If you’re staring at a credit report riddled with errors, you’re not alone. Inaccuracies on credit reports can lead to higher interest rates, denied loans, or missed financial opportunities. The good news? A well-crafted credit bureau dispute letter can help set the record straight. But how do you ensure your dispute gets the attention it deserves?

Let’s dive into the process and answer your burning questions, such as “How do I write a dispute letter that works?”

Start Today and Explore the Features Firsthand!

What Is a Credit Bureau Dispute Letter and Why Do You Need One?

A credit bureau dispute letter is a formal request to correct errors on your credit report. These errors may include incorrect balances, late payments, or accounts that don’t belong to you.

When you identify inaccuracies, the letter prompts the credit bureau to investigate and address them. This process helps maintain an accurate credit report and can significantly impact your financial future.

Why Credit Bureau Dispute Letters Matter?

Errors on credit reports can harm your financial health. Issues like fraudulent accounts or incorrect late payments lower your credit score. Dispute letters demand verification, ensuring the information reported is accurate.

This is critical for anyone aiming to improve their creditworthiness. By ensuring errors are corrected, you protect yourself from financial setbacks and increase your opportunities for financial success.

These letters are an essential tool for anyone serious about financial stability.

Benefits of Using a Dispute Letter

Filing a credit bureau dispute letter can enhance your financial standing. It holds credit bureaus accountable for errors and ensures fair reporting. By addressing mistakes, you can improve your credit score, access better financial products, and avoid unnecessary stress.

This proactive approach also helps in maintaining long-term financial credibility and trustworthiness. Regular use of this process keeps your credit profile accurate and ensures you’re not penalized for errors beyond your control.

Why Is It Important to Dispute Credit Report Errors?

Mistakes on credit reports can lead to major financial setbacks. These issues might cause difficulties in getting loans, higher insurance premiums, or missed employment opportunities.

Correcting these errors ensures your financial credibility remains intact. It’s a step you can’t afford to ignore if you’re serious about maintaining a healthy credit profile.

Consequences of Ignoring Errors

Ignoring errors on your credit report can lead to long-term consequences. Inaccurate negative marks can stay for years, damaging your score. This may hinder opportunities for loans or better interest rates. Taking immediate action can help mitigate these risks and secure your financial future.

Moreover, unresolved issues may lead to further complications with lenders and other financial institutions. Procrastinating on disputes can lead to avoidable financial hardships.

Start Today and Explore the Features Firsthand!

Common Errors to Look For

Errors often include accounts you don’t recognize, incorrect balances, or duplicate entries. These mistakes can happen due to data entry errors or identity theft. Reviewing your credit report thoroughly ensures these issues are addressed promptly.

Checking for incorrect personal information, such as misspelled names or outdated addresses, is also essential to avoid potential confusion. Make it a habit to periodically review your credit report for any anomalies.

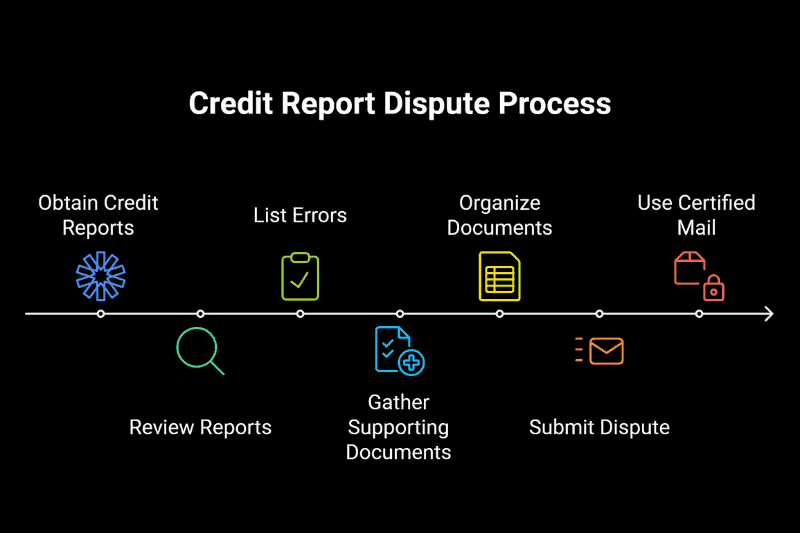

Step-by-Step Guide to Properly Fill Out a Credit Report Dispute Form

Filling out a credit report dispute letter requires attention to detail and proper documentation. Let’s break it down into manageable steps.

Reviewing Your Credit Report

Obtain a copy of your credit report from all three major bureaus: Equifax, Experian, and TransUnion. Review it for errors like inaccurate account statuses or balances. Make a list of the errors you wish to dispute, highlighting significant inaccuracies that affect your score.

Carefully examine each section of your report, paying special attention to payment histories and account statuses. This step is crucial in identifying discrepancies that could harm your financial standing.

Collecting Supporting Documents

Gather evidence to support your claims. This might include bank statements, receipts, or letters from creditors. Organize these documents logically so the credit bureau can easily review your case.

Ensure all documents are legible and relevant to the errors you’re disputing. A clear, well-organized file strengthens your case and speeds up the investigation process. Make sure your evidence directly addresses the errors you’re disputing.

Start Today and Explore the Features Firsthand!

Submitting Your Dispute

You can submit a dispute online, by mail, or by phone. Mail allows for detailed documentation, while online submissions are quicker. For serious errors, mailing a detailed credit report dispute letter is often the best approach.

Include copies of all relevant documents and keep originals for your records. Use certified mail with a return receipt to ensure your dispute is received and tracked properly. This provides peace of mind and ensures accountability during the process.

How to Write an Effective Credit Bureau Dispute Letter?

A well-written dispute letter increases your chances of success. Follow this structured approach to make your letter stand out.

Structuring Your Letter

Start with your name, address, and contact details. Address the credit bureau clearly and include the date. Specify the errors you’re disputing, providing details like account numbers and exact issues.

Attach evidence and request the bureau to correct or remove the inaccuracies promptly. Include a clear subject line, such as “Dispute of Inaccurate Information on Credit Report.” Ensure your letter is straightforward and easy to understand.

Tone and Professionalism

Keep your letter polite and professional. Avoid emotional language and stick to the facts. A respectful tone shows you’re serious about resolving the issue. Refrain from using accusatory language, as this can delay the process or lead to misunderstandings.

Presenting your case clearly and objectively improves your chances of a favorable outcome. Remember, professionalism conveys credibility.

Start Today and Explore the Features Firsthand!

Request for Confirmation

Politely request confirmation once the errors are corrected. Ask for an updated copy of your credit report to verify the changes. This ensures all inaccuracies are resolved properly.

Confirm that the corrected information is reflected across all credit bureaus to avoid discrepancies in the future. Documentation of the bureau’s response is critical for your records. Always follow up if corrections are not confirmed.

How to Follow Up After Submitting a Dispute Letter?

Submitting your dispute is just the first step. Following up ensures the bureau acts on your request.

Monitoring the Timeline

Credit bureaus have 30 days to respond to your dispute. Mark this date on your calendar. If you don’t hear back, contact the bureau to check the status. Regular follow-ups show your commitment and keep the process on track.

Being proactive ensures your dispute doesn’t fall through the cracks. Persistent tracking guarantees timely results.

Reviewing the Outcome

When you receive the results, verify the corrections made. If the dispute was denied, review the reason and decide your next steps. This might include providing additional evidence or escalating the issue.

A thorough review of the bureau’s explanation helps you identify areas for improvement in your next submission. Understanding the outcome helps refine your approach.

Escalating the Dispute

If unresolved, consider escalating your dispute to a consumer protection agency. Provide all supporting evidence and a clear explanation of the issue. This step can push for faster resolution.

Agencies like the Consumer Financial Protection Bureau (CFPB) can help mediate disputes and ensure fair treatment. Escalation should always be supported by a well-documented case. Ensure your escalation letter is as clear and factual as your original dispute.

How Credit Repair Letters Can Improve Your Financial Health?

Credit repair letters are essential tools in maintaining your financial credibility. They help address specific issues like late payments, incorrect account statuses, or fraudulent accounts.

These letters not only repair inaccuracies but also demonstrate your commitment to financial responsibility. By actively managing your credit, you improve your score and gain access to better financial opportunities.

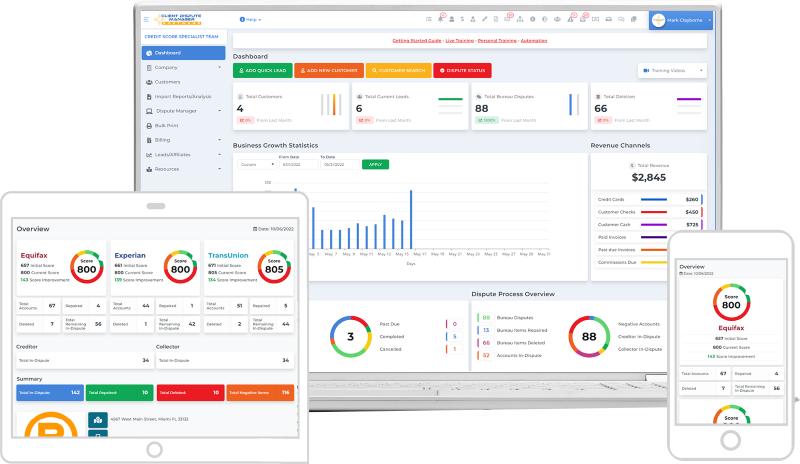

Client Dispute Manager Software: A Powerful Tool for Credit Repair

For those serious about streamlining their credit repair efforts, Client Dispute Manager Software is a game-changer. This software is designed to simplify the dispute process and increase your chances of success. Whether you’re handling disputes for yourself or managing multiple clients, it offers a suite of features to help you stay organized and efficient.

Start Today and Explore the Features Firsthand!

Key Features of Client Dispute Manager Software

Automated Letter Templates: Create accurate and professional credit bureau dispute letters in minutes.

Document Management: Upload and organize supporting evidence for quick access during disputes.

Progress Tracking: Monitor the status of each dispute and ensure timely follow-ups.

Client Management: Perfect for entrepreneurs running credit repair businesses, this tool simplifies managing multiple cases.

Why Use Client Dispute Manager Software?

The software is built for ease of use and efficiency. It reduces the time spent on manual tasks, allowing you to focus on improving credit scores. Entrepreneurs can use it to scale their credit repair businesses and deliver excellent results for their clients. Individuals benefit from its guided approach, making complex processes more manageable.

Start Today and Explore the Features Firsthand!

Integrating Technology with Credit Repair

Using tools like Client Dispute Manager Software ensures your disputes are thorough and professional. With automation and organization at your fingertips, you can confidently tackle errors on credit reports and improve financial health. Leveraging technology streamlines the process, making credit repair less daunting and more effective.

In addition to dispute letters, other credit repair letters can help. Examples include goodwill letters for late payment removal and debt validation letters for verifying debts. Incorporating these tools ensures a comprehensive approach to managing your credit.

Pay-for-delete letters can also be useful when negotiating with creditors for account removal in exchange for payment. Combining these strategies strengthens your overall credit repair efforts.

Conclusion: Take Charge of Your Credit

Writing a credit bureau dispute letter is a simple but powerful way to fix errors on your credit report. Following the steps outlined here ensures your letter is effective and professional.

Start today to protect your financial future and improve your credit score. Take control of your credit and unlock better financial opportunities through diligent credit report management.

Mark Clayborne

Mark Clayborne specializes in credit repair, starting and running credit repair businesses. He's passionate about helping businesses gain freedom from their 9-5 and live the life they really want. You can follow him on YouTube.

Start Today and Explore the Features Firsthand!