In an era where a three-digit number can determine whether you can buy a home, get a job, or even start a business, maintaining a good credit score is paramount. But sometimes, credit reports carry inaccuracies, outdated information, or instances of identity theft, which can tarnish your score. Rectifying these issues can be tedious and complex, often leaving many feeling overwhelmed. Enter credit repair software, the unsung hero in the digital age of financial management.

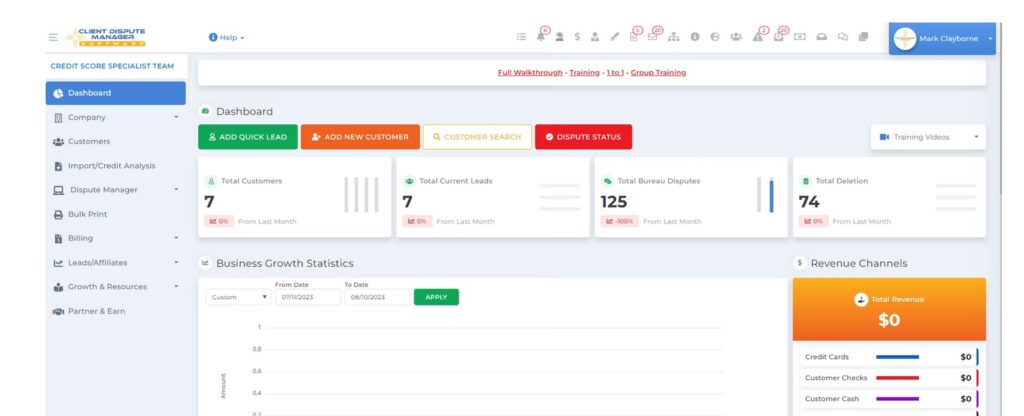

Specifically, the Client Dispute Manager Software stands out, offering innovative solutions to demystify and streamline the credit repair process. So, how does credit repair software, like Client Dispute Manager Software, actually work? Dive in as we unravel the intricacies of these digital tools and their transformative power in the world of credit.

Behind the Scenes: How Credit Repair Software Works

Credit repair software, like the Client Dispute Manager Software, functions as the backbone for businesses and individuals striving to rectify inaccuracies on credit reports. With the increasing importance of credit scores in today’s financial landscape, having a reliable mechanism to ensure the accuracy and fairness of these scores is paramount. But how does the software actually manage this seemingly complex process?

Let’s delve into the behind-the-scenes operations of credit repair software.

Automated Data Import and Analysis

The very first step for any credit repair journey involves collecting and analyzing the client’s credit reports from the three major bureaus: Experian, Equifax, and TransUnion. Instead of manually scanning these reports, Client Dispute Manager Software uses advanced algorithms to pull this data, identify negative items, and systematically categorize them based on type (e.g., late payments, collections, bankruptcies).

Dispute Management

One of the primary features of credit repair software is its ability to manage disputes. After detecting negative items, the software provides users with templated dispute letters which can be tailored to the specific issue at hand. The Client Dispute Manager Software ensures each letter adheres to the Fair Credit Reporting Act (FCRA) regulations, increasing the chances of successful disputes.

Regular Monitoring and Reporting

After dispatching dispute letters, it’s essential to keep tabs on their status. Client Dispute Manager Software automatically tracks the progress of each dispute, sending out reminders for follow-ups and notifying the user of any updates from the credit bureaus. This automation saves time and ensures no dispute falls through the cracks.

Client Portal Access

Understanding that transparency is key in credit repair, the software provides an intuitive client portal. Here, clients can check their dispute status, view before-and-after reports, and communicate with credit repair specialists in real-time. This direct channel empowers clients by giving them an insight into the credit repair process.

Continuous Learning and Updates

The world of credit reporting and finance is ever-evolving. Client Dispute Manager Software is designed to learn from every dispute, refining its algorithms and approaches. Plus, with regular updates, the software remains compliant with any new credit reporting regulations.

Factors to Consider When Choosing Credit Repair Software

In the realm of financial management, credit repair software stands as an indispensable tool for individuals and businesses looking to rectify their credit scores and manage their credit histories more effectively. With the evolution of technology, a multitude of such software is available in the market.

Among the top contenders, Client Dispute Manager Software stands out for its unique features and capabilities. However, before making a selection, one must consider various factors to ensure the chosen software aligns with their needs.

- Ease of Use: A user-friendly interface is paramount. You want a software that’s straightforward, easy to navigate, and doesn’t require a steep learning curve. The Client Dispute Manager Software boasts an intuitive design, ensuring users, whether novices or professionals, can efficiently operate it.

- Automation Capabilities: Automation simplifies the credit repair process. The capability to automatically generate dispute letters, for instance, can save significant time and reduce errors. Client Dispute Manager Software provides an array of automation features, streamlining your credit repair tasks.

- Security Measures: With sensitive financial data involved, robust security features are non-negotiable. Make sure the software employs state-of-the-art encryption, secure data storage, and has built-in protective measures against potential breaches.

- Integration with Other Platforms: A good credit repair software should seamlessly integrate with other essential platforms, be it credit reporting agencies or financial management tools. Client Dispute Manager Software’s ability to smoothly integrate ensures you have all the information you need in one place.

- Cost-effectiveness: Price plays a pivotal role. Ensure the software offers good value for money. Consider the features, benefits, and long-term gains against the investment. With Client Dispute Manager Software, not only do you get advanced functionalities but also a pricing structure that caters to both individuals and professionals.

- Customizability: Every user has unique requirements. A good credit repair software should offer customizable templates and features, allowing users to tailor the tool according to their specific needs. Client Dispute Manager Software offers this flexibility, ensuring each user gets a personalized experience.

- Customer Support: Even the most technologically adept individuals may run into occasional hitches. A responsive customer support team, offering guidance through issues, is a must-have. Client Dispute Manager Software prides itself on its robust support system, ensuring users always have assistance when needed.

The Impact and Future of Credit Repair Software

Credit repair software has revolutionized the way individuals manage their finances, offering them the tools they need to improve their credit scores. This technology has had a significant impact on financial well-being and is set to shape the future of credit repair.

Advancements in credit repair software have led to the automation of dispute generation, making it easier for users to challenge inaccuracies on their credit reports. With AI-powered algorithms, these software solutions can now provide more accurate and efficient dispute generation processes. This not only saves time but also increases the chances of successfully resolving disputes.

Tips for Maximizing the Benefits of Client Dispute Manager Software

Credit repair has evolved significantly with the advent of technology, and one of the most powerful tools in this realm is Client Dispute Manager Software. This software offers individuals the means to take charge of their credit repair journey, allowing them to identify inaccuracies, dispute erroneous information, and ultimately improve their credit scores.

To harness the full potential of Client Dispute Manager Software, consider the following tips:

Familiarize Yourself with the Software

Before diving into credit repair with Client Dispute Manager Software, take the time to familiarize yourself with its features and functions. Understand how to navigate through the interface, generate dispute letters, track progress, and utilize any additional tools provided. This initial investment of time will pay off as you use the software effectively.

Review Your Credit Report

To make the most of the software, begin by obtaining and reviewing your credit reports from all three major credit bureaus: Equifax, Experian, and TransUnion. Identify any discrepancies, inaccuracies, or outdated information that might be negatively impacting your credit score. Client Dispute Manager Software can help streamline this process, making it easier to pinpoint areas that need attention.

Customize Dispute Letters

One of the key features of Client Dispute Manager Software is its ability to generate dispute letters. While the software typically provides templates, take the extra step to customize these letters based on the specific inaccuracies you’ve identified on your credit report. Personalized dispute letters are more likely to grab the attention of creditors and credit bureaus, increasing the chances of a successful resolution.

Keep Detailed Records

Successful credit repair relies on maintaining organized records of your efforts. Use the software’s features to keep track of the disputes you’ve initiated, the responses received, and any progress made. Detailed records not only help you monitor the status of your disputes but also serve as evidence should you need to escalate the matter.

Seek Professional Guidance When Needed

While Client Dispute Manager Software empowers individuals to manage their credit repair independently, there are situations where professional guidance might be beneficial. If you encounter complex credit issues or legal concerns, consider consulting a credit repair professional or a credit counseling agency. They can offer specialized advice tailored to your circumstances.

Conclusion

In conclusion, credit repair software has revolutionized the way individuals and businesses manage their credit profiles. With its advanced functionality and user-friendly interface, it offers a convenient solution for improving credit scores and repairing negative items.

By automating the dispute process, credit repair software streamlines the traditionally tedious task of challenging inaccuracies on credit reports. This saves time and effort, allowing users to focus on other important aspects of their financial lives.

Bonus: Now that you have read this article, why not take your new skill and start your own credit business helping others? We have free training that can help you do just that.

Click here to learn more.