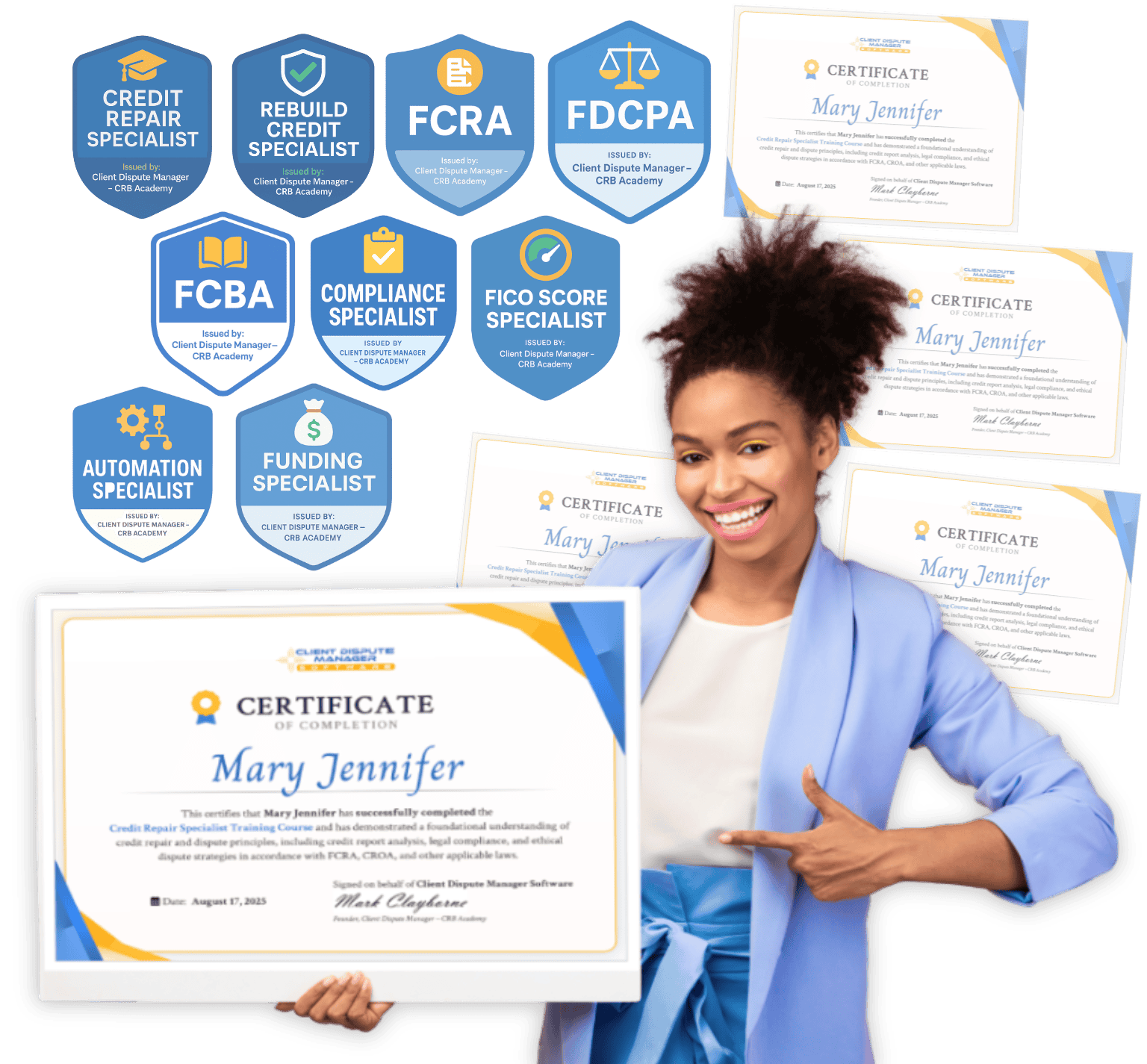

Free Certificates & Training for Credit Repair Professionals

Unlock 9 step-by-step programs—each with its own certificate and badge—built to simplify compliance, strengthen client trust, and grow your business. With your software membership, you’ll gain the clarity and confidence to deliver results the right way.

- Learn with Confidence

- Grow your Skills

- Train with Experts

Build the Foundation of Your Credit Repair Business

Start with the essentials. These trainings give you the tools to understand credit reports, guide clients, and create rebuilding plans that deliver long-term results.

Starting a credit repair business can feel overwhelming. You want to help clients, but figuring out reports, disputes, and laws isn’t easy. One mistake could hurt your reputation—or even put your business at risk.

That’s why this training gives you a clear path. You’ll learn how to read reports with confidence, follow proven dispute steps, and stay legally safe while building client trust. Instead of guessing, you’ll have the knowledge and structure to grow your company the right way.

What You’ll Gain From This Course

Easily review and explain reports so clients understand what matters most.

Follow the FCRA and FDCPA to protect both your clients and your business.

Apply a proven process for drafting letters and tracking responses without errors.

Strengthen your company with onboarding, education, and strategies that create long-term growth.

Access the Credit Repair Specialist Training directly inside Client Dispute Manager Software and start building your business the right way.

Access the Credit Repair Specialist Training directly inside Client Dispute Manager Software and start building your business the right way.

Most new credit repair businesses focus only on removing negative items. But if clients don’t add positive history, their scores stall—and they may feel like your service didn’t deliver.

Without the right rebuilding guidance, clients often fall back into the same habits and never see the long-term progress they hoped for. That can damage both their trust and your reputation.

This course shows you how to help clients go beyond disputes by teaching them how to build new, positive credit history and healthy habits.

What You’ll Gain for Your Credit Repair Business

Understand the five score factors and explain their impact in simple terms.

Teach clients that adding positives is what truly drives score growth.

Coach discipline, patience, and smart habits that support lifelong credit health.

Use tools like secured cards, builder loans, and rent reporting to track client progress.

Get the Rebuild Credit Specialist Training inside Client Dispute Manager Software and help clients achieve lasting results.

Get the Rebuild Credit Specialist Training inside Client Dispute Manager Software and help clients achieve lasting results.

Unlock All 9 Certificates with Your Software Membership

No extra cost – included with software membership.

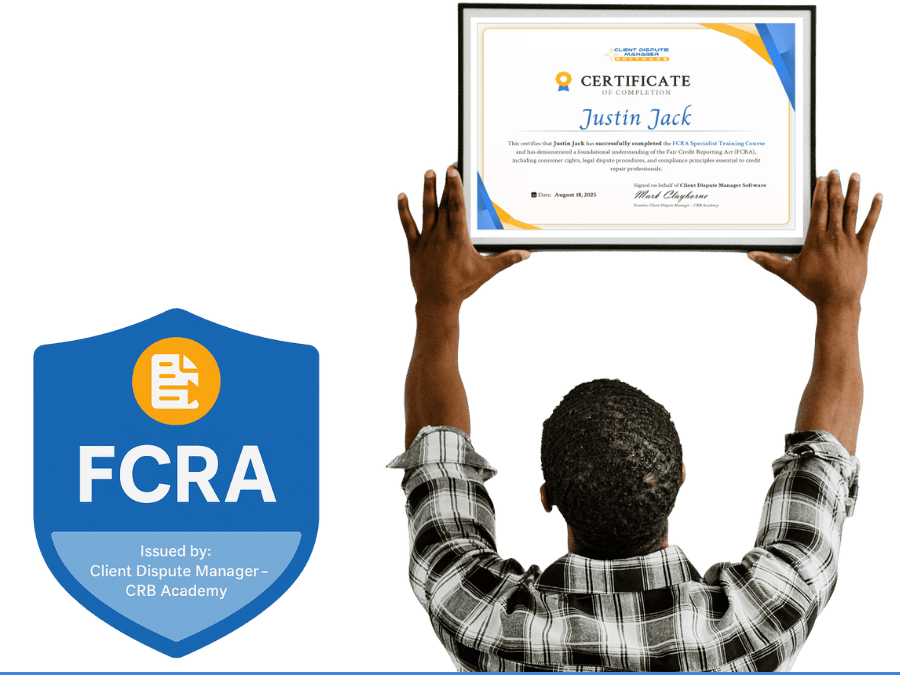

Master the Credit Laws That Protect Your Clients

Strong credit repair businesses are built on compliance. Learn the major laws that govern reporting, collections, and billing so you can serve clients safely and professionally.

Access the FCRA Specialist Training inside Client Dispute Manager Software to strengthen your legal foundation.

New credit repair owners often struggle with laws. If you don’t understand the FCRA, you could make mistakes that not only fail your clients but also risk legal trouble.

Confusion around consumer rights, disputes, and dealing with agencies leaves many businesses vulnerable—and clients disappointed.

This training gives you full clarity on the Fair Credit Reporting Act, showing you how to use it properly to protect clients and safeguard your business.

What You’ll Gain for Your Credit Repair Business

Explain consumer rights and credit laws clearly to your clients.

Follow compliant, step-by-step dispute procedures with confidence.

Communicate professionally with agencies and creditors the right way.

Stay aligned with CROA, TSR, and UDAP while building trust through compliance.

Access the FCRA Specialist Training inside Client Dispute Manager Software to strengthen your legal foundation.

Get the FDCPA Specialist Training inside Client Dispute Manager Software and guide your clients with confidence.

Many credit repair specialists don’t fully understand how debt collection laws affect their clients. Without the right knowledge, you might miss violations—or worse, give unsafe advice.

Debt collection mistakes can harm your clients and put your business credibility on the line. Staying compliant is the only way to stay trusted.

This course teaches you how to apply the Fair Debt Collection Practices Act (FDCPA) so you can protect clients and keep your company professional.

What You’ll Gain for Your Credit Repair Business

Explain client rights under the law in clear, simple language.

Identify harassment, false threats, and unfair charges quickly.

Rely on written communication and documentation, not risky methods.

Prevent mistakes while documenting violations the right way.

Get the FDCPA Specialist Training inside Client Dispute Manager Software and guide your clients with confidence.

Access the FCBA Specialist Training inside Client Dispute Manager Software and add another layer of value to your services.

Billing errors can ruin a client’s finances and credit profile. But many new credit repair specialists don’t know how to recognize or dispute them properly.

If these errors go unnoticed or mishandled, clients may lose money and lose faith in your service. That’s why you need clear FCBA training.

This course shows you exactly how to apply the Fair Credit Billing Act to spot, dispute, and fix billing mistakes the right way.

What You’ll Gain for Your Credit Repair Business

Know when the law applies so you can protect client rights.

Identify unauthorized charges, duplicate entries, or uncredited payments.

Send accurate, timely letters while setting proper client expectations.

Show expertise that extends beyond simple disputes.

Access the FCBA Specialist Training inside Client Dispute Manager Software and add another layer of value to your services.

Your Membership Includes Course Certificate + Badge

Every course comes free with your software access.

Strengthen Your Knowledge and Compliance Systems

Go deeper into compliance while building advanced expertise. These trainings help you stay legally safe while adding high-value education for your clients.

Running a credit repair business isn’t just about sending letters. If you don’t follow FTC, CROA, or TSR rules, you could face fines—or even lose your company.

Many new specialists underestimate compliance until it’s too late. One slip can damage your reputation and shut down your progress.

This course helps you stay safe by breaking down complex rules into clear, simple steps for your daily business.

What You’ll Gain for Your Credit Repair Business

Avoid unfair or deceptive practices in marketing and onboarding.

Follow contract, disclosure, and fee-ban rules without confusion.

Set realistic expectations and explain your services clearly.

Use checklists and staff training to keep your company legal.

Get the Compliance Specialist Training inside Client Dispute Manager Software and protect your business for the future.

Get the Compliance Specialist Training inside Client Dispute Manager Software and protect your business for the future.

FICO® scores drive nearly every lending decision. But most new credit repair specialists don’t fully understand how they’re calculated.

If you can’t explain scores clearly, clients may lose confidence in your expertise—and look elsewhere for answers.

This course gives you deep knowledge of FICO, helping you guide clients responsibly while building credibility for your company.

What You’ll Gain for Your Credit Repair Business

Explain payment history, utilization, and other score drivers with ease.

Interpret reason codes and create actionable plans for clients.

Teach without promises while showing how behaviors impact scores.

Use score versions and advanced strategies for higher-level coaching.

Access the FICO Score Expert Certification inside Client Dispute Manager Software and upgrade your client education.

Access the FICO Score Expert Certification inside Client Dispute Manager Software and upgrade your client education.

Get Certified While You Build Your Business

All training is bundled inside your software membership.

Scale and Expand Your Service Offerings

Once your foundation is strong, it’s time to grow. These trainings show you how to save time with automation and offer funding guidance that clients need.

Get the Automation Specialist Training inside Client Dispute Manager Software and scale smarter, not harder.

Most new credit repair owners waste hours on manual tasks like onboarding or disputes. That slows growth and leaves room for mistakes.

Over time, constant busywork drains your energy and keeps you from focusing on strategy or scaling your business.

This course shows you how to set up automation so you save time, improve accuracy, and deliver consistent client experiences.

What You’ll Gain for Your Credit Repair Business

Automate daily tasks like onboarding and disputes to save time and reduce mistakes.

Set up automatic reminders, secure document collection, and progress updates to keep clients informed.

Assign tasks, track progress, and keep your team or VAs organized with automation tools.

Integrate tools into one system that supports scaling without adding extra workload.

Get the Automation Specialist Training inside Client Dispute Manager Software and scale smarter, not harder.

Access the Business Funding Certification inside Client Dispute Manager Software and expand your service offerings.

Credit repair is just the beginning. Many clients want funding to grow their business—but most specialists don’t know how to guide them.

If you can’t offer this support, clients may look elsewhere for solutions, leaving money and trust on the table.

This course equips you to help clients prepare for funding opportunities responsibly, without overpromises.

What You’ll Gain for Your Credit Repair Business

Teach clients the three pillars lenders review so they can prepare for approvals with confidence.

Guide clients to PG or EIN-only options that align with their business stage and readiness.

Explain SBA loans, credit lines, and revenue-based funding in simple terms clients can understand.

Expand your business by offering funding guidance as a trusted extension of credit repair.

Access the Business Funding Certification inside Client Dispute Manager Software and expand your service offerings.

Start Using The Client Dispute Manager Software Today !

Try it now for FREE. No Credit Card Needed.

Frequently Asked Questions

Got questions about your free training certificates? You’re not alone. Here are the answers most new and aspiring credit repair business owners ask before starting with Client Dispute Manager Software.

When can I get access to all of the certificates?

When can I get access to all of the certificates?

In your first month, you’ll unlock the Credit Repair Specialist certificate. Starting in your second month of active membership, you’ll gain access to all remaining certificates.

If I purchase the yearly plan, do I get access to all of the classes?

If I purchase the yearly plan, do I get access to all of the classes?

Yes. With the yearly plan, you’ll immediately unlock every certificate training without waiting month-to-month.

Do the certificates help build trust and credibility?

Do the certificates help build trust and credibility?

Yes. Certificates show that you’ve completed professional training, which helps you build authority and client confidence.

Can my staff be trained on the certificates?

Can my staff be trained on the certificates?

At this time, certificates are available only for the credit repair business owner, not staff members.

Are the certificates recognized by government or licensing boards?

Are the certificates recognized by government or licensing boards?

No. These are private certificates offered through Client Dispute Manager Software to help you improve your skills and credibility.

How long does it take to complete each training?

How long does it take to complete each training?

Most courses can be completed in a few hours, but you can go at your own pace and review the material anytime.

Do I need prior experience to take these courses?

Do I need prior experience to take these courses?

No. The training is designed for beginners and new credit repair business owners, with step-by-step lessons that are easy to follow.

Are the certificates printable or digital only?

Are the certificates printable or digital only?

Certificates are digital, but you can download and print them to display in your office or share with clients.

Will these certificates help me get more clients?

Will these certificates help me get more clients?

While we can’t guarantee results, certificates show proof of training, which builds trust and makes your services stand out.

Do I have to pay extra for the certificates?

Do I have to pay extra for the certificates?

No, there’s no extra cost. Certificates are included with your paid Client Dispute Manager Software membership. In your first month, you’ll unlock the Credit Repair Specialist certificate. Starting in your second month of active membership, you’ll gain access to all the remaining certificates.

What Our Users Are Saying

Nothing speaks louder than the voices of our users. Read how our software and step-by-step training have helped credit repair business owners work smarter and serve clients better.

Real Stories from Real Business Owners

3:06

1:17

1:15

1:02

3:31

1:35