Are you struggling with credit issues or considering starting a credit repair business? Understanding credit repair laws is crucial for both consumers and entrepreneurs. This guide explores key regulations governing credit repair, including the Fair Credit Reporting Act (FCRA), the Credit Repair Organizations Act (CROA), and the Telemarketing Sales Rule (TSR).

Credit repair laws ensure fair practices and protect consumers’ rights. By the end of this guide, you’ll understand the legal framework that governs credit repair activities and how to maintain compliance.

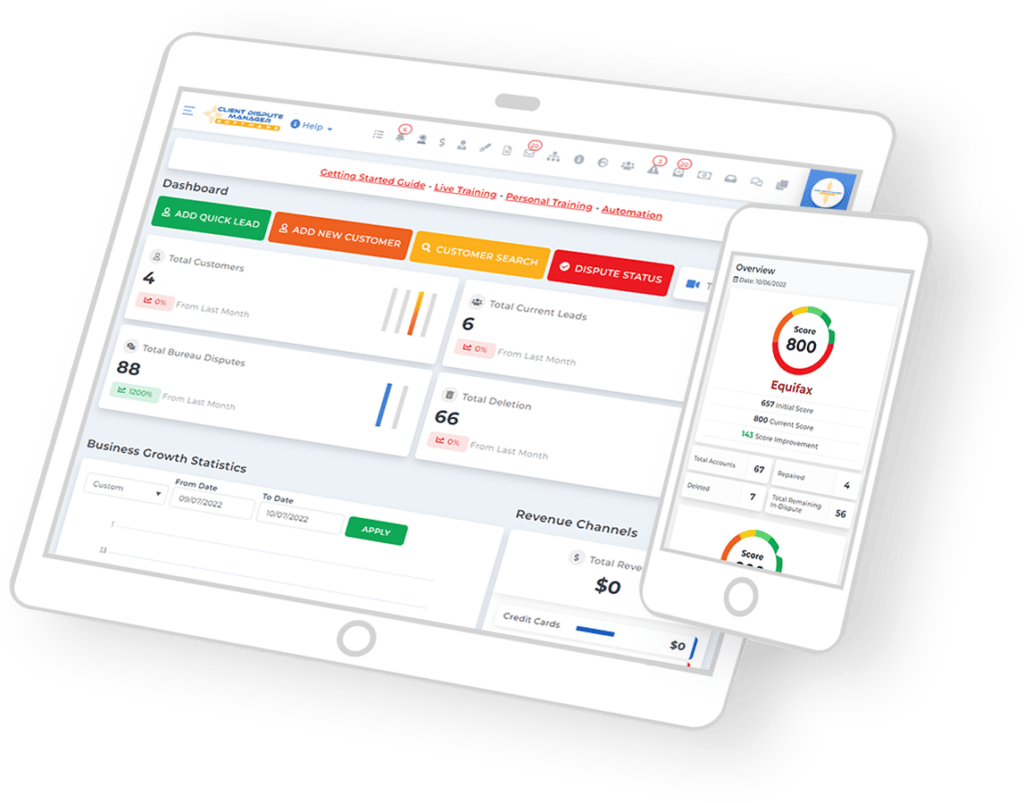

Start Today and Explore the Features Firsthand!

The Importance of Credit Repair Laws for Consumers and Businesses

Credit repair laws form the foundation of ethical practices in the industry. These laws for credit repair are designed to protect consumers and ensure fair practices in the credit repair industry. They play a vital role in maintaining the integrity of the credit reporting system and preventing fraudulent or deceptive practices that could harm consumers.

Benefits of Understanding Laws for Credit Repair

By understanding and following these credit repair laws, you can:

- Protect yourself from fraudulent schemes

- Ensure your credit repair business operates legally and ethically

- Avoid costly fines and legal troubles

- Build trust with clients and creditors

- Contribute to a more transparent and fair credit repair industry

As we delve deeper into specific regulations, you’ll see how these laws for credit repair shape the landscape of credit improvement services. Credit repair company regulations play a crucial role in maintaining integrity in the industry and protecting consumer rights.

Historical Context of Credit Repair Laws and Credit Repair Compliance

To fully appreciate the importance of current credit repair laws, it’s helpful to understand their historical context. Before the implementation of these regulations, the credit repair industry was largely unregulated, leading to numerous instances of consumer exploitation.

Unscrupulous companies would often make unrealistic promises, charge exorbitant fees, and use questionable tactics to “repair” credit.

The introduction of laws like the Fair Credit Reporting Act (FCRA) in 1970 and Credit Repair Organizations Act (CROA) in 1996 marked significant milestones in consumer protection. These laws established clear guidelines for credit reporting agencies and credit repair organizations, bringing much-needed oversight to the industry.

The Fair Credit Reporting Act (FCRA): Cornerstone of Credit Repair Laws

The Fair Credit Reporting Act is a cornerstone of credit repair laws. Enacted in 1970, the FCRA has been amended several times to keep pace with the evolving credit landscape. FCRA compliance is essential for both consumers and credit repair companies. This act regulates how credit reporting agencies collect, use, and share consumer credit information.

Key Provisions of Fair Credit Reporting Act (FCRA) for Credit Repair Compliance

Key provisions of the FCRA include:

- The right to request a free annual credit report from each major credit bureau

- The ability to dispute errors on your credit report

- Time limits on how long negative information can stay on your credit report

- Requirements for employer consent before accessing credit reports for employment purposes

- The right to be informed if information in your credit report has been used against you

- The right to place a security freeze on your credit report

Start Today and Explore the Features Firsthand!

Fair Credit Reporting Act FCRA Compliance for Credit Repair Companies: Best Practices

For credit repair companies, FCRA compliance means always obtaining written permission before pulling a client’s credit report and educating clients on their rights under the Fair Credit Reporting Act. While assisting clients in disputing inaccurate information is a key service, it’s crucial that credit repair companies never guarantee the removal of accurate negative information, as this would violate Fair Credit Reporting Act (FCRA) guidelines.

FCRA compliance also extends to credit reporting agencies, which must follow reasonable procedures to ensure the accuracy and fairness of the information in credit reports. This aspect of FCRA compliance is crucial for maintaining the integrity of the credit reporting system.

The Credit Repair Organizations Act (CROA): Protecting Consumers

The Credit Repair Organizations Act is another pivotal piece of credit repair laws. Enacted in 1996, CROA sets the standard for credit repair company regulations and ensures that consumers are treated fairly when seeking credit repair services. Understanding and adhering to CROA is crucial for anyone involved in credit repair.

Key Credit Repair Organizations Act (CROA) Requirements for Credit Repair Businesses

Key CROA requirements include:

- Providing clients with a written contract outlining services and fees

- Prohibiting companies from charging fees before performing services

- Giving clients a three-day cancellation period after signing a contract

- Prohibiting false or misleading advertising claims

- Requiring a separate written disclosure of consumer rights

- Prohibiting the practice of advising consumers to make false statements to credit reporting agencies

CROA Compliance: Building Trust in the Credit Repair Industry

For credit repair businesses, staying compliant with CROA involves more than just following rules it’s about building a reputation as a trustworthy organization.

By developing clear, transparent contracts, implementing systems for tracking service completion before charging fees, and training staff on proper communication with clients, credit repair companies can differentiate themselves in a competitive market and provide genuine value to their clients.

The Impact of Credit Repair Organizations Act (CROA) on Credit Repair Practices and Consumer Protection

The implementation of the Credit Repair Organizations Act (CROA) has significantly changed the landscape of the credit repair industry. Before CROA, many credit repair companies used questionable tactics and made unrealistic promises to attract clients. The act’s prohibition on upfront fees and requirement for honest advertising have forced companies to focus on providing real value to clients rather than relying on deceptive marketing practices.

For example, prior to the Credit Repair Organizations Act (CROA), a credit repair company might have promised to “erase all negative items from your credit report” and charged hundreds of dollars upfront. Now, such practices are illegal. Instead, compliant companies focus on educating clients about their rights, assisting with legitimate disputes, and providing ongoing support throughout the credit repair process.

Start Today and Explore the Features Firsthand!

The Telemarketing Sales Rule (TSR): Additional Credit Repair Compliance for Credit Repair Companies

While the Telemarketing Sales Rule might not seem immediately relevant to credit repair, it adds another layer to credit repair company regulations, particularly for those using telemarketing as part of their business model.

Understanding and following the Telemarketing Sales Rules is crucial for credit repair businesses that engage in any form of telemarketing.

Key TSR Provisions Affecting Credit Repair Organizations

The TSR requires credit repair companies to clearly disclose the nature of their services and any limitations when communicating with potential clients via telephone. One of the most significant provisions of the TSR for credit repair companies is the payment restriction, which prohibits requesting or receiving payment for credit repair services until six months after the promised results have been achieved.

Other key provisions include:

- Prohibiting misrepresentations about any aspect of the credit repair service

- Requiring clear disclosure of the total cost of services

- Mandating compliance with the National Do-Not-Call Registry

- Prohibiting abusive or deceptive telemarketing acts or practices

Ensuring TSR Credit Repair Compliance in Credit Repair Business Practices

To ensure TSR compliance, credit repair businesses should:

- Develop clear scripts for telemarketing calls that include all required disclosures

- Implement a system to track the timing of results and payments

- Regularly update and check against the Do-Not-Call Registry

- Provide comprehensive staff training on proper telemarketing practices

- Establish a robust record-keeping system to document compliance efforts

The Intersection of TSR and Other Credit Repair Laws & Credit Repair Compliance

It’s important to note that the TSR works in conjunction with other credit repair laws to provide comprehensive consumer protection. For instance, while CROA prohibits upfront fees for credit repair services, the TSR extends this prohibition to telemarketing contexts and adds the six-month waiting period. This synergy between different regulations underscores the importance of a holistic approach to credit repair law compliance.

Balancing Credit Repair Compliance and Effective Credit Repair: Strategies for Success

Now that we’ve covered the main credit repair laws, you might be wondering: “How can I effectively help clients improve their credit while staying compliant?” The key lies in focusing on education, accuracy, and transparency.

Let’s explore some strategies for balancing legal compliance with effective credit repair services.

Education and Empowerment: Key Components of Compliant Credit Repair

Educating clients about their rights under credit repair laws and how to improve their credit themselves aligns with the spirit of these regulations while providing valuable service. This approach empowers consumers to take control of their financial health, which is the ultimate goal of ethical credit repair.

Consider developing educational materials that explain credit repair laws in simple terms. Offer workshops or webinars on topics like understanding credit reports, disputing errors, and building good credit habits. By positioning yourself as an educator as well as a service provider, you can build trust with clients while ensuring they’re well-informed about their rights and responsibilities.

Accuracy and Transparency in Credit Repair Practices

Emphasizing accuracy in credit reporting is at the heart of FCRA compliance and ethical credit repair. Setting realistic expectations is crucial for CROA compliance. Be clear about what you can and cannot do, avoiding any guarantees of specific results.

Develop a clear, step-by-step process for reviewing credit reports and identifying potential errors or discrepancies. When assisting clients with disputes, ensure that all information provided is accurate and verifiable. Maintain open communication with clients throughout the process, explaining each step and potential outcomes.

Documentation and Ongoing Credit Repair Compliance

Thorough documentation is essential for demonstrating compliance with all credit repair laws. Implement a robust system for tracking client interactions, disputes filed, and services performed. This not only helps in case of any legal scrutiny but also allows you to track your progress and improve your services over time.

Staying updated on changes in credit repair laws is key to long-term success in this industry. Regularly review and update your policies to ensure ongoing compliance with changing regulations. Consider subscribing to legal update services or joining industry associations that provide timely information on regulatory changes.

Client Dispute Manager Software: Enhancing Compliance in Credit Repair

In the ever-evolving landscape of credit repair laws and regulations, technology plays a crucial role in ensuring compliance and efficiency. Client Dispute Manager Software has emerged as a valuable tool for credit repair organizations seeking to maintain FCRA compliance and adhere to credit repair company regulations.

The Role of Software in Credit Repair Compliance

Client Dispute Manager Software serves as a comprehensive solution for managing the complex process of credit repair while staying within the bounds of laws for credit repair. These platforms are designed to streamline operations, enhance accuracy, and provide a clear audit trail for regulatory compliance.

Key Features of Client Dispute Manager Software:

- Secure Client Information Management: In line with data protection aspects of credit repair laws, these systems offer secure storage and management of sensitive client information.

- Dispute Tracking and Management: The software facilitates the tracking of disputes from initiation to resolution, ensuring adherence to FCRA timelines and requirements.

- Document Generation and Management: Automated generation of CROA-compliant contracts and disclosures helps credit repair organizations meet legal requirements consistently.

- Audit Trail and Reporting: Comprehensive logging and reporting features aid in demonstrating compliance with credit repair company regulations during audits or legal scrutiny.

Start Today and Explore the Features Firsthand!

Conclusion

Navigating credit repair laws can be complex, but understanding these regulations is essential for both consumers and credit repair professionals. By staying informed and compliant with FCRA, CROA, and TSR regulations, you can protect yourself, build trust with clients, and contribute to a fair and ethical credit repair industry.

Remember, knowledge is power when it comes to credit repair laws. Whether you’re a consumer looking to improve your credit or an entrepreneur in the credit repair industry, understanding these laws is your first step towards success. Stay informed, stay compliant with credit repair company regulations, and you’ll be well-equipped to navigate the world of credit repair with confidence.

Mark Clayborne

Mark Clayborne specializes in credit repair, starting and running credit repair businesses. He's passionate about helping businesses gain freedom from their 9-5 and live the life they really want. You can follow him on YouTube.

Start Today and Explore the Features Firsthand!

Below Is More Content For Your Review: