Your credit report holds the key to your financial opportunities. When lenders assess your report, they’re checking more than just numbers. They’re looking at your behavior, your reliability, and your habits.

Credit inquiries play a crucial role in shaping this narrative. But what happens when there are too many inquiries, or worse, unauthorized ones? Understanding, managing, and removing these inquiries can be the game-changer you need.

Whether you’re looking for 24 hour inquiry removal, trying to remove credit inquiries in 24 hours, or uncovering secret ways to remove hard inquiries, this guide will help. Let’s dive in and explore the world of credit inquiries together.

Start Today and Explore the Features Firsthand!

Understanding Credit Inquiries: The Basics

Credit inquiries happen when lenders check your credit report. They help assess your financial behavior. There are two main types: hard and soft inquiries. Hard inquiries occur during credit applications and may lower your score. Soft inquiries happen when you check your credit or get pre-approved and don’t impact your score.

What is a Credit Inquiry?

A credit inquiry is a review of your credit report. It shows lenders your financial habits and reliability. This insight helps them decide if you’re trustworthy with loans or credit cards. There are two types of inquiries hard and soft. Hard inquiries occur when you apply for credit and may slightly lower your score.

Soft inquiries happen when you check your own credit or a lender pre-qualifies you. These do not affect your credit score. Knowing how inquiries appear on your report can help you manage your financial reputation. For lenders, inquiries are a sign of your credit behavior. Frequent hard inquiries might indicate risk, while soft inquiries are neutral.

Understanding their role is essential to maintaining a healthy credit profile.

How Do Credit Inquiries Impact Your Credit?

Hard inquiries can lower your score by a few points, but the exact impact varies by individual. Multiple hard inquiries in a short time suggest financial stress to lenders. This may reduce your chances of approval for loans or credit cards.

Soft inquiries, by contrast, have no impact on your score. They’re useful for monitoring your credit without risking any damage. Hard inquiries remain visible on your report for two years, with their effect diminishing over time. Managing these inquiries is crucial to maintaining a strong credit profile.

Limiting unnecessary hard inquiries and regularly reviewing your report can prevent potential issues. Addressing unauthorized inquiries quickly also ensures your credit remains accurate. Combining proactive strategies and understanding the types of inquiries helps protect your score effectively.

Why Are Credit Inquiries Important?

Lenders care about inquiries because they reflect your financial habits and credit-seeking behavior. Too many inquiries may signal financial instability, which can impact approval decisions. A clean and limited inquiry history reassures lenders that you are not overextending yourself financially.

Regular credit checks help you stay aware of your report’s contents. Catching unauthorized inquiries early prevents them from lowering your score unnecessarily. Monitoring your report allows you to track your financial progress and maintain lender trust.

Taking proactive measures, such as limiting unnecessary applications, supports a stable credit profile. Lenders view a manageable number of inquiries as a sign of responsible credit behavior. Being mindful of how inquiries appear ensures you maintain a strong credit profile.

Start Today and Explore the Features Firsthand!

The Difference Between Hard and Soft Inquiries

Hard and soft inquiries affect your credit differently. Hard inquiries happen when applying for credit and can slightly lower your score. They stay on your report for two years. Soft inquiries occur when you or others, like employers, check your credit without impacting your score.

Why Do Hard Inquiries Matter to Lenders?

Lenders see hard inquiries as signs of credit-seeking behavior, which can raise concerns if frequent. This can indicate financial instability if inquiries are made repeatedly in a short timeframe. Mortgage and auto loan inquiries are treated differently, as these are often grouped when made within a specific window.

This protects consumers from penalty while rate shopping. Lenders want to assess whether you are responsibly managing your credit. A high number of hard inquiries may suggest you’re seeking credit to cover financial gaps. Keeping your inquiries low is a sign of stability and helps improve approval chances.

Knowing secret ways to remove hard inquiries can help manage their impact effectively. By addressing unauthorized inquiries and monitoring your applications, you maintain better control of your credit profile.

How Long Do Inquiries Stay on Your Report?

Hard inquiries remain on your credit report for two years, but their negative impact diminishes over time. During the first 12 months, these inquiries weigh more heavily on your score. By the second year, their effect is minimal. Soft inquiries, on the other hand, are not visible to lenders and have no impact on your score.

They are only visible to you for monitoring purposes. Regularly checking your report helps track the timeline for your inquiries. This ensures that older, irrelevant inquiries do not continue to affect your credit decisions. Understanding how to remove hard inquiries in 24 hours can help resolve issues quickly if unauthorized inquiries appear.

Can Legitimate Inquiries Be Removed?

Legitimate inquiries typically cannot be removed unless an error has occurred. These inquiries reflect your credit applications and provide transparency for lenders. However, unauthorized inquiries can and should be disputed.

Ensuring that only valid inquiries appear on your report keeps it accurate. Disputing inquiries promptly reduces the risk of errors lowering your score. Knowing how to remove credit inquiries in 24 hours equips you to handle disputes quickly and effectively.

Using monitoring services or professional credit repair can simplify this process further.

Start Today and Explore the Features Firsthand!

How Hard Inquiries Impact Your Credit Score

Hard inquiries can lower your credit score by a few points. The effect is small but adds up if there are many. Each hard inquiry reflects a potential new credit account, which lenders may view as risky. Disputing unauthorized inquiries helps clean your report and prevents long-term damage to your score.

How Many Points Do Inquiries Lower Your Score?

A single hard inquiry might lower your score by 5 points. However, the impact depends on your overall credit profile. Multiple inquiries within a short period can harm your credit more significantly. Each inquiry indicates a credit-seeking action, which lenders view as a potential risk.

Addressing unauthorized inquiries quickly ensures that they do not linger unnecessarily. Proactively monitoring and disputing suspicious activity prevents larger issues. Knowing how to remove credit inquiries in 24 hours ensures your profile remains strong and appealing to lenders.

A proactive approach strengthens your creditworthiness over time.

Can Removing Inquiries Boost Your Score?

Removing inquiries has a small impact on your score, typically less than 5 points per inquiry. However, it improves your overall credit health by eliminating unnecessary red flags. When you know secret ways to remove hard inquiries, you’re better equipped to maintain a clean credit report.

Removing errors or unauthorized entries restores accuracy to your report. This ensures that only relevant and legitimate inquiries affect your profile. Building good credit habits alongside this approach leads to long-term benefits.

What Should Victims of Identity Theft Do?

Victims of identity theft should freeze their credit to prevent further misuse. File disputes for any unauthorized inquiries as soon as they are discovered. Reporting identity theft to the authorities is also essential.

Quick action minimizes financial harm and helps you access credit inquiry removal in 24 hour free.

Strategies to Remove Credit Inquiries in 24 Hours

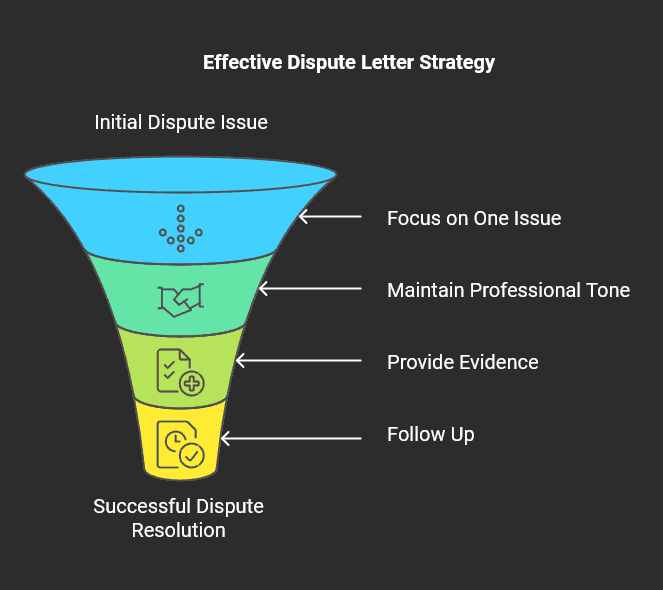

When it comes to 24 hour inquiry removal, a structured approach is key. Here are proven strategies to ensure success:

Review Your Credit Report Thoroughly

Start by obtaining a free copy of your credit report from Annual Credit Report Website. Examine the “inquiries” section carefully to identify unauthorized or unnecessary hard inquiries. Pay special attention to entries you don’t recognize or recall authorizing. Take note of the date, creditor’s name, and the type of inquiry.

Reviewing your report ensures you have a clear picture of all inquiries affecting your credit. Unauthorized inquiries can go unnoticed for months without consistent monitoring.

By checking your report, you identify potential fraudulent activities. Knowing what inquiries to dispute is the first step to achieving credit inquiry removal in 24 hour free. A thorough review sets a strong foundation for further actions to protect your credit score.

Create a detailed list of questionable inquiries. This list will serve as the foundation for your dispute. Having organized information simplifies the process and speeds up dispute resolutions.

Start Today and Explore the Features Firsthand!

Contact the Creditor Directly

If you find unauthorized inquiries, contact the creditor listed on your report. Ask for details about the inquiry to confirm its legitimacy. If the inquiry was unauthorized, request that they remove it immediately. Some creditors may require you to provide proof of identity theft or Clear communication with creditors ensures faster resolutions.

Explain your concerns calmly and factually. Provide any supporting documentation promptly to build your case. Unauthorized inquiries often stem from data errors or fraudulent attempts. Directly addressing these issues with the creditor can result in immediate action.

Steps to Follow:

- Call the creditor using the contact information from your credit report.

- Clearly explain your concern and provide any supporting documentation.

- Request written confirmation once the inquiry is removed.

- Follow up to ensure the inquiry has been removed from your credit report.

File a Dispute with Credit Bureaus

For faster results, dispute the unauthorized inquiries directly with the credit bureaus. This process can often be done online through Equifax, Experian, or TransUnion’s dispute portals. Provide evidence, such as letters from creditors or a police report if identity theft is involved.

Submitting a dispute ensures that the credit bureau investigates the validity of the inquiry. Credit bureaus have a legal obligation to resolve disputes within 30 days.

By providing thorough evidence, you increase the chances of a favorable outcome. Keep records of all communication and uploads to ensure nothing is overlooked.

How to File:

- Log in to the credit bureau’s dispute portal.

- Select the inquiries you want to dispute.

- Upload supporting documents (e.g., proof of identity theft or error).

- Monitor the dispute status for updates.

- Verify the results after the bureau completes their investigation.

Leverage Fraud Alerts or Credit Freezes

If you suspect fraud, consider adding a fraud alert to your credit file. This notifies creditors to verify your identity before approving new credit applications. For severe cases, freezing your credit prevents any access to your credit report, blocking further unauthorized inquiries.

Fraud alerts and freezes act as protective measures to safeguard your credit file. Fraud alerts last for one year but can be renewed. A credit freeze adds an extra layer of security by restricting access to your credit report entirely. These tools prevent further damage and offer peace of mind.

Benefits:

- Fraud alerts are free and easy to set up with all three credit bureaus.

- Credit freezes provide long-term protection and can be temporarily lifted as needed.

- These measures are particularly effective if your personal information has been compromised.

Start Today and Explore the Features Firsthand!

Monitor Your Progress

Keep track of the status of your disputes and follow up if necessary. Credit bureaus typically resolve disputes within 30 days. However, persistence is key to ensuring inquiries are removed promptly.

Monitoring your progress ensures nothing falls through the cracks. Check your report regularly to confirm the inquiries have been removed. Follow up with the credit bureau or creditor if there are delays. Staying proactive keeps your credit profile accurate and updated.

- Set reminders to check updates on your disputes.

- Verify that resolved inquiries no longer appear on your credit report.

- Use credit monitoring tools to track real-time changes.

Prevent Future Inquiries

Once you’ve cleared unauthorized inquiries, focus on prevention. Limit credit applications to essential needs, and use pre-qualification tools that perform only soft inquiries. Educate yourself on secret ways to remove hard inquiries and keep your credit report in pristine condition.

Preventing unnecessary inquiries is essential to maintaining a strong credit profile. Avoid frequent credit applications and ensure your personal information is secure. Implementing preventive measures reduces the risk of unauthorized inquiries in the future.

Long-Term Strategies:

Regularly review your credit report for accuracy.

Enable credit monitoring alerts to detect unauthorized activity quickly.

Safeguard your personal information to prevent identity theft.

Use secured networks and strong passwords for online accounts.

Why Lenders Care About Your Credit Inquiries

Frequent inquiries may indicate financial instability or a pattern of excessive credit-seeking behavior. Lenders view too many inquiries within a short period as a sign of risk. It could mean the applicant is relying too much on borrowed funds, which might lead to repayment issues. This perception can make lenders hesitant to approve loans or credit cards.

Additionally, hard inquiries stay on your report for up to two years, signaling your financial decisions during that time. For lenders, it’s important to evaluate the context of these inquiries.

Grouped inquiries for rate shopping, like mortgages or auto loans, are less concerning. Limiting unnecessary applications and managing inquiries wisely builds confidence with lenders. Monitoring your report ensures you catch and address red flags early to maintain a strong profile.

Do All Inquiries Have the Same Weight?

Not all inquiries impact your credit equally, as their purpose matters significantly. Mortgage and auto loan inquiries are often grouped as a single inquiry if conducted within a short period, which is beneficial for consumers. Lenders prioritize recent hard inquiries over older ones, as they reflect your current credit-seeking activity.

Soft inquiries, on the other hand, are harmless and invisible to lenders. Understanding how each inquiry type affects your profile helps you navigate applications wisely. For example, a single inquiry for a new credit card carries more weight than grouped inquiries for rate shopping.

Proper timing and context ensure lenders view your report favorably. Avoiding excessive hard inquiries helps improve your chances of approval. Regularly reviewing your credit keeps you informed and prepared to address potential issues.

Start Today and Explore the Features Firsthand!

How Can You Reduce Lender Concerns?

Reducing lender concerns about your credit inquiries requires strategic planning and proactive management. First, limit your applications for new credit to only when absolutely necessary.

This minimizes the number of hard inquiries on your report. Second, take advantage of pre-qualification tools, which perform only soft inquiries and help you assess your eligibility without affecting your score.

Additionally, consider explaining any grouped inquiries during loan applications, especially if they were for rate shopping. Using tools like fraud alerts and credit freezes can also prevent unauthorized inquiries. Consistently monitoring your report ensures that you address errors promptly.

By keeping your credit profile clean and organized, you build a reputation of responsibility with lenders. Strong financial habits reassure lenders that you’re a trustworthy borrower.

Final Thoughts: Achieving Credit Success

Removing unauthorized inquiries protects your credit health and ensures your financial profile remains strong. Stay proactive by monitoring your reports regularly and disputing errors immediately. Taking control of your credit ensures a secure financial future.

Whether you’re aiming for credit inquiry removal in 24 hour free or exploring how to remove credit inquiries in 24 hours, these proven strategies will empower you to take control of your financial future.

Mark Clayborne

Mark Clayborne specializes in credit repair, starting and running credit repair businesses. He's passionate about helping businesses gain freedom from their 9-5 and live the life they really want. You can follow him on YouTube.

Start Today and Explore the Features Firsthand!