As we enter 2026, the landscape of running a successful credit repair business has evolved dramatically. Modern credit repair automation solutions and business credit repair software have revolutionized how companies operate, making it easier than ever to scale while maintaining service quality.

This comprehensive guide will explore how credit repair business software and automated credit repair business systems can transform your operations.

Transforming Your Credit Repair Business Through Credit Repair Automation Software

The modern credit repair business landscape demands efficiency and scalability that only advanced technology can provide. Implementation of credit repair automation software has become crucial for success in today’s competitive market. Leading companies are leveraging sophisticated credit repair software for business to handle increasing client demands while maintaining service quality.

The transition from manual processes to automated systems represents more than just a technological upgrade – it’s a fundamental shift in how credit repair businesses operate. This transformation enables companies to process more disputes, manage larger client bases, and maintain higher accuracy rates than ever before.

The Evolution of Credit Repair Technology

The credit repair industry has witnessed significant technological advancement over the past decade. What began as simple spreadsheet-based tracking systems has evolved into sophisticated, AI-driven platforms that can handle complex dispute processes automatically.

This evolution has been driven by increasing regulatory complexity in the credit repair industry, coupled with growing consumer demand for transparent, efficient services.

The need for scalable solutions that maintain compliance has become paramount, especially as competition from tech-savvy market entrants continues to rise.

Additionally, modern consumers have higher expectations for real-time reporting and updates, pushing the industry toward more sophisticated technological solutions.

Why Your Credit Repair Business Needs Business Credit Repair Software?

Modern credit repair business software has transformed how companies handle client disputes and manage operations. Every successful credit repair business now relies on some form of credit repair automation to stay competitive.

The implementation of automated credit repair business systems allows companies to handle hundreds of clients simultaneously without sacrificing service quality.

Credit repair automation software has become the backbone of successful operations, enabling businesses to scale efficiently while maintaining compliance. The right business credit repair software can dramatically reduce manual workload while improving accuracy and client satisfaction.

Key Benefits of Automation Implementation

Credit repair automation software has become the backbone of successful operations, enabling businesses to scale efficiently while maintaining compliance. The right business credit repair software can dramatically reduce manual workload while improving accuracy and client satisfaction.

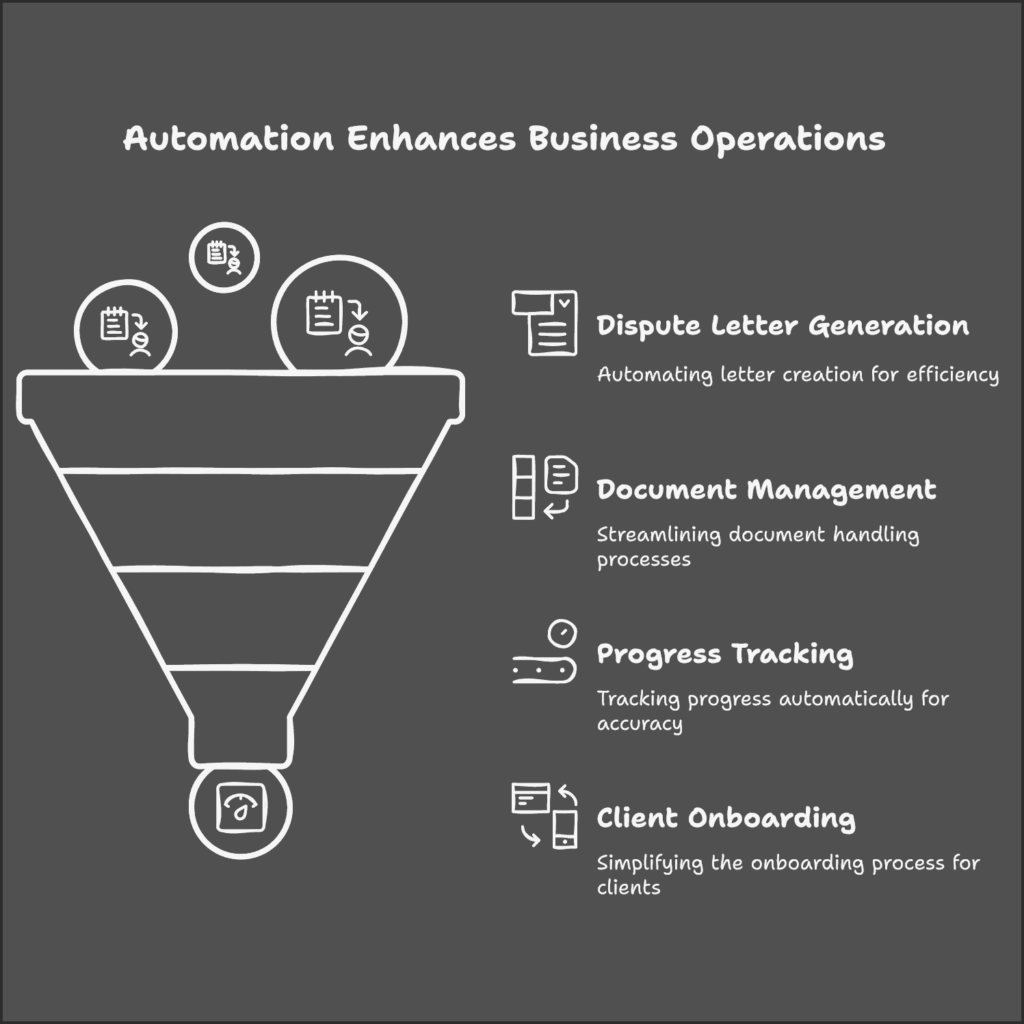

Operational efficiency is significantly enhanced through automated dispute letter generation, streamlined document management, automated progress tracking, and simplified client onboarding processes.

These systems ensure enhanced accuracy and consistency through standardized dispute processes and reduced human error, while maintaining reliable tracking systems and consistent communication templates.

The scalability benefits are substantial, as businesses can handle more clients effectively through automated client communication and efficient resource allocation, all while maintaining streamlined workflow management.

Essential Credit Repair Business Software Features

Today’s credit repair business requires sophisticated tools to operate efficiently. Advanced credit repair business software provides comprehensive solutions for every aspect of operations. The latest credit repair automation systems integrate seamlessly with existing business processes while enabling rapid scaling.

Core Software Components

Modern credit repair software platforms typically include several essential components that work together seamlessly. The client portal management system provides secure login capabilities, comprehensive document upload functionality, detailed progress tracking dashboards, and integrated communication channels, all while managing payment processing efficiently.

The dispute processing center handles template management and automated letter generation, while maintaining status tracking and bureau-specific workflows with comprehensive response management capabilities.

The business analytics dashboard provides detailed insights through performance metrics, revenue tracking, and success rate analysis, while monitoring client retention data and key growth indicators.

Leveraging Credit Repair Automation for Compliance

Every successful credit repair business must prioritize compliance with industry regulations. Modern business credit repair software includes built-in compliance features that automate legal requirements.

The credit repair automation software handles everything from contract generation to disclosure management. Sophisticated automated credit repair business systems ensure all operations meet FCRA and CROA requirements.

Implementation of proper credit repair software for business helps prevent costly compliance violations. These automated systems maintain detailed audit trails for all compliance-related activities.

Automated Compliance Management

The success of a modern credit repair business depends heavily on effective automation and technology implementation. Choosing the right credit repair business software and implementing proper credit repair automation systems are crucial steps for growth. Professional credit repair software for business solutions, combined with business credit repair software features, enable companies to serve more clients efficiently.

The future of credit repair automation software continues to evolve, making automated credit repair business operations more effective than ever. As we move further into 2025, embracing credit repair automation is not just an option – it’s essential for long-term success in the industry.

Companies that leverage these technological advances while maintaining focus on client service and compliance will be best positioned for sustained growth and success in the competitive credit repair market.

Client Management Systems for Your Credit Repair Business

Effective client management is crucial for any credit repair business looking to scale. Advanced credit repair business software provides comprehensive client management solutions. Modern credit repair automation tools enable seamless client communication and progress tracking.

Enhanced Credit Repair Automation for Client Communication

The latest business credit repair software includes sophisticated client portals for enhanced service delivery. Every credit repair automation software system provides 24/7 access to client information and updates. The automated credit repair business model relies heavily on client self-service capabilities.

Implementation of proper credit repair software for business improves client satisfaction through transparency and accessibility. These systems enable clients to track their progress and communicate effectively with their service providers.

Dispute Management with Credit Repair Business Software

At the core of every credit repair business is the dispute management process. Modern credit repair business software excels in automating dispute workflows. The latest credit repair automation systems provide comprehensive dispute management solutions.

Advanced Credit Repair Automation Software for Disputes

Advanced business credit repair software leverages artificial intelligence for improved dispute processing. The credit repair automation software includes hundreds of customizable dispute letter templates.

Modern automated credit repair business systems can handle complex dispute strategies automatically.

Implementation of sophisticated credit repair software for business dramatically improves dispute success rates. These systems continuously learn and adapt to changing dispute requirements and scenarios.

Financial Management in Your Credit Repair Business

Successful financial management is crucial for any credit repair business growth. Modern credit repair business software includes comprehensive billing and payment solutions. The latest credit repair automation tools streamline all financial processes.

Business Credit Repair Software Payment Features

Advanced business credit repair software integrates seamlessly with popular payment processors. The credit repair automation software handles recurring billing and payment tracking automatically.

Sophisticated automated credit repair business systems provide detailed financial reporting and analytics. Implementation of proper credit repair software for business ensures consistent cash flow and revenue tracking. These systems also handle refunds and payment disputes efficiently.

Marketing Your Credit Repair Business Through Automation

Growing a successful credit repair business requires effective marketing tools. Modern credit repair business software includes comprehensive marketing automation features. The latest credit repair automation systems streamline lead generation and nurturing.

Credit Repair Automation Software Marketing Tools

Advanced business credit repair software provides sophisticated lead management solutions. The credit repair automation software includes website integration for automatic lead capture.

Modern automated credit repair business systems nurture leads through automated email campaigns. Implementation of proper credit repair software for business improves lead conversion rates significantly.

These systems track and analyze marketing performance for optimal results.

Security Solutions for Your Credit Repair Business

Data security is paramount for any modern credit repair business. Advanced credit repair business software includes comprehensive security features. The latest credit repair automation systems protect sensitive client information.

Business Credit Repair Software Security Features

Modern business credit repair software implements bank-level security measures. The credit repair automation software includes encrypted communication and data storage.

Sophisticated automated credit repair business systems provide detailed security audit trails. Implementation of proper credit repair software for business ensures compliance with data protection regulations. These systems regularly backup all important business data.

Conclusion

The success of a modern credit repair business depends heavily on effective automation and technology implementation. Choosing the right credit repair business software and implementing proper credit repair automation systems are crucial steps for growth.

Professional credit repair software for business solutions, combined with business credit repair software features, enable companies to serve more clients efficiently.

The future of credit repair automation software continues to evolve, making automated credit repair business operations more effective than ever. Embracing credit repair automation is essential for long-term success in the industry.

Mark Clayborne

Mark Clayborne specializes in credit repair, starting and running credit repair businesses. He's passionate about helping businesses gain freedom from their 9-5 and live the life they really want. You can follow him on YouTube.

Start Today and Explore the Features Firsthand!