Are you searching for effective ways to improve credit score results? Mastering the art of improving credit scores has become essential in today’s financial landscape. Whether you’re looking for the fastest way to improve credit score or seeking long-term solutions for improving credit score success, this comprehensive guide will walk you through proven strategies that work.

Table of Contents

Start Today and Explore the Features Firsthand!

Understanding the Fundamentals of Improving Credit Scores

Before diving into specific ways to improve credit score rankings, it’s crucial to understand what makes up your credit score. Your journey to improve credit score standings begins with knowledge of the key factors that influence your creditworthiness. Financial experts agree that understanding these components is the foundation for improving credit scores effectively.

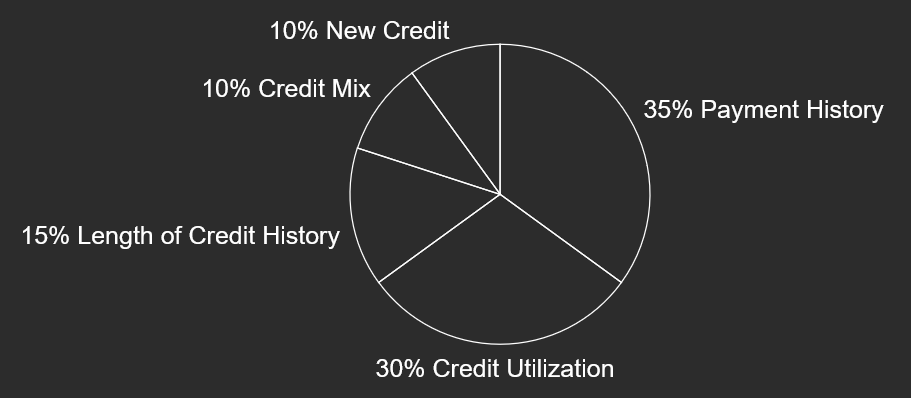

The Five Key Components of Your Credit Score

Your FICO score calculation considers five main elements that affect your ability to improve credit score rankings. Understanding these components is crucial when exploring ways to improve credit score standings.

- Payment History (35%): This is the most significant factor in your credit score calculation. Your history of paying bills on time, including both credit cards and loan payments, carries the most weight. A consistent pattern of timely payments is essential for improving credit scores and demonstrates reliability to lenders. Missing payments or making late payments can significantly damage your credit score and take years to recover from.

- Credit Utilization (30%): As the second most important factor, credit utilization represents how much of your available credit you’re using. This ratio of current balances to credit limits plays a crucial role in improving credit score rankings. Maintaining a utilization rate below 30% is among the fastest way to improve credit score results, with lower percentages generally leading to better scores. Experts recommend keeping utilization as low as possible, ideally below 10%.

- Length of Credit History (15%): The duration of your credit history shows lenders your long-term experience with managing credit. This factor considers the age of your oldest account, your newest account, and the average age of all accounts combined. While building credit history takes time, it’s a fundamental element for improving credit scores sustainably. Keeping older accounts open and active can positively impact this component.

- Credit Mix (10%): Having diverse types of credit accounts demonstrates your ability to manage different credit responsibilities. A healthy mix might include credit cards, retail accounts, installment loans, and mortgages. While not the most crucial factor, a diverse credit mix can help when looking for ways to improve credit score standings. However, only open new accounts when necessary and manageable.

- New Credit (10%): This factor considers your recent credit applications and newly opened accounts. Too many hard inquiries or new accounts in a short period can suggest financial distress to lenders. Managing new credit applications carefully is important when improving credit scores. Space out credit applications and only apply for credit when necessary.

Strategy #1: Perfect Payment History - The Fastest Way to Improve Credit Score

Creating a perfect payment history is crucial for improving credit scores. This strategy focuses on never missing a payment and consistently paying bills on time. Consider these essential tactics for maintaining a spotless payment record.

Research shows that payment history has the single biggest impact on credit scores, making this the most critical area to focus on when seeking to improve credit score rankings. Regular, timely payments can help offset other credit challenges and demonstrate financial responsibility to lenders.

Setting Up Systems for Improving Credit Scores

Establish automatic payments for all your bills to ensure timely payments. Create a budget that accounts for all payment due dates, and maintain a calendar system for tracking payments. This systematic approach is one of the most effective ways to improve credit score rankings over time.

Consider setting up payment alerts as a backup to your automatic payments, ensuring you never miss a due date even if there are issues with automatic scheduling. Building redundancy into your payment systems helps protect your credit score from accidental oversights or technical problems.

Start Today and Explore the Features Firsthand!

Addressing Past Issues to Improve Credit Score

Contact creditors about previous late payments and request goodwill adjustments. Document all communication and work to establish a positive relationship with creditors. While fixing past issues isn’t the fastest way to improve credit score standings, it’s essential for long-term success.

Many creditors are willing to work with customers who show genuine effort to improve their payment habits and maintain open communication. Consider writing goodwill letters explaining any extraordinary circumstances that led to missed payments, as some creditors may be willing to remove negative marks from your credit report.

Strategy #2: Mastering Credit Utilization for Improving Credit Scores

Managing your credit utilization requires careful attention to both overall and per-card balances when working to improve credit score rankings. Understanding how utilization affects your credit score can help you make strategic decisions about when and how to use your credit cards.

Many consumers don’t realize that credit scoring models consider both individual card utilization and aggregate utilization across all cards, making this aspect particularly important for improving credit scores. Credit utilization changes can reflect quickly on your credit report, often making this the fastest way to improve credit score results when managed correctly.

Strategic Ways to Improve Credit Score Through Utilization

Keep your credit card balances well below their limits, ideally under 30% utilization for optimal credit score impact. Consider making multiple payments throughout the month to maintain low utilization, even if you use your cards frequently. This approach to managing utilization is one of the most effective ways to improve credit score standings quickly.

Credit scoring models often capture your card balances at random points during the month, so maintaining consistently low utilization is more effective than paying down balances just before your statement date. Consider setting up balance alerts at 25% utilization to help you stay well within optimal ranges.

Increasing Credit Limits to Boost Your Score

Request credit limit increases periodically, especially if your income has increased or you’ve maintained a good payment history. Time these requests carefully to minimize hard inquiries while maximizing their positive impact on your credit utilization ratio.

Most credit card issuers review accounts periodically and may offer automatic increases to responsible customers, making this a passive way of improving credit scores. Build a strong payment history with each credit card issuer before requesting increases, as this improves your chances of approval without triggering a hard inquiry.

Consider spreading out limit increase requests among different cards to maximize your chances of approval.

Strategy #3: Building a Strong Credit Mix for Improved Scores

Diversifying your credit portfolio demonstrates financial maturity and responsibility to lenders. While not the most crucial factor, having a mix of credit types can enhance your creditworthiness and provide additional ways to improve credit score standings.

Understanding how different types of credit impact your score allows you to make strategic decisions about which accounts to open or maintain. Remember that building a diverse credit mix should be done gradually and thoughtfully to avoid appearing credit-hungry to lenders.

Types of Credit That Help Improve Credit Score

Maintain a balanced combination of revolving credit (like credit cards) and installment loans (such as auto loans or mortgages). Each type of credit serves a different purpose in improving credit scores and demonstrates various aspects of credit management ability.

Consider starting with a secured credit card if you’re new to credit building or recovering from past credit issues.

Remember that the goal is to show responsible management of different credit types, not to open accounts unnecessarily just for the sake of diversity. Focus on obtaining credit products that serve your actual financial needs while contributing to a healthy credit mix.

Start Today and Explore the Features Firsthand!

Strategy #4: Optimizing Credit History Length

The age of your credit accounts significantly impacts your ability to improve credit score rankings. While building credit history takes time, maintaining older accounts and managing them responsibly can help in improving credit scores over the long term. Understanding how account age affects your credit score allows for better strategic decisions about account management.

Managing Older Accounts to Improve Credit Score

Keep your oldest credit cards active by using them occasionally for small purchases. This practice helps maintain the length of your credit history while contributing to improving credit scores. Consider setting up small recurring charges on older accounts to keep them active without risking overspending.

Building New Credit Strategically

When adding new accounts to your credit profile, consider how they’ll affect your average account age. While this isn’t the fastest way to improve credit score results, thoughtful account management helps build a strong credit foundation. Balance the potential benefits of new credit against the impact on your credit history length.

Strategy #5: Monitoring and Disputing for Better Scores

Regular credit monitoring represents one of the most overlooked ways to improve credit score standings. Checking your reports regularly helps identify and address issues quickly, preventing long-term damage to your credit profile. Make it a habit to review your reports from all three major credit bureaus.

Regular Credit Report Reviews

Check your credit reports at least once every four months, rotating between the three major bureaus. Look for inaccuracies, outdated information, or signs of identity theft that could be affecting your efforts at improving credit scores. Document any discrepancies you find for follow-up.

Start Today and Explore the Features Firsthand!

Effective Dispute Processes

When you find errors, dispute them promptly with both the credit bureaus and the creditors. This can be one of the fastest way to improve credit score results if legitimate errors are found and corrected. Keep detailed records of all communications during the dispute process.

Understanding your rights under the Fair Credit Reporting Act (FCRA) strengthens your position when disputing inaccuracies. Consider sending disputes via certified mail with return receipt requested to maintain proper documentation.

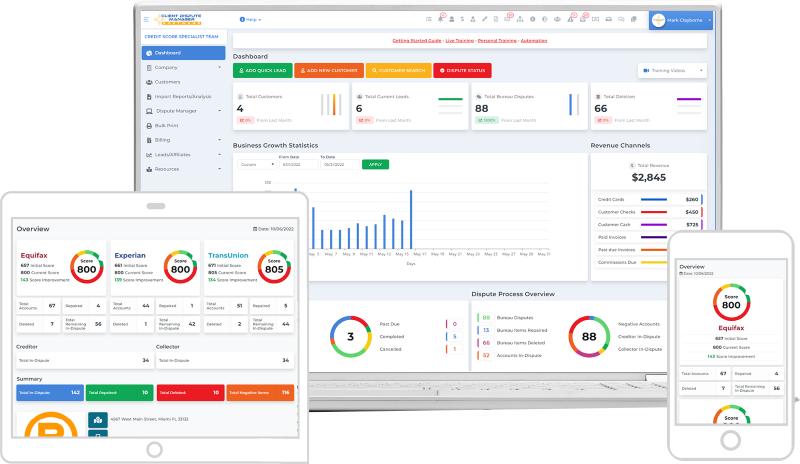

Leveraging Client Dispute Manager Software

In today’s digital age, Client Dispute Manager Software has become an invaluable tool for effectively managing credit report disputes and improving credit scores. This specialized software streamlines the dispute process and helps maintain organized records of all credit repair efforts.

Benefits of Using Client Dispute Manager Software

- Organized Documentation: The software helps you keep all your documents, correspondence, and dispute information in one place. This is crucial when trying to remove bankruptcy from credit report that are inaccurate, as you’ll need to manage multiple pieces of evidence and communications.

- Automated Dispute Letters: Many Client Dispute Manager Software options can generate dispute letters based on the specific inaccuracies you’ve identified. This can save time and ensure your disputes are clearly articulated when addressing issues like Chapter 7 bankruptcies that are incorrectly reported.

- Progress Tracking: The software typically includes features to track the progress of your disputes. This is helpful in understanding where you are in the process of removing bankruptcy from credit report which are inaccurate.

- Compliance with Regulations: Good Client Dispute Manager Software is updated regularly to comply with current credit reporting laws and regulations. This ensures that your efforts to remove bankruptcy from credit report that are inaccurate are within legal boundaries.

- Reminder Systems: These tools often include reminder features to help you follow up on disputes in a timely manner, which is crucial when dealing with the time-sensitive nature of credit bureau investigations.

Strategy #6: Smart Credit Applications

Being selective about new credit applications is essential when working to improve credit score rankings. Each application typically results in a hard inquiry, which can temporarily impact your score. Plan your credit applications carefully to minimize their impact on your credit profile.

Strategic Application Timing

Group similar credit applications within a short timeframe to minimize the impact of multiple inquiries. This approach helps protect your score while you’re improving credit scores through other methods. Research qualification requirements before applying to avoid unnecessary hard inquiries.

Start Today and Explore the Features Firsthand!

Managing Credit Inquiries

Understand the difference between hard and soft inquiries when looking for ways to improve credit score standings. Use pre-qualification tools whenever possible to assess your approval chances without triggering hard inquiries. Limit new applications to maintain steady progress in your credit-building efforts.

Strategy #7: Patience and Consistency

While everyone seeks the fastest way to improve credit score results, sustainable improvement requires patience and consistent good habits. Focus on maintaining positive credit behaviors over time rather than looking for quick fixes. Remember that credit improvement is a gradual process that rewards steady, responsible credit management.

Setting Realistic Goals

Create achievable milestones in your journey to improve credit score rankings. Track your progress regularly and adjust your strategies as needed. Understand that different credit improvement methods may show results at different rates.

Develop and maintain positive credit habits for improving credit scores over time. Create systems that help you consistently meet credit obligations. Regular review of your credit management strategies helps ensure continued progress toward your credit goals.

Conclusion

Successfully working to improve credit score rankings requires a multi-faceted approach and dedication. While everyone seeks the fastest way to improve credit score results, sustainable improvement comes from implementing multiple strategies consistently. By following these proven ways to improve credit score standings and maintaining positive financial habits, you can achieve and maintain the credit score you desire.

Mark Clayborne

Mark Clayborne specializes in credit repair, starting and running credit repair businesses. He's passionate about helping businesses gain freedom from their 9-5 and live the life they really want. You can follow him on YouTube.

Start Today and Explore the Features Firsthand!

Below Is More Content For Your Review:

- From Average to Excellent: A Comprehensive Guide to Improving Your Credit Score

- How to Get 850 Credit Score: A Step-by-Step Guide