Get Started for as Low a $107 for the First Month: Click Here

Google

- 4.9 Excellent

- 100 + Reviews

Get Started for as Low a $107 for the First Month: Click Here

A good credit repair agent takes on several roles to help prepare and support their clients on their way to restoring their credit scores. Some of the major roles are:

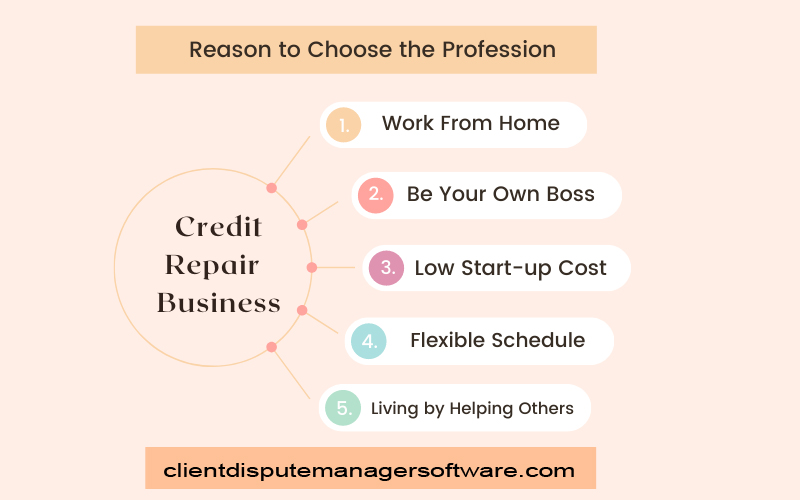

Being a credit repair agent is no walk in the park. So, it would be handy to put up a list of the reasons as to why you are doing this. Know the advantages and the benefits and use them as your daily motivation to provide exceptional service to your clients.

If you have the time and the means, go ahead and get a college degree or formal training. Your credibility as a specialist in this field of finance may also reflect how seasoned you are as a professional. Nevertheless, you need to know that there is no educational requirement to become a credit repair specialist.

However, having proper training related to finance will give your client a sense of security they are dealing with someone who can do things for the long haul. It gives the impression that you can cross the finish line even if it takes years. You may also take it a notch higher if you go for a board certification such as Certified Public Accountant. Or, perhaps as a lawyer, as it will boost your reputation as a high-level specialist.

There is no specific licensing for any credit repair specialist to start operating or work as an agent. However, you may take offline and online credit training courses to learn how to work the trade and be certified as one. Your skill of understanding the industry will make things easier and more rewarding for you and your clients.

Moreover, finding a popular and reputable company that offers these certifications is crucial to your career as a starting credit repair agent.

With today’s tools and social media platforms, it has become easier to look for and be part of groups in which you share the same interests. Being with legitimate professionals of the same or similar industries can help you gain insights into areas you would have otherwise not gained by trying to make it alone.

You can also learn from other people’s mistakes, which is one of the best ways to learn faster and smarter as a growing professional. Of course, when it is your turn to share, you’ll also help other agents sidestep career-breaking blunders, which in turn would create this upward spiral of benefits and relationship-building ties with co-credit repair agents. Who knows, some of your groupmates might become your strongest connections in the future.

Laws exist for this part of the market mainly to protect consumers from unscrupulous individuals and companies that conduct unethical business practices. If you understand the laws then you will know what you can and cannot do as a credit specialist.

As a credit repair agent, you must always adhere to honesty and some level of common sense to be familiar enough with the laws and be at your best in conducting business the right way.

Learn more about Credit Repair Organizations Act (CROA)

Naturally, you would be offering services available for everyone, may it be for consumers or the corporate sector. You may also improve your likelihood of success as a repair agent if you learn to specialize in particular groups of people. These groups have specific needs unique to them, especially if you belong to that group.

For example, faith-based Client Dispute Manager Software models aren’t exactly doing charity or church work. They are simply individuals offering their services but are of the same faith. Thus, an established kinship and trust already exist even before the business. Although it’s not 100% foolproof, the familiarity will at least position you as a credit repair agent as quickly as it would take for anyone to establish a relationship that would otherwise take time.

Other examples are women’s credit repair, credit repair for the recently incarcerated, and other different niches. Be creative, as you may come across an unknown niche that you can eventually make your own.

Take the necessary steps to be informed about policies and the means involved in securing your client’s information. Security and privacy measures are a must-have on your list of essential processes in dealing with clients. Any lapse on your part will be construed as incompetence and carelessness. And more often than not, there is no excuse for it. You wouldn’t want to lose your clients in matters of confidence, would you?

You may consult security experts and create a system to ensure the safety of your clientele’s information. Digital information when submitted online should be encrypted or done with protections of similar nature. Today’s technology is way too advanced even to leave anything to chance.

Having your own tools especially a credit repair software will help you so much when it comes to managing your tasks and your time. As a credit repair specialist, here are the main benefits of using a software:

If you are interested to know what a software can do for you as a credit repair agent, you can check out Client Dispute Manager Software which is best for individuals and businesses starting up in the credit repair industry.

Whether you choose to work as a credit repair specialist part time or put up your own business, always remember that you are capable of being the best. Your capacity to respond to different situations and use your accumulated experience to resolve issues shall be your tools to forge your best future as a credit repair specialist. Enjoy the challenge, and good luck!