Improving your credit score is not just about numbers; it’s about gaining the financial freedom and opportunities you deserve. If you’ve ever wondered how to boost your credit score or how credit repair strategies can transform your financial future, you’re in the right place.

Let’s dive into proven techniques to take control of your credit, whether you’re an individual looking to rebuild your finances or an entrepreneur exploring the credit repair industry.

Understanding Credit and Credit Reports

Understanding your credit score is the foundation of effective credit repair. It helps you see where improvements are needed. Knowing how lenders use this score gives you an edge in managing your financial health. When you understand your credit, you’re better prepared to use proven credit repair strategies to rebuild it.

What Are Credit Scores and Why Do They Matter?

Your credit score is a three-digit number that tells lenders how reliable you are when it comes to borrowing money. A good credit score can open doors to better financial opportunities, like lower interest rates and higher credit limits.

On the other hand, a poor credit score can make it harder to qualify for loans and result in higher costs. Understanding why your credit score matters is the first step to taking control of your financial health.

Why Lenders Care About Credit Scores?

Lenders use credit scores to assess the risk of lending to you. A high score shows that you’re financially responsible and likely to repay loans on time. This helps lenders make informed decisions about offering you credit and setting interest rates.

How Credit Scores Impact Daily Life & Why Monitoring Your Score Matters?

Your credit score affects more than just loans. It can influence your ability to rent an apartment, secure a job, or even lower your insurance premiums. A strong score gives you more opportunities and flexibility in many areas of life.

Keeping an eye on your credit score helps you identify trends and spot potential issues early. Regular monitoring ensures that you’re aware of any changes, such as a drop in your score or new accounts that you didn’t authorize. Regular monitoring aligns with effective credit repair strategies to maintain financial health.

How Credit Scores Are Calculated?

Learning how credit scores are calculated is key to improving them. Each factor from payment history to credit utilization affects your score differently.

By focusing on the most important factors, you can implement credit repair strategies that deliver the biggest impact. This knowledge ensures that every step you take is meaningful and effective. Credit scores are determined by analyzing five key factors.

Payment history is the most important, making up 35% of your score. This reflects whether you pay your bills on time. Credit utilization, which measures how much of your available credit you’re using, accounts for 30%.

A lower utilization rate is better for your score. The length of your credit history contributes 15%, showing how long you’ve been managing credit. Credit mix, which looks at the variety of accounts you have, and new credit inquiries make up the remaining 20% combined.

By understanding these factors, you can focus on areas that will have the biggest impact on your score with proper credit repair strategies.

Credit Repair Strategies: The Importance of Regular Credit Report Checks

Regular credit report checks are an essential part of any credit repair strategy. They allow you to spot errors and fix them before they hurt your score. Frequent monitoring also helps you identify potential fraud and stay on top of your financial health. This proactive approach makes credit repair more effective.

Checking your credit report regularly is a simple yet effective way to protect your financial health. Errors on credit reports are surprisingly common and can drag down your score. Reviewing your report helps you catch these mistakes early and dispute credit report issues before they cause further problems.

Additionally, monitoring your credit report can alert you to signs of identity theft, such as accounts you don’t recognize. Make it a habit to check your report at least once a year to stay informed.

How Often Should You Check Your Credit Report?

Experts recommend checking your credit report at least once a year. If you’re planning a major financial move, such as buying a home, you may want to review it more frequently. Regular checks ensure you can address any inaccuracies or issues promptly using effective credit repair strategies.

Dispute Credit Report Errors: Proven Credit Repair Strategies

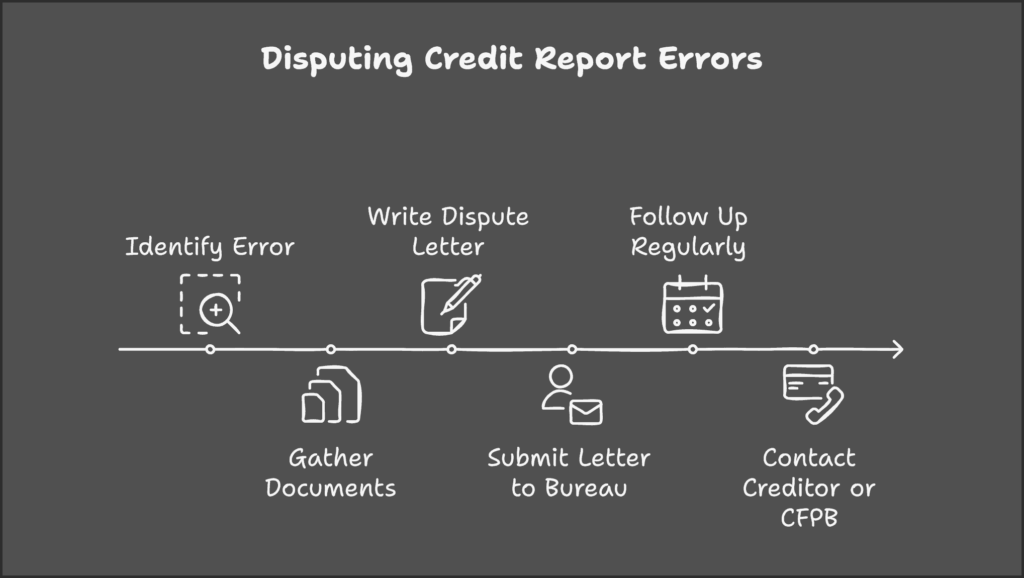

Errors on your credit report can drag down your score unnecessarily. Disputing these inaccuracies is a key part of successful credit repair strategies. By taking the right steps, such as submitting a dispute letter and following up, you can correct errors and boost your score effectively. Persistence is vital in this process.

Finding an error on your credit report can be frustrating, but correcting it is easier than you might think. Start by gathering documents that prove the error, such as receipts or bank statements. Next, write a clear and concise credit dispute letter explaining the issue and include copies of your evidence.

Submit the letter to the credit bureau reporting the error Experian, Equifax, or TransUnion. Follow up regularly to ensure the issue is resolved. Remember, fixing errors can quickly boost your credit score.

Gathering Documents & Writing an Effective Dispute Letter

Before disputing an error, collect any documents that support your claim. These may include bank statements, receipts, or account records showing payments. Ensure all documents are accurate and clearly highlight the discrepancy. Proper documentation strengthens your credit dispute letter and increases the chances of resolution in your favor.

An effective credit dispute letter is clear, concise, and includes all necessary details. Start by identifying yourself and the error you’re disputing. Explain why the information is incorrect and attach copies of your supporting documents. Address the letter to the appropriate credit bureau and request a correction.

Following Up on Disputes

After submitting your dispute, follow up regularly to check the status. Credit bureaus typically respond within 30 days. If the issue isn’t resolved, consider contacting the creditor directly or filing a complaint with the Consumer Financial Protection Bureau. Persistence is key to ensuring the error is corrected. A thorough approach to dispute credit score issues is an essential part of any credit repair strategy.

Credit Repair Strategy: Timely Payments as the Key to Success

Timely payments are one of the most effective credit repair strategies you can adopt. Every on-time payment builds a positive payment history, which is the largest factor in your credit score. Consistency in paying bills not only improves your score but also establishes trust with creditors.

Paying your bills on time is the single most important factor in maintaining a good credit score. Missed payments can stay on your report for years, but consistent, on-time payments will gradually improve your score.

Set up automatic payments to ensure you never miss a due date. If you’re struggling to keep up, create a budget to prioritize your bills. Over time, your payment history will become a positive reflection of your financial reliability. This approach forms a cornerstone of effective credit repair strategies.

Credit Repair Strategies for Reducing Credit Card Balances

High credit card balances can damage your credit score. Reducing these balances is a proven credit repair strategy that lowers your credit utilization rate. Whether you choose the snowball or avalanche method, paying down debt steadily improves your financial health and boosts your credit score over time.

High credit card balances can harm your credit score by increasing your credit utilization rate. Focus on paying down your balances using strategies like the snowball method, which involves paying off the smallest debts first. Alternatively, use the avalanche method, which targets debts with the highest interest rates.

Another option is to negotiate with your credit card issuer for lower interest rates or better payment terms. Reducing your balances will not only improve your credit score but also save you money on interest. These methods are part of actionable credit repair strategies.

Credit Repair Strategy: The Role of Credit Utilization in Your Score

Credit utilization is one of the most important factors in your credit score. Keeping this ratio low is a key credit repair strategy. By managing your balances and credit limits effectively, you can maintain a healthy utilization rate and see steady improvements in your credit score.

Your credit utilization ratio compares your total credit card balances to your total credit limits. For example, if you have a credit limit of $10,000 and a balance of $3,000, your utilization rate is 30%. Experts recommend keeping this rate below 30% to maintain a healthy credit score.

Paying off balances before your statement date can help lower your utilization. You might also consider requesting a credit limit increase to improve your ratio. Be careful not to use the extra credit, as this could lead to more debt. Understanding and managing credit utilization is a key credit repair strategy.

Credit Repair Strategies: Best Tools and Resources to Aid Your Efforts

Using the right tools can make credit repair easier and more effective. Free credit report services, budgeting apps, and score-monitoring tools help you track progress. Incorporating these resources into your credit repair strategies ensures you’re equipped to make smart financial decisions.

There are many tools available to help you repair your credit. Free credit report websites allow you to monitor your credit history and spot errors. Apps like Credit Karma provide updates on your score and offer tips to improve it.

Budgeting tools, such as Mint, can help you manage your finances and ensure you have enough to make timely payments. Using these resources consistently can make a big difference in your credit repair strategies.

Credit Repair Strategy: Financial Education for Long-Term Credit Health

Financial education is essential for maintaining a healthy credit score. Learning about credit and personal finance empowers you to avoid common mistakes. As part of your credit repair strategy, gaining knowledge ensures you’re prepared to manage your finances effectively in the future.

Improving your credit is only part of the equation. Financial education is essential for maintaining long-term credit health. Understanding how credit works can help you avoid common pitfalls, like overspending or missing payments.

Look for local workshops or online courses that teach personal finance basics. Books and podcasts can also be valuable resources. The more you know, the better equipped you’ll be to make smart financial decisions as part of your ongoing credit repair strategy.

Frequently Asked Questions (FAQs)

Credit repair is a journey that requires dedication and consistency. Before diving into the details, it’s important to understand that there is no overnight solution. Each step you take toward improving your credit contributes to long-term financial health and freedom. Let’s address some of the most common questions about credit repair timelines and strategies.

How Long Does It Take to Improve a Credit Score?

The time it takes to improve a credit score depends on several factors, including the nature of the issues on your report and the actions you take. Small changes, like fixing an error or reducing credit utilization, can show results within 30-60 days. However, rebuilding a poor credit score after missed payments or defaults can take 6 months to a year.

Consistent use of credit repair strategies, such as making on-time payments and disputing inaccuracies, can accelerate progress. It’s a process that rewards patience and persistence.

It depends on your starting point. Small errors can be fixed in months, while rebuilding a poor score takes a year or more.

What Should I Do If I Can’t Make a Payment?

If you’re unable to make a payment, the first step is to contact your lender immediately. Many creditors offer options like deferment, forbearance, or temporary payment plans to help you manage your situation. Ignoring the issue can lead to missed payments, late fees, and damage to your credit score.

Explain your financial situation honestly and ask about available options. Utilizing these alternatives can protect your credit and give you the time you need to recover.

Contact your lender immediately to discuss options like forbearance or a temporary payment plan.

Can Credit Repair Services Guarantee Results?

No legitimate credit repair service can guarantee results. Credit repair involves identifying and disputing inaccuracies on your credit report, and the outcome depends on the validity of the dispute and the response from the credit bureaus.

Be cautious of companies that promise guaranteed improvements or quick fixes, as this can often be a sign of a scam. Effective credit repair strategies require effort, time, and adherence to legal processes. It’s always best to approach credit repair with realistic expectations.

No. Be cautious of companies that promise guaranteed results. Credit repair requires effort, time, and adherence to the law.

What Is the Quickest Way to Repair Credit?

The quickest way to repair your credit is to focus on high-impact actions. Start by disputing errors on your credit report, as removing inaccuracies can lead to immediate improvements. Next, reduce your credit utilization by paying down high credit card balances.

Ensure all future payments are made on time, as even one late payment can significantly impact your score. Combining these strategies can deliver noticeable results within a few months, though the extent of improvement varies.

Focus on disputing errors, paying down balances, and ensuring timely payments. Small, consistent steps yield faster results.

How Can I Raise My Credit Score 200 Points in 30 Days?

Raising a credit score by 200 points in 30 days is challenging but not impossible under certain circumstances. Start by addressing errors on your credit report; removing significant inaccuracies can lead to a substantial boost. If possible, pay off high credit card balances to lower your credit utilization immediately.

For individuals with collections accounts, negotiating pay-for-delete agreements can help remove negative marks. Keep in mind that results vary based on the current state of your credit.

While rare, major improvements can happen by disputing errors, paying off significant debt, and ensuring no missed payments.

How to Get a 900 Credit Score in 45 Days?

Achieving a perfect credit score of 900 in 45 days is nearly impossible, as credit improvement is typically a gradual process. Instead, focus on long-term strategies like making on-time payments, maintaining low credit utilization, and keeping older accounts open to build a positive credit history.

If you’re already close to a perfect score, small actions like correcting errors or slightly reducing balances could help. Remember, a perfect score is not necessary to access the best financial opportunities.

Achieving a perfect score is nearly impossible in such a short time. Focus on long-term habits like timely payments and low credit utilization.

Is It True That After 7 Years Your Credit Is Clear?

Many negative items, such as late payments and collection accounts, fall off your credit report after seven years. However, some items, like unpaid tax liens or bankruptcy, may remain longer depending on the type of record.

While these items may disappear from your report, the financial responsibility still exists if the debt is unpaid. It’s important to address outstanding debts proactively, even if they no longer appear on your credit report, to avoid future complications.

Negative items generally fall off your report after 7 years, but some exceptions, like unpaid tax liens, may remain longer.

Conclusion

Improving your credit score is not just about fixing numbers; it’s about creating opportunities for a better financial future. By using proven credit repair strategies, such as disputing errors, reducing balances, and making timely payments, you can regain control of your financial health.

Whether you’re aiming to buy a home, start a business, or secure a loan, a better credit score opens doors. Stay consistent, remain patient, and use the tools and knowledge you’ve gained to achieve lasting financial freedom.

The journey may take time, but every step brings you closer to a stronger credit profile and brighter opportunities.

Mark Clayborne

Mark Clayborne specializes in credit repair, starting and running credit repair businesses. He's passionate about helping businesses gain freedom from their 9-5 and live the life they really want. You can follow him on YouTube.