Are you ready to make a difference in people’s lives while building a thriving credit repair business? Starting a credit repair business or a credit restoration business can be an incredibly rewarding venture, both financially and personally. However, navigating the complexities of the credit repair industry can feel overwhelming, especially for aspiring credit repair entrepreneurs.

Don’t worry; we’ve got you covered! In this comprehensive guide, we’ll walk you through the essential steps to launch your own successful credit repair business or credit restoration business.

Start Today and Explore the Features Firsthand!

Understanding the Fundamentals of Credit Repair

Before diving into the nitty-gritty of starting a credit repair business or a credit restoration business, it’s crucial to grasp the basics. Credit repair involves helping individuals improve their credit scores by identifying and addressing inaccuracies, outdated information, or unfair negative items on their credit reports.

By assisting clients in this process, you empower them to access better financial opportunities and achieve their goals as a credit repair entrepreneur.

The Importance of Credit in Today's World

In today’s financial landscape, credit plays a pivotal role in determining an individual’s access to loans, mortgages, and even job opportunities. A poor credit score can lead to higher interest rates, reduced borrowing capacity, and missed chances for personal and professional growth.

By offering credit repair services through your credit restoration business, you not only help clients improve their financial standing but also open doors to a brighter future as a credit repair entrepreneur.

Researching Legal Requirements and Regulations

One of the most critical aspects of starting a credit repair business or a credit restoration business is ensuring compliance with legal requirements and regulations. The Credit Repair Organizations Act (CROA) sets forth specific guidelines for credit repair companies, including advertising practices, contract requirements, and consumer protections.

Additionally, each state may have its own laws governing credit repair businesses and credit restoration businesses. Take the time to thoroughly research and understand these regulations to avoid any legal pitfalls as a credit repair entrepreneur.

Familiarizing Yourself with the Credit Repair Organizations Act (CROA)

The CROA is a federal law that regulates the credit repair industry. It mandates that credit repair businesses and credit restoration businesses provide clients with a written contract outlining their rights and the services to be performed. The contract must also include a three-day rescission period, during which clients can cancel the agreement without penalty.

Familiarize yourself with the CROA’s requirements to ensure your credit repair business or credit restoration business practices are compliant from the start.

Navigating State-Specific Regulations

In addition to federal laws, each state may have its own regulations for starting a credit repair businesses and credit restoration businesses. Some states require specific licenses or bonds, while others have more stringent advertising guidelines.

Research your state’s requirements thoroughly and consult with legal professionals if needed to ensure you’re operating within the bounds of the law as a credit repair entrepreneur.

Start Today and Explore the Features Firsthand!

Developing Your Business Plan and Structure

With a solid understanding of the legal landscape, it’s time to start a credit repair business plan. This roadmap will guide you through the early stages of your credit repair venture and help secure funding if needed.

Key components of your plan should include:

- Target market and ideal client profile

- Unique selling proposition and competitive analysis

- Marketing and client acquisition strategies

- Operational processes and staffing needs

As part of this process, decide on your credit repair business or credit restoration business structure (e.g., sole proprietorship, LLC, or corporation) and register your company with the appropriate state and local authorities.

Defining Your Target Market and Unique Selling Proposition

To starting a credit repair business or credit restoration business, you must identify your target market and develop a unique selling proposition (USP) that sets you apart from competitors. Consider factors like demographics, income level, and specific credit challenges when defining your ideal client for your credit repair services.

Your USP should highlight the distinctive benefits your credit repair services offer, such as personalized attention, innovative technology, or a proven track record of success as a credit repair entrepreneur.

Investing in Essential Tools and Technology

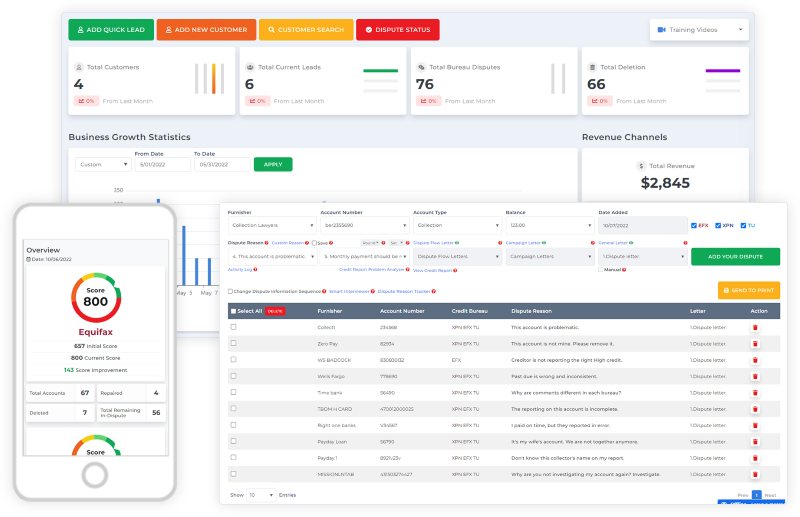

To streamline your operations and provide top-notch service to your credit repair clients, consider investing in Client Dispute Manager Software. This platform offers features like automated dispute letters, client portals, and progress tracking, allowing you to focus on growing your credit repair business or credit restoration business while efficiently managing your clients’ needs as a credit repair entrepreneur.

Streamline Your Debt Validation Process with Client Dispute Manager Software

As an entrepreneur in the credit repair industry, managing the debt validation process for your clients can be a time-consuming and complex task. That’s where Client Dispute Manager Software comes in. This innovative tool is designed to streamline the debt validation process, making it easier for you to generate debt verification letters, validation request letters, and debt dispute letters on behalf of your clients.

With Client Dispute Manager Software, you can:

- Automate the creation of personalized debt verification letters, validation request letters, and debt dispute letters based on your clients’ specific needs and circumstances.

- Keep track of important deadlines and follow-up dates related to the debt validation process and debt collection validation.

- Securely store and organize all documentation related to your clients’ cases, including debt verification letters, validation request letters, debt collection validation responses, and debt dispute letters.

- Access a comprehensive library of templates and resources to help you navigate the debt validation process and provide the best possible service to your clients.

By leveraging the power of Client Dispute Manager Software, you can save time, reduce errors, and improve your overall efficiency in managing the debt validation process for your clients. This powerful tool empowers you to focus on what matters most helping your clients achieve their financial goals and build a brighter future.

Start Today and Explore the Features Firsthand!

Building Your Knowledge and Expertise For Starting A Credit Repair Business

Continuous learning is key to success as a credit repair entrepreneur. Invest in credit repair training programs, attend workshops and conferences, and stay updated on changes in credit reporting laws and best practices. By expanding your knowledge base, you’ll be better equipped to assist your clients and stand out from competitors in your credit repair business or credit restoration business.

Pursuing Credit Repair Certifications and Training Programs

Several organizations offer certification programs and credit repair training courses specifically designed for credit repair professionals. The National Association of Credit Services Organizations (NACSO) and the Credit Consultants Association (CCA) are two reputable entities that provide comprehensive education and support for credit repair entrepreneurs.

Pursuing these certifications demonstrates your commitment to excellence and can instill confidence in potential clients of your credit repair business or credit restoration business.

Crafting Your Marketing Strategy For Credit Restoration Business

With your credit repair business or credit restoration business foundation in place, it’s time to attract clients. Develop a multi-faceted marketing strategy that includes:

- Creating an informative and user-friendly website for your credit repair business or credit restoration business

- Leveraging social media platforms to engage with potential credit repair clients

- Networking with local businesses and financial professionals to promote your credit repair services

- Implementing targeted online advertising campaigns for your credit repair business or credit restoration business

- Offering educational workshops or webinars to establish your expertise as a credit repair entrepreneur

Focus on highlighting the unique value your credit repair business or credit restoration business provides and the transformative impact your credit repair services can have on your clients’ financial well-being.

Developing a Strong Online Presence

In today’s digital age, having a professional website and active social media profiles is essential for attracting clients to your credit repair business or credit restoration business. Your website should clearly articulate your credit repair services and unique value proposition.

Optimize your site for search engines by incorporating relevant keywords and creating informative blog content related to credit repair. Engage with potential clients on social media platforms like Facebook, Twitter, and LinkedIn by sharing helpful tips, success stories, and industry news about credit repair.

Building Strategic Partnerships and Referral Networks

Networking with local businesses and financial professionals can be a powerful way to generate referrals and expand your client base for your credit repair business or credit restoration business. Build relationships with mortgage brokers, real estate agents, and financial advisors who serve clients that could benefit from your credit repair services.

Attend local business events, join professional associations, and consider offering reciprocal referrals to create mutually beneficial partnerships that can help grow your credit repair business or credit restoration business.

Start Today and Explore the Features Firsthand!

Prioritizing Client Success and Satisfaction

As you begin working with clients in your credit repair business or credit restoration business, remember that their success is your success. Develop a client-centric approach that emphasizes education, empathy, and transparent communication.

Celebrate their victories, no matter how small, and continuously refine your processes based on their feedback. By prioritizing client satisfaction, you’ll foster a loyal customer base and benefit from positive word-of-mouth referrals for your credit repair business or credit restoration business.

Providing Exceptional Customer Service and Support

Differentiate your credit repair business or credit restoration business by offering unparalleled customer service. Be responsive to client inquiries, provide regular progress updates, and take the time to educate clients on credit management best practices.

Go above and beyond to address their concerns and celebrate their successes. By building strong, supportive relationships with your clients, you’ll create a foundation for long-term success as a credit repair entrepreneur.

Measuring and Improving Client Outcomes

To continually enhance your credit repair services and maintain a competitive edge, regularly assess your clients’ progress and gather feedback. Track key metrics like credit score improvements, item deletions, and client satisfaction ratings.

Use this data to identify areas for improvement and refine your processes accordingly. By consistently delivering measurable results and incorporating client feedback, you’ll establish your credit repair business or credit restoration business as a leader in the credit repair industry.

Frequently Asked Questions (FAQs)

Do I Need Special Licenses Or Certifications To Start A Credit Repair Business Or Credit Restoration Business?

While there are no specific licenses required at the federal level, certain states may have licensing or registration requirements for credit repair businesses and credit restoration businesses. Research your state’s regulations to ensure compliance as a credit repair entrepreneur.

Can I Operate My Credit Repair Business Or Credit Restoration Business Entirely Online?

Yes, with the right credit repair software and tools, you can run a successful credit repair business or credit restoration business online. Many credit repair software platforms offer secure client portals and communication channels, enabling you to serve clients remotely as a credit repair entrepreneur.

How Long Does It Take To See Results For Clients In A Credit Repair Business Or Credit Restoration Business?

The timeline for credit improvement varies depending on each client’s unique situation. Some clients may see positive changes within the first few months, while others may require more time. Set realistic expectations and celebrate progress along the way in your credit repair business or credit restoration business.

Conclusion

Starting a credit restoration business can be a challenging yet immensely gratifying journey. By following these steps and staying committed to your clients’ success, you’ll be well on your way to building a thriving credit repair business or credit restoration business that makes a real difference in people’s lives. Embrace the challenges, celebrate the victories, and never stop learning and growing as a credit repair entrepreneur in the credit repair industry.

Mark Clayborne

Mark Clayborne specializes in credit repair, starting and running credit repair businesses. He's passionate about helping businesses gain freedom from their 9-5 and live the life they really want. You can follow him on YouTube.

Start Today and Explore the Features Firsthand!

Below Is More Content For Your Review: