The Fair Credit Reporting Act (FCRA) plays a crucial role in safeguarding consumer rights in the credit reporting process. For entrepreneurs, individuals facing credit challenges, and those in the credit repair industry, understanding the FCRA is essential.

This guide simplifies the complexities of the law, explains how it impacts credit reporting, and provides actionable steps to stay compliant. Whether you’re improving your own credit or running a credit repair business, this resource has you covered.

Start Today and Explore the Features Firsthand!

What Is the Fair Credit Reporting Act?

The Fair Credit Reporting Act (FCRA) is a federal law enacted in 1970 to ensure accuracy, fairness, and privacy in the credit reporting process. It governs how credit information is collected, shared, and used by businesses, lenders, and credit reporting agencies (CRAs). By regulating these practices, the FCRA protects consumers and promotes trust in the financial system.

The FCRA applies to anyone involved in credit reporting, from major credit bureaus to landlords using credit checks. It provides a framework that balances the needs of businesses and consumers, ensuring a fair and transparent system.

Why Was the FCRA Introduced?

Before the FCRA, credit reports were often inaccurate, and consumers had no way to dispute errors. Credit information could be misused, and there were no privacy protections in place.

The FCRA was introduced to fix these issues. It established a system of accountability for credit bureaus and businesses. By giving consumers rights to access and dispute their credit reports, it created a more equitable credit reporting system.

How Does the FCRA Compliance Work?

The FCRA regulates the practices of credit reporting agencies and the businesses that use their data. Key provisions include:

- Giving consumers the right to access their credit reports annually.

- Allowing disputes of errors in credit reports.

- Requiring businesses to notify consumers when adverse actions are taken based on credit information.

- Ensuring privacy by limiting access to credit reports.

By enforcing these rules, the Fair Credit Reporting Act ensures that credit data is handled responsibly and transparently.

Start Today and Explore the Features Firsthand!

What Are the Key Rights Under the Fair Credit Reporting Act?

The FCRA grants several important rights to consumers, giving them control over their financial information. These rights are essential for addressing inaccuracies, preventing misuse, and maintaining credit health.

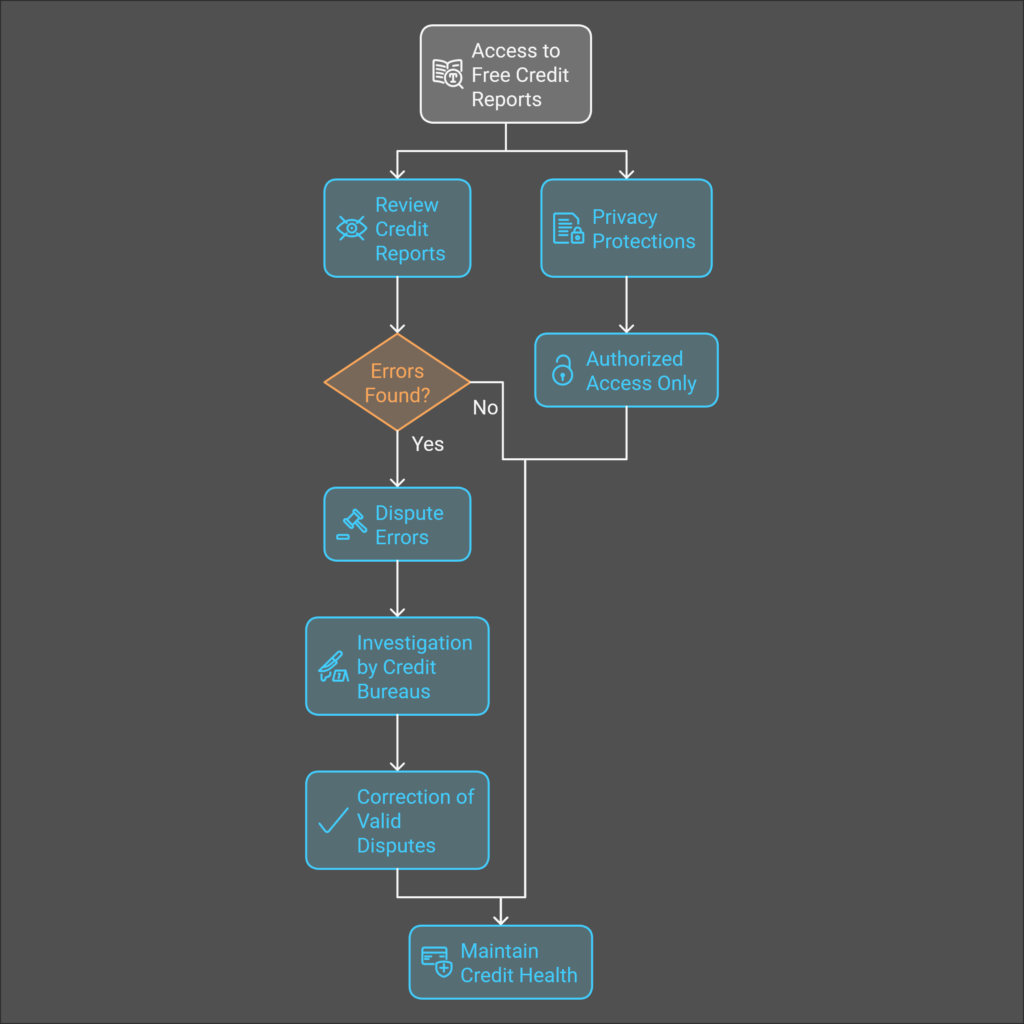

Access to Free Credit Reports

Under the FCRA, consumers are entitled to one free credit report annually from each of the three major credit bureaus: Experian, Equifax, and TransUnion. These reports can be accessed through Annual Credit Report Website, the only website authorized by the federal government.

Reviewing your credit report regularly helps you catch errors or signs of identity theft early. For example, a consumer once discovered a fraudulent loan on her report, disputed it, and resolved the issue before it damaged her credit score.

For credit repair businesses, this right forms the foundation of client services. Identifying errors in credit reports is often the first step in improving a client’s financial health.

Disputing Errors on Credit Reports

The Fair Credit Reporting Act gives consumers the right to dispute inaccuracies in their credit reports. If you find an error, such as an account incorrectly marked as delinquent, you can file a dispute with the credit bureau.

Credit bureaus are required to investigate disputes within 30 days. If the dispute is valid, they must correct the error and notify you. For example, John, a small business owner, noticed a late payment on his report for a loan he had paid on time.

By disputing the error and providing payment records, he had the mistake corrected and improved his credit score.

This process is a cornerstone of the services offered by credit repair organizations under the Credit Repair Organization Act (CROA).

Privacy Protections for Credit Information

The FCRA ensures that only authorized parties can access your credit report. For instance, lenders, landlords, or employers must have a valid reason, and employers need written consent to pull a credit report.

This privacy protection prevents unauthorized use of sensitive financial data. For businesses, adhering to these rules builds trust with clients and ensures FCRA compliance.

Why Is FCRA Compliance Important for Businesses?

Businesses must follow the Fair Credit Reporting Act to avoid legal penalties and maintain customer trust. FCRA compliance ensures that credit information is handled responsibly and ethically.

Obtaining Consumer Consent

Before accessing a consumer’s credit report, businesses must obtain explicit consent. This consent can be written or electronic, depending on the context. For example, employers need written permission before running a credit check during the hiring process.

Clear consent forms help businesses avoid misunderstandings and build trust. Non-compliance, such as failing to obtain consent, can result in hefty fines and lawsuits.

Reporting Accurate Credit Data

Businesses that report credit information to bureaus must ensure its accuracy and timeliness. Incorrect data, such as reporting an account as unpaid when it’s settled, can harm consumers.

Regular audits of reporting practices help businesses meet FCRA standards. A lender that proactively corrects errors not only complies with the law but also builds stronger relationships with customers.

Start Today and Explore the Features Firsthand!

Handling Adverse Actions Transparently

If a business denies credit, employment, or services based on a credit report, it must provide an adverse action notice. This notice explains the decision and gives consumers details to access their credit report.

Transparency in this process ensures fairness and helps consumers take corrective actions. Businesses that ignore this step risk fines and damage to their reputation.

How the Fair Credit Reporting Act Works With Other Laws

The Fair Credit Reporting Act doesn’t operate in isolation. It works alongside other laws to provide comprehensive consumer protection. Understanding these connections is crucial for credit repair professionals and businesses.

The Credit Repair Organization Act (CROA)

The Credit Repair Organization Act regulates credit repair businesses to ensure transparency and ethical practices. It prohibits false promises and requires clear contracts that outline services and fees.

For example, Sarah hired a credit repair company to improve her score, but they promised results they couldn’t deliver. Under CROA, Sarah was able to terminate the contract and file a complaint. Adhering to CROA builds trust and keeps businesses compliant.

Start Today and Explore the Features Firsthand!

The Fair Credit Billing Act (FCBA)

The Fair Credit Billing Act protects consumers from billing errors and fraudulent charges on credit accounts. Under the Fair Billing Act, creditors must investigate disputes within 60 days and resolve them fairly.

This law works in tandem with the FCRA to ensure that credit reports accurately reflect resolved billing disputes. For consumers, it’s an additional layer of protection against financial harm.

The Equal Credit Opportunity Act (ECOA)

The Equal Credit Opportunity Act (ECOA) ensures fairness in credit decisions by prohibiting discrimination based on race, gender, or other personal characteristics. While it is separate from the FCRA, it complements its goal of promoting fairness in financial systems.

How to Stay Compliant With the Fair Credit Reporting Act

Staying compliant with the Fair Credit Reporting Act is crucial for businesses. Non-compliance can result in fines, lawsuits, and loss of consumer trust. Here’s how businesses can ensure they meet FCRA standards.

Educating Employees About FCRA Compliance

Employees who handle credit information should be trained on FCRA requirements. Regular training sessions help staff understand their responsibilities and avoid unintentional violations.

Businesses can also provide quick-reference guides to reinforce compliance procedures. An informed team is the first step toward maintaining ethical practices.

Start Today and Explore the Features Firsthand!

Implementing Regular Audits

Audits ensure that credit reporting practices align with FCRA standards. Businesses should review how they collect, store, and share credit data.

For example, a company that discovered outdated procedures during an audit implemented automated systems to improve accuracy. This proactive approach minimizes errors and enhances compliance.

Leveraging Technology for Compliance

Modern tools, such as credit repair software, can streamline compliance. These systems automate dispute tracking, generate notices, and secure consumer data.

Investing in technology reduces the risk of human error and keeps businesses compliant with FCRA regulations.

Final Thoughts on the Fair Credit Reporting Act

The Fair Credit Reporting Act (FCRA) is a vital law that ensures fairness, transparency, and accountability in credit reporting. For consumers, it provides rights to manage credit effectively. For businesses, it establishes clear rules to handle credit data responsibly.

Understanding related laws, such as the Credit Repair Organization Act and the Fair Credit Billing Act, enhances compliance and promotes ethical practices. By staying informed, you can protect your financial health or grow a successful credit repair business.

Take advantage of the tools and rights provided by the Fair Credit Report.

Mark Clayborne

Mark Clayborne specializes in credit repair, starting and running credit repair businesses. He's passionate about helping businesses gain freedom from their 9-5 and live the life they really want. You can follow him on YouTube.

Start Today and Explore the Features Firsthand!