If you’ve ever applied for a credit card, loan, or even an apartment, you might have seen a sudden dip in your credit score. That dip? It’s often due to a hard inquiry.

While some inquiries are legitimate, others may not be. Understanding the secret ways to remove hard inquiries can give you more control over your credit profile.

In this guide, we’ll explore legal and effective strategies to help with hard inquiries removal, how to write a proper letter to remove hard inquiries, and how to avoid common mistakes.

Whether you’re fixing your personal credit or running a credit repair business, this information will help you stay compliant and confident.

Start Today and Explore the Features Firsthand!

What Are Hard Inquiries and Why They Matter for Your Credit Score?

A hard inquiry occurs when a lender checks your credit during an application for credit. This can slightly lower your score and stay on your report for up to two years.

Too many inquiries can hurt your chances of being approved for future credit. That’s why learning the secret ways to remove hard inquiries is so important.

Hard inquiries removal isn’t about tricking the system—it’s about knowing your rights. Not every hard inquiry is valid, and in many cases, you can take action to remove hard inquiry records that don’t belong there.

How to Identify a Inaccurate Hard Inquiry That Can Be Removed?

Not every inquiry is disputable, but many consumers are surprised to learn how often questionable inquiries appear on their reports.

Understanding what qualifies can help you take the right steps toward hard inquiries removal.

In fact, identifying an unauthorized or inaccurately reported hard inquiry is often the first step to getting it resolved.

Here’s how to know if you have a case to remove hard inquiry records or send a letter to remove hard inquiries:

- Review your credit report from all three major bureaus.

- Highlight any hard inquiry you don’t recognize.

- Compare inquiry dates to any recent applications.

Look for duplicates or inquiries from companies you didn’t authorize. These steps are key to uncovering opportunities for hard inquiries removal.

#1: Contact the Creditor to Remove a Hard Inquiry Directly

Reaching out to the creditor is one of the most overlooked yet effective secret ways to remove hard inquiries.

When you believe a hard inquiry has been placed on your credit report in error or without proper authorization, contacting the company directly gives you a chance to resolve the issue quickly.

Many creditors are willing to correct mistakes, and if you approach them with the right information and tone, you might not need to go through a formal dispute process.

This strategy allows you to remove hard inquiry entries before they become a bigger issue, and it’s a key part of successful hard inquiries removal plans.

Often, just one phone call or a well-written letter to remove hard inquiries is all it takes to start the correction process.

Start Today and Explore the Features Firsthand!

When to Ask a Creditor to Remove a Hard Inquiry?

If you see an inquiry you don’t recognize, contact the creditor listed immediately. They may have pulled your credit in error, used incorrect information, or you might have been a victim of identity confusion.

This is a crucial step in the process of hard inquiries removal because creditors can sometimes take corrective action without the need for a formal dispute.

When contacting them, be sure to explain your situation clearly and request that they verify the inquiry.

If it was unauthorized or added by mistake, ask them to remove the hard inquiry as soon as possible. In many cases, a respectful phone call or written communication can lead to the removal of the entry.

To increase your chances, consider sending a well-documented letter to remove hard inquiries, which includes details like the date of the inquiry, the name of the company, and why the inquiry was invalid.

This can serve as written proof of your request and help expedite the resolution process.

How to Request Hard Inquiry Removal Politely and Effectively

Explain your situation clearly. Mention the inquiry in question and why you believe it should be removed. Be sure to reference any relevant details, such as whether you provided written authorization or if the inquiry appears completely unfamiliar.

A courteous but confident tone can make a big difference in the outcome. This is one of the secret ways to remove hard inquiries that people often overlook, and it often leads to faster hard inquiries removal without needing to escalate the issue.

If needed, follow up with a written letter to remove hard inquiries to reinforce your request and maintain a record of your communication.

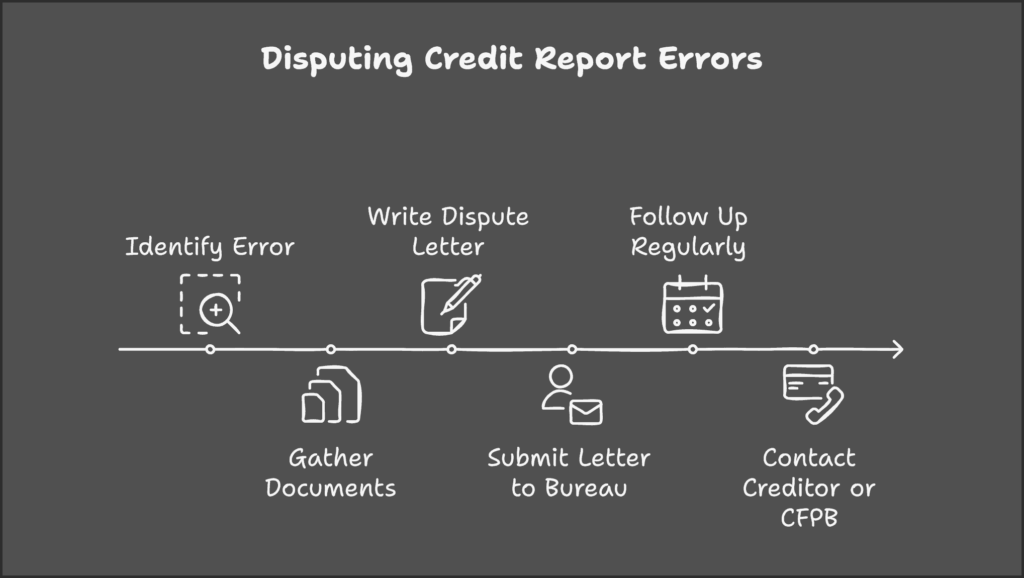

#2: Dispute Hard Inquiries with the Credit Bureaus

Disputing directly with the credit bureaus is one of the most common and effective methods for hard inquiries removal.

If you find an unauthorized or inaccurate hard inquiry on your credit report, you have the right to challenge it.

This is one of the secret ways to remove hard inquiries that puts the power in your hands.

Whether you’re working on your own credit or helping clients through a credit repair business, knowing how to properly file a dispute or send a detailed letter to remove hard inquiries can lead to faster and more successful results.

Start Today and Explore the Features Firsthand!

What Makes a Hard Inquiry Eligible for Dispute?

Only inquiries that were unauthorized or inaccurately reported can be disputed. If a lender didn’t get your permission, or the inquiry is fraudulent, you have grounds.

This is why reviewing your credit report regularly is crucial in identifying opportunities for hard inquiries removal.

Disputing these entries allows you to assert your consumer rights and maintain a clean credit profile.

In many cases, sending a formal letter to remove hard inquiries is the first step to correct the situation and ensure the hard inquiry is eliminated from your report.

How to Dispute a Hard Inquiry Online or by Mail?

Each bureau offers online portals, or you can send a letter to remove hard inquiries by mail. Always include a copy of your report and ID to verify your identity and support your case. It’s important to be clear, concise, and factual in your letter.

Using this method is one of the most direct and commonly used approaches for effective hard inquiries removal.

If done correctly, this step alone can help you successfully remove hard inquiry entries that were reported in error or without proper authorization.

Start Today and Explore the Features Firsthand!

What Happens After You Submit a Hard Inquiry Dispute?

The bureau investigates and responds within 30 days. If your claim is valid, the hard inquiry is removed.

This process is at the heart of hard inquiries removal strategies and reinforces the importance of accurate credit reporting.

By taking initiative and staying organized, you improve your chances of having the inquiry removed quickly.

Whether you submit an online request or send a physical letter to remove hard inquiries, the dispute process remains a powerful tool to help you remove hard inquiry records from your report.

#3: Report Identity Theft for Unauthorized Hard Inquiries

Identity theft is one of the most serious threats to your credit profile, and it often results in unfamiliar hard inquiries that you never authorized.

If you’re seeing entries on your credit report that you can’t explain, there’s a strong chance your information has been misused.

Addressing these unauthorized entries quickly is one of the most important secret ways to remove hard inquiries and protect your financial standing.

Whether you take action through official fraud reporting channels or send a formal letter to remove hard inquiries, acting swiftly can help you resolve the issue and minimize further damage.

How Identity Theft Can Lead to Unknown Hard Inquiries?

Identity thieves often apply for credit in your name, causing unfamiliar hard inquiries. These are major red flags that not only impact your credit score but may also indicate broader identity theft issues.

Immediate action is essential, as each unauthorized hard inquiry can lower your credit score and make it harder to get approved for future credit.

Learning how to identify and address these entries is one of the most practical secret ways to remove hard inquiries before they lead to further damage.

By staying alert and following proper procedures, you can dispute the entry, file fraud reports, and send a formal letter to remove hard inquiries linked to identity theft.

Start Today and Explore the Features Firsthand!

How to Report Identity Theft and Remove Fraudulent Inquiries?

File a report at IdentityTheft.gov, contact the bureaus, and include a letter to remove hard inquiries due to fraud.

Make sure your letter explains that the inquiry is a result of identity theft and request that it be removed from your report. Include supporting documents such as a police report or your FTC Identity Theft Affidavit.

This combination of formal documentation and a clear request greatly increases your chances to successfully remove the unauthorized hard inquiry and strengthens your overall hard inquiries removal efforts.

#4: Send a Letter to Remove Hard Inquiries (If Eligible)

Sending a written request is still one of the most effective and reliable secret ways to remove hard inquiries from your credit report.

A well-crafted letter to remove hard inquiries can lead to results when dealing with unauthorized or inaccurate entries.

This approach helps document your efforts, shows you’re taking initiative, and gives credit bureaus or creditors a clear reason to investigate the issue.

If your goal is to successfully remove hard inquiry records and improve your credit profile, submitting a letter remains a go-to method in your overall hard inquiries removal strategy.

What Is a Hard Inquiry Removal Letter?

A letter to remove hard inquiries is a formal document sent to a creditor or bureau, disputing an inquiry. It outlines why the hard inquiry is incorrect, unauthorized, or possibly fraudulent.

This type of letter is a vital component of successful hard inquiries removal efforts because it gives both creditors and bureaus the necessary details to begin an investigation.

Whether you’re trying to correct an error or protect your credit after identity theft, submitting a thorough and well-structured letter to remove hard inquiries can help you remove the hard inquiry and improve your credit profile over time.

Start Today and Explore the Features Firsthand!

When a Dispute Letter Will and Won’t Work?

It works when the inquiry is fraudulent or unauthorized, especially if you can provide proof that you never applied for the credit in question.

In such cases, a well-written letter to remove hard inquiries can be highly effective in resolving the issue and leading to a successful hard inquiries removal.

It won’t work if the inquiry is legitimate and authorized. Attempting to dispute valid inquiries is not only ineffective but could also raise compliance concerns.

However, keeping documentation of your inquiries can help you determine when it is appropriate to attempt to remove hard inquiry entries.

#5: Use Credit Dispute Software to Manage Hard Inquiries Removal

Using software is one of the smartest and most efficient secret ways to remove hard inquiries, especially if you’re managing multiple disputes or running a credit repair business.

Many individuals find the manual process of writing letters and tracking deadlines overwhelming. With the right tools, you can simplify hard inquiries removal, reduce errors, and stay organized.

Whether you’re sending a letter to remove hard inquiries or following up on a response from a bureau, dispute software can streamline each step and help you quickly remove hard inquiry records with greater accuracy.

Why DIY Disputes Can Be Time-Consuming and Confusing?

Most people find the dispute process overwhelming. Missing a step can result in denied disputes, especially when dealing with multiple accounts or limited knowledge of the credit system.

This is why using tools to streamline your workflow is one of the most effective secret ways to remove hard inquiries.

By simplifying each step, you reduce errors, stay compliant, and improve your chances to successfully remove hard inquiry records through well-timed and accurate submissions.

Whether you’re handling your own credit or managing client files, automating the process can strengthen your overall hard inquiries removal strategy.

Start Today and Explore the Features Firsthand!

How Credit Dispute Software Simplifies Hard Inquiries Removal?

Software automates the process, sends letters, tracks progress, and helps manage deadlines. It’s one of the most efficient secret ways to remove hard inquiries because it saves time and eliminates common human errors that can delay the resolution process.

By automating the generation of a letter to remove hard inquiries, software helps ensure that your message is professionally written and properly formatted.

These tools are especially helpful for those managing multiple disputes or working in the credit repair industry.

With the right system in place, it becomes easier to track progress, meet dispute deadlines, and successfully remove hard inquiry records with confidence.

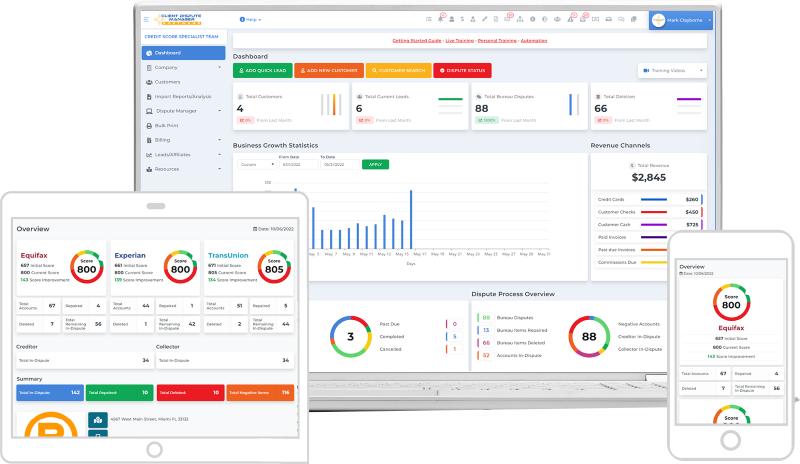

How Client Dispute Manager Software Helps You Stay Compliant and Organized?

Client Dispute Manager Software is built for credit repair businesses and individuals who want to take a more efficient and compliant approach to managing credit disputes.

Whether you’re working on your own credit or assisting clients, this software helps you stay organized, automate repetitive tasks, and maintain accurate records throughout the dispute process.

It’s especially useful when sending out a high volume of customized letter to remove hard inquiries communications or tracking multiple cases simultaneously. It provides:

- Built-in Letter to Remove Hard Inquiries Templates: Access a library of pre-written, customizable templates that help you quickly generate effective dispute letters tailored to each situation.

- Dispute Tracking Dashboard: Stay organized with a centralized dashboard that shows the status of every active and completed dispute in real time.

- FTC/CROA – Compliant Workflows: Ensure every step of your dispute process follows legal guidelines to protect your business and your clients.

- Automation for Sending Bulk Dispute Letters: Save hours of manual work by automating the delivery of multiple dispute letters at once, all formatted for compliance and accuracy.

- Customizable Client Management Features: Manage client profiles, case history, communication, and documents from one easy-to-use interface.

- Real-time Updates on Dispute Status: Get instant alerts and updates as disputes are processed by the credit bureaus, so you always know where things stand.

- Integrated Credit Report Importing for Faster Reviews: Upload and analyze credit reports directly within the software, making it easier to identify and address every hard inquiry.

- Secure Cloud-based Storage for Compliance and Documentation: Keep all dispute letters, credit reports, and client records stored safely and securely, while meeting industry compliance standards for data protection.

It’s a smart way to organize your hard inquiries removal efforts.

Start Today and Explore the Features Firsthand!

Conclusion

Now that you know the secret ways to remove hard inquiries, you have the power to take action. Whether you send a letter to remove hard inquiries, file a dispute, or use software to manage the process, every step counts.

Each of these strategies plays an important role in your overall hard inquiries removal plan.

Don’t underestimate the impact that removing just one inaccurate hard inquiry can have on your credit score and approval chances.

With consistency and the right tools, you’ll be better prepared to remove hard inquiry records and maintain a healthier financial future.

Stay consistent, stay compliant, and take charge of your credit future with confidence and clarity.

Mark Clayborne

Mark Clayborne specializes in credit repair, starting and running credit repair businesses. He's passionate about helping businesses gain freedom from their 9-5 and live the life they really want. You can follow him on YouTube.

Start Today and Explore the Features Firsthand!

Below Is More Content For Your Review: