Are you thinking about starting a credit repair business but not sure where to begin? You’re not alone. Every year, thousands of entrepreneurs look into how to start a credit repair business because they see the demand—millions of people struggle with errors, collections, and negative items on their credit reports.

Helping those people while building your own business can be both rewarding and profitable. But here’s the truth: jumping in without knowing the rules can cost you big time.

Imagine spending months building your dream company, only to find out you broke a state law or failed to follow a federal rule. Some business owners even get fined or shut down simply because they didn’t understand the basics. That’s why learning the 10 things you must know before starting a credit repair business is so critical.

In this guide, we’ll walk through everything step by step—from federal and state laws to ethical marketing, client retention, and the right credit repair software. We’ll answer the most common questions new entrepreneurs ask, like:

- Do I need a license to start a credit restoration business?

- How can I legally start a credit repair business from home?

- What software do I need to manage disputes and clients?

- What mistakes should I avoid when building my credit repair business plan?

By the end, you’ll have a clear roadmap to launch legally, ethically, and with confidence. Whether you’re an entrepreneur looking for your next opportunity, someone with credit challenges who wants to turn experience into a business, or a professional interested in financial services, this guide will give you the answers you need.

So, let’s dive into the 10 things you must know before starting a credit repair business and set the foundation for your long-term success.

Key Takeaways:

- Follow federal rules like CROA and FTC’s Business Opportunity Rule, plus your state’s requirements before starting.

- Register your business, use written contracts, and include cancellation rights to stay compliant.

- Credit repair software (like Client Dispute Manager Software) helps with automation, compliance, and client management.

- Avoid false promises, secure client data, and communicate clearly to build long-term credibility.

- Keep learning, invest in training/certification, and use retention strategies to scale your credit repair business.

Start Today and Explore the Features Firsthand!

#1: Know the Federal and State Laws Before Starting a Credit Repair Business

If you’re starting a credit repair business, the very first thing you must understand is the law. Credit repair is legal, but only if you follow the rules set by both the federal government and your state. Too many entrepreneurs skip this step and end up facing lawsuits, fines, or even being shut down.

Why Compliance Matters When You Start a Credit Restoration Business?

Think of compliance as the foundation of your business. Without it, nothing you build will last. The Credit Repair Organizations Act (CROA) is the main federal law you must know. It tells you exactly what you can and cannot do as a credit repair company. For example:

- You cannot charge upfront fees before services are performed.

- You must provide clients with a written contract that explains their rights.

- You must allow clients to cancel within three business days without penalty.

- You cannot make false claims or guarantee specific results.

Ignoring these rules is a fast way to lose credibility and put your company at risk. Following them, however, sets you apart as a trustworthy credit repair business owner.

Examples of State Rules for How to Start a Credit Repair Business

In addition to federal laws, each state has its own requirements. Some states require you to get a license, register with the attorney general’s office, or post a surety bond before you can operate legally.

Here are a few examples:

- Texas: Requires a $10,000 surety bond for credit services organizations.

- Florida: Requires registration and strict consumer protection disclosures.

- California: Has additional licensing rules and tight advertising restrictions.

- Georgia: Requires companies to register and comply with strict recordkeeping standards.

That’s why doing your homework matters. Before you launch, check with your state’s attorney general or financial regulation office to see what’s required where you live.

Problem → Many businesses fail because they jump in without knowing the rules.

Solution → Build your business on a legal foundation from day one.

By making compliance your top priority, you’ll not only avoid costly mistakes but also create a credit repair business that clients can trust and recommend.

#2: Understand the FTC’s Business Opportunity Rule

If you’re planning to start a credit restoration business, it’s not enough to just know how disputes work or how to find clients. The Federal Trade Commission (FTC) has a set of rules called the Business Opportunity Rule, and they apply directly to companies in the credit repair industry.

These rules are designed to protect consumers and make sure businesses operate fairly. Ignoring them can put your entire operation at risk.

What the FTC Requires from Credit Repair Companies?

The Business Opportunity Rule says that if you’re offering a business service—like credit repair—you must give clients clear, written information before they sign up. This disclosure has to include:

- Earnings Claims: If you talk about results, you must back it up with facts.

- References: Clients should be able to check your reputation.

- Cancellation Rights: Customers must know they can cancel within the legal time frame.

- No Upfront Fees: Just like under CROA, you cannot collect payment before services are completed.

By following these FTC rules, you show potential clients that your company is transparent and trustworthy. It also protects you legally if someone ever questions your business practices.

Start Today and Explore the Features Firsthand!

How This Impacts Your Credit Repair Business Plan?

Many entrepreneurs think a credit repair business plan is only about marketing and finances. But compliance needs to be part of the plan from the very beginning.

Here’s why:

- If you promise instant results, you’re breaking the law.

- If you collect payments too early, you’re putting your business in danger.

- If you don’t provide written disclosures, you could face lawsuits or fines.

On the other hand, when you build your credit repair business plan with the FTC’s requirements in mind, you create a structure that’s safe, legal, and appealing to clients. Instead of worrying about penalties, you can focus on growing your company with confidence.

Problem → Many new owners forget about the FTC’s rules and end up in legal trouble.

Solution → Make the Business Opportunity Rule a core part of your strategy when you start a credit restoration business.

By respecting these guidelines, you’ll prove that you’re serious about running your business the right way. That not only helps you stay out of trouble but also builds a strong reputation that clients can trust.

#3: Register Your Business Legally Before You Start a Credit Repair Business from Home

One of the most important steps in starting a credit repair business is making it official. Even if you plan to work from your kitchen table, you can’t just start taking clients without the right setup.

Learning how to start a credit repair business from home means understanding what paperwork, registrations, and protections you need.

LLC vs. Sole Proprietorship for a Credit Repair Business

When you’re choosing a legal structure, most small business owners pick between two main options:

- Sole Proprietorship: This is the simplest option. You operate under your own name or a “doing business as” (DBA). The downside? If something goes wrong, you are personally responsible for all debts and legal claims.

- Limited Liability Company (LLC): This option takes a little more effort to set up, but it protects your personal assets. If your business is sued, your house, car, and savings are shielded. LLCs also look more professional to banks, software providers, and potential partners.

For most people who want to start a credit repair business from home, an LLC is the safer and smarter choice.

Steps to Start a Credit Repair Business from Home Legally

Here’s a quick checklist to help you set things up properly:

- Choose a business name and check that it’s available in your state.

- Register your business as an LLC or other structure with the state’s Secretary of State.

- Get an Employer Identification Number (EIN) from the IRS. This acts like a Social Security Number for your business.

- Open a business bank account to keep personal and business finances separate.

- Check your state’s licensing requirements, since some states require registration or a bond before offering credit repair services.

- Set up a business address (even if it’s your home, you can use a P.O. Box or virtual address for privacy).

Problem → Many new entrepreneurs skip legal registration because they want to save money or don’t know the process.

Solution → Taking time to set up your company correctly gives you legal protection, credibility, and a foundation for growth.

When you build your credit repair company on a legal framework, you’re not just protecting yourself—you’re also showing clients that you’re serious and trustworthy. That confidence is what separates long-lasting businesses from short-lived hustles.

Start Today and Explore the Features Firsthand!

4#: Draft Compliant Service Agreements for Your Credit Repair Business Plan

If you’re serious about how to start a credit repair business, one of the most important steps is having the right paperwork in place. A solid service agreement protects you, sets clear expectations for your clients, and keeps your business compliant with the law.

In fact, including contracts in your credit repair business plan is just as important as choosing software or marketing strategies.

Why Contracts Matter in Credit Repair Services?

A service agreement is more than just a piece of paper—it’s your safeguard. Here’s why it matters:

- Protects Your Business: If a client misunderstands what you’re offering, the agreement clears things up.

- Builds Trust: Clients feel safer when they see everything in writing.

- Prevents Disputes: When terms are clear, there’s less room for confusion or arguments.

- Shows Professionalism: Clients will see you as organized and credible.

Without a contract, you’re exposed to risks. One unhappy client could turn into a complaint, a refund demand, or worse—a lawsuit.

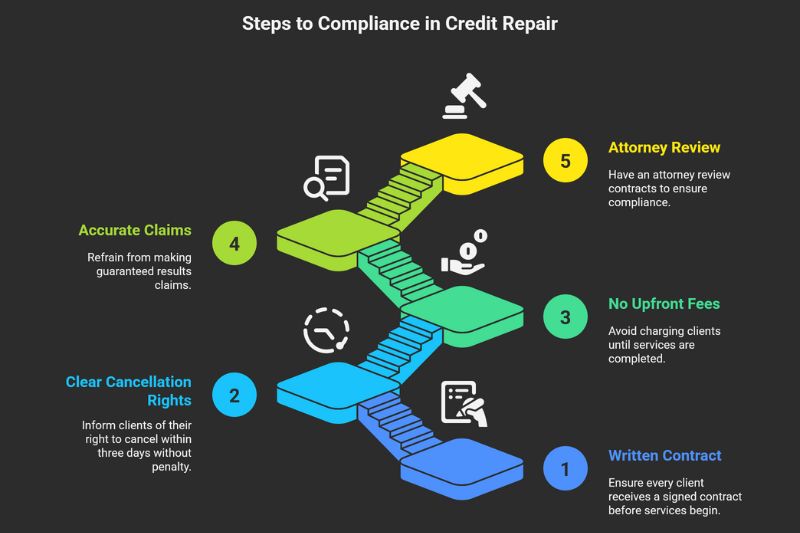

Key Compliance Points for How to Start a Credit Repair Business

When writing your contracts, you must follow the Credit Repair Organizations Act (CROA). This law requires certain language and prohibits others.

Here are the must-haves:

- Written Contract: Every client must get a signed copy before you start services.

- Clear Cancellation Rights: Clients must be told they can cancel within three business days without penalty.

- No Upfront Fees: You cannot charge until services have been completed.

- Accurate Claims: Never guarantee results like “We’ll raise your score by 100 points.”

A good practice is to have an attorney review your contracts to ensure they meet both federal and state requirements. This may feel like an extra step, but it protects your business long-term.

Problem → Many new owners rush into signing clients without proper agreements, leaving themselves vulnerable.

Solution → Make compliant service contracts part of your credit repair business plan from the very beginning.

By putting clear, legal agreements in place, you’ll not only stay compliant but also gain client confidence. That confidence often leads to referrals and repeat business, helping your company grow the right way.

#5: Choose the Right Credit Repair Software to Start Your Credit Restoration Business

When you’re ready to start a credit restoration business, you’ll quickly realize that trying to manage everything by hand is overwhelming. From sending dispute letters to tracking client progress, the workload adds up fast.

That’s where the right credit repair business software becomes essential. It saves you time, keeps you organized, and helps you stay compliant with the law.

Features Every Credit Repair Business Software Should Have

Not all programs are created equal. Before you choose a tool, make sure it includes these must-have features:

- Automated Dispute Letter Generation → so you don’t waste hours writing letters one by one.

- Client Portal Access → allows clients to log in, check updates, and stay engaged.

- Progress Tracking Tools → so you can show clear results to clients.

- Secure Data Storage → keeps sensitive personal and financial information protected.

- Built-in Compliance Support → helps you follow CROA rules and avoid mistakes.

With these features, you can focus less on paperwork and more on helping clients improve their credit.

Start Today and Explore the Features Firsthand!

How Software Supports Compliance and Growth?

Using credit repair business software isn’t just about convenience—it’s about safety and growth. The right platform keeps accurate records, prevents missed deadlines, and ensures all client communications are stored securely. This is especially important if regulators ever ask for proof of your processes.

When your software handles routine tasks automatically, you’ll have more time to market your services, onboard new clients, and grow your company. In short, good software helps you move from simply running a business to building a professional, scalable operation.

Client Dispute Manager Software: Your All-in-One Tool for Credit Repair Success

One powerful option that many entrepreneurs use is Client Dispute Manager Software. It was designed specifically for people who want to start a credit restoration business or take their existing company to the next level.

Instead of juggling spreadsheets, documents, and random tools, this all-in-one platform brings everything together so you can work smarter, not harder.

Here are some of the most important features that make it stand out:

- Dispute Letter Generation: Save hours by creating letters with just a few clicks. The software includes dozens of templates that you can customize, so you don’t have to start from scratch every time.

- Client Portal Access: Give your clients their own secure login. They can see updates, track progress, and even upload documents directly to their account—reducing the number of phone calls and emails you’ll need to answer.

- Automated Workflows: Tired of doing the same tasks over and over? The system automates follow-ups, reminders, and dispute cycles. This not only saves time but also ensures nothing slips through the cracks.

- Compliance Safeguards: Staying compliant with CROA and FTC rules is built into the software. From proper recordkeeping to contract templates, the system helps you avoid costly mistakes and stay on the right side of the law.

- Progress Tracking and Reports: Easily show clients the results of your work. The software creates reports that highlight deleted items, disputes in progress, and overall credit improvement. This transparency builds trust and keeps clients engaged.

- Secure Data Storage: Every piece of client information is encrypted and stored safely. You’ll know that sensitive data is protected, which is crucial for both compliance and peace of mind.

- Scalability for Growth: Whether you’re running your business from home or planning to grow into a full office with a team, the software is built to grow with you. Add more clients, team members, or services without worrying about outgrowing the system.

By bringing all these features together, Client Dispute Manager Software helps entrepreneurs launch and grow their businesses with confidence. It takes away the stress of manual work and gives you the tools you need to build a professional, client-focused credit repair company.

Problem → Many business owners fail because they try to manage everything manually.

Solution → Use an all-in-one tool like Client Dispute Manager Software to save time, stay compliant, and scale your credit repair business with ease.

#6: Develop Transparent Client Communication in Your Credit Repair Business Plan

When starting a credit repair business, many entrepreneurs focus on marketing, software, and laws. But one of the most overlooked keys to success is clear client communication. Your clients are often stressed and uncertain about their financial future.

If you keep them in the dark, they’ll lose trust quickly. If you’re open and honest, they’ll feel reassured and more likely to stick with your services long-term.

Building Trust When You Start a Credit Repair Business

Clients often come to you after dealing with rejection, high interest rates, or even debt collectors. They’re hoping for quick results, but as you know, credit repair takes time. That’s why it’s your job to set realistic expectations right from the start.

Here are a few ways to build trust:

- Be Upfront About Timelines: Explain that some disputes may take 30–45 days to process and that results vary.

- Avoid Big Promises: Never guarantee a score increase or a specific outcome. Instead, focus on your proven process.

- Share Progress Often: Let clients know what’s happening with their disputes and accounts.

This level of honesty not only builds trust but also keeps you in compliance with the law.

Start Today and Explore the Features Firsthand!

Examples of Clear Client Communication Practices

If you want your credit repair business plan to stand out, add communication strategies as part of your daily operations.

For example:

- Welcome Packet: Provide every new client with a simple guide explaining how the process works.

- Monthly Updates: Send regular progress reports through email or your software’s client portal.

- Client Calls or Check-ins: Schedule short follow-ups so clients know you’re invested in their success.

- Transparent Contracts: Make sure agreements clearly explain services, fees, and cancellation rights.

Problem → Many credit repair businesses fail because clients feel confused or misled.

Solution → Build open communication into your credit repair business plan so every client feels informed, respected, and cared for.

When you make communication a priority, clients are more likely to stay with you, recommend your services, and trust you to help them through one of the most challenging parts of their financial journey.

#7: Build Ethical Marketing Practices When Starting a Credit Repair Business

If you’ve been researching how to start a credit repair business, you’ve probably thought a lot about how to get clients. Marketing is exciting because it’s how you spread the word about your services. But here’s the catch: not all marketing strategies are legal in this industry.

The FTC has strict rules about credit repair advertising, and breaking them can ruin your reputation or even shut your business down.

What to Avoid in Credit Repair Advertising?

When you’re eager to start a credit restoration business, it can be tempting to promise quick results or guaranteed outcomes. But that’s exactly what you must avoid. Here are common mistakes that get businesses into trouble:

- “We guarantee to raise your score by 100 points” → You can’t promise results you can’t control.

- “We can erase all negative items” → Some items are accurate and cannot be removed legally.

- “Instant credit repair” → Credit repair is a process that takes time.

- Charging upfront fees in ads → This violates the Credit Repair Organizations Act (CROA).

These kinds of statements might bring in leads fast, but they also bring legal risks and unhappy clients.

How to Create Compliant, Ethical Campaigns?

The good news is you don’t have to lie or exaggerate to attract clients. Ethical marketing can be just as effective—if not more so—because it builds trust. Here are better ways to promote your services:

- Educate Instead of Oversell: Share tips on credit reports, debt management, or budgeting through blogs, videos, or social media.

- Be Honest About the Process: Explain that results vary and improvement takes time.

- Highlight Your Professionalism: Use testimonials, reviews, or case studies (with permission) to show credibility.

- Promote Compliance: Let potential clients know you follow federal and state laws.

By focusing on education, honesty, and transparency, you’ll attract clients who value long-term results and are more likely to stay with your business.

Problem → Many new businesses fail because they use misleading ads that spark complaints and legal issues.

Solution → Focus on ethical marketing that tells the truth, educates clients, and builds trust over time.

When you make honesty the center of your marketing strategy, you’ll create a stronger brand that stands out in the crowded credit repair industry.

#8: Secure Customer Data Properly in Your Credit Repair Business

When starting a credit repair business, you’re not just handling names and phone numbers—you’re dealing with Social Security numbers, credit reports, and other sensitive financial details.

Protecting this information isn’t optional. It’s required by law, and it’s also one of the best ways to build trust with your clients. If people don’t believe their data is safe, they won’t work with you.

Data Protection Laws for Credit Repair Businesses

Credit repair companies must follow strict data protection rules. One of the most important is the Gramm-Leach-Bliley Act (GLBA), which requires businesses that handle financial information to safeguard client records. On top of that, some states have their own privacy laws that may require extra steps.

Here are a few basics you must follow:

- Protect client records from unauthorized access.

- Create a written plan that explains how you secure and handle data.

- Train anyone on your team to follow security protocols.

- Safely dispose of documents you no longer need.

If you’re building your credit repair business plan, data security should be part of your foundation, not an afterthought.

Start Today and Explore the Features Firsthand!

Best Practices for Secure Client Records

The good news is you don’t need to be a tech expert to keep client data safe.

Here are practical steps you can put in place right away:

- Use Encrypted Software: Choose tools that store client data securely (like Client Dispute Manager Software).

- Strong Passwords: Require complex logins and change them regularly.

- Limit Access: Only you or trusted team members should handle sensitive files.

- Secure Wi-Fi: Avoid working on unsecured networks when handling client documents.

- Paper Safety: If you keep paper records, store them in locked cabinets and shred them when no longer needed.

Problem → Many new business owners forget about data protection until it’s too late—leading to client complaints or even fines.

Solution → Make data security part of your credit repair business plan from the very beginning to protect both your clients and your company.

By showing clients that you take their privacy seriously, you’ll set yourself apart as a professional they can trust with their most personal financial details.

#9: Invest in Training and Education to Grow Your Credit Repair Business Plan

If you want to start a credit restoration business that lasts, you can’t stop learning once you launch. The credit repair industry is shaped by laws, credit bureau practices, and financial trends that change often. What worked last year may not work today.

That’s why investing in training and education is a key part of every successful credit repair business plan.

Certifications and Learning Resources for Credit Repair Specialists

Even though no federal license is required to operate a credit repair company, certifications and training can set you apart. They show clients that you’re serious about your craft and willing to go above and beyond.

Here are a few places to start:

- NACSO (National Association of Credit Services Organizations) → Offers resources and industry standards.

- Credit Repair Certification Programs → Online training courses that teach laws, dispute methods, and business management.

- Small Business Administration (SBA) wWrkshops → Great for learning business fundamentals like marketing and finance.

- Books, Podcasts, and Webinars → Keep your knowledge current and sharp.

By pursuing certifications and ongoing learning, you position yourself as an expert rather than just another company offering basic services.

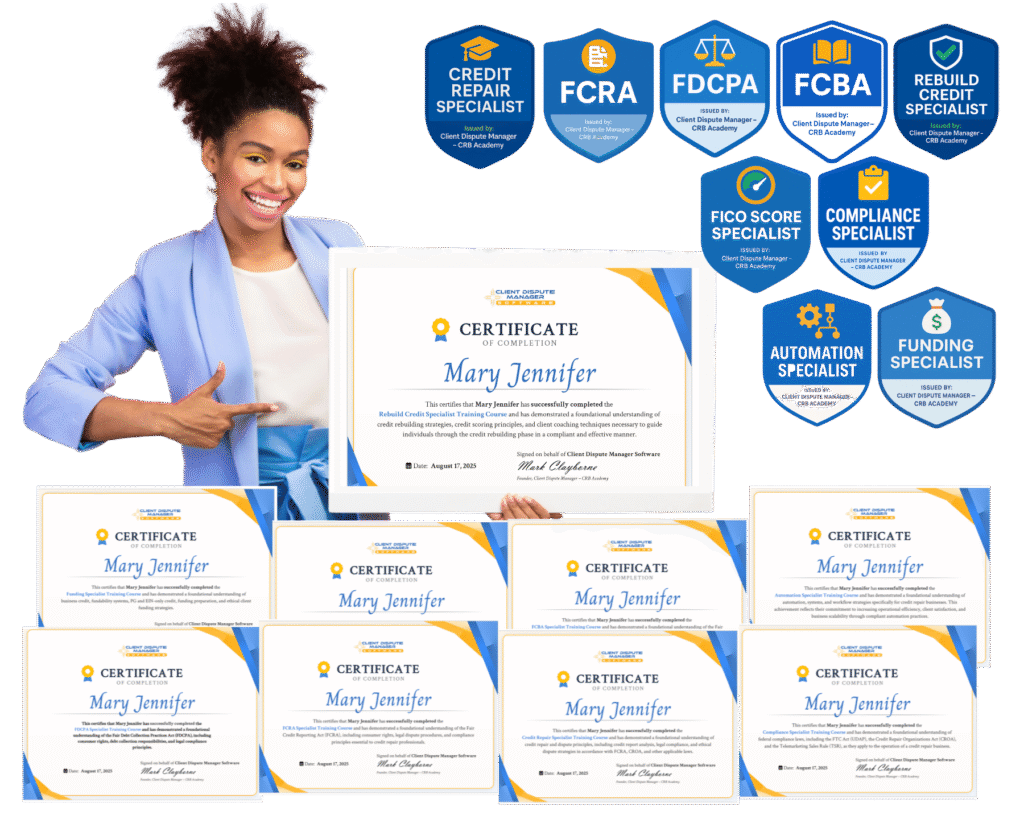

Get Certified with the Client Dispute Manager Software Training Program

When exploring credit repair certification programs, it’s easy to find generic courses that only cover the basics. But if you’re serious about starting a credit repair business, you need training that’s hands-on, practical, and directly connected to the tools you’ll actually use every day.

That’s where the Client Dispute Manager Software Training Program and 15-Step Roadmap stands out. This program is more than just a course—it’s a complete guide to building and running your business.

Here’s what makes it unique:

- Step-by-Step Roadmap → Learn how to legally register your business, stay compliant with CROA, and structure your services the right way.

- Dispute Letter Systems → Get access to pre-built templates, including advanced dispute strategies like Metro 2, so you can serve clients effectively from day one.

- Client and Business Tools → Use software features like automated workflows, client portals, and progress tracking while you train, so you’re learning and working at the same time.

- Certification and Credibility → At the end of the training, you’ll have certification to show clients that you’re qualified and professional.

- Growth and Marketing Guidance → Beyond disputes, the program also covers lead generation, client retention, and strategies to expand your company.

Adding this program to your credit repair business plan gives you two powerful advantages: knowledge and tools. You’ll know how to run your business the right way, and you’ll already have the software that helps you do it efficiently.

Problem → Many new entrepreneurs waste time piecing together random courses, templates, and tools.

Solution → With the Client Dispute Manager Software Certification Program, you get everything in one place—training, software, and a proven roadmap to success.

Start Today and Explore the Features Firsthand!

#10: Plan for Client Retention and Professional Growth in Your Credit Repair Business Plan

When starting a credit repair business, many entrepreneurs focus only on getting their first clients. But the real key to long-term success is keeping those clients and planning for growth. A strong credit repair business plan should always include strategies for both retention and professional development.

How Retention Strategies Grow Your Credit Repair Business?

Client retention is about making sure customers stay with you long enough to see results. If clients leave too soon, they won’t get the benefit of your work, and your business will constantly struggle to replace lost revenue.

Here are some retention strategies you can build into your operations:

- Regular Updates → Send progress reports and explain what’s happening behind the scenes.

- Client Education → Teach customers about budgeting, credit utilization, and healthy financial habits.

- Excellent Support → Make yourself available for questions and provide quick responses.

- Loyalty and Referral Programs → Reward clients who stick with you and encourage them to refer friends.

When clients feel informed and supported, they’re far more likely to stay with you until they reach their goals.

Long-Term Vision for Entrepreneurs Who Start a Credit Restoration Business

Retention isn’t the only part of growth—you also need to think about where you want your company to be in 2, 5, or even 10 years. Do you want to stay a one-person business, or expand into a larger team with employees and multiple service offerings?

Here’s how you can build professional growth into your plan:

- Invest in ongoing training.

- Adopt scalable tools like Client Dispute Manager Software so you can handle more clients without extra stress.

- Network with other professionals in finance, real estate, or law to create referral partnerships.

- Expand services over time, such as credit education workshops or financial coaching.

Problem → Too many businesses focus only on the short term and struggle to stay afloat.

Solution → Include both client retention and professional growth strategies in your credit repair business plan, so you’re building for stability and long-term success.

By thinking beyond the launch phase, you’ll create a business that doesn’t just survive—it thrives. Clients will stay with you, refer others, and your company will grow into the professional credit repair brand you envisioned from the start.

FAQs: How to Start a Credit Repair Business by State

One of the top questions new entrepreneurs ask is: “What are the rules in my state?” While federal laws like CROA and the FTC’s Business Opportunity Rule apply nationwide, every state has its own additional requirements. Some require registration, some need a license, and others may even demand a surety bond before you can begin.

Here’s a deeper look at some of the most commonly searched states and what you should know before opening your doors.

How to Start a Credit Repair Business in Texas?

Texas is one of the stricter states. To operate as a credit services organization, you must register with the Secretary of State and post a $10,000 surety bond. This bond protects consumers in case your company violates the law. You’ll also need to provide detailed disclosures and contracts that follow state law.

Many new entrepreneurs in Texas forget about the bond requirement and end up facing penalties—so this step should always be part of your business plan.

Start Today and Explore the Features Firsthand!

How to Start a Credit Repair Business in Florida?

Florida requires registration before you can legally provide credit repair services. The state also enforces very strict consumer protection rules, especially around contracts, disclosures, and cancellation rights.

For example, you must clearly state in writing that clients have the right to cancel within three business days.

If you’re planning to market heavily in Florida, make sure your ads and contracts are reviewed for compliance to avoid trouble with the Attorney General’s office.

How to Start a Credit Repair Business in California?

California has some of the toughest consumer protection laws in the country. Credit repair companies must follow licensing rules and restrictions on what can be promised in ads.

California regulators pay close attention to false or misleading claims, so your marketing and contracts must be 100% transparent. For entrepreneurs, this means building your business on honesty and compliance from day one.

How to Start a Credit Repair Business in Georgia?

Georgia requires credit repair companies to register with the state and comply with strict recordkeeping and disclosure rules. Contracts must include detailed explanations of services, fees, and client rights.

The state monitors these businesses closely, so keeping thorough documentation is critical.

Conclusion: Building a Successful Credit Repair Business the Right Way

Starting a credit repair business is more than just sending dispute letters—it’s about building a company that is legal, ethical, and built to last. From learning federal and state laws to drafting compliant contracts, choosing the right software, and planning for client retention, every step matters.

When you put compliance, honesty, and professionalism at the center of your credit repair business plan, you protect yourself and create trust with the people you serve.

Remember, this industry is about hope. Most of your clients will come to you feeling stressed, overwhelmed, and ready for a fresh start. If you follow the 10 steps in this guide, you’ll not only help them repair their credit—you’ll also build a business that grows steadily and earns respect in the community.

If you’re ready to take the next step, make sure you’re equipped with the right training and the right tools. The Client Dispute Manager Software Certification Program and 15-Step Roadmap is a great place to start.

It gives you everything you need—training, certification, software, and compliance support—to launch with confidence and grow without guessing.

Start Today and Explore the Features Firsthand!

Mark Clayborne

Mark Clayborne specializes in credit repair, starting and running credit repair businesses. He's passionate about helping businesses gain freedom from their 9-5 and live the life they really want. You can follow him on YouTube.