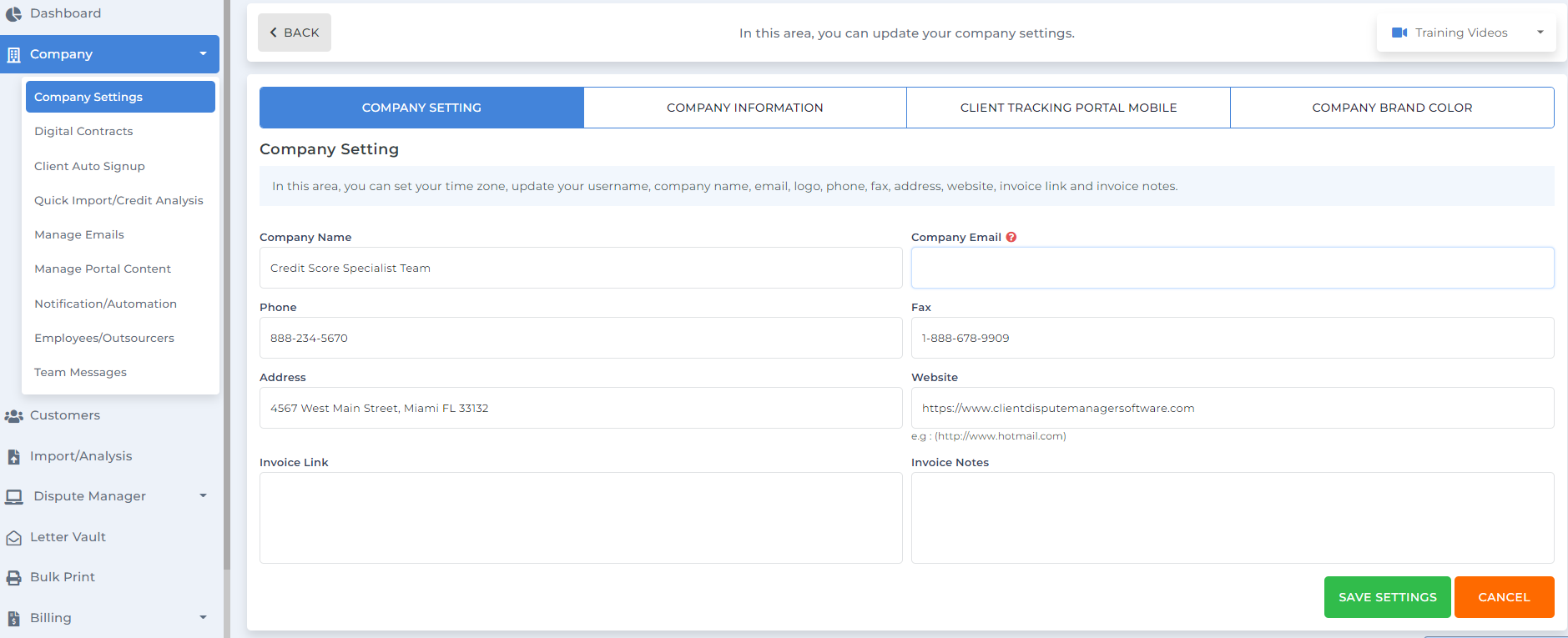

Once you access the credit repair software, it is best to initially set up your company profile and information to align all reports and any outgoing emails from the software.

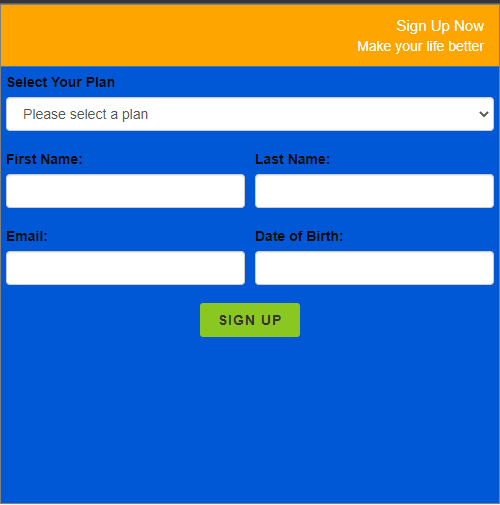

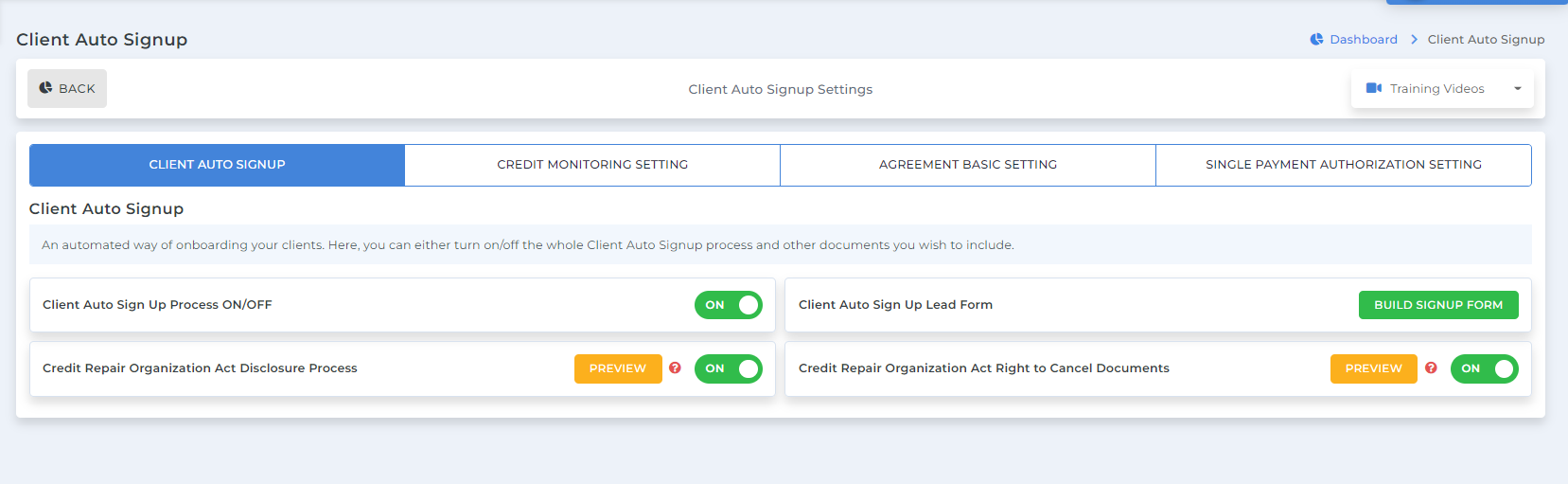

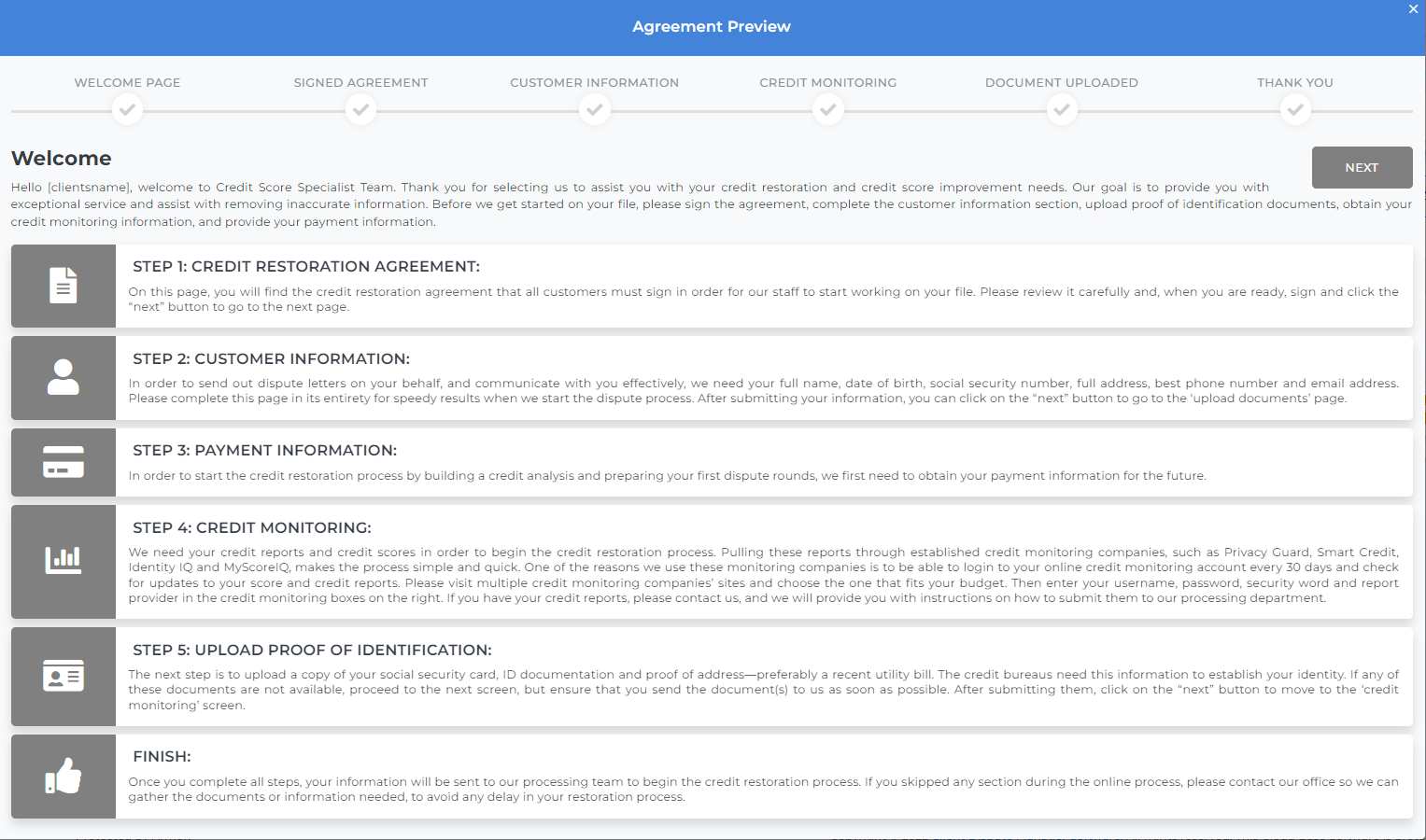

Welcome Page – sets the expectation and gives early instructions on what they will go through.

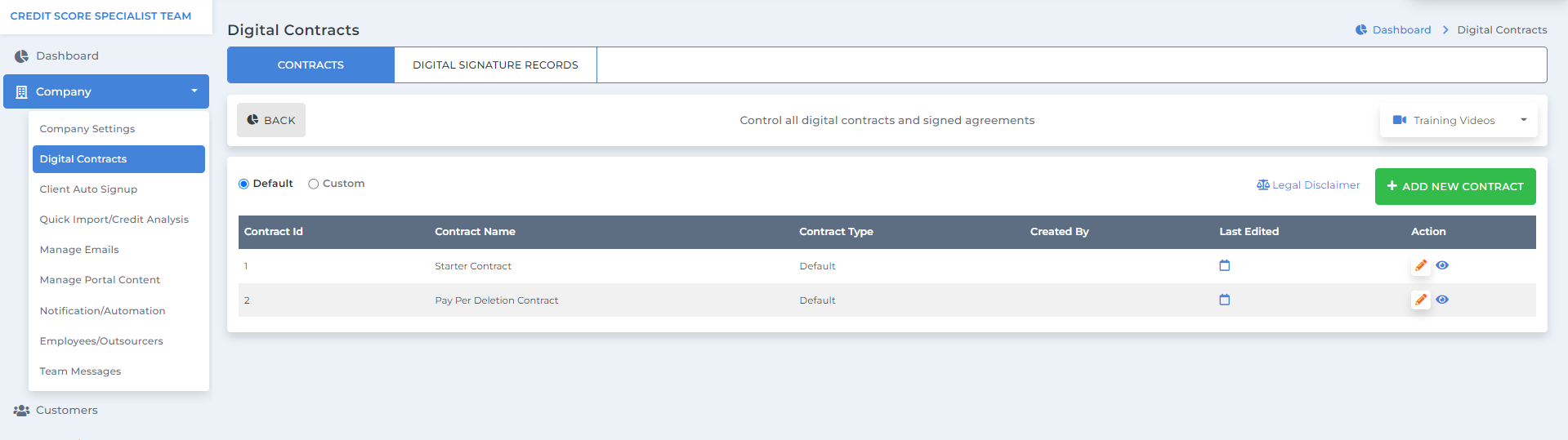

The Agreement – review and sign the contract and disclosures.

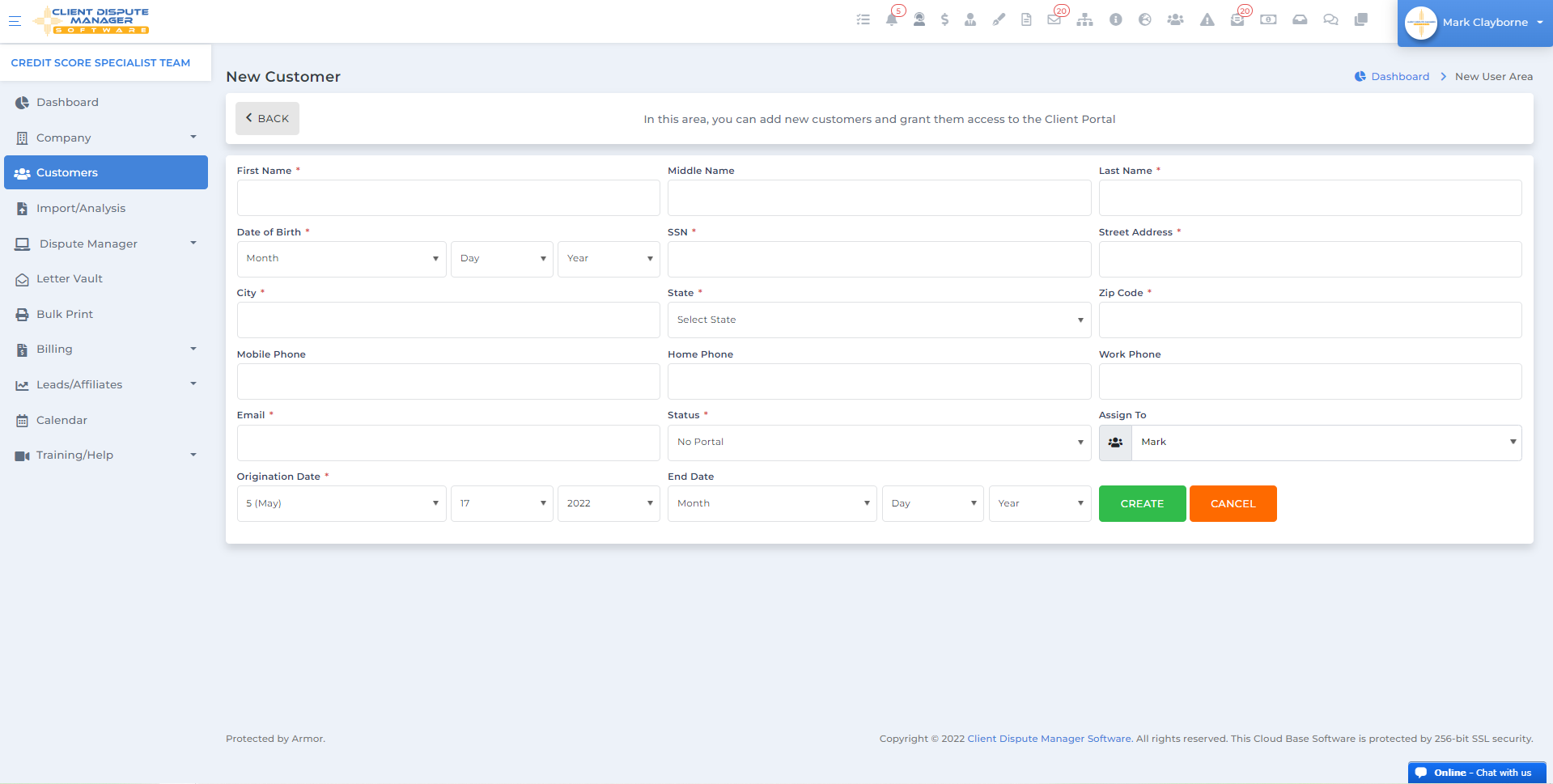

Customer Information – provide all other basic information you need.

Billing Information – collate necessary information to proceed with billing as needed.

Credit Monitoring – collate credit monitoring information to import the credit report easily.

Document Upload – providing initial documents like proof of identification.

Thank You – a message to let them know they completed the process.

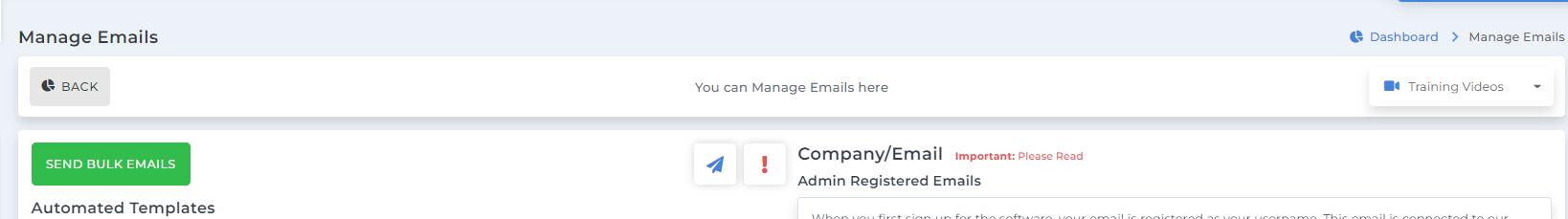

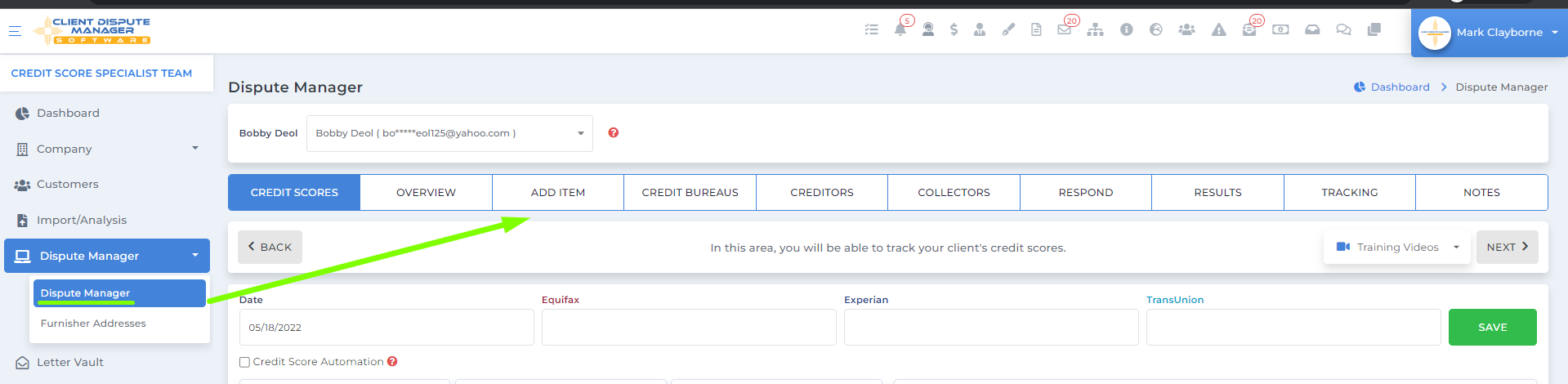

Now that you are fully set up and have your process to go through daily, it is time to learn about other features of this credit repair software that can help you run and grow your business to the next level.