The credit repair industry thrives on trust, efficiency, and results. To turn prospects into paying clients, you need a streamlined credit repair sales funnel that captures leads, nurtures trust, and converts potential customers into loyal advocates.

Achieving this requires a deep focus on DIY credit repair software, maintaining credit repair compliance, and leveraging tools like credit dispute software to build credibility and ensure long-term credit repair success.

In this article, we’ll explore how to create and optimize every stage of your sales funnel, using effective strategies to guarantee success in credit repair while building trust in credit repair among your clients.

Start Today and Explore the Features Firsthand!

What Is a Credit Repair Sales Funnel and Why Does It Matter?

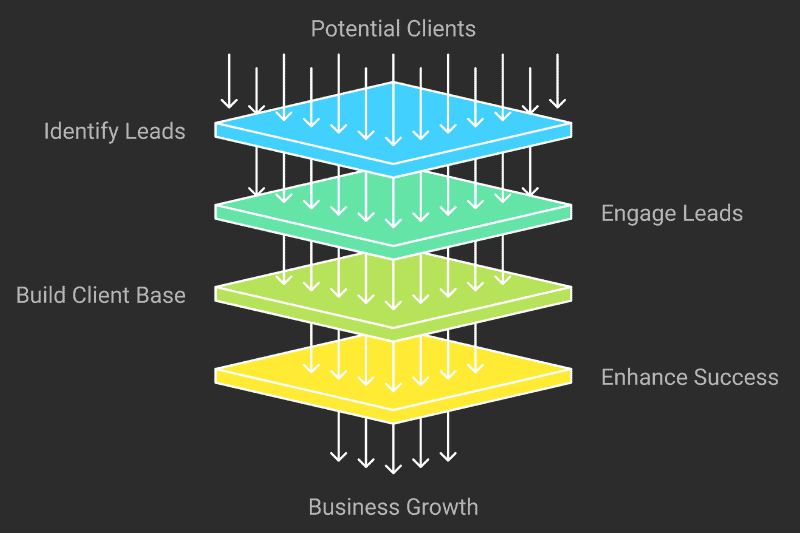

A credit repair sales funnel is a structured framework that outlines how businesses attract, nurture, and convert prospects. It is essential for creating a seamless path from lead generation to long-term client retention.

Why Credit Funnel Optimization Drives Success in Credit Repair

An optimized funnel ensures:

- Improved Efficiency: Streamline processes with tools like DIY credit repair software to reduce manual effort.

- Compliance at Every Step: Ensuring credit repair compliance minimizes legal risks while building client trust.

- Trust in Credit Repair: A transparent and reliable funnel enhances client confidence.

Businesses that master their funnel see improved conversions, better client relationships, and long-term credit repair success.

Stage #1: Attracting Prospects With Credit Repair Lead Generation

The first stage of the credit repair sales funnel is about generating leads. This involves attracting individuals who are actively seeking credit repair solutions and introducing them to your services.

Effective Strategies for Credit Repair Lead Generation

Write articles that address common credit-related concerns, such as “What Is the Best DIY Credit Repair Software?” or “How to Stay Compliant in Credit Repair.” Use keywords like credit repair compliance and credit repair success to rank higher in search results. Engaging and informative content establishes your business as an authority in the industry.

Example: Publish a guide titled, “10 Proven Strategies to Achieve Credit Repair Success Using Affordable Tools.”

Social Media Advertising

Leverage platforms like Facebook and Instagram to target individuals based on their financial interests. Promote free resources like webinars or consultations to showcase how credit dispute software simplifies the repair process. Testimonials highlighting success in credit repair further build confidence.

Example: Share a client’s story of improving their credit score by 100 points with the help of your services.

Lead Magnets and Free Resources

Offer valuable tools like e-books, credit score assessments, or free consultations to capture leads. For instance, an e-book titled “How to Use DIY Credit Repair Software for Faster Results” attracts prospects looking for hands-on solutions.

Example: Provide a downloadable guide on “Mastering Credit Disputes While Ensuring Credit Repair Compliance.”

Why Lead Generation Is Essential for Credit Repair Success

Quality lead generation ensures your funnel attracts prospects who are actively seeking credit repair solutions. Tools like credit dispute software simplify lead onboarding, while transparent communication fosters trust in credit repair.

Start Today and Explore the Features Firsthand!

Stage #2: Nurturing Leads With Credit Funnel Optimization

After attracting leads, the next step is nurturing them. This stage focuses on building relationships, educating prospects, and demonstrating the value of your services. Credit funnel optimization ensures that leads move closer to becoming paying clients.

How to Nurture Leads Effectively

Send targeted email sequences addressing specific pain points. For example, educate prospects on how DIY credit repair software can streamline their journey or how staying compliant ensures long-term success. Include tips like “3 Steps to Ensure Credit Repair Compliance.”

Example Email Series:

- Email 1: Welcome and introduction to your services.

- Email 2: How Credit Dispute Software Simplifies the Process.

- Email 3: Client Testimonial on Achieving Credit Repair Success.

Educational Webinars

Host sessions on topics like “How to Achieve Success in Credit Repair Without Legal Risks.” These events provide value while positioning your business as an expert. Use real-life examples to show how your tools ensure credit repair compliance.

Example: A webinar titled “The Role of DIY Credit Repair Software in Simplifying Disputes” can engage prospects effectively.

Success Stories and Testimonials

Highlight client achievements to build trust in credit repair. For example, feature a case study showing how a client used your services and improved their credit score significantly while staying compliant.

Example: “John resolved five major credit disputes in three months using our software, achieving remarkable credit repair success.”

The Role of Engagement in Nurturing Leads

Engagement helps build trust and keeps your business top of mind for potential clients. By delivering consistent value, you ensure that leads see your business as the best option for their credit repair needs.

Start Today and Explore the Features Firsthand!

Stage #3: Converting Leads Into Paying Clients

The decision phase of the credit repair sales funnel focuses on converting nurtured leads into paying clients. This stage requires addressing objections, showcasing value, and ensuring a seamless onboarding process.

Strategies to Drive Conversions

Use user-friendly tools like DIY credit repair software to make onboarding effortless. Clearly explain your processes and how your services adhere to credit repair compliance standards. Simplicity and transparency encourage prospects to take the next step.

Example: Provide an easy-to-follow guide on signing up and using credit dispute software for faster results.

Social Proof and Results

Showcase testimonials and case studies that highlight success in credit repair. For instance, a story about a client resolving disputes and increasing their credit score by 120 points reassures prospects of your capabilities.

Example: “Sarah improved her credit score by 150 points using our tools, achieving remarkable credit repair success.”

Exclusive Offers and Promotions

Create time-sensitive offers to encourage immediate action. For instance, offer free consultations or discounts on premium features in your DIY credit repair software.

Example: “Sign up today and receive a free credit analysis worth $150! Limited-time offer.”

Addressing Objections

Address common concerns about cost, timelines, and outcomes by offering free consultations and transparent communication. Highlighting your focus on credit repair compliance reassures clients of your professionalism.

Start Today and Explore the Features Firsthand!

Stage #4: Retaining Clients for Long-Term Success in Credit Repair

Retention is a crucial aspect of credit repair success. Loyal clients generate recurring revenue, refer new business, and enhance your reputation.

How to Retain Clients Effectively

Keep clients informed about their journey with monthly reports. Highlight milestones achieved with tools like credit dispute software and how their actions comply with regulations.

Example: “This month, your credit score improved by 40 points—great progress! Let’s continue working toward your goals.”

Loyalty Programs

Offer rewards to long-term clients, such as discounts on advanced services or free upgrades to premium DIY credit repair software features. These programs make clients feel valued.

Example: “As a loyal client, you’re eligible for a 15% discount on our premium credit monitoring service.”

Ongoing Education

Share tips for maintaining good credit even after disputes are resolved. For example, create content on “Staying Compliant With Credit Laws After Repairing Your Credit.”

Example: A blog series titled “Maintaining Financial Wellness for Long-Term Credit Repair Success” keeps clients engaged.

Scaling Your Credit Repair Sales Funnel With Automation

As your business grows, automation becomes essential for managing the credit repair sales funnel. Automation ensures efficiency without sacrificing personalization.

Benefits of Automation

- Efficient Lead Management: Use CRM tools to track where each lead is in the funnel. Automation allows you to personalize communication based on client needs and behaviors.

- Automated Follow-Ups: Schedule emails to remind clients of their next steps. For instance, send follow-ups like, “Complete your onboarding process to achieve faster credit repair success.”

- Scalability: Automating processes like onboarding and compliance checks allows you to handle more clients while maintaining trust in credit repair and ensuring credit repair compliance.

Conclusion

An optimized credit repair sales funnel is key to attracting, converting, and retaining clients. By leveraging tools like DIY credit repair software, adhering to credit repair compliance, and fostering trust in credit repair, businesses can achieve consistent credit repair success.

Take action today by mapping out your funnel, refining each stage, and integrating automation tools. With a focus on client satisfaction and compliance, your success in credit repair will continue to grow.

Mark Clayborne

Mark Clayborne specializes in credit repair, running and growing a credit repair businesses. He's passionate about helping businesses gain freedom from their 9-5 and live the life they really want. You can follow him on YouTube.

Start Today and Explore the Features Firsthand!