In today’s rapidly evolving financial technology landscape, credit repair services have undergone a dramatic transformation through the integration of artificial intelligence and automation. The emergence of automated credit repair software and credit repair automation tools has revolutionized how businesses approach credit restoration.

From sophisticated credit repair CRM systems to best AI credit repair platforms, the industry now offers unprecedented efficiency and accuracy in dispute resolution. Whether you’re operating an established automated credit repair business or exploring free AI credit repair solutions, understanding these technological advancements is crucial for success in the modern credit repair industry.

This comprehensive guide explores the latest innovations, best practices, and future trends shaping the credit repair technology landscape.

Table of Contents

Start Today and Explore the Features Firsthand!

The Evolution of Automated Credit Repair Software

The credit repair industry has undergone a dramatic transformation with the advent of automated credit repair software. Modern technology solutions have revolutionized how professionals handle credit disputes and client management.

The integration of artificial intelligence with traditional credit repair processes has created unprecedented opportunities for business growth and efficiency improvement. These innovations continue to shape how credit repair agencies operate and serve their clients.

Understanding Modern Credit Repair Automation Systems

The integration of automated credit repair software with AI has revolutionized the industry landscape. These platforms combine credit repair automation with intelligent analysis tools for superior results. Modern credit repair CRM solutions enable unprecedented efficiency in client management.

The continuous evolution of these technologies creates new opportunities for business growth and service improvement. Advanced integration capabilities ensure seamless operation across different platforms and services.

Leveraging Best AI Credit Repair Solutions

The emergence of best AI credit repair technology has transformed traditional dispute processes. Advanced algorithms analyze credit reports and identify optimal dispute strategies automatically. Modern automated credit repair software handles complex cases with precision and consistency.

Integration of credit repair automation tools streamlines workflow management and reduces manual intervention. AI-powered systems learn from historical data to improve success rates and predict outcomes. Sophisticated analytics provide insights into dispute patterns and success factors. The continuous learning capabilities ensure improving performance over time.

Start Today and Explore the Features Firsthand!

Exploring Free AI Credit Repair Options

Many providers offer free AI credit repair trials for comprehensive business evaluation. These platforms demonstrate basic credit repair automation capabilities and potential benefits. Testing automated credit repair software helps assess specific business needs and requirements.

Credit repair CRM integration varies among free solutions but provides valuable insights. Trial periods enable staff training and process optimization for better results. The ability to test multiple solutions helps in making informed decisions. Extended trial periods allow thorough evaluation of system capabilities.

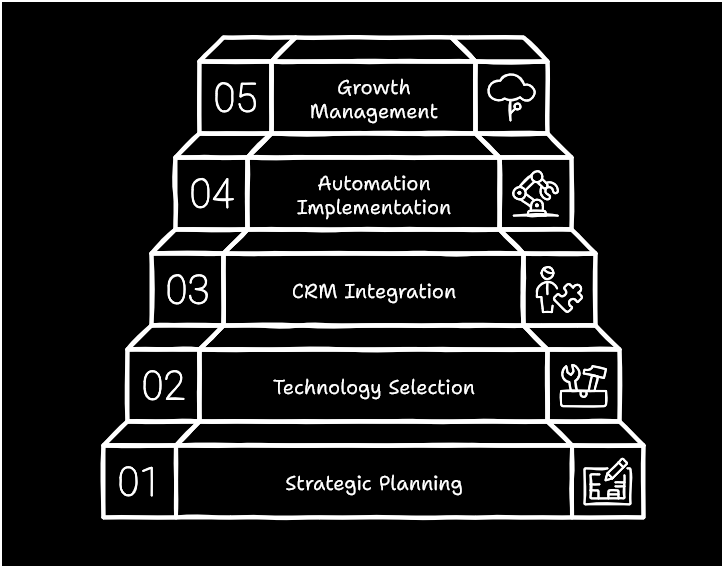

Building an Automated Credit Repair Business

Establishing an automated credit repair business requires strategic planning and technology selection for optimal results. Modern credit repair CRM platforms form the foundation of efficient operations for sustainable growth. The right automated credit repair software enables scalable growth while maintaining service quality.

Integration of various technological components creates a comprehensive solution that positions businesses for success. The implementation of proper systems from the start prevents costly transitions later.

Implementing Credit Repair Automation Tools

Effective credit repair automation improves operational efficiency and accuracy in dispute processing. Best AI credit repair solutions reduce manual intervention requirements while maintaining quality standards. Integration with credit repair CRM systems ensures seamless workflows and data consistency.

Advanced platforms automate routine tasks and communications to improve productivity. Client satisfaction increases with faster dispute resolution and better outcomes. The automation of repetitive tasks allows staff to focus on strategic activities. These systems provide comprehensive tracking and reporting capabilities for better management oversight.

Start Today and Explore the Features Firsthand!

Managing Growth Through Technology

Successful automated credit repair business models leverage comprehensive software solutions for sustainable expansion. Free AI credit repair trials help evaluate scaling potential before making significant investments.

Credit repair automation enables handling larger client volumes efficiently without proportional staff increases. Modern systems provide detailed analytics and reporting capabilities for informed decision-making.

Technology integration supports sustainable business expansion while maintaining service quality. Advanced features ensure compliance and consistency across operations. The scalability of modern solutions accommodates business growth without system limitations.

Workflow Automation and Task Management

Modern automated credit repair software transforms daily operational workflows. Credit repair automation eliminates repetitive manual tasks while maintaining accuracy. Credit repair CRM integration ensures smooth task transitions between team members. The automation of routine processes allows staff to focus on strategic activities and complex cases.

Task Prioritization and Assignment

Leading best AI credit repair platforms include intelligent task management systems. Credit repair automation tools automatically prioritize disputes based on success probability. Automated credit repair business operations benefit from smart workload distribution. The system assigns tasks based on staff expertise and availability.

Free AI credit repair trials demonstrate basic task management capabilities. Advanced analytics help optimize task allocation for maximum efficiency.

Deadline Tracking and Compliance

Advanced credit repair CRM systems maintain automated deadline tracking. Automated credit repair software ensures timely submission of disputes and responses. Best AI credit repair platforms include built-in compliance monitoring.

The system generates alerts for approaching deadlines automatically. Comprehensive tracking prevents missed deadlines and maintains compliance. Regular reports highlight workflow efficiency and potential bottlenecks.

Financial Management and Billing Integration

Modern automated credit repair business solutions include integrated billing systems. Credit repair automation streamlines payment processing and tracking. Credit repair CRM features manage client billing cycles efficiently. The automation of financial processes reduces errors and improves cash flow management.

Automated Payment Processing

Advanced credit repair CRM platforms handle recurring billing automatically. Automated credit repair software maintains accurate payment records and histories. Free AI credit repair solutions often include basic billing features. Integrated payment gateways ensure secure transaction processing. Automated reminders reduce late payments and improve collection rates. Regular financial reports provide insights into business performance.

Start Today and Explore the Features Firsthand!

Financial Reporting and Analytics

Leading best AI credit repair systems generate comprehensive financial reports. Credit repair automation tools track revenue, expenses, and profitability metrics. Automated credit repair business solutions provide real-time financial insights. The system generates customized reports for different stakeholders. Advanced analytics help identify revenue optimization opportunities. Regular financial analysis supports strategic decision-making.

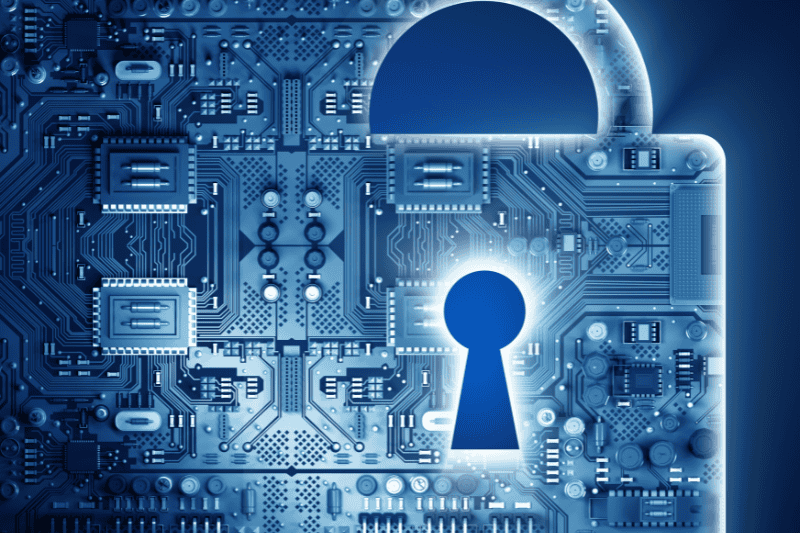

Data Security and Compliance Management

Modern automated credit repair software prioritizes data security and compliance. Credit repair automation includes built-in security protocols and monitoring. Credit repair CRM systems ensure secure data handling and storage. Regular updates maintain compliance with changing regulations.

Automated Compliance Monitoring

Advanced best AI credit repair platforms include comprehensive compliance checks. Credit repair automation tools track regulatory requirements automatically. Free AI credit repair solutions demonstrate basic compliance features. The system flags potential compliance issues for review. Regular audits ensure adherence to industry regulations. Automated updates reflect changing legal requirements.

Secure Data Management

Leading automated credit repair business solutions employ advanced encryption. Credit repair CRM systems protect sensitive client information effectively. Best AI credit repair platforms include multi-layer security protocols. Regular backups ensure data preservation and availability. Access controls maintain information security and privacy. Comprehensive audit trails track all system activities.

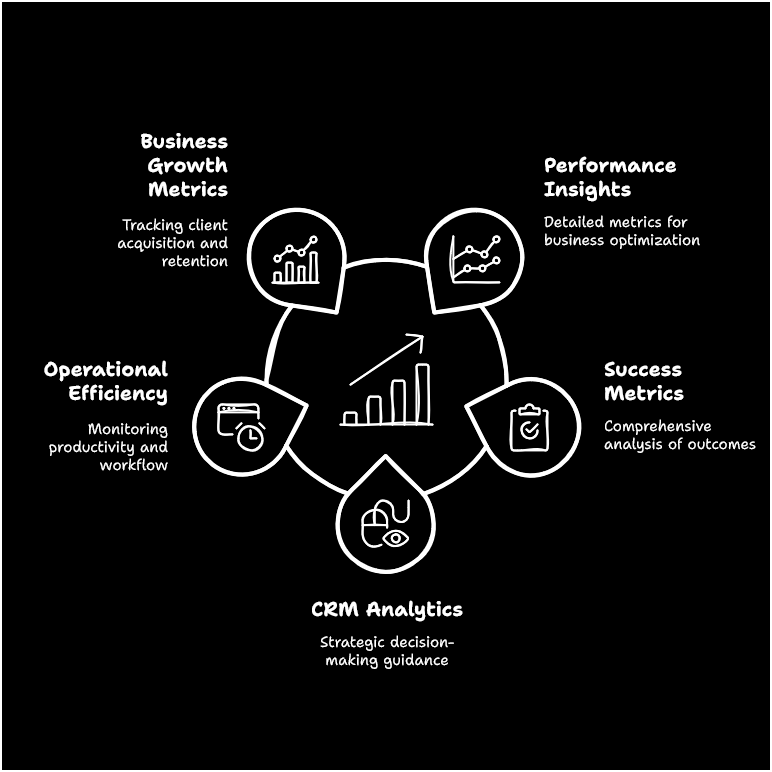

Performance Analytics and Reporting

Modern credit repair automation provides detailed performance insights for business optimization. Automated credit repair software generates comprehensive success metrics across all operational areas. Credit repair CRM analytics guide strategic decision-making and resource allocation.

These advanced reporting capabilities enable data-driven improvements in service delivery and client outcomes. Regular performance monitoring helps identify trends and opportunities for workflow enhancement.

Success Rate Analysis

Leading best AI credit repair platforms track dispute success rates across different categories. The automated credit repair business model benefits from detailed outcome analysis and trending. Credit repair automation tools identify the most effective dispute strategies through pattern recognition.

Advanced analytics compare success rates across different credit bureaus and dispute types. Free AI credit repair trials demonstrate basic reporting capabilities for evaluation. Comprehensive tracking helps optimize dispute strategies and improve success rates.

Start Today and Explore the Features Firsthand!

Operational Efficiency Metrics

Advanced credit repair CRM systems monitor staff productivity and workflow efficiency. Automated credit repair software tracks processing times and task completion rates. Best AI credit repair platforms generate detailed workload distribution reports.

The system identifies bottlenecks and optimization opportunities automatically. Regular efficiency reports help maintain optimal resource allocation. Performance metrics guide training and process improvement initiatives.

Business Growth Analytics

Modern automated credit repair business solutions provide comprehensive growth metrics. Credit repair automation tracks client acquisition and retention rates effectively. Free AI credit repair features demonstrate basic business analytics capabilities. Advanced reporting helps identify market trends and opportunities.

Regular analysis of key performance indicators guides strategic planning. The system generates forecasts based on historical performance data.

Maximizing Credit Repair CRM Efficiency

Advanced credit repair CRM platforms centralize client management operations for better control. Automated credit repair software integration enhances service delivery and client satisfaction. Modern systems enable data-driven decision making through comprehensive analytics. The centralization of data improves accessibility and security across the organization. These platforms provide insights that drive strategic planning and operational improvements.

Optimizing Client Management

Effective credit repair automation streamlines client communications and tracking for better service delivery. Best AI credit repair features enhance dispute success rates through intelligent processing. Integration of free AI credit repair tools helps evaluate system capabilities before full implementation.

Advanced platforms provide comprehensive client portals for transparency and engagement. Automated updates maintain client engagement throughout the dispute process. Real-time access to case information improves client confidence and satisfaction. The automation of routine communications ensures consistent client interaction.

Advanced Security Implementation

Modern automated credit repair software includes robust security features for data protection. Credit repair CRM systems protect sensitive client information through multiple security layers. Credit repair automation tools ensure regulatory compliance while maintaining efficiency.

Advanced encryption safeguards client data from unauthorized access. Regular security updates maintain system integrity and protection. Comprehensive audit trails ensure accountability and compliance documentation. Multi-factor authentication and role-based access control enhance security.

Future Trends in Credit Repair Technology

The evolution of credit repair automation continues to advance with new innovations. Best AI credit repair solutions incorporate increasingly sophisticated algorithms. The integration of blockchain technology promises enhanced security and transparency. Modern platforms continuously adapt to changing regulatory requirements and market needs. The future holds exciting possibilities for further automation and efficiency improvements.

Start Today and Explore the Features Firsthand!

Emerging Technologies and Innovations

Advanced automated credit repair software increasingly leverages artificial intelligence for better results. Credit repair CRM systems evolve to provide more comprehensive business intelligence capabilities. Free AI credit repair solutions offer more sophisticated features as technology advances.

Machine learning algorithms improve dispute success rates through pattern recognition. Predictive analytics help optimize dispute strategies and timing. Integration capabilities expand to include more business tools and services. The continuous evolution of technology creates new opportunities for service improvement.

Industry Impact and Adaptation

The automated credit repair business model continues to evolve with technological advances. Credit repair automation drives industry standards for efficiency and accuracy. Modern credit repair CRM platforms enable new service delivery models. Integration of advanced technologies improves client outcomes and satisfaction.

The accessibility of sophisticated tools levels the playing field for businesses of all sizes. Advanced analytics provide insights for strategic planning and growth. The industry’s future depends on embracing technological innovation.

Conclusion

The integration of automated credit repair software with credit repair automation has transformed industry workflows. From free AI credit repair solutions to advanced best AI credit repair platforms, these technologies streamline operations while improving outcomes.

The modern automated credit repair business relies on credit repair CRM systems for comprehensive workflow management and optimization. This technological evolution continues to drive efficiency and success in credit repair operations.

Mark Clayborne

Mark Clayborne specializes in credit repair, starting and running credit repair businesses. He's passionate about helping businesses gain freedom from their 9-5 and live the life they really want. You can follow him on YouTube.

Start Today and Explore the Features Firsthand!