In today’s digital age, credit repair has evolved from manual paperwork to sophisticated software solutions. The emergence of DIY credit repair software has democratized the industry, enabling both professionals and individuals to achieve remarkable results.

This comprehensive guide explores how modern credit dispute software is revolutionizing credit restoration while maintaining strict credit repair compliance. As we delve into the intricacies of digital credit repair, we’ll discover how technology builds trust in credit repair services and drives consistent credit repair success.

Start Today and Explore the Features Firsthand!

The Evolution of Modern Credit Dispute Software

Modern credit repair has undergone a dramatic transformation with the advent of sophisticated software solutions. The implementation of DIY credit repair software has revolutionized how professionals approach credit restoration, making enterprise-level tools accessible to everyone.

The integration of advanced technology has created unprecedented opportunities for achieving success in credit repair while maintaining strict compliance standards.

Understanding DIY Credit Repair Software Fundamentals

The foundation of effective credit repair lies in understanding how modern software solutions work. Today’s credit dispute software incorporates advanced algorithms and automation features that streamline the entire dispute process.

These sophisticated systems handle everything from initial credit analysis to final resolution tracking, making it easier to maintain credit repair compliance.

The evolution of these tools has significantly improved the efficiency and accuracy of credit repair services. Professional platforms now offer comprehensive solutions that cater to both individual practitioners and large-scale operations.

Building Trust in Credit Repair Through Technology

Establishing credibility in the credit repair industry requires more than just effective dispute handling. Modern DIY credit repair software includes features specifically designed to build and maintain trust in credit repair services.

These platforms provide transparent progress tracking and detailed reporting capabilities that demonstrate commitment to client success. The implementation of systematic approaches has revolutionized how professionals communicate with clients and document their progress.

Advanced security measures protect sensitive client information while maintaining operational efficiency.

Maximizing Success in Credit Repair Through Software Integration

The integration of professional software tools has become essential for achieving consistent results in credit repair. Advanced credit dispute software provides the framework necessary for scaling operations while maintaining high service standards.

The combination of automation and customization features enables practitioners to focus on strategy while ensuring credit repair compliance.

Leveraging Advanced Features for Credit Repair Success

Professional DIY credit repair software includes sophisticated tools that enhance service delivery and client satisfaction. These features range from automated dispute generation to comprehensive progress tracking systems.

The ability to monitor multiple aspects of credit repair operations has transformed how practitioners approach their work. Advanced analytics provide insights that drive better decision-making and improve outcomes. Regular performance analysis helps maintain consistent success in credit repair across all client accounts.

Implementing Effective Credit Repair Compliance Measures

Maintaining regulatory compliance has become increasingly complex in today’s credit repair landscape. Modern credit dispute software incorporates built-in compliance tools that help businesses navigate these requirements effectively.

The automation of compliance-related tasks significantly reduces the risk of regulatory issues while improving operational efficiency. Advanced tracking systems ensure all actions meet current industry standards and regulations.

The integration of comprehensive compliance features has become essential for sustainable credit repair success.

Developing Professional Trust in Credit Repair Services

Building lasting client relationships requires a combination of technology and expertise. Professional DIY credit repair software provides the tools necessary for demonstrating commitment to client success. The implementation of systematic approaches has elevated industry standards while maintaining strict credit repair compliance.

Enhancing Client Communication Through Credit Dispute Software

Effective communication forms the cornerstone of successful credit repair services. Modern credit dispute software includes robust communication tools that facilitate regular client updates and progress reports.

These features help build and maintain trust in credit repair services by keeping clients informed and engaged.

Advanced tracking systems document all client interactions for compliance purposes. The integration of professional communication tools has transformed how practitioners manage client relationships.

Measuring Success in Credit Repair Through Analytics

Professional DIY credit repair software provides comprehensive analytics tools for tracking progress and success rates. These measurements enable practitioners to identify effective strategies and areas for improvement in real-time.

The ability to monitor multiple aspects of operations has enhanced service delivery significantly. Detailed reporting features provide insights that drive better decision-making. Regular analysis of performance metrics helps maintain consistent credit repair success.

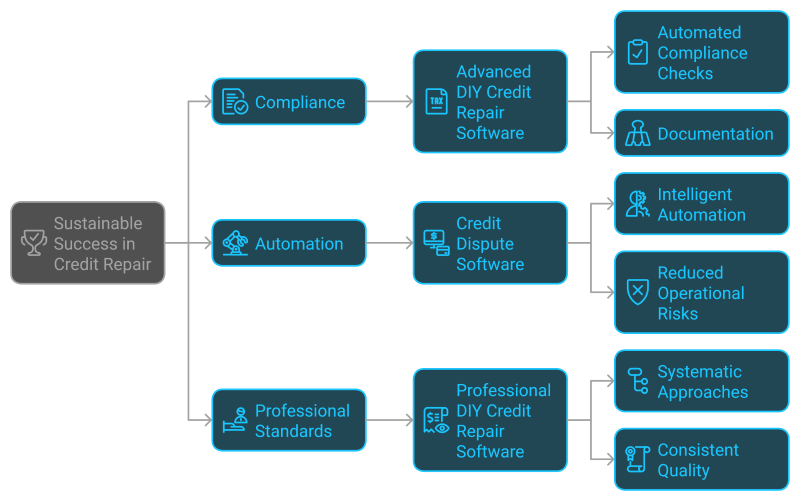

Ensuring Long-term Credit Repair Compliance

Sustainable success in credit repair requires strict adherence to regulatory requirements. Advanced DIY credit repair software includes features that automate compliance checks and documentation. These tools help businesses maintain high standards while achieving consistent success in credit repair.

Automating Credit Dispute Software Workflows

Modern credit dispute software streamlines operations through intelligent automation. These systems handle routine tasks while maintaining accuracy and compliance standards. The automation of key processes has significantly reduced operational risks while enhancing service quality.

Advanced tracking mechanisms ensure all actions align with current industry standards. The integration of automated workflows has become essential for modern credit repair operations.

Maintaining Professional Standards in Credit Repair Success

Achieving sustainable success in credit repair requires ongoing commitment to professional excellence. Professional DIY credit repair software provides the tools necessary for maintaining high service standards.

The implementation of systematic approaches has revolutionized how practitioners deliver results. Advanced features ensure consistent quality across all client accounts. The integration of professional tools has become essential for competitive advantage.

Future Trends in Credit Dispute Software Development

The evolution of credit repair technology continues to accelerate. Advanced DIY credit repair software incorporates emerging technologies that promise even greater efficiency and effectiveness. These developments will further transform how professionals approach credit repair while maintaining strict credit repair compliance.

Innovation in Trust in Credit Repair Services

Future developments in credit dispute software will focus on enhancing transparency and client engagement. These advancements will strengthen trust in credit repair services through improved communication and reporting capabilities.

The integration of new technologies will revolutionize how practitioners demonstrate results. Advanced features will provide even greater insights into credit repair progress. The evolution of professional tools will continue to elevate industry standards.

Conclusion: Embracing Digital Solutions for Credit Restoration

The future of credit repair lies in the effective implementation of professional software solutions. By leveraging advanced DIY credit repair software while maintaining strict credit repair compliance, practitioners can achieve consistent success in credit repair. The ongoing development of credit dispute software promises even greater opportunities for building trust in credit repair services and achieving sustainable credit repair success.

Mark Clayborne

Mark Clayborne specializes in credit repair, running and growing a credit repair businesses. He's passionate about helping businesses gain freedom from their 9-5 and live the life they really want. You can follow him on YouTube.

Start Today and Explore the Features Firsthand!

Below Is More Content For Your Review:

- Unlock the Power of DIY Credit Repair Software: A Comprehensive Guide

- Revolutionizing Financial Recovery: The Rise of Automation in Credit Repair