The credit analysis in the Client Dispute Manager Software is not just a report that contains the credit score of an individual from the three major credit bureaus. It is a report that contains basic demographic information about an individual.

There’s a section in the credit analysis report that talks about the credit history of an individual such as how an individual pays his/her bills and if there are any unpaid debts. The report also shows payment history, credit inquiries, bankruptcy, and repossessions. You can build a credit analysis in one click using Client Dispute Manager Software.

A better understanding and knowledge of the importance of a credit analysis report is a must if you want to become successful in establishing your career in the credit repair business. It is because the credit analysis report is the sole source of information when calculating the creditworthiness of a person.

It’s a good thing Client Dispute Manager Software has this feature to offer wherein you can import the credit analysis report of your customer and it will highlight the negative accounts that affect the credit scores of your customer from the three credit bureaus.

There are 2 ways to import the credit analysis report of your customer inside the software.

Upload the credit analysis report manually

Do a quick import

1. UPLOAD THE REPORT MANUALLY

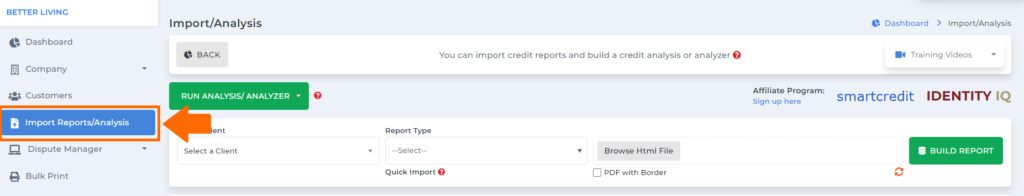

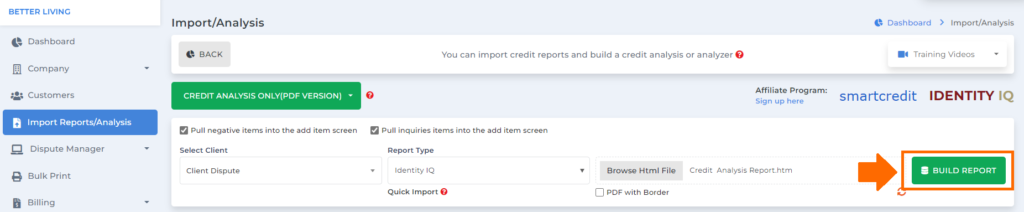

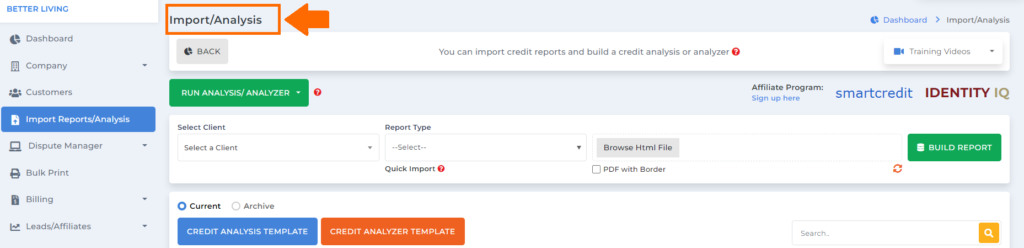

First, you need to go to the dashboard and click Import Reports/Analysis.

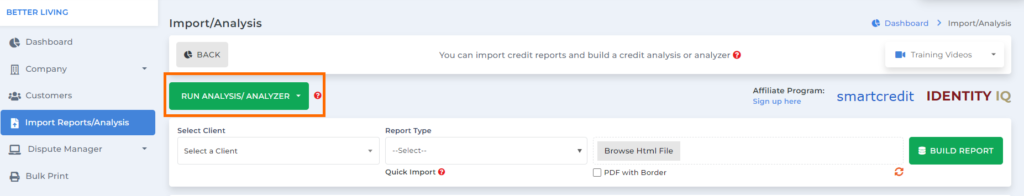

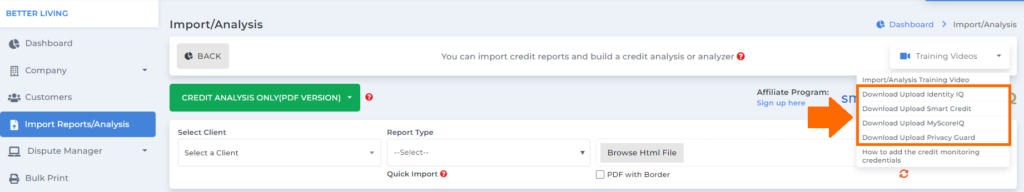

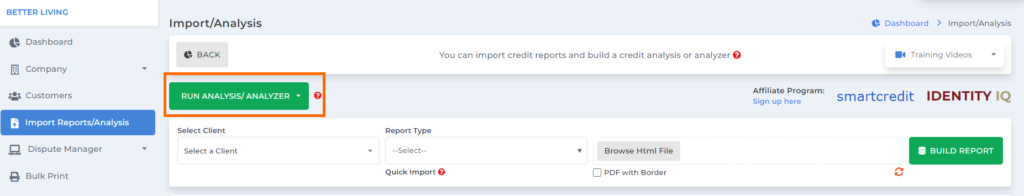

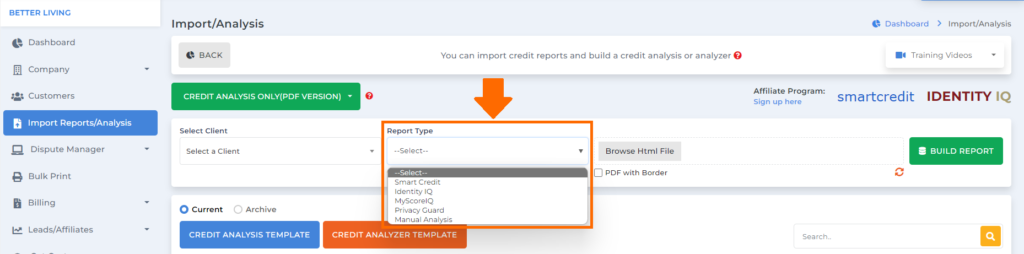

Then click the dropdown for run analysis/analyzer.

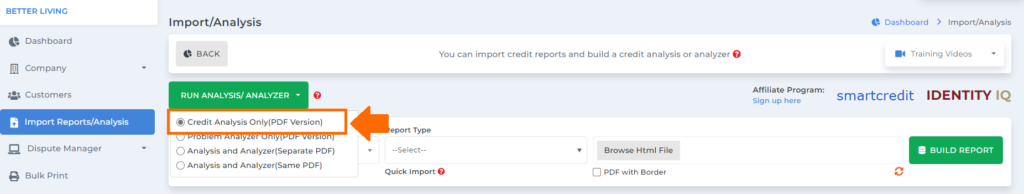

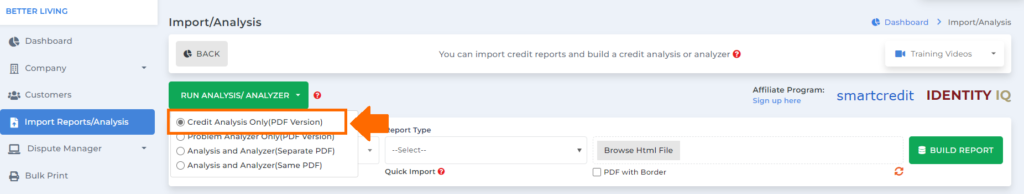

Choose the credit analysis report.

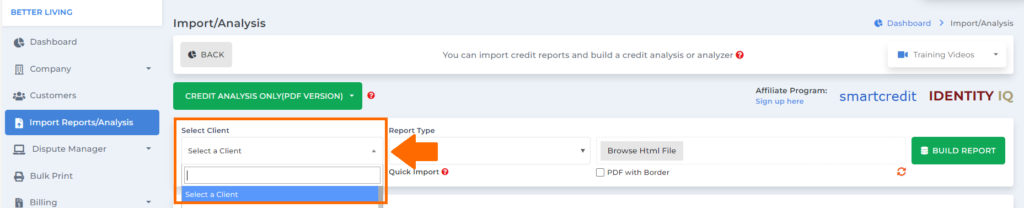

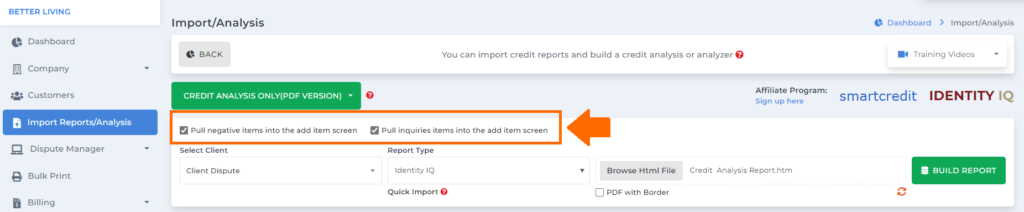

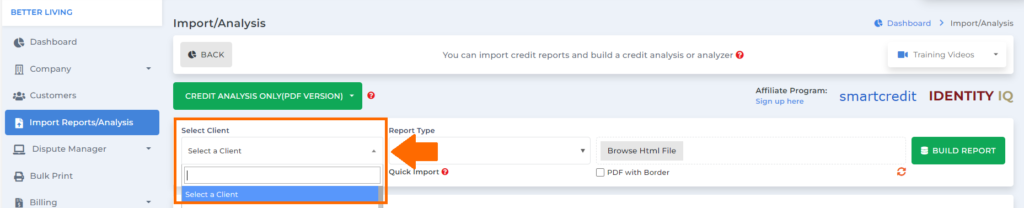

Select the customer you would like to upload his/her credit analysis report.

Note: Make sure to save/download the credit report of your customer from his/her credit monitoring service before uploading it manually inside the credit report software. You can watch the training video here for your reference.

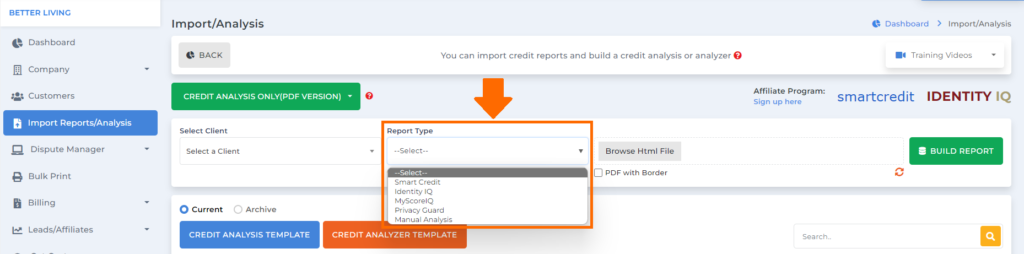

After selecting your customer, click the credit monitoring service of your customer under the report type.

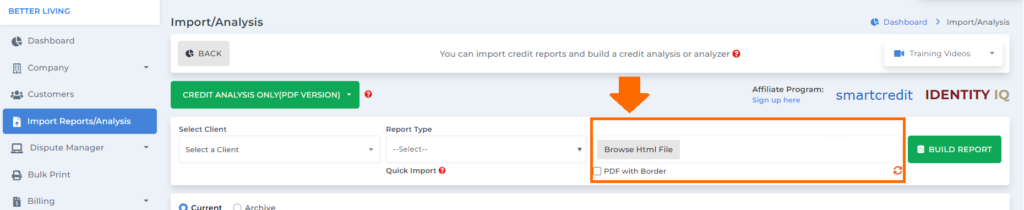

Then click browse Html file to grab the credit report file that you downloaded from the credit monitoring service of your customer.

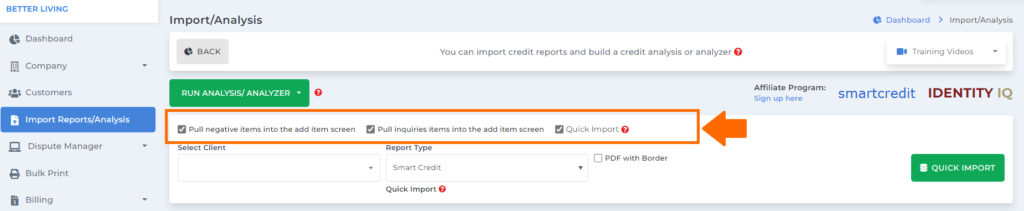

Make sure you click these boxes; pull negative items into the add item screen and pull inquiries items into the add item screen.

Once you’re done selecting your client, report type, and uploading the credit report you may now click the build report button.

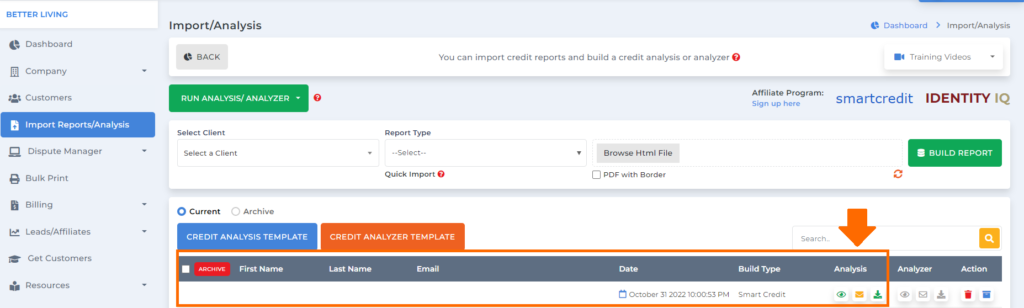

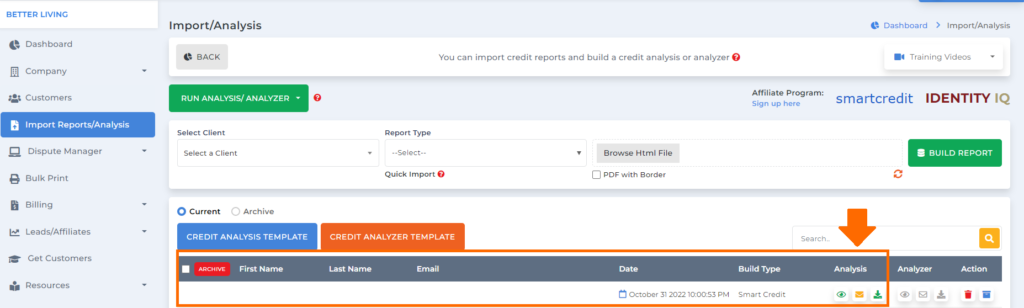

The credit analysis report will be in this table under the analysis column.

2. QUICK IMPORT

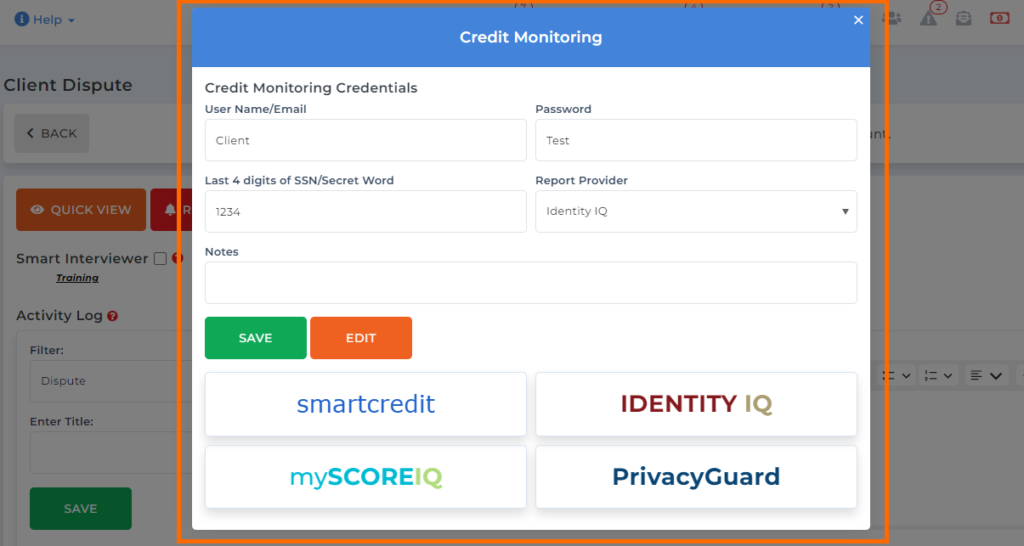

The easiest and fastest way to import the credit analysis report of your customer inside the credit repair software would be via quick import. To do a quick import make sure that you have your customer’s credit monitoring credentials inside the software.

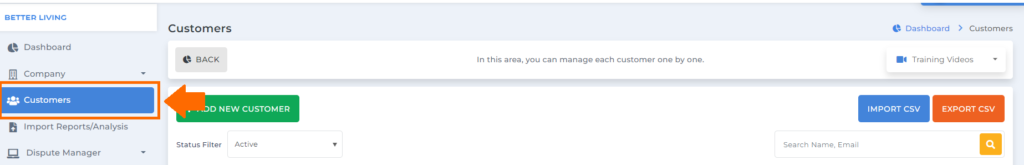

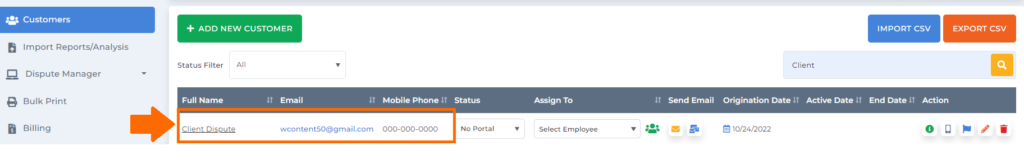

To check if you have the credentials ready for your customer’s credit monitoring service. Go to the customer’s screen.

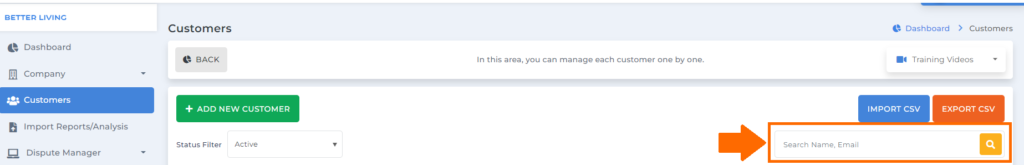

Search for your customer using the search box in the Client Dispute Manager Software.

Then click the customer’s name.

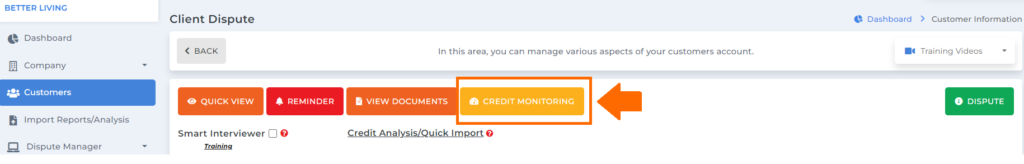

You will be routed to the customer information screen. From there click the credit monitoring button.

If the credentials are all correct you can now do a quick import for the credit analysis report.

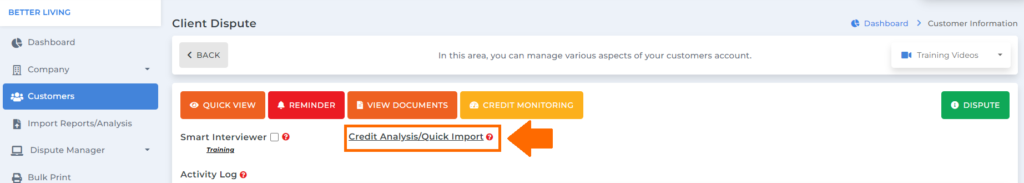

Now click the credit analysis/quick import on the customer information screen.

And you’ll be routed to the import reports/analysis screen.

Then click the dropdown for run analysis/analyzer.

Choose the credit analysis report.

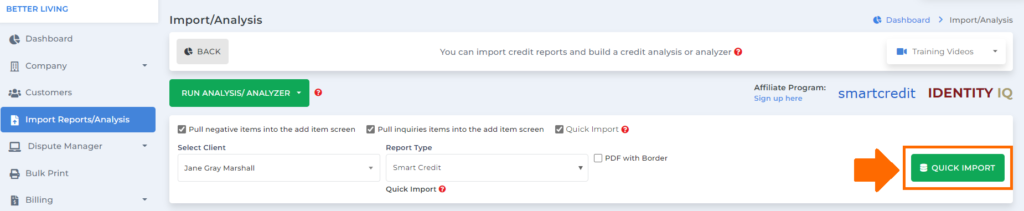

Select the customer you would like to upload his/her credit analysis report.

After selecting your customer, click the credit monitoring service of your customer under the report type.

Make sure you click these boxes; pull negative items into the add item screen, pull inquiries items into the add item screen, and quick import.

Then click the quick import button.

The credit analysis report will be in this table under the analysis column.

Knowing what information you can obtain when you do a credit analysis report will help you make the most out of the Client Dispute Manager Software and at the same time add value to your service.

Bonus: Now that you have read this article, why not take your new skill and start your own credit business helping others? We have free training that can help you do just that.

Click here to learn more.