- Credit Repair Automation uses AI and smart software to fix credit reports faster and with fewer errors—great for individuals and businesses.

- AI Credit Repair Software pulls reports, finds errors, writes dispute letters, and tracks progress automatically.

- Credit Repair Business automation helps you serve more clients, stay organized, reduce stress, and grow your business without burnout.

- The Best Automation Tools for credit repair services include dispute generators, real-time tracking, CRM, billing features, and legal compliance.

- Tools like Client Dispute Manager Software are perfect for those who want to automate credit repair business tasks while staying compliant and scaling up fast.

Fixing mistakes on your credit report can be really hard and stressful. It takes time, and it’s easy to mess things up. Whether you’re trying to fix your own credit or help others, the old way of doing things takes a lot of work. That’s where credit repair automation comes in.

In this guide, you’ll learn how AI credit repair software makes everything easier. We’ll show you how it helps people fix credit reports faster and helps business owners serve more clients without working all day.

We’ll also talk about the best automation tools for credit repair services, how to use them the right way, and how they can help your business grow.

Start Today and Explore the Features Firsthand!

What Is Automated Credit Repair and How Does It Work?

Automated credit repair means using smart tools to help find and fix problems on credit reports. In the past, people had to do everything by hand. They had to look at reports, write letters, and wait for results.

Now, with automated credit repair software, the software can do most of that work for you.

With credit repair automation, computers scan credit reports, find mistakes, write dispute letters, and even track everything for you. This makes it faster and easier for people to get better credit.

How AI Credit Repair Software Is Changing Everything

Before, fixing credit meant tons of paperwork and slow results. Now, AI credit repair software is changing all of that. These smart tools learn how to fix problems better over time.

They also save people hours of manual work each week and make it easier to track every step of the process. This helps both individuals and credit repair businesses feel more in control.

Here’s what AI software can do:

- Pull credit reports from the three main credit bureaus

- Look for mistakes or bad information

- Create letters to fix those problems

- Send reminders and updates

- Track the progress of each case

With automated credit repair, people get help faster, with fewer mistakes. They don’t have to worry about missing steps or writing confusing letters. Everything is handled in a smooth, automatic way that saves time and gets better results.

Start Today and Explore the Features Firsthand!

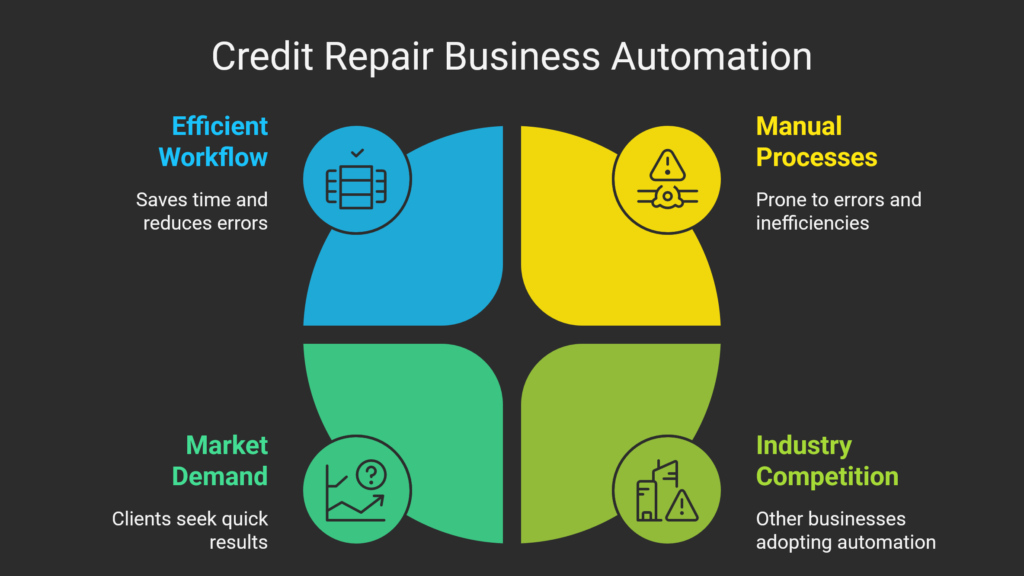

Why Credit Repair Business Automation Matters Now?

If you run a credit repair company, your time is valuable. That’s why credit repair business automation is so important. It helps you do more work without spending more time.

Automation also helps you stay organized and avoid forgetting important steps. With the right tools, you can grow your business and help more people with less stress.

Here’s why you should automate your business:

- Clients want quick updates and results

- Doing everything by hand can cause mistakes

- Automation helps you grow without stress

- Other businesses are already using it

With good automation software for credit repair, you can help more clients and make fewer errors. It also gives you more time to focus on helping people understand their credit. Plus, it makes your business look more professional and trustworthy.

Key Features of a Credit Repair Automation Tools

The best automation tools for credit repair services offer several features that make your work faster and easier. These tools help you stay organized, save time, and improve the way you manage clients and disputes.

Client Management in Automated Credit Repair Software

Managing client information is simple with automated credit repair software. You can store contact details, upload documents, and track each person’s progress all in one place.

This makes it easier to keep up with each case and provide better customer service. It also helps businesses stay organized as they grow, and reduces the risk of losing important information.

With a well-structured system, you can give clients the attention they deserve. The ability to see everything in one dashboard allows you to respond faster to client questions and deliver a more personalized experience.

As your client base grows, these credit repair automation tools help keep everything running smoothly without missing a beat.

Dispute Letter Tools in AI Credit Repair Software

Creating dispute letters by hand can take hours. With AI credit repair software, you can create, customize, and send letters in just a few clicks.

Many systems even include templates to save you time and make sure the letters follow the rules.

These tools can also personalize letters based on the type of credit error, helping to improve your chances of success.

The faster you send accurate disputes, the sooner clients may see results. By using automated credit repair software, you can also track which letters were sent and what responses you’ve received.

This keeps everything organized and makes follow-up easier for both you and your clients.

Start Today and Explore the Features Firsthand!

Credit Report Access with Credit Repair Automation Software

One of the best parts of credit repair automation software is being able to pull full credit reports directly from the major credit bureaus. The software then scans for errors or negative items and gives you suggestions for how to fix them.

This is a big help for both professionals and people repairing their own credit. Having fast access and automatic scanning cuts down on time and helps you act right away.

It’s one of the smartest ways to get ahead in the credit repair process. With automated credit repair software, you don’t have to waste time reading line by line.

Everything is flagged for you, so you can focus on fixing issues instead of searching for them. This makes the entire credit repair journey faster and more efficient.

Legal Compliance in Automation Software for Credit Repair

Following the law is very important in credit repair, especially when you’re using automation software for credit repair. The best systems include built-in features that help you stay compliant every step of the way.

These tools track client agreements, log all activities, and help you follow important rules like those from the FTC and CROA.

This protects your business from legal trouble and helps keep your clients’ information safe. Using credit repair automation software that keeps you compliant shows that your business is responsible and trustworthy.

It also makes it easier to train team members and maintain consistent, ethical practices.

Billing Features in Credit Repair Business Automation Tools

Running a business also means handling money. With credit repair business automation, you can set up automatic billing and send invoices without doing it manually.

This saves you time and keeps your business running smoothly.

It also ensures that payments are consistent and tracked properly. Your clients will appreciate easy payment systems, and you’ll avoid delays or missed charges. Plus, having everything in one place reduces the risk of billing errors.

It also gives you insights into cash flow, so you can plan better and grow your business with confidence.

Client Dispute Manager Software - A Powerful Automated Credit Repair Software

One of the best automation tools for credit repair services is Client Dispute Manager Software. It was built for business owners who want to save time and help more people.

This powerful platform combines everything you need in one place, including dispute management, billing, and client communication tools.

It’s designed to help you stay organized, improve efficiency, and grow your automated credit repair business. Many users say it’s the easiest way to get started with credit repair automation services and take their business to the next level.

Key Features of Client Dispute Manager Software

- Dispute Automation: The software automatically generates dispute letters, allowing you to address multiple client issues quickly. This is essential for businesses handling large client volumes.

- Client Management: With built-in CRM features, Client Dispute Manager Software helps businesses keep track of client interactions, credit report changes, and dispute statuses. This makes managing multiple clients easier and more organized.

- Progress Tracking: The platform offers real-time tracking and reporting, so both you and your clients can monitor the progress of disputes as they move through the process. Clients can also receive updates on credit score changes.

- Customization and Scalability: Whether you’re a small business or looking to scale, Client Dispute Manager Software can grow with you. It offers customizable templates and tools that fit businesses of various sizes.

Start Today and Explore the Features Firsthand!

Is Automation Software for Credit Repair Safe and Legal?

Yes! Using automation software for credit repair is legal if you follow the rules. The key is to make sure your software doesn’t promise results it can’t guarantee, clearly explains the process to your clients, and keeps detailed records of everything it does.

These steps help you stay compliant with laws like the FTC Act and CROA. When your system is built to follow the rules, you can confidently run your business without worrying about legal trouble.

Using credit repair automation services the right way means protecting your clients and your business while delivering great results.

What’s Next for Task Automation for Credit Repair Businesses

The future looks bright for businesses that use task automation for credit repair. Tools are becoming smarter, more user-friendly, and more connected than ever. Starting now means you’ll have an advantage over others as these tools continue to evolve.

We can expect more advanced features like smart prediction tools that guess the next best action, voice-activated apps that make it easy to manage your business hands-free, and secure dashboards where clients can log in to check updates in real time.

These innovations are designed to make your work easier and improve the client experience.

Credit repair automation will keep growing, and businesses that embrace it will be better prepared for long-term success.

Conclusion: Why You Should Try Credit Repair Automation Services

Credit repair is changing. With tools like AI credit repair software and automated credit repair software, you can get better results with less effort.

Whether you want to fix your own credit or grow a business, credit repair automation is the way to go.

If you’re serious about helping people and working smarter, it’s time to try automation software for credit repair. Tools like Client Dispute Manager Software can help you automate credit repair business tasks while keeping things simple and legal.

Try it today and see how credit repair automation services can change the way you work.

Mark Clayborne

Mark Clayborne specializes in credit repair, starting and running credit repair businesses. He's passionate about helping businesses gain freedom from their 9-5 and live the life they really want. You can follow him on YouTube.

Start Today and Explore the Features Firsthand!

Below Is More Content For Your Review: