5-Step Credit Repair Strategy

- Fix Your Payment History – It makes up 35% of your credit score. Start here by removing errors and building on-time habits.

- Reduce Debt and Credit Utilization – Pay down high balances and keep usage under 30% to boost your score.

- Keep Old Accounts Open – Your credit age matters. Don’t close long-standing accounts unnecessarily.

- Diversify Your Credit Mix – Use both revolving and installment credit for a stronger score profile.

- Limit New Credit Applications – Too many inquiries can hurt your score. Be strategic and space out new credit.

If you’re trying to help yourself or others improve their credit, understanding the best credit repair strategies is a must. Credit affects nearly every part of your financial life — from getting a home loan to applying for a credit card or even landing a job.

But here’s the good news: you don’t need to be a financial expert to make smart moves. With the right credit repair strategy, anyone can start turning things around.

This guide is designed for entrepreneurs, individuals with credit challenges, and anyone interested in financial literacy or the credit repair industry.

We’ll walk you through the most effective credit repair strategies in a way that’s simple, practical, and easy to apply.

Start Today and Explore the Features Firsthand!

Understanding Credit Repair Strategies

Credit repair strategies are step-by-step methods used to fix errors on your credit report and build stronger financial habits.

Whether you’re just learning or looking to improve your services as a pro, mastering a basic credit repair strategy can make all the difference.

These methods are part of a larger set of effective credit repair strategies that focus on accuracy, education, and sustainable financial behavior.

By following proven systems, professionals can deliver better experiences for clients, while individuals can apply the best credit repair strategies to rebuild their scores over time.

Who Needs Credit Repair Strategies Like These?

There are many types of people who can benefit from learning and applying the right credit repair strategies.

Whether you’re fixing your own credit or helping others through a business, these methods are valuable for understanding how credit works and how to manage it better.

The following groups are especially likely to benefit from using a basic credit repair strategy:

- Entrepreneurs looking to start or grow a credit repair business

- Individuals with low credit scores due to errors or bad habits

- People who want to understand how credit score repair strategies work

- Those interested in writing or reading credit repair strategies blogs

Let’s dive into the five key steps every credit professional should follow.

Step #1: Mastering Payment History – A Core Credit Repair Strategy

Your payment history makes up 35% of your credit score. That’s why fixing issues here is one of the best credit repair strategies you can use.

Establishing a clean and accurate payment record is essential for long-term credit health.

Many professionals agree that focusing on payment history is the foundation of all effective credit repair strategies, especially when combined with client education and consistency.

Start Today and Explore the Features Firsthand!

Why Payment History Matters in Any Credit Score Repair Plan?

Late payments, collections, charge-offs — these all damage your score. If these are incorrect, using a strong credit repair strategy to remove them can make a big difference.

Even if they’re accurate, you can still help clients build better payment habits moving forward. This is one of the most important credit score repair strategies because it focuses on the root of many credit issues.

As part of the best credit repair strategies, professionals should also educate clients on how to prevent new negative marks from appearing on their reports.

Common Credit Report Issues & How to Spot Them Using Credit Repair Strategies

Identifying and correcting credit report errors is a critical part of any credit repair strategy. These issues are often overlooked but can significantly damage a person’s credit score.

By spotting these problems early, you can apply the most effective credit repair strategies to correct them and support long-term improvement.

Here are the most common credit report errors to watch for when applying credit score repair strategies:

- Late payments that are reported incorrectly

- Duplicate accounts

- Collection accounts paid but still showing as unpaid

- Mixed files (someone else’s info on your report)

Step #2: Reducing Debt – One of the Best Credit Repair Strategies

After payment history, the amount you owe — also known as credit utilization — makes up 30% of your score. Helping clients lower their balances is one of the most effective credit repair strategies available.

This step is essential in nearly all basic credit repair strategy plans because high credit card balances can significantly drag down a credit score.

By applying targeted credit score repair strategies, such as reducing balances and increasing available credit, individuals can make measurable progress toward financial stability.

Start Today and Explore the Features Firsthand!

Understanding Credit Utilization in Credit Repair Strategies

Credit utilization is the amount of available credit you’re using. The lower it is, the better. A common credit score repair strategy is to keep it under 30%.

This simple but powerful principle is a key part of many basic credit repair strategy plans because it shows lenders you’re managing your credit responsibly.

By applying effective credit repair strategies that reduce credit usage, clients can rebuild trust with creditors and improve their overall credit profile.

Best Credit Repair Strategies to Pay Down Balances

Paying down credit balances is a top priority in any set of credit repair strategies. This approach helps reduce credit utilization and is one of the fastest ways to show positive changes in a credit profile.

The strategies listed below are widely recognized as part of the best credit repair strategies for improving scores and financial health.

- Pay more than the minimum each month

- Use extra income to tackle high-interest cards first

- Make two payments per month instead of one

- Use installment loans to pay off revolving credit

- Apply for a credit limit increase (only if it triggers a soft inquiry)

Simple Debt Reduction Techniques That Work

Debt reduction is more than just paying down what’s owed. It’s also about knowing which balances hurt the most.

A solid credit repair strategy includes prioritizing high-interest debt and teaching clients how to avoid accumulating new balances.

These credit repair strategies are especially effective when combined with tools like budgeting apps and goal-setting plans. Suggest that clients:

- Stop using maxed-out cards

- Track spending and set goals

- Consider part-time work or side gigs to increase income

These steps are part of any smart credit repair strategy that focuses on long-term change.

Start Today and Explore the Features Firsthand!

Step #3: Building Credit Age – A Basic Credit Repair Strategy That Works

Fifteen percent (15%) of your credit score is based on how long you’ve had credit. That means closing old accounts can hurt your score — even if you’re not using them.

This is why maintaining long-standing accounts is a vital part of the best credit repair strategies.

When building a strong credit profile, a key credit score repair strategy is to keep your positive, aged accounts open to reflect responsible usage over time.

Including this step in your overall credit repair strategy helps establish trust with lenders and adds stability to your credit history.

Why Keeping Older Accounts Open Is a Smart Credit Repair Strategy?

Older accounts show that you’ve been a responsible borrower over time. Keeping them open is one of the most overlooked credit repair strategies.

Many people close old accounts without realizing they’re damaging their credit history.

One of the best credit repair strategies is to preserve the age of credit lines, which demonstrates long-term financial responsibility to lenders.

By following this part of a basic credit repair strategy, clients can maintain a solid foundation for their overall credit score.

What to Avoid When Managing Credit Age?

Understanding what not to do is just as important as knowing what to do when it comes to credit age.

These common mistakes can damage your credit score and undo the progress made through other credit repair strategies.

The points below highlight actions that should be avoided to protect your credit history:

- Don’t close your oldest credit card

- Avoid applying for too many new cards

- Don’t let credit cards go unused for too long — creditors may close them automatically

Educate clients about these principles. They may not know, and they depend on your expertise to guide them. This is a key aspect of all credit score repair strategies.

Step #4: Mixing Up Your Credit – A Smart Strategy for Better Credit Scores

Ten percent (10%) of your score is based on your credit mix — having different types of credit. This is where basic credit repair strategy meets credit building.

Including a variety of credit types in your profile can make a big impact when applying the best credit repair strategies.

A strong credit score repair strategy doesn’t just fix mistakes — it also encourages healthy growth by using tools like secured cards, installment loans, and rental tradelines.

What Is a Healthy Credit Mix?

One of the most overlooked yet effective credit repair strategies is maintaining a healthy mix of credit types. A strong credit mix shows lenders that you can responsibly manage different types of credit accounts, like revolving and installment credit.

In your role as a credit repair specialist, part of your credit repair strategy should involve reviewing your client’s existing credit and identifying gaps that could be hurting their score.

For example, if a client only has credit cards, you may recommend adding an installment account such as a credit-builder loan or a small personal loan. This is especially important because credit mix accounts for 10% of the credit score.

The goal is to gradually build variety without overwhelming the client or causing unnecessary hard inquiries.

Here’s what a healthy credit mix might include:

- One or two credit cards

- A car loan

- A student loan

- A credit-builder loan or secured credit card

- Rental reporting services or utility tradelines

Educating clients on the importance of credit mix is one of the best credit repair strategies you can use to improve creditworthiness over time.

It’s not just about fixing errors — it’s also about helping clients become more attractive to lenders in the future.

Start Today and Explore the Features Firsthand!

Step #5: Controlling New Credit – A Key Part of Any Credit Score Repair Strategy

The last 10% of your score is impacted by how often you apply for new credit. Every application can cause a small drop, especially if there are too many. This is why managing new credit applications is a critical part of the best credit repair strategies.

By applying smart credit score repair strategies, clients can avoid unnecessary inquiries that may lower their score and signal credit risk to lenders.

A well-structured credit repair strategy should include guidance on when and how to apply for new credit without hurting your progress.

Why Too Many Applications Can Damage Your Credit: Credit Repair Strategy Insights

Each time you apply for credit, an inquiry is added to your report. Too many make you look desperate for credit, which can scare lenders.

Let clients know that top FICO achievers usually don’t apply for more than 3 credit accounts per year.

Tips to Stay in Control of New Credit:

- Limit applications to no more than three per year

- Wait 6 months between credit applications

- Always check if a lender uses a soft or hard pull

- Interview your clients before disputing inquiries

- Only challenge inquiries that are unauthorized or involve identity theft, and dispute with the creditor first

Teaching this is essential to any credit repair strategy that focuses on score stability.

Bonus: Stay Compliant While Using These Credit Repair Strategies

Whether you’re running a business or helping yourself, you need to follow the law. No credit repair strategy is worth doing if it violates regulations.

All effective credit repair strategies must operate within the legal framework set by the FTC, CROA, and TSR.

Violating these laws can lead to penalties and loss of trust from clients, which ultimately harms your business and reputation.

Staying compliant ensures your credit repair strategy is both ethical and sustainable.

FTC and CROA: What You Need to Know

- Never guarantee credit score increases

- Avoid misleading language (e.g., “we’ll fix your credit fast”)

- Get written authorization before working on someone’s report

- Stay compliant with the FTC Act, TSR, and CROA at all times

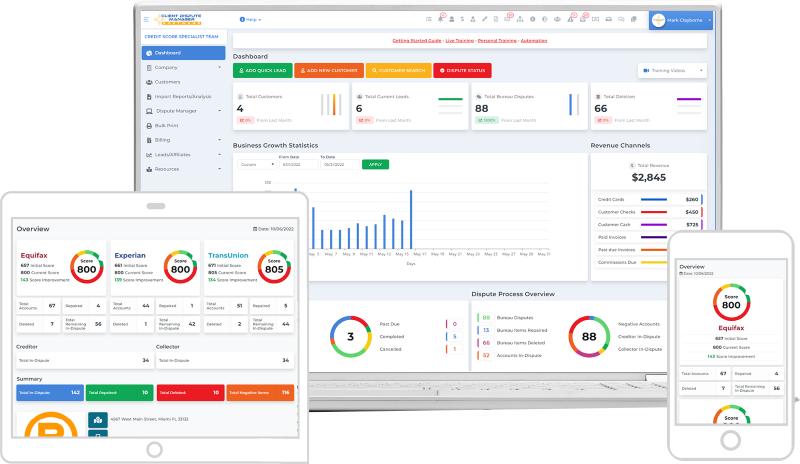

Using Client Dispute Manager Software to Streamline Your Credit Repair Strategy

If you’re serious about implementing the most effective credit repair strategies, the right tools can make all the difference.

Client Dispute Manager Software is a powerful, all-in-one platform designed to help credit repair professionals automate, manage, and scale their operations with ease.

The software supports the entire credit repair workflow—from importing credit reports and generating dispute letters to tracking client progress and educating them through automated emails.

It also includes built-in compliance features to help you stay aligned with FTC, CROA, and TSR regulations, which are essential for any ethical and legal credit repair strategy.

Start Today and Explore the Features Firsthand!

How Client Dispute Manager Software Enhances Your Workflow?

Client Dispute Manager Software is built to support your credit repair business at every stage. By automating tedious tasks and providing a centralized hub for managing disputes and client communication, it simplifies your day-to-day operations.

Below are just a few ways this software empowers professionals using credit repair strategies to stay efficient and organized:

- Automatically generate and manage dispute letters

- Organize clients by dispute stage and credit factor

- Send educational, nurturing emails to clients automatically

- Track dispute outcomes and credit report updates

- Monitor client activity and progress over time

Incorporating this tool into your business isn’t just smart—it’s part of a modern, professional, and effective credit repair strategy.

Whether you’re a solo entrepreneur or running a growing credit repair agency, Client Dispute Manager helps you serve clients more efficiently and achieve better outcomes without cutting corners or risking non-compliance.

Conclusion

The five-step credit repair strategy offers a simple, proven path to help clients work toward better credit. From payment history to managing new credit, these credit repair strategies give structure to your process while staying compliant.

With tools like Client Dispute Manager Software, you can save time, stay organized, and deliver more value.

These strategies are designed to support both professionals and individuals using basic credit repair strategy techniques to drive meaningful improvements.

When implemented consistently, the best credit repair strategies help build trust with clients, boost retention, and foster long-term results.

Mark Clayborne

Mark Clayborne specializes in credit repair, starting and running credit repair businesses. He's passionate about helping businesses gain freedom from their 9-5 and live the life they really want. You can follow him on YouTube.

Start Today and Explore the Features Firsthand!