Have you ever checked your credit report and found mistakes that didn’t belong there? Maybe it was a late payment you know you made on time, or a debt that was already paid off but still showing as active. Errors like these can lower your credit score, cost you higher interest rates, or even stop you from getting approved for a loan.

That’s why so many people are asking the big question: “What is the best credit repair software for 2025?”

Credit repair used to mean mailing letters, waiting months for responses, and keeping stacks of paperwork. But today, things have changed. With AI credit repair software, you can track disputes, generate letters, and organize everything in one place. The right software doesn’t just save time — it gives you confidence that you’re taking the right steps to fix your credit.

In this guide, we’ll walk you through:

- What makes the best credit repair software in 2025?

- How AI and automation are changing the game?

- Why individuals and businesses use software differently — and how one solution can work for both?

- The key features you should look for if you’re serious about credit repair.

Whether you’re an individual trying to clean up errors or an entrepreneur looking to start or grow a credit repair business, this guide will help you understand how the best credit repair software can empower you to take control of credit challenges and build a stronger financial future.

Key Takeaways:

- Credit repair software automates the dispute process. It helps users identify report errors, generate compliant letters, and track progress with bureaus.

- AI technology is transforming credit repair. Smart workflows, automation, and letter generation tools make the process faster, more accurate, and compliant.

- DIY credit repair is on the rise. Consumers now use software to manage disputes on their own instead of paying expensive repair services.

- Businesses use credit repair software to scale efficiently. Tools like automation, reporting, and compliance tracking help manage multiple clients under FTC, FCRA, and CROA guidelines.

- Client Dispute Manager Software stands out in 2025. It offers automation, compliance safeguards, real-time reporting, and flexible tools for both individuals and professionals.

Start Today and Explore the Features Firsthand!

What Is the Best Credit Repair Software?

When people search for the best credit repair software, they usually want one thing: a tool that makes fixing credit errors easier and faster. But what does “best” really mean when it comes to credit repair tools?

At its core, credit repair software is a program that helps you:

- Spot mistakes on your credit report.

- Create and send dispute letters.

- Track your progress with creditors and credit bureaus.

- Stay organized while managing multiple disputes.

The best credit repair software goes beyond just writing letters. It combines automation, AI, and compliance tools so that individuals and businesses can repair credit more effectively.

For example, instead of spending hours drafting letters by hand, modern software can generate professional, legally sound letters in just a few clicks.

For individuals, the best software means:

- A simple way to challenge errors on their own.

- Guidance through every step without needing deep financial knowledge.

- Clear progress reports to see how their credit is improving.

For business owners or professionals, the best software means:

- The ability to manage multiple clients.

- Features like built-in compliance protections and automation.

- Tools for scaling a credit repair business.

So, the real answer to “What is the best credit repair software?” is this: it’s the one that combines powerful automation, legal compliance, and easy-to-use features that work for both individuals and entrepreneurs.

Why Credit Repair Software Matters in 2025?

Credit repair has always been important, but in 2025, it looks very different than it did even a few years ago. Technology, automation, and smarter tools are changing how people fix credit errors. The rise of AI credit repair software is giving both individuals and businesses new ways to take control of credit challenges.

Let’s look at why this matters now more than ever.

AI Is Transforming Credit Repair

One of the biggest changes in credit repair today is the use of AI credit repair software. Instead of writing every letter by hand or keeping track of disputes in messy spreadsheets, AI makes the process faster and smarter.

Here’s how:

- Automation: AI can automatically suggest dispute strategies based on the type of error.

- Letter Generation: It can create professional letters that are legally compliant in just a few clicks.

- Smart Workflows: AI organizes your cases, tracks deadlines, and helps you stay on top of responses.

Does AI credit repair work?

Yes — but it’s important to understand what it really does. AI doesn’t magically erase negative items from your credit report. What it does is help you challenge mistakes more efficiently and make sure you follow the right steps. It saves time, reduces errors, and gives both individuals and businesses more confidence in the process.

Start Today and Explore the Features Firsthand!

The Shift Toward DIY Credit Repair

Not long ago, most people believed the only way to fix credit problems was to pay a credit repair company. But now, more and more people are realizing they can do it themselves with DIY credit repair software.

With the right tool, individuals can:

- Review their own credit reports.

- Dispute mistakes directly with bureaus.

- Stay organized without relying on expensive services.

This shift matters because it puts control back into people’s hands. Instead of feeling powerless or overpaying for help, everyday consumers now have access to software that makes credit repair doable, affordable, and less stressful.

Business Growth in the Credit Repair Industry

The credit repair industry isn’t just about personal use anymore. Many entrepreneurs see it as a growing business opportunity. That’s where credit repair business software comes in.

For professionals, this kind of software provides:

- Tools to manage multiple clients at once.

- Built-in compliance checks to stay within legal guidelines.

- Automation features that save hours of manual work.

- Reporting systems that show clients real progress.

In 2025, more businesses are entering the credit repair field, and software is the key to scaling. By using credit repair business software, entrepreneurs can serve more clients, build trust faster, and grow their business with less stress.

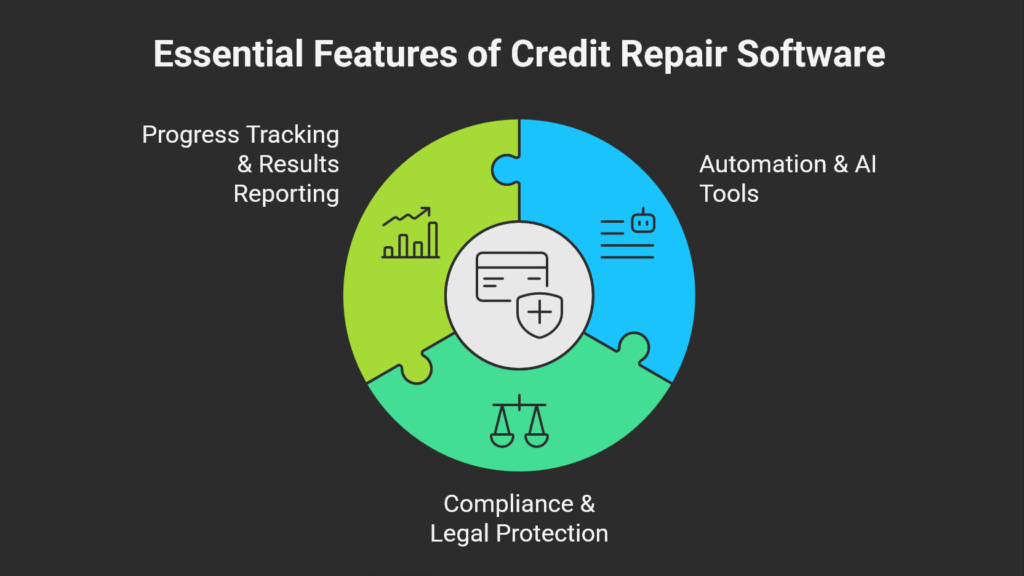

Features That Make the Best Credit Repair Software

When you’re asking yourself, “What should I look for in the best credit repair software?” the answer comes down to features that save time, protect you legally, and give you confidence in the process.

The right software should do more than just help you send dispute letters. It should combine automation, compliance, reporting, and flexibility so that both individuals and businesses can succeed.

Here are the features that truly make the difference.

Start Today and Explore the Features Firsthand!

Automation & AI Tools

The best AI credit repair software takes the guesswork out of fixing credit errors. Instead of spending hours drafting letters or tracking disputes by hand, automation steps in to handle the heavy lifting.

Modern software can guide you through smart dispute flows, generate professional letters in just a few clicks, and even remind you when it’s time to follow up with a credit bureau.

This level of automation not only saves time but also reduces stress. You don’t have to worry about missing deadlines or overlooking important details because the software helps you stay on track every step of the way.

Compliance & Legal Protection

Credit repair isn’t only about correcting mistakes — it’s also about protecting yourself legally. That’s why the best credit repair business software and credit report repair software are built with compliance in mind.

They’re designed to keep you aligned with laws like the Credit Repair Organizations Act (CROA), Federal Trade Commission (FTC) guidelines, and the Fair Credit Reporting Act (FCRA).

Following these rules isn’t optional — it’s the difference between safe credit repair and practices that could get you into trouble. Software that integrates compliance safeguards ensures that both individuals and professionals can move forward with confidence.

Progress Tracking & Results Reporting

One of the most motivating parts of repairing credit is seeing results. That’s why credit repair software with progress reports is such a valuable feature. Instead of guessing whether your efforts are working, you can log in and instantly see the status of your disputes.

For individuals, this is a confidence booster — proof that changes are happening. For businesses, it builds trust with clients, showing them clear updates and measurable progress. Being able to track disputes from start to finish keeps you focused and motivated until the job is done.

How Individuals Use Credit Repair Software (DIY Success)?

For many people, hiring a company to fix credit errors feels expensive and out of reach. That’s why DIY credit repair software has become so popular — it gives individuals the ability to take control of their credit reports on their own.

The process usually follows a few simple steps:

- Review the Credit Report – The software highlights errors such as late payments, duplicate accounts, or debts that were already paid off.

- Generate Dispute Letters – With built-in templates, the program helps users create professional and legally sound letters without needing legal expertise.

- Send and Track Disputes – The software keeps a record of which letters were sent and reminds users when follow-ups are due.

- Monitor Results – As credit bureaus respond, the system updates the status and shows which items were corrected or removed.

Using a credit report repair software in this way allows individuals to stay organized, save time, and feel confident that they are following the right process. Instead of guessing how to write a letter or when to send it, the software provides clear guidance from start to finish.

The end result is that consumers can handle their own disputes in a structured way, without relying on expensive third parties. That’s the power of DIY credit repair software — it makes the credit repair process manageable and accessible to anyone willing to take action.

Client Dispute Manager Software: The Best Credit Repair Software for 2025

Start Today and Explore the Features Firsthand!

When people search for the best credit repair software, they’re usually looking for a program that combines power, compliance, and ease of use. Client Dispute Manager Software stands out because it was built to serve both individuals repairing their own credit and professionals running a credit repair business.

Here are the core features that make it a trusted choice.

Why Client Dispute Manager Is the Best Credit Repair Software?

When choosing the best credit repair software, it’s important to look for features that combine automation, compliance, flexibility, and reporting. Client Dispute Manager Software brings all of these elements together, making it a reliable solution for both individuals and businesses who want to take control of the credit repair process.

Features of Client Dispute Manager Software:

- Automation & Dispute Flows: Includes AI credit repair software tools and automated credit repair software functions, with unique dispute flows for handling different types of credit errors. Letters are generated automatically, and deadlines are tracked without manual effort.

- Compliance-First Design: Aligned with CROA, FTC regulations, and FCRA, ensuring that every letter and workflow follows the correct legal standards for both individuals and professionals.

- Tools for DIY and Professionals: Functions as powerful DIY credit repair software for individuals who want to fix their own reports, and as credit repair business software for entrepreneurs managing multiple clients.

- Client Tracking & Reporting: Operates as a credit repair software with progress reports, providing real-time updates on dispute statuses, motivating individuals, and building client trust with transparent reporting.

- Growth Features: Offers performance insights and advanced tools that help professionals scale operations while staying organized and compliant.

Start Today and Explore the Features Firsthand!

DIY vs. Professional Use Cases: Which One Fits You?

Not everyone approaches credit repair in the same way. Some people want to handle their own disputes, while others see credit repair as a business opportunity. The good news is that Client Dispute Manager Software is flexible enough to work as both DIY credit repair software for individuals and as full credit repair business software for professionals.

For Individuals (DIY Use Cases):

- Provides guided steps to review and dispute errors on personal credit reports.

- Simplifies the process with automated letter creation and dispute tracking.

- Offers progress reports that help users stay motivated and see results clearly.

- Ideal for people who want to take control of their credit without paying high service fees.

For Professionals (Business Use Cases):

- Functions as complete credit repair business software with client management tools.

- Tracks multiple cases at once, with built-in compliance support for CROA, FTC, and FCRA.

- Generates transparent reports that build trust with clients and improve retention.

- Scales easily, making it possible to serve more clients without adding more manual work.

How Client Dispute Manager Bridges Both Worlds:

- Designed with flexibility so one system works for both individuals and professionals.

- Helps DIY users stay organized and confident while fixing their own credit.

- Supports entrepreneurs in building and growing a structured, compliant business.

- Creates a single platform where both personal and business goals can be achieved effectively.

Start Today and Explore the Features Firsthand!

FAQs About the Best Credit Repair Software

What Is the Best AI Credit Repair Software?

The best AI credit repair software is one that automates disputes, generates professional letters, and organizes the entire process for you. Client Dispute Manager Software is designed with AI-driven tools that make repairing credit faster and more efficient, while staying compliant with all legal guidelines.

Does AI Credit Repair Work?

Yes — but not in the sense of instantly erasing negative items. What AI does is help you challenge mistakes more effectively. With the best credit repair software, AI suggests dispute strategies, creates accurate letters, and tracks your progress.

This means fewer errors, less wasted time, and a smoother repair process.

How Long Does Credit Repair Take With Software?

The timeline varies depending on the type of errors and how quickly credit bureaus respond. Some disputes may resolve in 30 days, while others take several months.

The benefit of using the best credit repair software is that it keeps everything organized, reminds you of deadlines, and makes follow-ups easier — which helps you stay consistent until results appear.

Is It Better to Use Software or Hire a Company?

It depends on your goals. If you want to save money and take control of your own credit, DIY credit repair software is a smart choice. If you prefer someone else to handle everything, a company might be an option — but it’s often more expensive. The advantage of software is that it puts you in charge and gives you the tools to repair credit step by step.

Can I Start a Business With Credit Repair Software?

Absolutely. Many entrepreneurs use credit repair business software to launch or grow their own companies. With features like client management, compliance checks, and progress reporting, software provides the structure needed to run a professional and trustworthy credit repair business.

Where Can I Start Using Client Dispute Manager Software?

You can start your free 30-day trial directly on the Client Dispute Manager Software website.

The platform offers automated dispute flows, real-time client tracking, and compliance tools designed for both DIY users and professional credit repair businesses. No credit card is required to begin your trial.

Conclusion

Finding the best credit repair software in 2025 comes down to choosing a solution that combines automation, compliance, and flexibility. The right tool should not only make it easier to challenge credit report errors but also give you the confidence that every step is organized and legally compliant.

Client Dispute Manager Software delivers all of these benefits in one platform. With automation and AI-driven tools, it streamlines the dispute process. With built-in compliance, it ensures alignment with CROA, FTC, and FCRA standards. With flexible options for both individuals and professionals, it supports personal credit repair as well as business growth.

Whether your goal is to improve your own credit or to build a successful credit repair business, Client Dispute Manager Software is designed to help you succeed. Start improving your credit or scaling your business with the right tools today.

Mark Clayborne

Mark Clayborne specializes in credit repair, starting and running credit repair businesses. He's passionate about helping businesses gain freedom from their 9-5 and live the life they really want. You can follow him on YouTube.

Start Today and Explore the Features Firsthand!

Below Is More Content For Your Review: