Save Time with Automated Credit Audit Tools

- Trial Begins Immediately

- Change Plans Anytime

- No CC Required

- Cancel Anytime

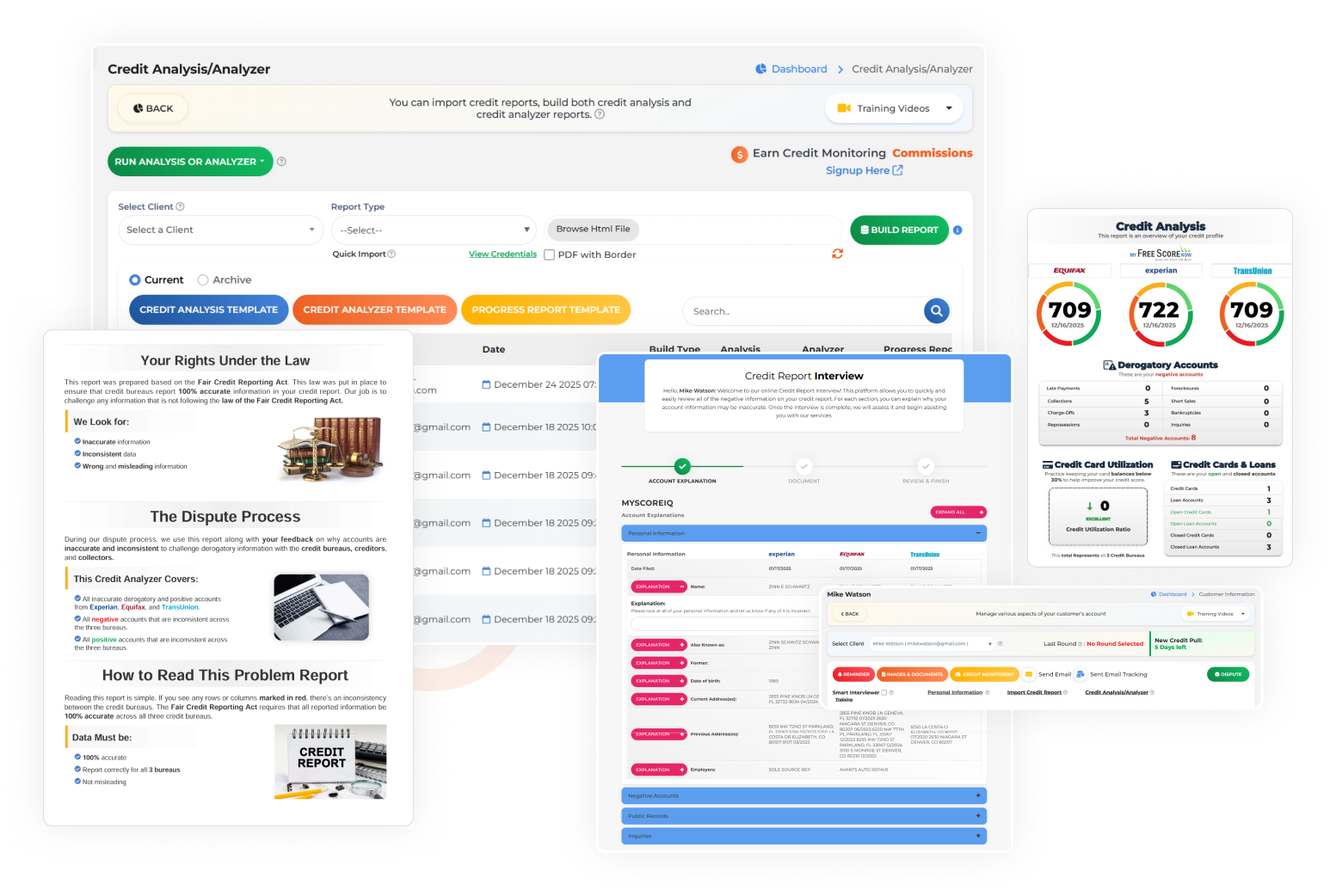

Transform Credit Analysis with Advanced Tools

Credit Analysis

Deliver actionable insights with a quick and efficient credit analysis.

- Get a snapshot of negative items in under 90 seconds.

- Provide clients with clear strategies to improve their scores.

- Create a personalized, step-by-step improvement plan to build trust and credibility.

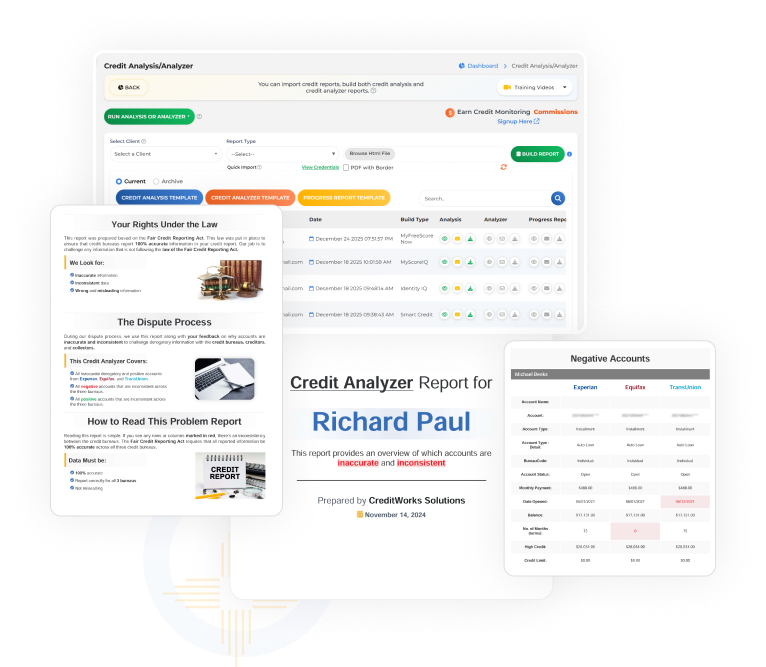

Credit Analyzer

- Identify inconsistent or negative accounts quickly and accurately.

- Perform a thorough analysis in just two clicks.

- Share professional, detailed reports with clients to keep them informed and engaged.

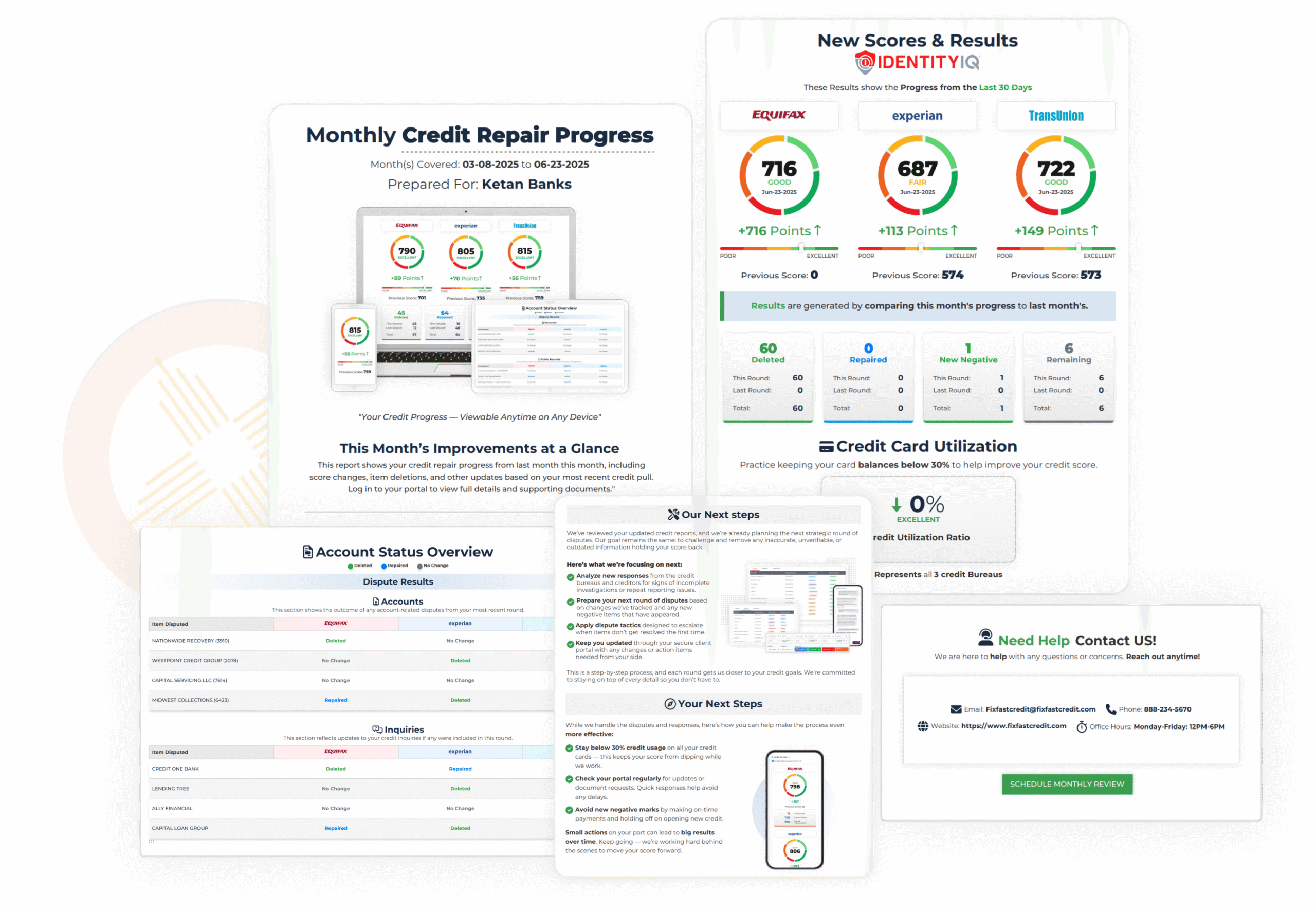

Progress Report

- Track deletions, disputes, and score changes automatically.

- Build trust and boost retention with real, easy-to-read results.

- Deliver branded updates that clients actually understand and value.

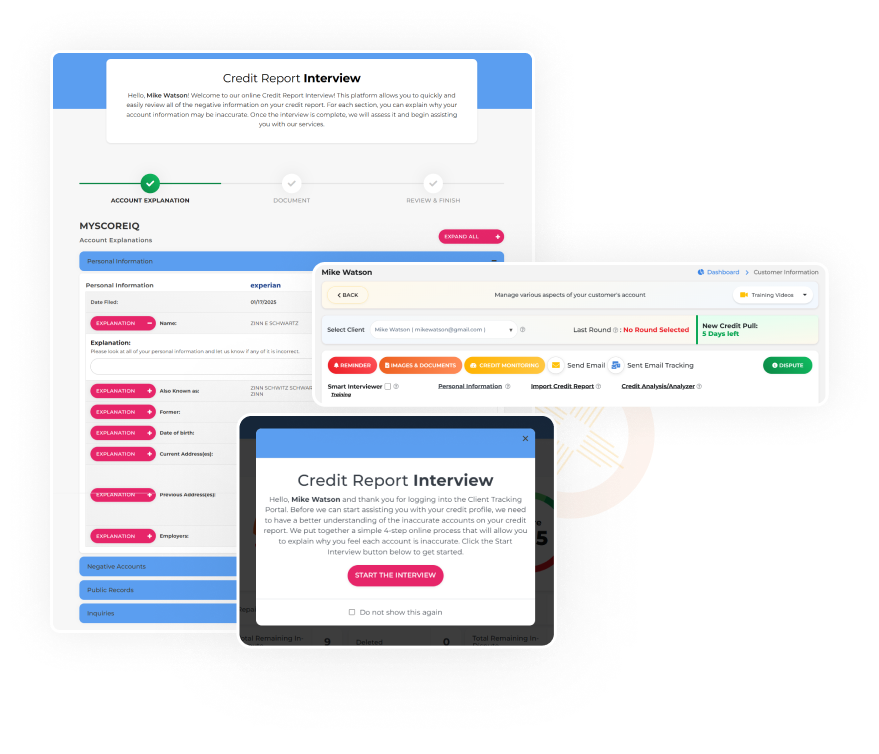

Smart Interviewer

- Share a secure link for clients to complete at their convenience.

- Receive their responses directly in the software for seamless integration.

- Use their feedback to craft precise, effective dispute letters, ensuring better results.

Testimonial

FAQ

The analysis delivers key insights on derogatory items and improvement steps in under 90 seconds, saving you time while enhancing your service delivery.

Absolutely. While the software offers a default strategy, you can tailor plans to align with individual client needs and goals.

The tool uses smart algorithms to scan credit reports and pinpoint inconsistent or inaccurate data across bureaus. This reduces manual errors and helps you focus on building effective dispute strategies.

It highlights inaccurate or conflicting information across their credit reports, giving you a clear way to show clients exactly what’s wrong. This builds trust, sparks meaningful conversations, and helps them understand the path forward.

The Progress Report tracks score changes, deletions, new negatives, and remaining accounts—then lets you send clear, visual updates to clients. This builds trust, boosts retention, and reduces refund requests.

You don’t have to build it from scratch, but yes—after running the Check New Updates feature, you’ll click to generate the Progress Report and then click once more to send it to your client. It’s fast, simple, and takes just a few seconds.

Yes, the Smart Interviewer link is encrypted, ensuring your clients’ sensitive information is protected while streamlining your workflow.

It lets your clients identify issues on their credit reports before you even start—giving you accurate input upfront. This means fewer delays, more precise letters, and a smoother dispute experience for everyone.