In today’s financial environment, scaling credit repair operations has become essential for providing broader access to financial freedom and opportunities through improved credit scores. Credit repair services are at the forefront of empowering individuals by addressing inaccuracies on their credit reports.

This crucial service not only enhances credit scores but also opens a myriad of new possibilities for consumers. Expanding credit repair operations means more individuals can enjoy the substantial benefits of a healthy credit score, such as securing mortgages, achieving employment goals, and obtaining favorable interest rates.

Start Today and Explore the Features Firsthand!

Understanding Credit Repair Basics

The journey to credit repair begins with obtaining credit reports from the three major credit bureaus: Equifax, Experian, and TransUnion. This step is crucial for identifying any inaccuracies, outdated information, or potential areas for improvement. By disputing errors and negotiating with creditors, credit repair agencies work tirelessly to clean up credit reports, ensuring that their clients’ credit scores reflect their true financial behavior and history.

The Need for Scalability

As more individuals become aware of the importance of a good credit score, the demand for credit repair services is skyrocketing. This surge presents a golden opportunity for credit repair businesses to expand their operations.

However, scaling up presents its own set of challenges, including maintaining high-quality service, ensuring compliance with legal standards, and managing an increasing volume of clients. Addressing these challenges head-on is essential for any credit repair business aiming for sustainable growth.

Key Strategies for Scaling

Scaling a credit repair operation is a delicate balancing act that requires strategic planning and execution. Here are some key strategies to consider:

Technology Integration

In the digital age, technology stands as the backbone of efficient and scalable operations. Credit repair businesses can leverage CRM (Customer Relationship Management) systems, automation tools, and cloud-based solutions to streamline processes, manage client interactions more effectively, and handle a larger volume of cases without compromising accuracy or quality.

Process Optimization

Optimizing internal processes is key to scaling efficiently. This could mean standardizing procedures for dispute resolution, automating routine tasks, or even integrating AI to assist with credit report analysis. By refining these processes, businesses can minimize errors, reduce turnaround times, and ultimately handle more clients with the same level of personalized attention.

Start Today and Explore the Features Firsthand!

Staff Training and Management

As operations expand, having a well-trained and motivated team becomes more critical than ever. Ongoing training programs can ensure that all staff members are up-to-date with the latest credit repair strategies, legal requirements, and customer service best practices. Effective management and clear communication channels further ensure that the team remains cohesive and focused on common goals.

Compliance and Regulation

Navigating the complex landscape of financial regulations is a challenge for any credit repair business. Scalability requires a proactive approach to compliance, with a dedicated team or resources set aside to monitor regulatory changes and implement necessary adjustments promptly. Maintaining high ethical standards not only avoids legal pitfalls but also builds trust with clients and partners.

Targeting New Markets

Exploring new geographic areas or demographic segments can uncover untapped markets eager for credit repair services. Digital marketing and social media platforms offer cost-effective ways to reach these new audiences, while partnerships with local businesses or community organizations can provide a foothold in these markets.

Client Dispute Manager Software: The Game-Changer for Scaling Operations

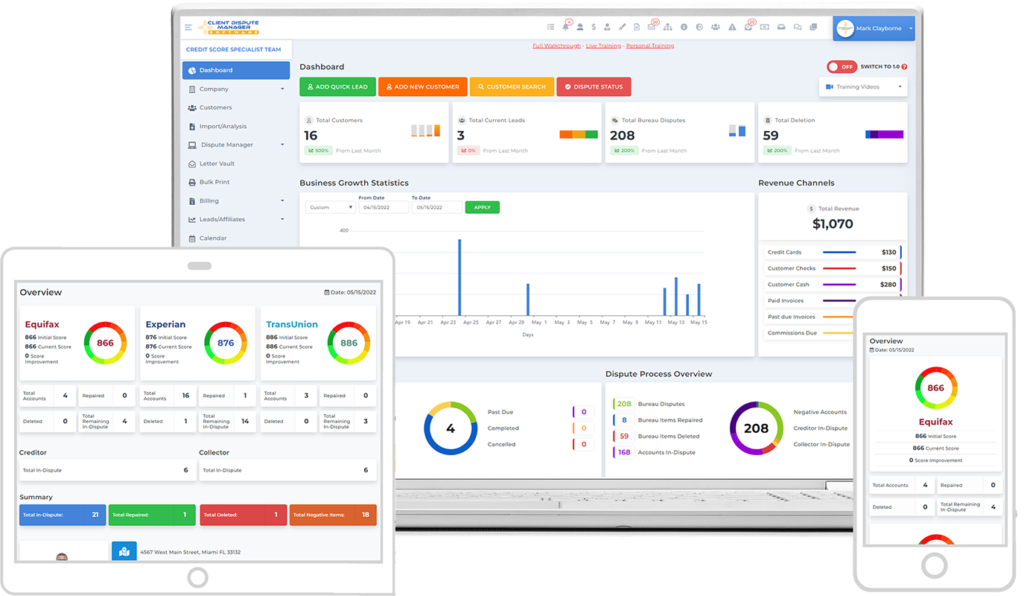

In the quest for scaling credit repair operations, the adoption of Client Dispute Manager Software emerges as a game-changing strategy. This specialized software is designed to automate and streamline the process of managing disputes, a core aspect of credit repair services. By integrating such a platform, credit repair businesses can significantly enhance their efficiency, accuracy, and client satisfaction levels. Let’s delve into how this software becomes an indispensable tool for businesses looking to scale.

Enhanced Efficiency and Productivity

Client Dispute Manager Software automates many of the time-consuming tasks associated with credit repair, such as drafting dispute letters, tracking progress with credit bureaus, and managing client communications. This automation frees up valuable time for credit repair specialists, allowing them to focus on more complex cases or expand their client base without compromising service quality.

Start Today and Explore the Features Firsthand!

Improved Accuracy and Compliance

One of the critical challenges in credit repair is ensuring that all disputes are accurate, well-documented, and compliant with legal standards. Client Dispute Manager Software comes equipped with templates and compliance checks that minimize the risk of errors and non-compliance issues. This not only protects the business and its clients but also increases the chances of successful dispute resolutions.

Data-Driven Insights for Continuous Improvement

Another advantage of utilizing Client Dispute Manager Software is the ability to gather and analyze data on dispute outcomes, client demographics, and service efficiency. These insights can inform strategic decisions, helping businesses to identify areas for improvement, optimize their operations, and better target their marketing efforts.

Conclusion

Scaling credit repair operations is an ambitious endeavor that requires careful planning, dedication, and a willingness to adapt. By embracing technology, optimizing processes, investing in staff, and expanding services thoughtfully, credit repair businesses can achieve sustainable growth. The path to scaling may be complex, but the rewards—helping more people achieve their financial goals and dreams—are undoubtedly worth the effort.