The 15-Step Roadmap to Starting & Growing Your Credit Repair Business

Follow this simple, step-by-step plan to launch, run, and scale a credit repair business — even if you’re starting from scratch. No guesswork. Just the exact steps, tools, and training to help you move forward with confidence.

- Learn with Clarity

- Act with Purpose

- Build for the Future

STAGE 1 - START YOUR BUSINESS

A strong business begins with steady steps — lay the right foundation today, and tomorrow’s growth will stand unshakable.

In this stage, you’ll establish the legal, operational, and technical base of your business. Think of it as building the solid ground on which your credit repair journey will grow.

STEP 1: Learn the Credit Laws

Many credit repair businesses fail before they even start — not because they can’t find clients, but because they ignore the laws. CROA, FCRA, and FDCPA aren’t just letters; they are the guardrails that protect your business. Learn them early, stay compliant, and position yourself as a professional people can trust.

STEP 1: Learn the Credit Laws

Many credit repair businesses fail before they even start — not because they can’t find clients, but because they ignore the laws. CROA, FCRA, and FDCPA aren’t just letters; they are the guardrails that protect your business. Learn them early, stay compliant, and position yourself as a professional people can trust.

Step 2: Form Your Business (LLC, EIN, Bank)

Without the right legal structure, you’ll struggle with payment processors, banks, and even potential partners. By forming your LLC, getting your EIN, and opening a business bank account, you protect yourself and prove to clients that you’re serious and professional.

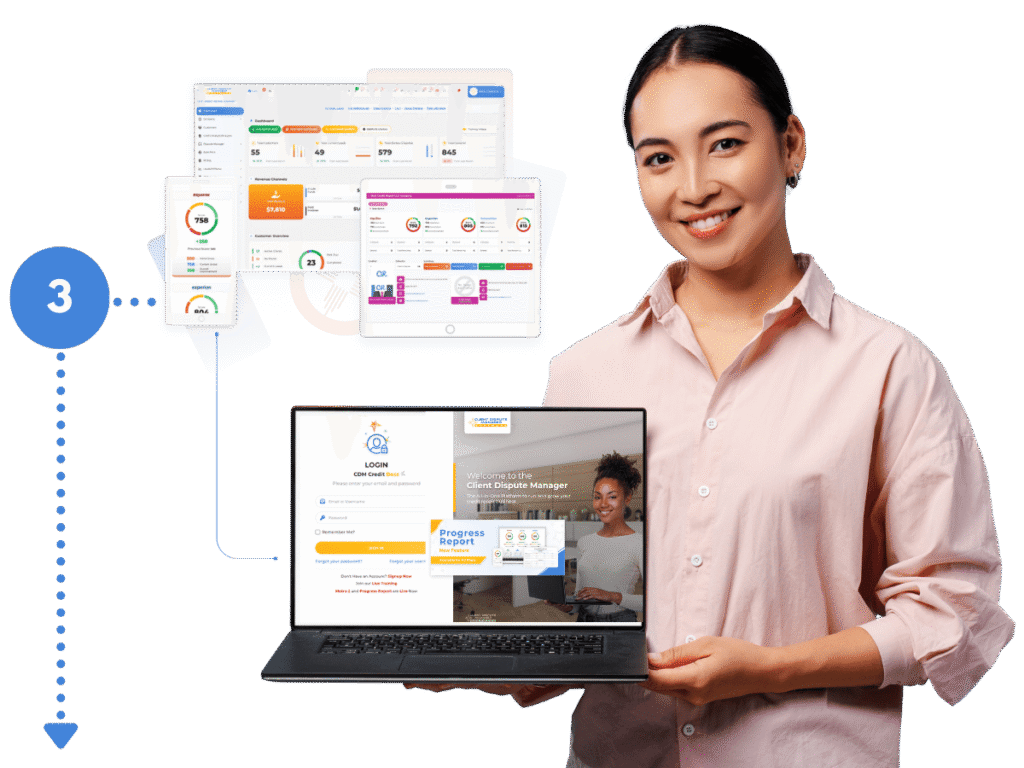

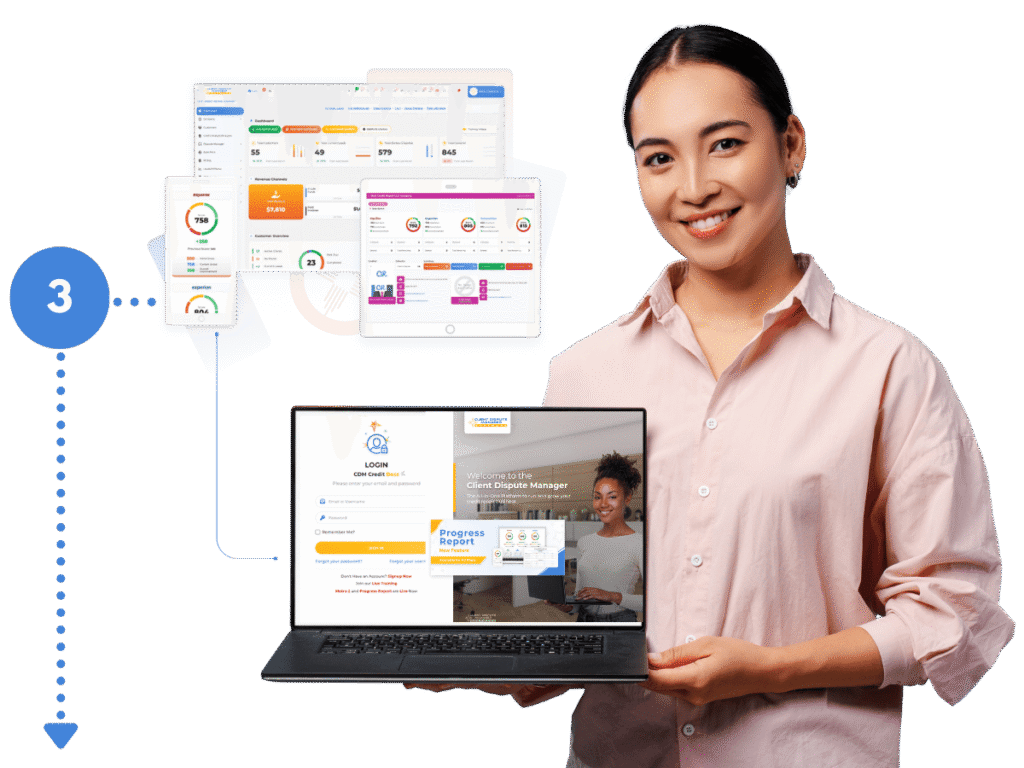

Step 3: Set Up Your Software

Trying to track clients with spreadsheets or notes leads to mistakes and wasted hours. Client Dispute Manager Software keeps everything in one place — client files, disputes, progress reports — so you stay organized and save time every single day.

Step 3: Set Up Your Software

Trying to track clients with spreadsheets or notes leads to mistakes and wasted hours. Client Dispute Manager Software keeps everything in one place — client files, disputes, progress reports — so you stay organized and save time every single day.

Step 4: Create Your Service Agreement & Packages

Nothing breaks trust faster than confusion over pricing or unclear agreements. By creating a transparent, CROA-compliant client contract and service packages, you protect your business legally and give clients confidence from the start.

Step 5: Connect to Credit Monitoring

Clients can’t move forward without credit reports, but recommending a provider the wrong way can create compliance issues. Partner with trusted credit monitoring services like SmartCredit or MyFreeScoreNow and use your affiliate link — giving clients the access they need while creating a simple, legal stream of passive income for you.

Step 5: Connect to Credit Monitoring

Clients can’t move forward without credit reports, but recommending a provider the wrong way can create compliance issues. Partner with trusted credit monitoring services like SmartCredit or MyFreeScoreNow and use your affiliate link — giving clients the access they need while creating a simple, legal stream of passive income for you.

STAGE 2 - RUN YOUR BUSINESS

Progress comes from action — every client you help and every letter you send moves you closer to the business you envisioned.

Now your foundation is set, it’s time to take action. This stage is where you stop preparing and start signing clients, sending disputes, and building momentum.

Step 6: Learn the Dispute Process

Most beginners feel lost when looking at a credit report — unsure of what’s inaccurate, what can be disputed, and what strategy to use. By learning how to identify and challenge errors using proven methods, you’ll gain the confidence to deliver real results for your clients.

Step 7: Write and Send Your First Letter

The first letter is often the hardest — too many credit repair specialists freeze, afraid they’ll get it wrong. With built-in AI and Metro 2 templates inside the software, you can create, edit, and send your first dispute quickly and confidently, proving your value right away.

Step 7: Write and Send Your First Letter

The first letter is often the hardest — too many credit repair specialists freeze, afraid they’ll get it wrong. With built-in AI and Metro 2 templates inside the software, you can create, edit, and send your first dispute quickly and confidently, proving your value right away.

Step 8: Build Your Website

Without a website, your business looks like a side hustle. Clients expect a digital home where they can learn, trust, and sign up. Launch a professional, credit repair–focused website that helps you stand out and turn visitors into paying clients.

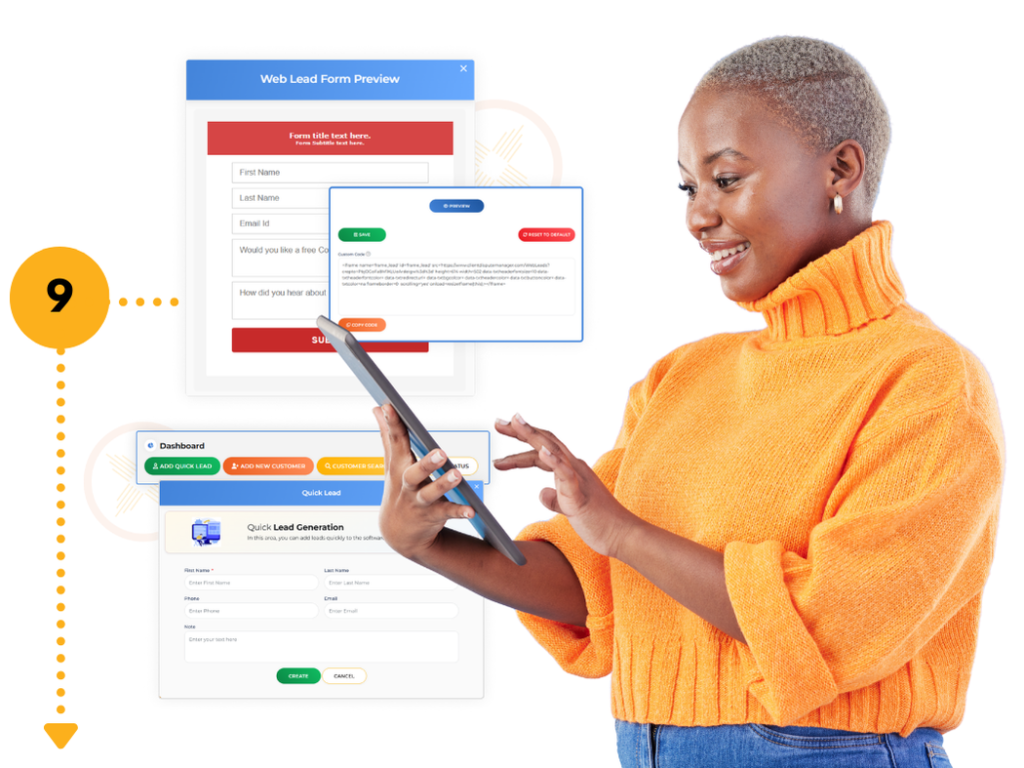

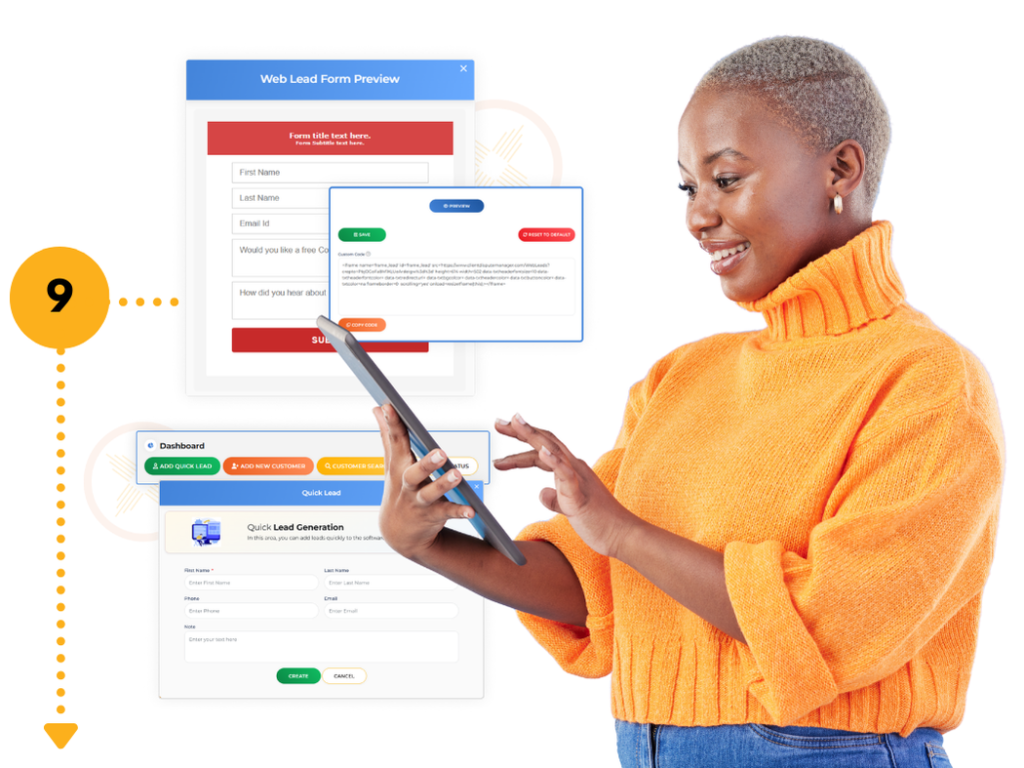

Step 9: Start Building Your Lead List

Chasing leads manually is exhausting and easy to mess up. With your Client Auto Sign Up Lead Link, every prospect who signs up is instantly added to your system — no spreadsheets, no lost opportunities, just smooth automation.

Step 9: Start Building Your Lead List

Chasing leads manually is exhausting and easy to mess up. With your Client Auto Sign Up Lead Link, every prospect who signs up is instantly added to your system — no spreadsheets, no lost opportunities, just smooth automation.

Step 10: Launch Your First Campaign

Waiting for clients to “find you” is one of the biggest mistakes new owners make. With the roadmap, you’ll know exactly how to promote your services — whether that’s posting on social, running an ad, or sending a simple email.

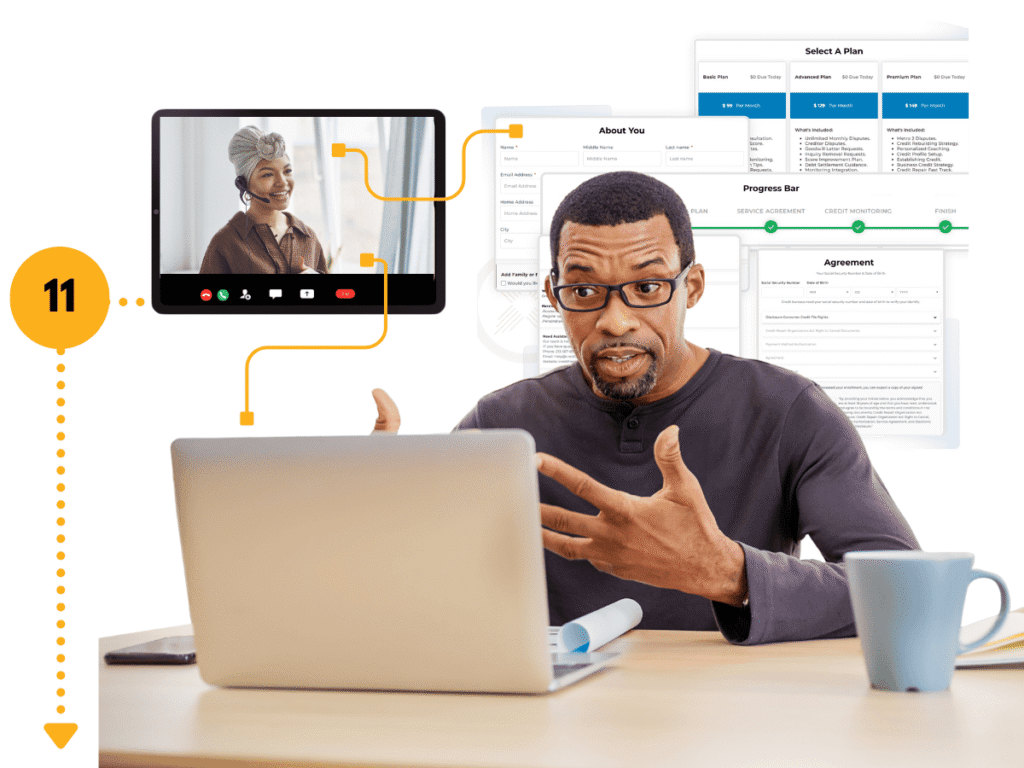

Step 11: Onboard Your First Client

Tired of chasing paperwork and calls? Send your Self-Service Sign-Up instead — clients onboard themselves with payment, documents, and credit access so you can start their case immediately.

Step 11: Onboard Your First Client

Tired of chasing paperwork and calls? Send your Self-Service Sign-Up instead — clients onboard themselves with payment, documents, and credit access so you can start their case immediately.

STAGE 3 - GROW YOUR BUSINESS

True growth isn’t just about doing more — it’s about building smarter systems that give you freedom, impact, and lasting success.

Once your business is running, it’s time to grow. With automations, outsourcing, and advanced strategies, you’ll be able to serve more clients, reduce manual work, and increase revenue — without burning out.

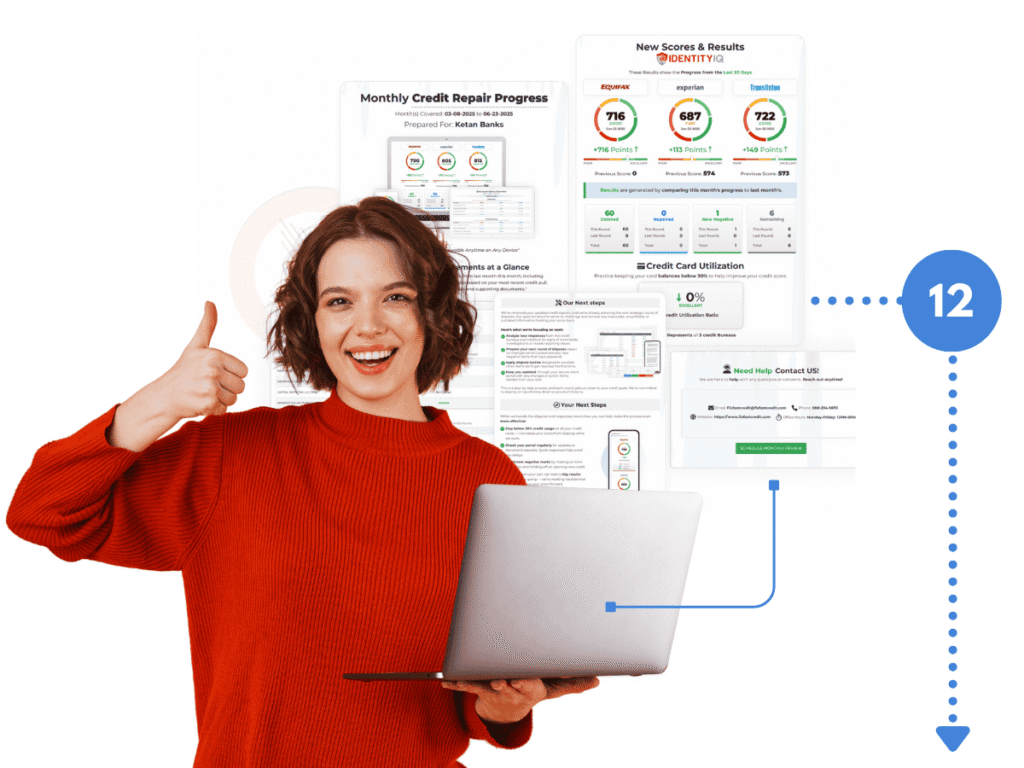

Step 12: Track Disputes and Show Results

Clients want to see results — and if you don’t show them clearly, they may not stick around. Use progress reports and trackers to keep them updated, build trust, and turn them into long-term clients who refer others.

Step 13: Automate Tasks and Follow-Up

Manual follow-ups, reminders, and dispute letters eat up your time and energy. With automation, you can set up texts, emails, and workflows that run on their own — saving hours every week and giving you more freedom.

Step 13: Automate Tasks and Follow-Up

Manual follow-ups, reminders, and dispute letters eat up your time and energy. With automation, you can set up texts, emails, and workflows that run on their own — saving hours every week and giving you more freedom.

Step 14: Hire Help or Outsource Disputes

Trying to do everything yourself leads to stress and burnout. When you’re ready to scale, outsourcing tasks like disputes, onboarding, or admin work lets you focus on growth — while still delivering excellent service.

Click the button below for the Free PDF – tasks, tips, tools, and how to delegate effectively

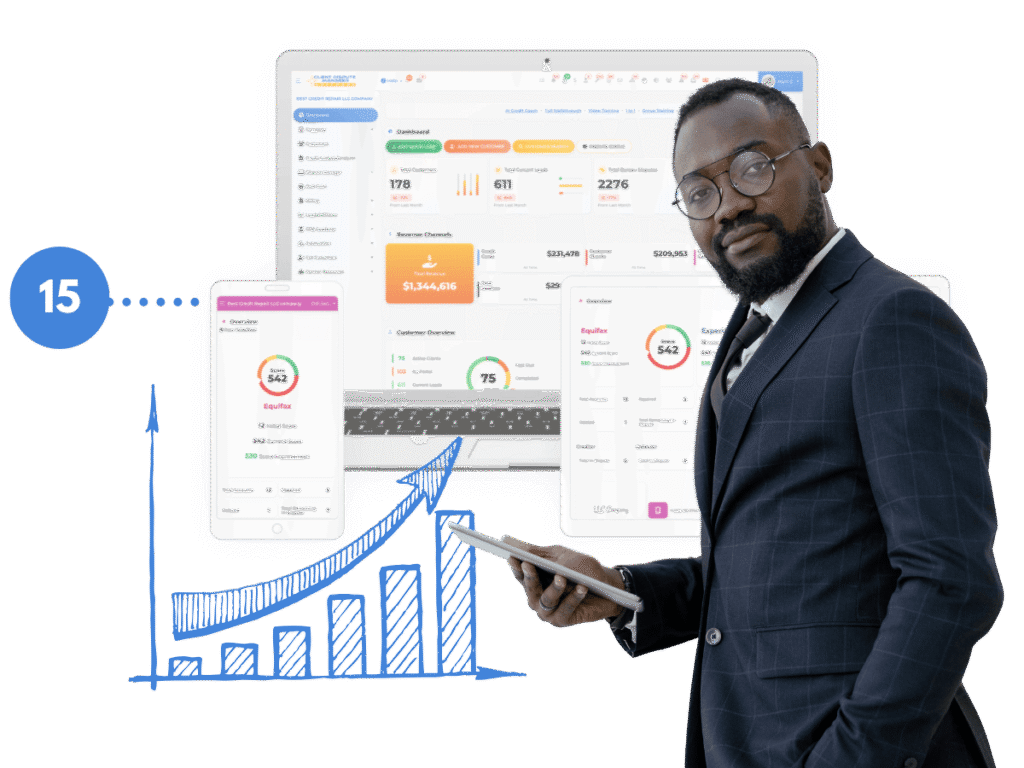

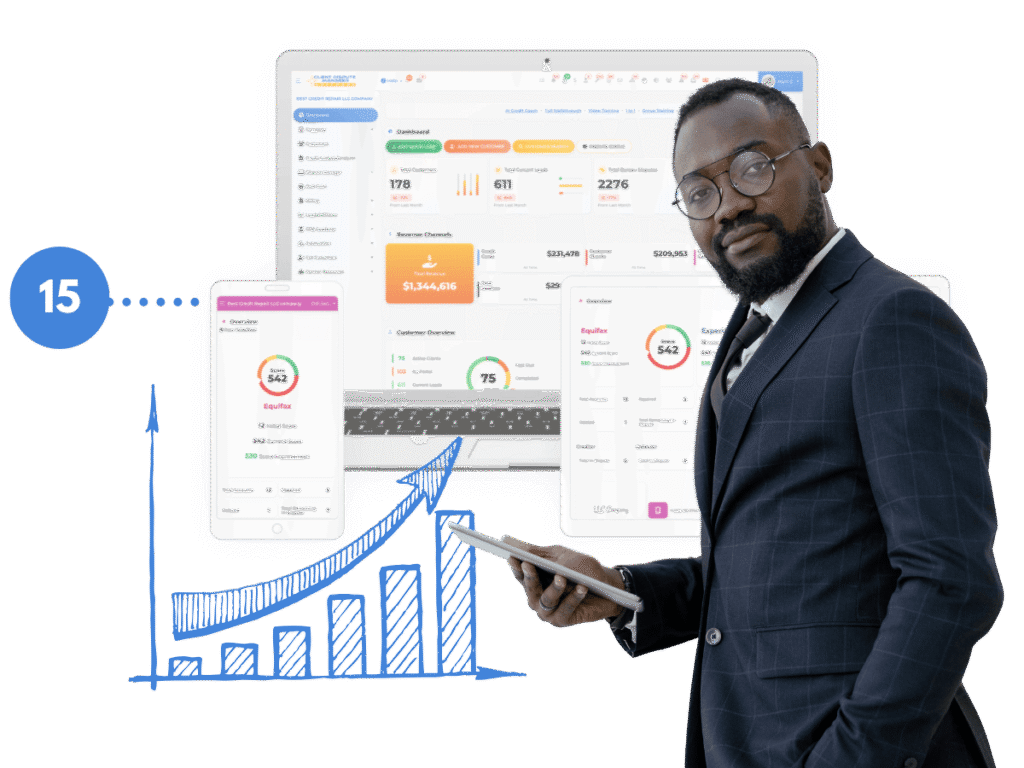

Step 15: Scale, Grow & Dominate Your Market

Once your systems are in place, the next step is scaling beyond just client work. Run webinars, create an affiliate program, or launch your own course — using your expertise to reach more people and grow your impact.

Step 15: Scale, Grow & Dominate Your Market

Now you can expand — run webinars, teach, start an affiliate program, or launch your own course. Use your software, brand, and system to build true freedom and impact.

Real Stories. Real Success.

See how entrepreneurs just like you used Client Dispute Manager Software to start, run, and grow their credit repair businesses with confidence. Their success shows what’s possible when you follow the roadmap and use the right tools.

Watch Their Journey

2:20

4:44

8:56

3:44

5:23

4:17

Frequently Asked Questions

We know starting a credit repair business comes with a lot of questions. That’s why we put together answers to the most common ones — so you can move forward with clarity and confidence.

Do I need experience to start a credit repair business?

Do I need experience to start a credit repair business?

No, you don’t need prior experience. The roadmap gives you each step, from learning the laws to getting your first clients. With the right tools and training, beginners can start with confidence.

What laws do I need to know before I begin?

What laws do I need to know before I begin?

The most important laws are the FCRA, FDCPA, and CROA. These protect consumers and guide how credit repair businesses must operate. Don’t worry — the roadmap explains these laws in simple terms so you stay compliant.

How long does it take to set up my business?

How long does it take to set up my business?

It depends on how quickly you move through the steps. Most people can complete the setup (laws, business registration, software, and pricing) in a few weeks. After that, you’ll be ready to take on clients.

Do I need a website before I can get clients?

Do I need a website before I can get clients?

A website helps, but you don’t have to wait for one to get started. You can begin with simple lead forms, referrals, and direct communication. Later, your website can boost your visibility and credibility.

How do I get my first clients?

How do I get my first clients?

Start with people you already know — friends, family, or referrals. Use the built-in lead forms in the software to collect and manage leads. The roadmap shows you how to launch your first campaign to attract clients.

Can I run this business part-time?

Can I run this business part-time?

Yes, many people start part-time while keeping their job. As you grow and set up automations, you’ll be able to manage more clients without working full-time hours right away.

What if I get stuck on the dispute process?

What if I get stuck on the dispute process?

The roadmap includes training on dispute strategies, plus with the Client Dispute Manager Software, you’ll have pre-written letters to guide you. You don’t have to figure it out alone — you’ll always have resources to help.

How do I scale once I have a few clients?

How do I scale once I have a few clients?

Once you’re comfortable, you can use automation to save time, outsource some tasks, and focus on growth. The roadmap walks you through scaling your business step by step.

Is credit repair legal?

Is credit repair legal?

Yes, credit repair is legal as long as you follow the laws. That’s why the roadmap starts with learning the rules first. Staying compliant protects both you and your clients.

Do I need expensive tools or can I start small?

Do I need expensive tools or can I start small?

You don’t need a big budget. The roadmap is designed to help you start lean with the software and essentials. As your business grows, you can add more tools and services.

Do I need special software to run my credit repair business?

Do I need special software to run my credit repair business?

Yes, having the right software makes everything easier. With Client Dispute Manager Software, you can manage clients, write dispute letters, track progress, and even automate tasks — all in one place. The best part? You can try it free before you decide. Click here to sign up.

What kind of support do I get when starting out?

What kind of support do I get when starting out?

You’re not alone! We provide daily live training, step-by-step video tutorials, and a support team ready to answer your questions. Whether you’re brand new or growing, you’ll always have guidance to help you succeed.